Previous Session Recap

Trading volume at PSX floor increased by 18.91 million shares or 19.55%, DoD basis. Whereas the benchmark KSE100 Index opened at 40832.14, posted a day high of 40910.17 and a day low of 40634.15 during the last trading session. The session suspended at 40844.40 with a net change of 31.09 and net trading volume of 58.02 million shares. Daily trading volume of KSE100 companies increased by 6.47 million shares or 12.56%, DoD basis.

Foreign Corporate Investors remained in a net buying position of 3.53 million shares and net value of Foreign Inflow increased by 1.56 million shares. Categorically Foreign Corporate and Overseas Pakistani Investors remained in net buying positions of 2.97 and 0.61 million shares. While on the other side Local Individuals, Companies, Banks and Mutual Funds remained in net selling positions of 1.83, 0.75, 1.54 and 4.2 million sahres respectively but Bokers and Insurance Companies remained in net buying positions of 2.3 and 2.4 million shares.

Analytical Review

The euro declined after German Chancellor Angela Merkel’s push to form a coalition government collapsed. Asian stocks resumed last week’s slide amid signs of fatigue following a stellar year for the region’s equities. Shares fell in Japan and Sydney. Chinese equities extended Friday’s slump triggered by state media warnings of stocks rising too fast. The dollar advanced against most G-10 counterparts, giving it a better start this week after dropping the past two. U.S. equities dropped on Friday, when the gap between two- and 10-year Treasury yields hit the tightest level in a decade, adding to concern about the pace of future economic growth. Bitcoin climbed to a fresh high, topping $8,000.

Pakistan can capture India’s $260 million rice business with the European Union following the EU’s zero tolerance on Tricyclazole chemical found in Indian grains. Rice Exporters Association of Pakistan Chairman Chaudhry Samee Ullah said that Pakistan can target India’s basmati rice share in the EU market, following the stringent policies placed by the European Union on the presence of hazardous pesticides in the commodity. From January 1, 2018, all countries that export basmati rice to the EU must bring down the maximum residue limit (MRL) level for Tricyclazole to 0.01 mg per kg. Up till now, the EU was accepting 1mg per kg from different countries, including India .

Amid increasing speculations about possibility of resignation by Finance Minister Ishaq Dar, Pakistan and the International Monetary Fund (IMF) are scheduled to initiate parleys from the first week of next month (December) under Post Program Monitoring (PPM) in order to gauge economic health of the country, The News has learnt. Both the Ministry of Finance as well as the IMF high-ups confirmed on Sunday that the upcoming PPM negotiations would be held in first week of next month as the Fund mission agreed to visit Islamabad by lowering security alert. The IMF’s high-ups are expected to get increased perks and privileges for visiting Islamabad amid tight security situation.

Large scale manufacturing (LSM) sector posted a decent growth of 8.36 percent year-on-year for the first three months of the current fiscal year on uptrend in oil output, strong auto demand and growing appetite of steel in infrastructure uplifts, official data revealed on Saturday.“The production in Jul-Sep 2017/18 as compared to Jul-Sep 2016/17 have been significantly increased in food, beverages and tobacco, coke and petroleum products, non-metallic mineral products, automobiles and iron and steel products while decreased in fertilizers,” PBS said in a web note.

Today ANL, ENGRO, DFML and SSGC may lead the market in the positive direction.

Technical Analysis

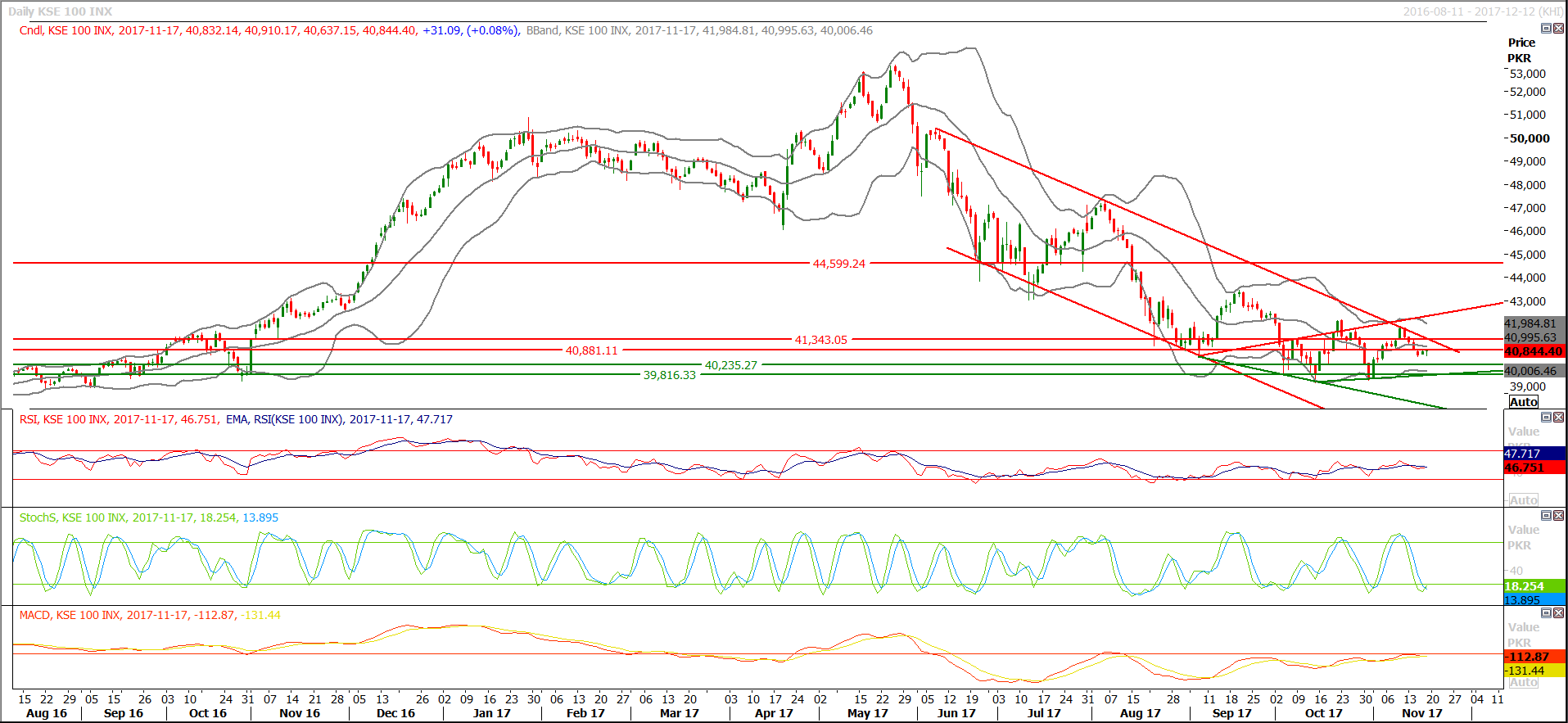

The Benchmark KSE100 Index is trying to bounce back after completing its 50% correction of its last bullish rally and daily stochastic is trying to generate a bullish crossover which would lead index in the bullish direction if opened with a gap above 40860. It is capped by a horizontal resistance on the daily chart and breakout of 40860 will call for 41340 where it will face resistance from a bearish trend line along with a horizontal resistance. Supportive regions are standing at 40400 and 40200 where it will fulfill its 61.8% correction. It is recommended to wait for a gap opening above 40860 and then closing of first hour above this level for new buying.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.