Previous Session Recap

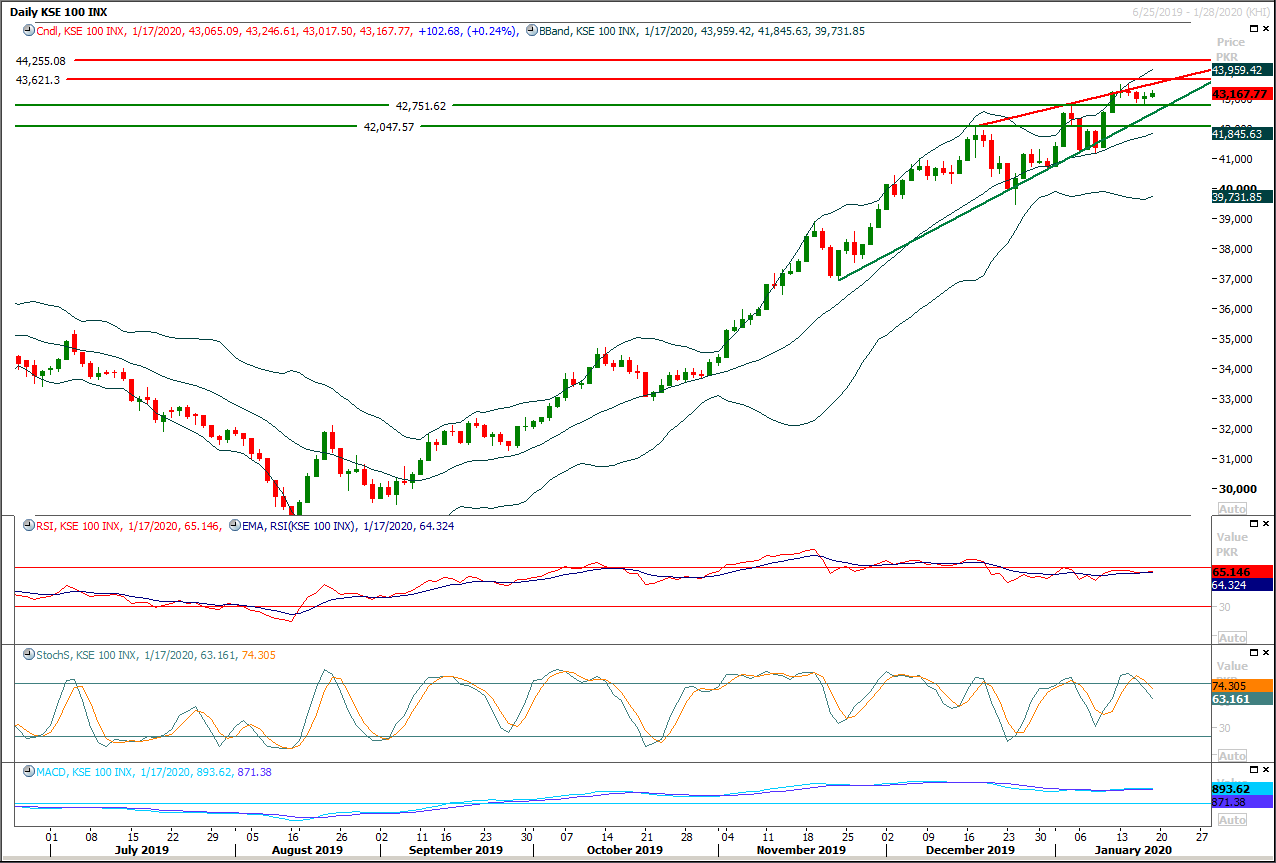

Trading volume at PSX floor dropped by 18.46 million shares or 8.03% on DoD basis, whereas the benchmark KSE100 index opened at 43065.09, posted a day high of 43,246.61 and a day low of 43,017.50 points during last trading session while session suspended at 43,167.77 points with net change of 102.68 points and net trading volume of 125.33 million shares. Daily trading volume of KSE100 listed companies also dropped by 26.80 million shares or 17.62% on DoD basis.

Foreign Investors remained in net selling positions of 8.41 million shares and net value of Foreign Inflow dropped by 0.64 million US Dollars. Categorically, Foreign Individuals remained in net long positions of 0.31 million shares but Foreign Corporate and Overseas Pakistani investors remained in net selling positions of 8.71 and 0.01 million shares. While on the other side Local Individuals, Banks, NBFC and Mutual Funds remained in net long positions of 16.49, 7.11, 0.34 and 5.35 million shares but Local Companies, Brokers and Insurance Companies remained in net selling positions of 6.61, 9.44 and 3.66 million shares respectively.

Analytical Review

Asia shares camp on high ground, oil jumps on Libya shutdown

Asian shares neared a 20-month top on Monday as Wall Street extended its run of record peaks on solid U.S. economic data and lashes of liquidity from the Federal Reserve. MSCI’s broadest index of Asia-Pacific shares outside Japan firmed 0.1%, after notching its highest close since June 2018. Japan’s Nikkei added 0.2% to be near its highest in 15 months. Chinese shares opened firm with the blue-chip CSI300 index up 0.2%. Australia’s main index scored another all-time peak and South Korea was near its best level since October 2018. E-Mini futures for the S&P 500 edged up 0.1%

Transport fuels startup funding scene

There was much to cherish for Pakistan’s tech entrepreneurs in 2019, be it their own growth trajectory or the progressive measures taken by the regulator. Investment-wise too, there was a fair bit of hype, starting with the highest-ever Series A round by Bykea, only to be broken by Cheetay, which again lost the mantel to Airlift. But beyond these star players, how did the overall investment landscape look like and what were the key trends? We compiled some data, using public news and own sources, plus support from PriceOye.pk and the National Incubation Centres.

Automakers expect a bumpy ride ahead

Following a drop of up to 72 per cent in automobile sales in the first half of 2019-20, stakeholders in the auto sector say dark clouds will likely continue hovering over the sector in January-June. Issues like high prices on account of the federal excise duty ranging from 2.5pc to 7.5pc on engines of different horsepower, additional customs duty on raw material imports, record high interest rates and strict vigilance by the Federal Board of Revenue (FBR) still persist.

Oil import bill falls by 20pc in first half of current fiscal year

Pakistan’s oil import bill and local production of petroleum products declined by almost 20 per cent and 12pc, respectively, during first half of the current fiscal year, a clear sign of economic slowdown. According to data released by the Federal Bureau of Statistics (PBS), the oil import bill during the first six months (July-December 2019) fell by 19.87pc in dollar terms as compared to the same period last year despite higher oil prices in the international market.

Sugar industry conundrum

A BIG question mark hangs over the viability of Sindh’s sugar industry amid a yawning gap between mills’ crushing capacity and the supply of sugar cane. The existing cumulative crushing capacity of sugar mills in Sindh stands at 253,300 tonnes per day, or a little over 90 million tonnes a year. Compared to this, sugar production in the province was 16.691m tonnes against the target of 18.752m in the last season (2018-19). At the same time, the number of sugar mills increased from 28 in 2007 to 38 in 2017. However, the area under sugar cane cultivation and sucrose content recovery have remained almost the same.

Asian shares neared a 20-month top on Monday as Wall Street extended its run of record peaks on solid U.S. economic data and lashes of liquidity from the Federal Reserve. MSCI’s broadest index of Asia-Pacific shares outside Japan firmed 0.1%, after notching its highest close since June 2018. Japan’s Nikkei added 0.2% to be near its highest in 15 months. Chinese shares opened firm with the blue-chip CSI300 index up 0.2%. Australia’s main index scored another all-time peak and South Korea was near its best level since October 2018. E-Mini futures for the S&P 500 edged up 0.1%

There was much to cherish for Pakistan’s tech entrepreneurs in 2019, be it their own growth trajectory or the progressive measures taken by the regulator. Investment-wise too, there was a fair bit of hype, starting with the highest-ever Series A round by Bykea, only to be broken by Cheetay, which again lost the mantel to Airlift. But beyond these star players, how did the overall investment landscape look like and what were the key trends? We compiled some data, using public news and own sources, plus support from PriceOye.pk and the National Incubation Centres.

Following a drop of up to 72 per cent in automobile sales in the first half of 2019-20, stakeholders in the auto sector say dark clouds will likely continue hovering over the sector in January-June. Issues like high prices on account of the federal excise duty ranging from 2.5pc to 7.5pc on engines of different horsepower, additional customs duty on raw material imports, record high interest rates and strict vigilance by the Federal Board of Revenue (FBR) still persist.

Pakistan’s oil import bill and local production of petroleum products declined by almost 20 per cent and 12pc, respectively, during first half of the current fiscal year, a clear sign of economic slowdown. According to data released by the Federal Bureau of Statistics (PBS), the oil import bill during the first six months (July-December 2019) fell by 19.87pc in dollar terms as compared to the same period last year despite higher oil prices in the international market.

A BIG question mark hangs over the viability of Sindh’s sugar industry amid a yawning gap between mills’ crushing capacity and the supply of sugar cane. The existing cumulative crushing capacity of sugar mills in Sindh stands at 253,300 tonnes per day, or a little over 90 million tonnes a year. Compared to this, sugar production in the province was 16.691m tonnes against the target of 18.752m in the last season (2018-19). At the same time, the number of sugar mills increased from 28 in 2007 to 38 in 2017. However, the area under sugar cane cultivation and sucrose content recovery have remained almost the same.

Market is expected to remain volatile during current trading session.

Technical Analysis

The Benchmark KSE100 index is caged in a rising wedge since start of this month and after retesting its supportive trend line multiple times now it have came to test its resistant regions but till now strong rejection have been faced, therefore it's recommended to stay cautious and post trailing stop loss on existing long positions because if index would not succeed in giving a breakout above 43,620pts then pressure would start piling up and index may face more resistances at 43,620, 43,860 and 44,255 points in near future because its being capped by a resistant trend line, weekly bearish correction and a strong horizontal resistant region at these levels respectively.

In case of facing rejection from its resistant regions index would try to target its supportive regions standing at 42,750-42,630 points where a horizontal supportive region would try to provide some ground with collaboration of supportive trend line of current rising wedge. But breakout below these regions would call for 42,000 points. Index would remain range bound until either it would succeed in breakout above 43,860 points or below 42,500 points therefore it's recommended to adopt swing trading with strict stop loss on both sides.

In case of facing rejection from its resistant regions index would try to target its supportive regions standing at 42,750-42,630 points where a horizontal supportive region would try to provide some ground with collaboration of supportive trend line of current rising wedge. But breakout below these regions would call for 42,000 points. Index would remain range bound until either it would succeed in breakout above 43,860 points or below 42,500 points therefore it's recommended to adopt swing trading with strict stop loss on both sides.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.