Previous Session Recap

Trading volume at PSX floor dropped by 25.10 million shares or 12.45% on DoD basis, whereas the Benchmark KSE100 index opened at 41,682.92, posted a day high of 41,682.92 and day low of 40,240.51 points during last trading session while session suspended at 41,352.77 with net change of -307.98 points and net trading volume of 68.04 million shares. Daily trading volume of KSE100 listed companies dropped by 39.52 million shares or 36.74% on DoD basis.

Foreign Investors remained in net selling position of 5.75 million shares and net value of Foreign Inflow dropped by 4.43 million US Dollars. Categorically, Foreign Individuals, Corporate and Overseas Pakistani investors remained in net selling positions of 0.11, 5.61 and 0.03 million shares respectively. While on the other side Local Individuals, Banks, Mutual Fund, Brokers and Insurance Companies remained in net buying positions of 2.07, 2.74, 4.29, 2.00 and 0.18 million shares respectively but Local Companies remained in net selling positions of 5.77 million shares respectively.

Analytical Review

Stock markets tumble on tech sell-off, dollar sags

Asian stock markets skidded on Tuesday, extending sharp losses on Wall Street as technology firms bore the brunt of worries about slackening demand, while the dollar sagged after weak U.S. data further sapped confidence in the currency. MSCI’s broadest index of Asia-Pacific shares outside Japan dropped 0.9 percent. The Shanghai Composite Index retreated 1 percent, Australian stocks lost 0.9 percent and tech-heavy South Korean shares dropped 0.8 percent.

Arrival of cotton at factories falls by 7.34pc: PCGA

The Pakistan Cotton Ginners Association (PCGA) has claimed that the arrival of cotton at ginning factories has plunged by 7.34 per cent compared to cotton arrival at the ginneries during the same period last year. The PCGA fortnightly cotton arrival report revealed on Monday seed cotton (Phutti) equivalent to over 86,71,596 bales of cotton reached ginneries across Pakistan as of Nov 15,2018 while the ginneries received 93,58,553 bales during the corresponding period last year.

Allied Bank says its systems, data secure

Allied Bank has assured its customers that its systems and cardholders’ data are absolutely secure. The bank has heavily invested on security and resilience of overall systems & infrastructure to make them secure, robust and reliable for safe and secure banking across all channels, as per press released by the bank.

CCP decides to proceed against PTCL

The Competition Commission of Pakistan (CCP) has passed an order assuming its jurisdiction in the matter of show cause notice issued to Pakistan Telecommunication Company Limited (PTCL) for abusing its dominant position in violation of Section 3 of the Competition Act, 2010. CCP will now proceed in the matter of show cause notice issued to PTCL for prima facie abuse of dominant position. This is the first time the Honorable High Court allowed CCP to decide the maintainability of the proceedings pending before CCP.

PCMA signs MoU with Turkish Association

The Pakistan Chemical Manufacturers Association (PCMA) has signed a MoU with Turkish Chemical Manufacturers Association (TCMA) to explore joint venture opportunities in the field of Chemical Industry between Pakistan and Turkey. According to a spokesperson of PCMA the documents of MoU were signed by Syed Iqbal A. Kidwai, Secretary General/CEO PCMA and Elif Özman PUSAT, Director (TCMA) the other day at PCMA’s stand in Turkchem Exhibition in Istanbul. Under this MOU, both the Associations shall facilitate their members to conduct industrial visits and to hold B2B meetings for any joint ventures with their Turkish and Pakistani counterparts.

Asian stock markets skidded on Tuesday, extending sharp losses on Wall Street as technology firms bore the brunt of worries about slackening demand, while the dollar sagged after weak U.S. data further sapped confidence in the currency. MSCI’s broadest index of Asia-Pacific shares outside Japan dropped 0.9 percent. The Shanghai Composite Index retreated 1 percent, Australian stocks lost 0.9 percent and tech-heavy South Korean shares dropped 0.8 percent.

The Pakistan Cotton Ginners Association (PCGA) has claimed that the arrival of cotton at ginning factories has plunged by 7.34 per cent compared to cotton arrival at the ginneries during the same period last year. The PCGA fortnightly cotton arrival report revealed on Monday seed cotton (Phutti) equivalent to over 86,71,596 bales of cotton reached ginneries across Pakistan as of Nov 15,2018 while the ginneries received 93,58,553 bales during the corresponding period last year.

Allied Bank has assured its customers that its systems and cardholders’ data are absolutely secure. The bank has heavily invested on security and resilience of overall systems & infrastructure to make them secure, robust and reliable for safe and secure banking across all channels, as per press released by the bank.

The Competition Commission of Pakistan (CCP) has passed an order assuming its jurisdiction in the matter of show cause notice issued to Pakistan Telecommunication Company Limited (PTCL) for abusing its dominant position in violation of Section 3 of the Competition Act, 2010. CCP will now proceed in the matter of show cause notice issued to PTCL for prima facie abuse of dominant position. This is the first time the Honorable High Court allowed CCP to decide the maintainability of the proceedings pending before CCP.

The Pakistan Chemical Manufacturers Association (PCMA) has signed a MoU with Turkish Chemical Manufacturers Association (TCMA) to explore joint venture opportunities in the field of Chemical Industry between Pakistan and Turkey. According to a spokesperson of PCMA the documents of MoU were signed by Syed Iqbal A. Kidwai, Secretary General/CEO PCMA and Elif Özman PUSAT, Director (TCMA) the other day at PCMA’s stand in Turkchem Exhibition in Istanbul. Under this MOU, both the Associations shall facilitate their members to conduct industrial visits and to hold B2B meetings for any joint ventures with their Turkish and Pakistani counterparts.

Market is expected to remain volatile therefore its recommended to stay cautious while trading during current trading session.

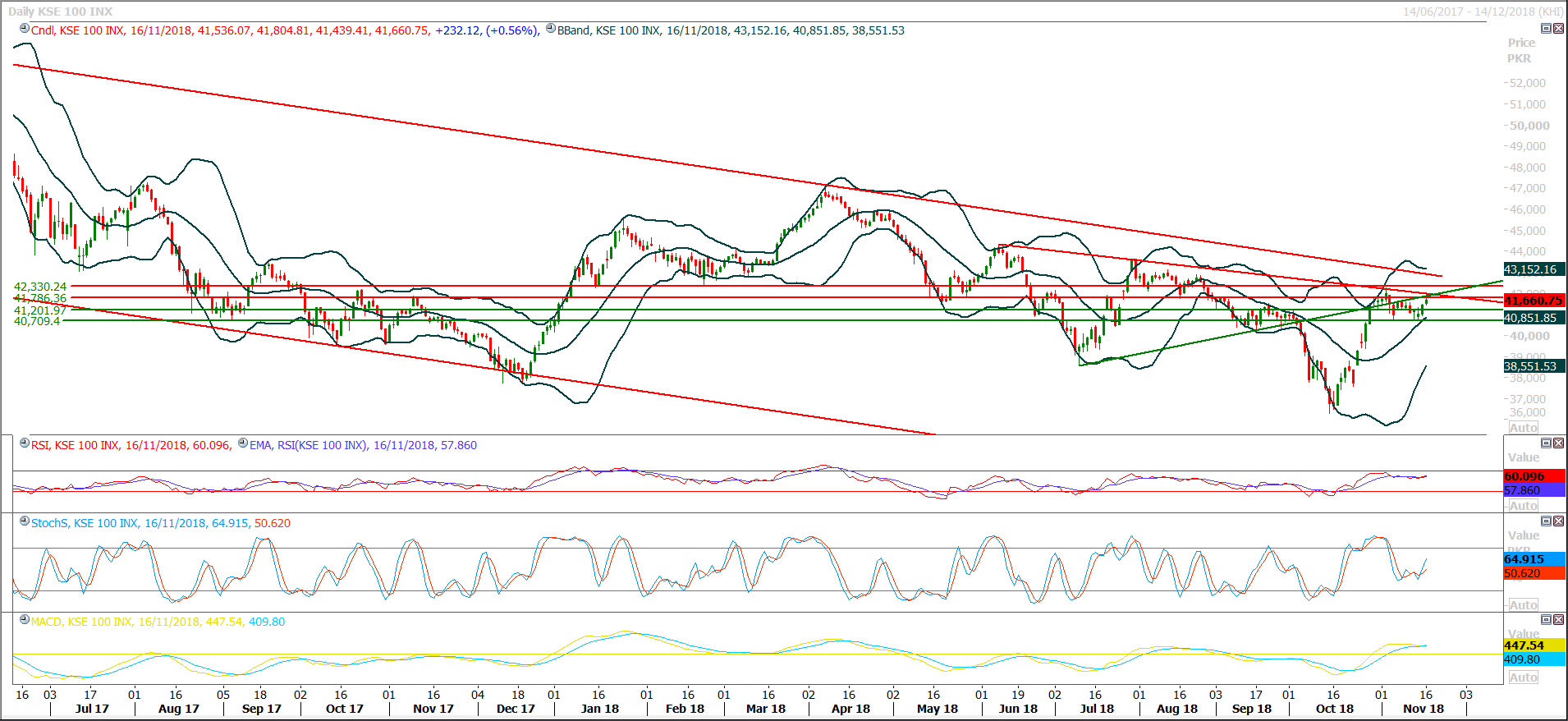

Technical Analysis

The Benchmark KSE100 Index is being capped by two strong resistant trend lines at 41,910 and 41,970 points during current trading session along with a horizontal resistant region which is trying to cap index move at 41,800 points. All these three elements have played a vital role at their respective regions previously and if index would not succeed in closing above 41,900 points during current trading session then tomorrow it would have to face a very strong resistance region at 41,950 points because tomorrow the said both trend lines would create a crossover with each other at 41,950 points and that region would become a strong resistance against any bullish trend if maintained during current trading session. Intraday bullish momentum is losing strength and it seems that index would try to take a dip in first half during current trading session and if this dip would occur after posting a high around 41,800 points then index would try to create an evening shooting star on daily chart. It’s recommended to stay cautious during current trading session as market is expected to remain volatile.

TRG have supportive regions ahead at 29.97-29.67 Rs and penetration of these regions in downward direction would call 29.20 but it’s recommended to adopt swing trading strategy around these region until clear breakout would happen. PSO is being capped by a strong resistant trend line along with a horizontal resistant region at 286 therefore it’s recommended to trade it cautiously because breakout of that region would call for 292 and 297 but if it would succeed in maintain that region then 267 could be witnessed in coming days. PAEL is moving downward after posting weekly double top therefore it is recommended to initiate selling on strength in it with strict stop of 34.40.

TRG have supportive regions ahead at 29.97-29.67 Rs and penetration of these regions in downward direction would call 29.20 but it’s recommended to adopt swing trading strategy around these region until clear breakout would happen. PSO is being capped by a strong resistant trend line along with a horizontal resistant region at 286 therefore it’s recommended to trade it cautiously because breakout of that region would call for 292 and 297 but if it would succeed in maintain that region then 267 could be witnessed in coming days. PAEL is moving downward after posting weekly double top therefore it is recommended to initiate selling on strength in it with strict stop of 34.40.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.