Previous Session Recap

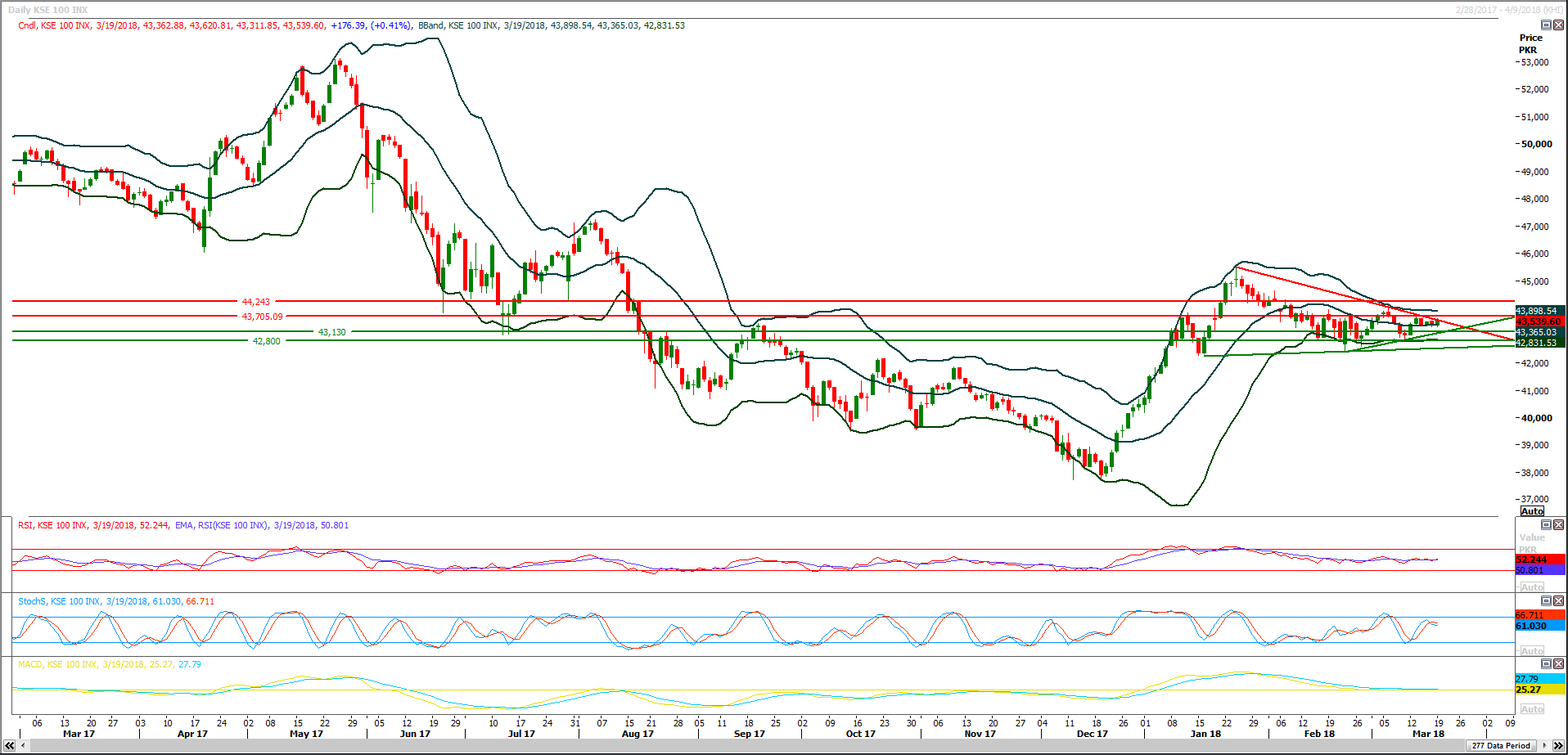

Trading volume at PSX floor dropped by 77.43 million shares or 40.04% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 43362.88, posted a day high of 43620.81 and a day low of 43311.85 during last trading session. The session suspended at 43539.60 with net change of 176.39 and net trading volume of 36.11 million shares. Daily trading volume of KSE100 listed companies dropped by 18.11 million shares or 33.41% on DoD basis.

Foreign Investors remained in net selling position of 7.32 million shares and net value of Foreign Inflow dropped by 4.31 million US Dollars. Categorically, Foreign Individual, Corporate and Overseas Pakistanis Investors remained in net selling positions of 0.08, 5.45 and 1.79 million shares respectively. While on the other side Local Individuals and Banks remained in net selling positions of 7.14 and 1.2 million shares but Local Companies, NBFCs, Mutual Funds, Brokers and Insurance Companies remained in net buying positions of 1.77, 2.46, 4.04, 1.77 and 2.99 million shares respectively.

Analytical Review

Asian shares fall as Facebook data flap spooks tech stocks

Asian shares fell on Tuesday as investors dumped high-flying U.S. technology shares on fears of stiffer regulation as Facebook came under fire following reports it allowed improper access to user data. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS dropped 0.2 percent. Japan's Nikkei .N225 fell 1.0 percent. On Wall Street the S&P 500 .SPX lost 1.42 percent and the Nasdaq Composite .IXIC 1.84 percent, both suffering their worst day in five weeks. “Investors lightened their positions ahead of the Fed’s policy meeting. The markets are completely split on whether the Fed will project three rate hikes this year or four,” said Hiroaki Mino, senior strategist at Mizuho Securities.

Govt monitoring market to issue Eurobond

Pakistan is closely monitoring international capital market before issuing Eurobond to raise at least one billion dollars to sustain its depleting foreign exchange reserves. The government would issue the Eurobond if investors show interest in investing in bond. "The total amount Pakistan will have to pay on its external debt is $3billion before June this year," a top official of the ministry of finance said. He further said that major part of the amount would be raised by tapping the international market. "We are expecting to generate at least one billion dollar. However, exact amount will be decided after a response from the international market," he added. Pakistan in November last year had successfully executed $1.0 billion five years Sukuk and $1.5 billion ten years Eurobond transactions at a profit rate of 5.625percent and 6.875 percent respectively. The order book for Pakistan's sovereign papers was over $8 billion. However, the government decided to pick up only $2.5 billion in order to ensure low final yields on the Sukuks and Eurobonds.

Pakistan hopes to sign FTA-II with China in April

Pakistan on Monday hoped to sign Free Trade Agreement (FTA) phase II with China in next month (April) during the visit of Prime Minister Shahid Khaqan Abbasi to China that would increase the bilateral trade. Secretary Commerce Mohammad Younus Dagha Monday expressed satisfaction over the progress on the FTA phase II. "I hoped that both sides can meet at an early date for the 10th rounds to finalize the remaining issues so that a formal announcement can be made during the prime minister's visit to China in April, 2018," the secretary said in a meeting with China's Ambassador to Pakistan Yao Jing. He briefed the ambassador on the status of negotiations of second phase of FTA. He thanked the Chinese government on accommodating the concerns of Pakistan's local industry and agreeing to provide a competitive edge to Pakistanis exports in Chinese market. The Chinese ambassador reaffirmed Chine's commitment to address any apprehensions of Pakistan's local industry. He also agreed on the need to finalise the negotiations before PM Abbasi's visit to China.

Bhasha Dam phase-I referred to Ecnec for approval

After a gap of almost half a century the construction of mega water reservoir Bhasha Dam has passed a major threshold on Monday as Central Development Working Party (CDWP) referred the phase-I of the project with an estimated cost of Rs649 billion for the approval of Executive Committee of National Economic Council (ECNEC). The CDWP meeting was held under the chairmanship of Planning Commission Deputy Chairman Sartaj Aziz, approved 34 projects worth Rs365.492 billion and referred five projects, including 800 MW Mohmand Hydro Power project to the ECNEC for further proceeding. The meeting was attended by Secretary Planning, Shoaib Ahmed Siddique, senior officials from federal and provincial governments. The government has decided to divide the dam into two parts — the reservoir and the powerhouse. The total cost of the project is around Rs1300 billion and the phase-1 , related to the construction of reservoir, will cost Rs649 billion. The project will be completed in 108 months and the cost will be funded by federal grant ( 67percent), Wapda (18 percent), and commercial financing (25 percent), said the official documents available with The Nation.

Unilever announces Rs12b new investment

The Unilever has announced an investment of Rs12 billion ($120 million) in Pakistan, acknowledging the country's high potential for long-term growth. The announcement was made by a delegation of Unilever Pakistan that called on Miftah Ismail, Adviser to PM on Finance. A majority of the investment will be made to enhance manufacturing operations across Unilever's four factories in Pakistan over the next two years, the team members said. They said that this is a testament to Unilever's commitment to growing the business in Pakistan and highlights the increasing uptake of consumer good products across the country. Appreciating the initiative of Unilever, the adviser added that the investment was indeed an acknowledgement of the country's growth potential and the macroeconomic stability it has gained during the last four years of the current government.

Market is expected to remain volatile therefore it is advised to remain cautious while trading today.

Asian shares fell on Tuesday as investors dumped high-flying U.S. technology shares on fears of stiffer regulation as Facebook came under fire following reports it allowed improper access to user data. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS dropped 0.2 percent. Japan's Nikkei .N225 fell 1.0 percent. On Wall Street the S&P 500 .SPX lost 1.42 percent and the Nasdaq Composite .IXIC 1.84 percent, both suffering their worst day in five weeks. “Investors lightened their positions ahead of the Fed’s policy meeting. The markets are completely split on whether the Fed will project three rate hikes this year or four,” said Hiroaki Mino, senior strategist at Mizuho Securities.

Pakistan is closely monitoring international capital market before issuing Eurobond to raise at least one billion dollars to sustain its depleting foreign exchange reserves. The government would issue the Eurobond if investors show interest in investing in bond. "The total amount Pakistan will have to pay on its external debt is $3billion before June this year," a top official of the ministry of finance said. He further said that major part of the amount would be raised by tapping the international market. "We are expecting to generate at least one billion dollar. However, exact amount will be decided after a response from the international market," he added. Pakistan in November last year had successfully executed $1.0 billion five years Sukuk and $1.5 billion ten years Eurobond transactions at a profit rate of 5.625percent and 6.875 percent respectively. The order book for Pakistan's sovereign papers was over $8 billion. However, the government decided to pick up only $2.5 billion in order to ensure low final yields on the Sukuks and Eurobonds.

Pakistan on Monday hoped to sign Free Trade Agreement (FTA) phase II with China in next month (April) during the visit of Prime Minister Shahid Khaqan Abbasi to China that would increase the bilateral trade. Secretary Commerce Mohammad Younus Dagha Monday expressed satisfaction over the progress on the FTA phase II. "I hoped that both sides can meet at an early date for the 10th rounds to finalize the remaining issues so that a formal announcement can be made during the prime minister's visit to China in April, 2018," the secretary said in a meeting with China's Ambassador to Pakistan Yao Jing. He briefed the ambassador on the status of negotiations of second phase of FTA. He thanked the Chinese government on accommodating the concerns of Pakistan's local industry and agreeing to provide a competitive edge to Pakistanis exports in Chinese market. The Chinese ambassador reaffirmed Chine's commitment to address any apprehensions of Pakistan's local industry. He also agreed on the need to finalise the negotiations before PM Abbasi's visit to China.

After a gap of almost half a century the construction of mega water reservoir Bhasha Dam has passed a major threshold on Monday as Central Development Working Party (CDWP) referred the phase-I of the project with an estimated cost of Rs649 billion for the approval of Executive Committee of National Economic Council (ECNEC). The CDWP meeting was held under the chairmanship of Planning Commission Deputy Chairman Sartaj Aziz, approved 34 projects worth Rs365.492 billion and referred five projects, including 800 MW Mohmand Hydro Power project to the ECNEC for further proceeding. The meeting was attended by Secretary Planning, Shoaib Ahmed Siddique, senior officials from federal and provincial governments. The government has decided to divide the dam into two parts — the reservoir and the powerhouse. The total cost of the project is around Rs1300 billion and the phase-1 , related to the construction of reservoir, will cost Rs649 billion. The project will be completed in 108 months and the cost will be funded by federal grant ( 67percent), Wapda (18 percent), and commercial financing (25 percent), said the official documents available with The Nation.

The Unilever has announced an investment of Rs12 billion ($120 million) in Pakistan, acknowledging the country's high potential for long-term growth. The announcement was made by a delegation of Unilever Pakistan that called on Miftah Ismail, Adviser to PM on Finance. A majority of the investment will be made to enhance manufacturing operations across Unilever's four factories in Pakistan over the next two years, the team members said. They said that this is a testament to Unilever's commitment to growing the business in Pakistan and highlights the increasing uptake of consumer good products across the country. Appreciating the initiative of Unilever, the adviser added that the investment was indeed an acknowledgement of the country's growth potential and the macroeconomic stability it has gained during the last four years of the current government.

Technical Analysis

The Benchmark KSE100 Index is caged in a triangle on daily chart and right its retesting resistant trend line of said triangle and if it would penetrate its resistant trend line then index would try to target 43960 and 44200 regions where it would face strong resistances. Before penetration index needs to close above its two initial resistant regions of 43630 and 43747 points which falls on two horizontal resistances. Daily momentum had turned to bearish since Friday as Stochastic and MAORSI have generated bearish crossovers. A false breakout of its resistant trend line is expected on intraday basis therefore it needs to be very cautious while trading today. Intraday supportive regions are standing at 43300 and 43100 points for index.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.