Previous Session Recap

Trading volume at PSX floor increased by 104.78 million shares or 92.09%,DoD basis, whereas the benchmark KSE100 Index opened at 42889.52, posted a day high of 43297.41 and a day low of 42889.52 during the last trading session. The session suspended at 43253.26 with a net change of 411.85 points and net trading volume of 95.14 million shares. Daily trading volume of KSE100 listed companies increased by 36.08 million shares or 61.1%, DoD basis.

Foreign Investors remained in a net buying position of 4.66 million shares and net value of Foreign Inflow increased by 1.93 million US Dollars. Categorically, Foreign Individual and Corporate Investors remained in net selling positions of 0.38 and 1.03 million shares but Overseas Pakistanis remained in net buying positions of 6.07 million shares. While on the other side Local Individuals, Banks, Mutual Funds and Brokers remained in net selling positions of 8.26, 1.19, 2.74 and 2.91 million shares respectively but Local Companies and Insurance Companies remained in net buying positions of 7.21 and 3.03 million shares.

Analytical Review

Asian stocks were mostly steady on Wednesday after Wall Street again rose to record highs, although movements were limited as a wait-and-see mood prevailed before the Federal Reserve reveals its monetary policy stance later in the day. The caution in financial markets ahead of the Fed has kept investors from making sharper adjustments to their positions despite heightened tensions over the Korean peninsula following hawkish statements from U.S. President Donald Trump overnight. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS stood little changed. Japan's Nikkei .N225 was flat. Shanghai .SSEC lost 0.2 percent while Hong Kong's Hang Seng .HSI added 0.2 percent. The three major U.S. stock indexes edged higher on Tuesday, logging record closes, with financial stocks providing the biggest boost.

The Central Development Working Party (CDWP) has approved 24 development projects worth Rs53.6 billion and recommended three mega projects worth Rs27.1 billion for the approval to Executive Committee of National Economic Council (Ecnec). The CDWP meeting, which was chaired by Planning Commission Deputy Chairman Sartaj Aziz, approved projects in transport & communication, energy, water resources, information technology, physical planning & housing, environment and health. The meeting was attended by senior officials from Planning Commission, federal ministries, government functionaries and representatives of the provincial governments. In energy sector, the CDWP approved three projects worth Rs18.8 billion out of which one project worth Rs12.8 billion was referred to Ecnec for approval. The CDWP validated the project of 220KV Punjab University Grid Station along with Associated Transmission Lines worth of Rs2,948.11 million. The objective of the project is to improve the reliability of NTDC network and provide relief to the 132kV grid station in Lesco. It would provide reliable, uninterrupted power to its consumers. The project would lead to improve voltage profile, system reliability of network and reduction in the loading of power transformers in the area.

The election process of All Pakistan Textile Mills Association (Aptma) has been halted and procedure may prolong to next month, as a former chairman of Aptma from Khyber Pakhtunhwa Ahmed Kuli Khan has approached the court for stay order. Usually election process completes in September every year and new body takes charge at the end of the month but this does not seem to happen this year and election process would be dragged till the end of October. According to the industry sources, as many as 34 members from Aptma Faisalabad, 63 from Aptma Lahore and 15 from Aptma Multan had exercised their voting right when the Aptma Karachi office communicated the court order to suspend elections then and there. “Verdict of the voters was a writing on the wall, as 111 votes were cast in favour of Shahzad Ayub against only one for Ahmad Kuli Khan. Therefore, he approached the PHC to get a stay order,” they added.

US Consul General Elizabeth Kennedy Trudeau Tuesday called on CEO PBIT Jahanzeb Burana. During the meeting, different matters of mutual interest came under discussion, including promotion of the Punjab-US trade relations and enhancement of bilateral cooperation in different sectors. While addressing the meeting, US Consul General expressed her country’s eagerness to contribute to Pakistan’s progress. She stated that Pakistan and the US enjoy close substantive ties but there was a need to focus on enhancing the existing trade and investment cooperation between the two countries. She affirmed that the Consulate was ready to facilitate PBIT to foster economic and commercial partnerships between Punjab and the US companies.

Federal Minister for Commerce and Textile, Mohammad Pervaiz Malik has said that trade between Pakistan and Canada stood at $0.91 billion during the FY2016-17, saying that there is tremendous potential between the two countries to increase the bilateral trade. He stated this while talking to Canadian High Commissioner to Pakistan, Perry John Calderwood who called him here on Tuesday. The minister welcomed the Canadian High Commissioner and also thanked him for the letter of facilitation and invitation to visit Canada, extended by Francois-Philippe Champagne, Canadian Commerce Minister. He also shared his intention to visit Canada soon to discuss ways and means to bolster the already cordial trade relations between the two countries.

Today PAEL, TRG and SSGC may lead the market in the positive direction.

Technical Analysis

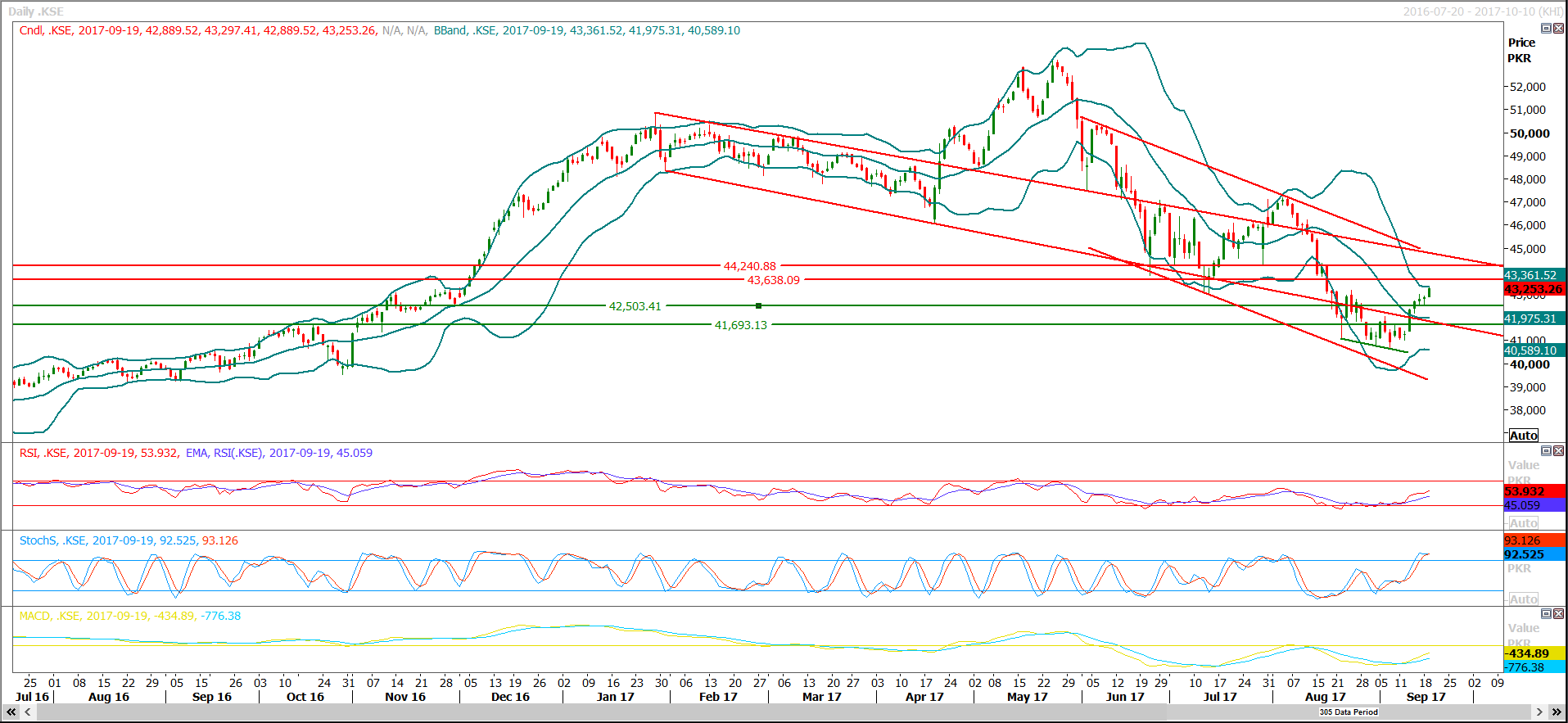

The Benchmark KSE100 index has closed after penetrating its first resistance of 43200 but it is still capped by a major resistance at 43700 from where it can be pushed back. Daily Stochastic is ready for a bearish crossover which may strengthen bearish momentum if started. For the current trading session selling around 43700 is recommended.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.