Previous Session Recap

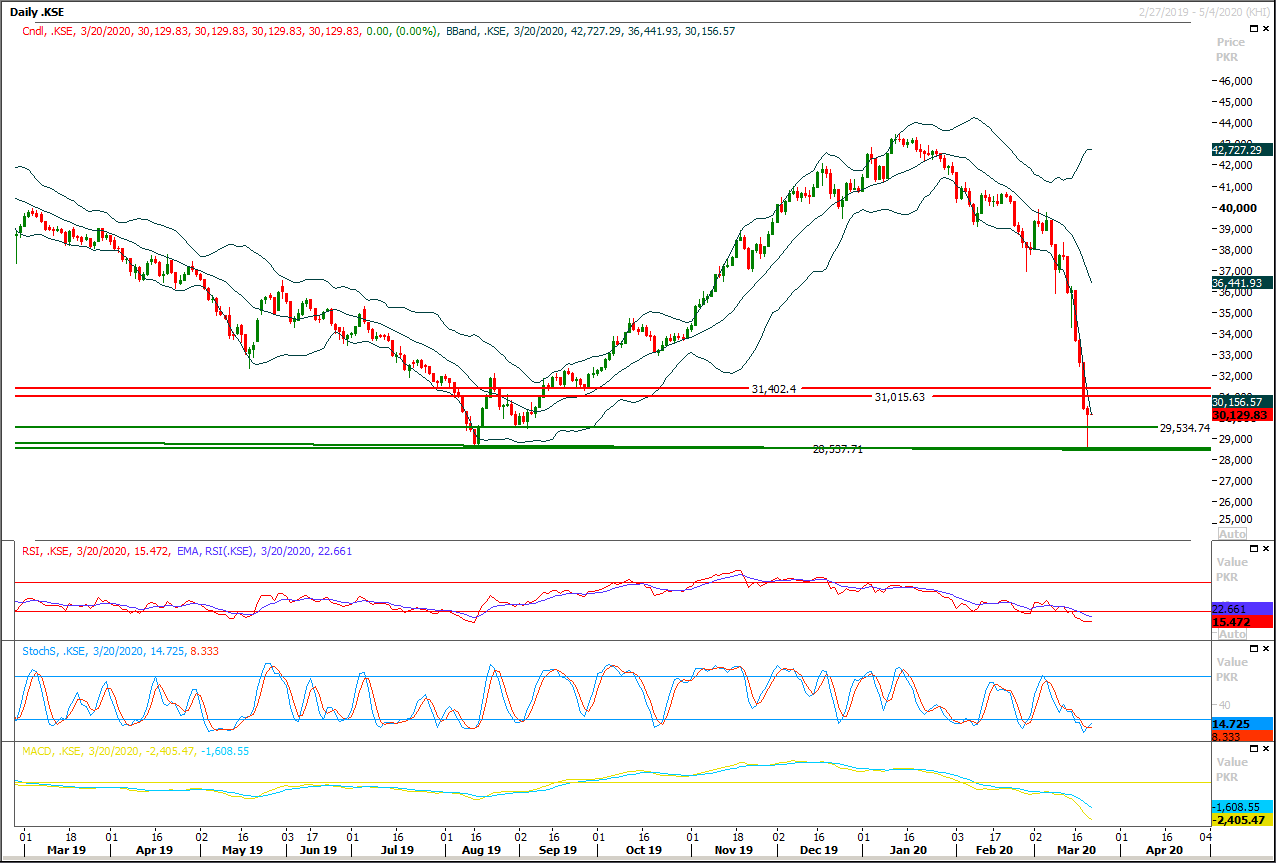

Trading volume at PSX floor increased by 121.69 million shares or 65.20% on DoD basis, whereas the benchmark KSE100 index opened at 28,853.62, posted a day high of 30,515.62 and a day low of 28,452.44 points during last trading session while session suspended at 30,129.83 points with net change of -286.22 points and net trading volume of 238.27 million shares. Daily trading volume of KSE100 listed companies also increased by 104.67 million shares or 78.34% on DoD basis.

Foreign Investors remained in net selling positions of 19.28 million shares and value of Foreign Inflow dropped by 5.36 million US Dollars. Categorically, Foreign Individuals and Corporate remained in net selling positions of 0.009 and 19.89 million shares Overseas Pakistani remained in net long positions of 0.61 million shares respectively. While on the other side Local Individuals Companies, Banks, Brokers and Insurance Companies remained in net long positions of 17.49, 7.09, 5.58, 0.09 and 10.23 million shares but NBFCs and Mutual Fund remained in net selling positions of 7.37 and 9.22 million shares respectively.

Analytical Review

Asia shares bounce after rout, rush for dollars causing stress

MSCI’s broadest index of Asia-Pacific shares outside Japan rose 3.2%, after seven sessions of losses. As the spread of the coronavirus brought much of the world to a halt, nations have poured ever-more-massive amounts of stimulus into their economies while central banks have flooded markets with cheap dollars to ease funding strains. The U.S. Senate was debating a $1 trillion-plus package that would include direct financial help for Americans, relief for small businesses and steps to stabilize the economy. Sources told Reuters that China was set to unleash trillions of yuan of fiscal stimulus to revive an economy facing its first contraction in four decades. “The speed and aggression with which authorities are wheeling out measures to cushion the economic fallout from the virus and sowing the seeds for a hopefully rapid recovery, has resonated somewhat in equity markets,” said Ray Attrill, head of FX strategy at NAB. “Yet there is little doubt that funds need to buy dollars to rebalance hedges in light of the 30% fall in equity markets so far this month,” he added. “The dollar remains the pre-eminent safe-haven asset during times of extreme market stress.”

Hot money outflows climb to $1.3bn

Foreign investors have pulled out more than $1.388 billion from the country’s capital markets in the ongoing month with hot money outflows amounting to $1.28bn, the State Bank of Pakistan (SBP) data showed on Thursday. Coronavirus pandemic has instigated a widespread selloff from the emerging markets as investors have dumped more than $30bn worth of riskier investments during the last 45 days towards safer bets especially currencies. Barring dollar, almost every other instrument has been blown away by panic selling despite emergency measures announced by central banks across the world including the State Bank of Pakistan (SBP) which cut interest rates by just 75bps for the first time since May 2016 disappointing the markets.

FBR estimates Rs300bn revenue loss in last quarter

The Federal Board of Revenue (FBR) has estimated a revenue loss of over Rs300 billion during the April-June quarter of the current fiscal owing to a slowdown in economic activities because of a coronavirus threat. At a time when the government is struggling to contain the spread of the virus, top FBR officials are reviewing the impact of coronavirus on various sectors as well as on revenue collection, Dawn has learnt from knowledgeable sources. “So far the performance of revenue is good in March,” an official said. However, in case of lockdown or shutdown of business activities, the revenue impact would be much higher, the official said.

Moody’s readying for mass downgrade of virus-hit firms

Credit rating agency Moody’s is carrying out a global review of its corporate ratings in light of the coronavirus and oil price slump, with a first mass wave of downgrades or downgrade warnings likely in the coming days. The firm has already begun the process in a number of the hardest-hit sectors such as airlines, cruise and oil firms, but the moves are about to ratchet up, two of the firm’s top analysts told Reuters. “We are undertaking a global review of ratings that are impacted by the virus,” Managing Director of Global Strategy & Research Anne Van Praagh and Christina Padgett, Associate Managing Director of Corporate Finance Research, said in an interview.

Ban on wheat movement to help achieve procurement targets

Ahead of wheat harvesting season, Ministry of National Food Security and Research on Thursday proposed restrictions on intra-district movement of wheat crop and ban on private sector from procuring the crop until public sector targets are achieved. The meeting, chaired by Minister for National Food Security and Research Makhdoom Khusro Bakhtyar reached a consensus on stopping wheat procurement by feed millers, rice mills and ginners. The wheat procurement target for Passco has been set at 1.8 million tonnes, while Punjab will procure 4.5m, Sindh 1.4m, Balochistan 1m, and Khyber-Pakhtunkhwa 0.45m.

MSCI’s broadest index of Asia-Pacific shares outside Japan rose 3.2%, after seven sessions of losses. As the spread of the coronavirus brought much of the world to a halt, nations have poured ever-more-massive amounts of stimulus into their economies while central banks have flooded markets with cheap dollars to ease funding strains. The U.S. Senate was debating a $1 trillion-plus package that would include direct financial help for Americans, relief for small businesses and steps to stabilize the economy. Sources told Reuters that China was set to unleash trillions of yuan of fiscal stimulus to revive an economy facing its first contraction in four decades. “The speed and aggression with which authorities are wheeling out measures to cushion the economic fallout from the virus and sowing the seeds for a hopefully rapid recovery, has resonated somewhat in equity markets,” said Ray Attrill, head of FX strategy at NAB. “Yet there is little doubt that funds need to buy dollars to rebalance hedges in light of the 30% fall in equity markets so far this month,” he added. “The dollar remains the pre-eminent safe-haven asset during times of extreme market stress.”

Foreign investors have pulled out more than $1.388 billion from the country’s capital markets in the ongoing month with hot money outflows amounting to $1.28bn, the State Bank of Pakistan (SBP) data showed on Thursday. Coronavirus pandemic has instigated a widespread selloff from the emerging markets as investors have dumped more than $30bn worth of riskier investments during the last 45 days towards safer bets especially currencies. Barring dollar, almost every other instrument has been blown away by panic selling despite emergency measures announced by central banks across the world including the State Bank of Pakistan (SBP) which cut interest rates by just 75bps for the first time since May 2016 disappointing the markets.

The Federal Board of Revenue (FBR) has estimated a revenue loss of over Rs300 billion during the April-June quarter of the current fiscal owing to a slowdown in economic activities because of a coronavirus threat. At a time when the government is struggling to contain the spread of the virus, top FBR officials are reviewing the impact of coronavirus on various sectors as well as on revenue collection, Dawn has learnt from knowledgeable sources. “So far the performance of revenue is good in March,” an official said. However, in case of lockdown or shutdown of business activities, the revenue impact would be much higher, the official said.

Credit rating agency Moody’s is carrying out a global review of its corporate ratings in light of the coronavirus and oil price slump, with a first mass wave of downgrades or downgrade warnings likely in the coming days. The firm has already begun the process in a number of the hardest-hit sectors such as airlines, cruise and oil firms, but the moves are about to ratchet up, two of the firm’s top analysts told Reuters. “We are undertaking a global review of ratings that are impacted by the virus,” Managing Director of Global Strategy & Research Anne Van Praagh and Christina Padgett, Associate Managing Director of Corporate Finance Research, said in an interview.

Ahead of wheat harvesting season, Ministry of National Food Security and Research on Thursday proposed restrictions on intra-district movement of wheat crop and ban on private sector from procuring the crop until public sector targets are achieved. The meeting, chaired by Minister for National Food Security and Research Makhdoom Khusro Bakhtyar reached a consensus on stopping wheat procurement by feed millers, rice mills and ginners. The wheat procurement target for Passco has been set at 1.8 million tonnes, while Punjab will procure 4.5m, Sindh 1.4m, Balochistan 1m, and Khyber-Pakhtunkhwa 0.45m.

Market is expected to remain volatile during current trading session.

Technical Analysis

The Benchmark KSE100 index have supportive regions ahead at 30,000 points and 29,500 points where two strong horizontal supportive regions would try to resist against current bearish pressure but if index would succeed in sliding below 29500 points then its next target would be 28,500pts where a rising trend line on monthly chart would try to support market against current bearish pressure. It's recommended to stay cautious and adopt swing trading strategy until index either close below 29,500 points or above 32,500 points. Index would remain bearish until it would not succeed in closing above 32,500 points.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.