Previous Session Recap

Trading volume at PSX floor dropped by 21.64 million shares or 14.59% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 43753.08, posted a day high of 43945.62 and a day low of 43512.09 during last trading session. The session suspended at 43572.67 with net change of -54.43 and net trading volume of 39.23 million shares. Daily trading volume of KSE100 listed companies dropped by 24.62 million shares or 38.56% on DoD basis.

Foreign Investors remained in net buying position of 1.89 million shares and net value of Foreign Inflow increased by 2.31 million US Dollars. Categorically, Foreign Corporate and Overseas Pakistanis remained in net buying positions of 0.89 and 0.93 million shares. While on the other side Local Individuals, Companies, Banks, Brokers and Insurance Companies remained in net selling positions of 0.27, 0.57, 0.79, 2.0 and 1.32 million shares respectively but Local NBFCs and Mutual Funds remained in net buying positions of 0.71 and 2.97 million shares.

Analytical Review

Asian stocks slipped on Tuesday, their recent recovery stalling after European equities broke a winning streak, while the dollar edged up to pull further away from three-year lows.MSCI’s broadest index of Asia-Pacific shares outside Japan shed 0.5 percent. Australian stocks fell 0.3 percent, South Korea’s KOSPI lost 0.7 percent and Hong Kong’s Hang Seng dropped 0.85 percent.Japan’s Nikkei retreated 1.25 percent after three successive days of gains.The pan-European STOXX index fell 0.6 percent on Monday following a three-day ascent, dragged down by falls in consumer staples stocks.U.S. markets were closed on Monday for a holiday, and the focus will be on whether Wall Street can maintain its recovery once trading resumes.The Dow gained 4.5 percent last week, winning back more than half of the territory lost during a sharp downturn earlier in the month.

Oil markets were split on Tuesday, with U.S. crude was pushed up by reduced flows from Canada while international Brent prices eased.U.S. West Texas Intermediate (WTI) crude futures were at $62.16 a barrel at 0153 GMT, up 48 cents, or 0.8 percent, from their last settlement.Traders said the higher WTI prices were a result of reduced flows from Canada’s Keystone pipeline, which has been operating below capacity since late last year due to a leak, cutting Canadian supplies into the United States.Outside North America, Brent crude eased on the back of a dip in Asian stocks and a stronger dollar, which potentially curbs demand as it makes fuel more expensive for countries using other currencies domestically.Brent crude futures were at $65.23 per barrel, down 44 cents, or 0.7 percent, from their last close.

IT’S business as usual for banks amid media reports that the United States and its European allies have tabled a motion before the Financial Action Task Force (FATF) to place Pakistan on a watchlist of countries considered non-compliant with global terrorist-financing regulations.Paris-based FATF could adopt the motion against Pakistan during its meeting this week, Reuters news agency reported on Tuesday.The FATF, an intergovernmental body of 37 full member countries, sets global standards for fighting illicit finance. Pakistan is its associate member and is part of its affiliate body Asia-Pacific Group (APG).Senior bankers say they are watching the development with mixed feelings of confidence and unease: they are confident that the move to put Pakistan on the FATF watchlist will not succeed, but feel uneasy because it seems there is more to this issue than meets the eye.

Power distribution companies charged about Rs3 per unit higher than the actual fuel cost in January as a petition has been filed in the National Electric Power Regulatory Authority (Nepra), seeking approval of fuel adjustment for a month.In its petition, the Central Power Purchasing Agency-Guarantee (CPPA-G) reported to Nepra that it had charged a higher reference tariff of Rs9.867 per unit in January but actual fuel cost turned out to be Rs6.90 per unit. Therefore, it said, there was a legal requirement to return Rs2.98 per unit to consumers.The regulator is expected to hold a public hearing on the matter on Feb 22.A relief in electricity rates for one month will not be applicable to residential and agricultural consumers with less than 300 units of monthly consumption as per decision of the PML-N government on the grounds that they are already being provided subsidised electricity and do not qualify for monthly fuel price cut.

Russian Ambassador to Pakistan Alexey Y Dedov said that trade volume between Russia and Pakistan has improved and it would be strengthened by increasing exchange of business to business delegations.He was speaking at a gathering of the Sarhad Chamber of Commerce and Industry (SCCI) Peshawar on Monday.He said Russia was ready to revamp the Pakistan Still Mill (PSM), but the government was yet unclear about its actual plan whether to privatize it or give it on lease.SCCI President Zahidullah Shinwari, executive members, businessmen and traders and Honorary Consul General of Russian Consulate in Peshawar Arsala Khan were present on the occasion.Flanked by Trade Representative Yury M Kozlov and officials of the Russian Embassy in Islamabad, the envoy said that Russian companies were taking keen interest in making investment in Pakistan.

Its recommended to practice caution as market is expected to remain volatile.

Technical Analysis

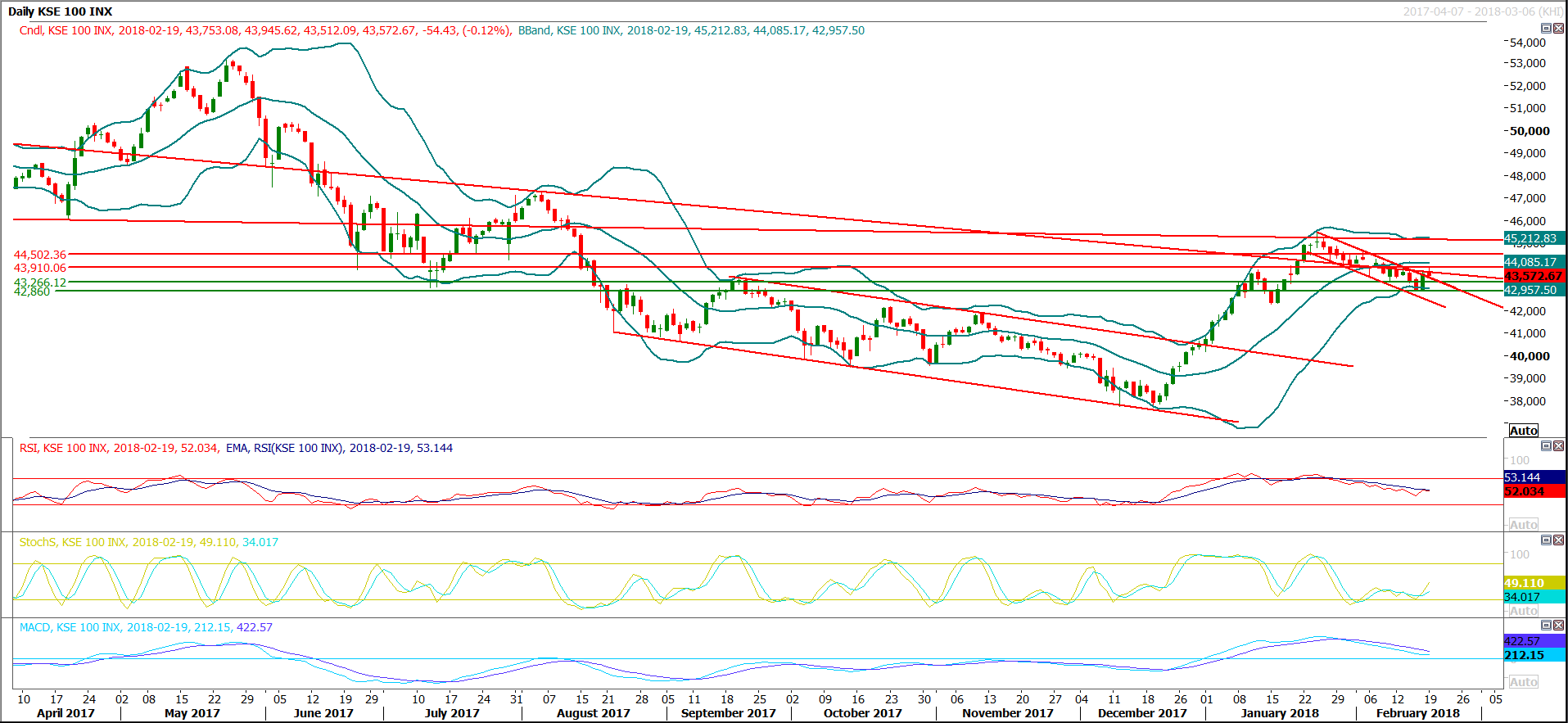

The Benchmark KSE100 Index have bounced back after retesting a horizontal supportive region during last trading session in its daily bearish trend channel and closed at resistant trend line of said channel. As of right now index have resistances ahead from a descending trend line along with a horizontal resistant region at 43860 and 43910. Its expected that Index would try to open with a positive gap today and if index would open above 43860 then it can hit 44474 in coming days. If index would become able to close above 43910 on hourly basis then it can move forward on intraday basis because major resistant region on hourly chart is standing at that region. Its recommended to buy on dip for intraday trading.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.