Previous Session Recap

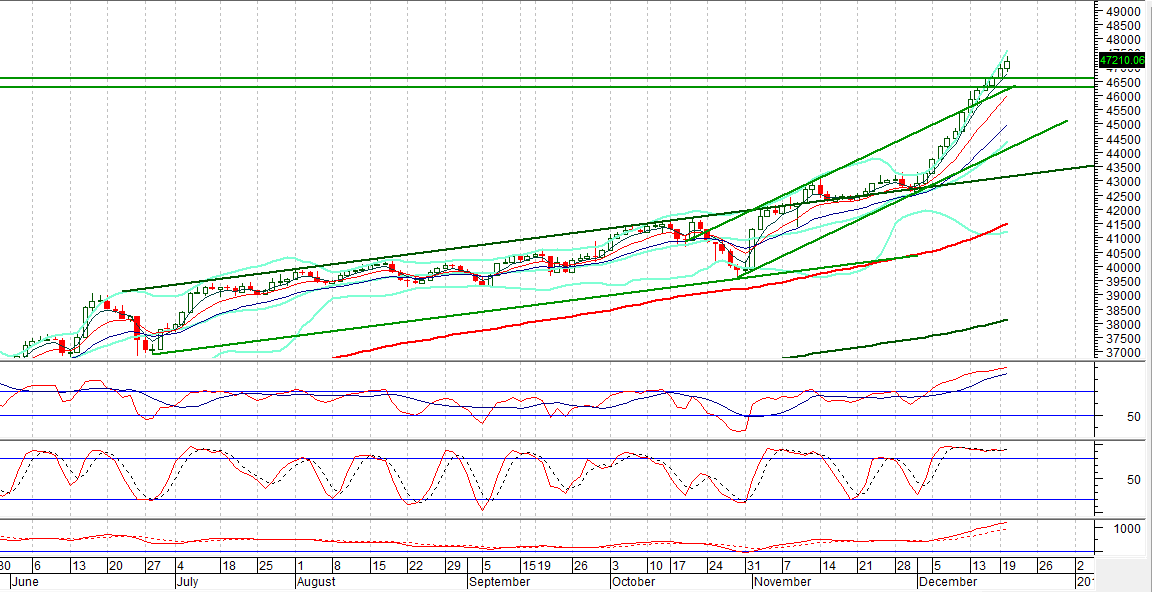

The Bench Mark KSE100 Index Opened at 46938.59, posted day high of 47380.88 and day low of 46810.02 during last trading session. The session suspended at 47210.06 with net change of 271.47 points and trading volume of 201.19 million shares. Daily trading volume of KSE100 listed companies increased by 13.94 million shares or 7.44% on DOD bases.

Foreign Investors remained in net selling position of 2.43 million shares and net value of Foreing Inflow dropped by 8.44 million US Dollars. Categorically Foreign Individuals and Overseas Pakistanis remained in net buying position of 0.19 and 0.44 million shares respectively but Foreign Corporate Investors remained in net selling position of 3.06 million shares. While on the other side Local Individuals, Companies and Mutual Funds remained in net buying position 11.52, 9.01 and 1.91 million shares respectively but Local Banks and Brokers remained in net selling position of 2.85 and 22.15 million shares respectively during last trading session.

Analytical Review

The U.S. dollar held near 14-year peaks on Wednesday as global yield spreads moved inexorably in its favor, while a falling yen lifted Japanese shares to a one-year top. The Nikkei .N225 added 0.3 percent in thin trade, while Australian main index climbed 0.6 percent to its highest in 17 months after Wall Street racked up more records. Japanese government upgraded its overall assessment of the economy on Wednesday, echoing a more upbeat view from the Bank of Japan delivered the day before. The dollar reveled in its rapidly widening yield premium, with the Federal Reserve set on a tightening course even as its peers in Europe and Japan act to keep their short-term rates deep in negative territory.

The Ministry of Petroleum & Natural Resources is expected to convene a meeting today (Wednesday) to resolve the issue between the Federal Board of Revenue (FBR) and provincial sales tax authorities regarding input tax adjustment on provincial sales tax on the services of inter-city transportation of petroleum (POL) products.

Textile exports grew 9.71 per cent to $1.05 billion in November year-on-year driven mainly by value-added products, the Pakistan Bureau of Statistics (PBS) said on Tuesday. Textile export proceeds have been growing for the past two months. Their rise is also evident in rupee terms particularly because of better prices.

The current account deficit widened 91 per cent year-on-year in the July-November period to $2.601 billion, the State Bank of Pakistan (SBP) said on Tuesday. The deficit in November skyrocketed 120pc to $839 million compared to October’s. The trend could be alarming, particularly in the wake of increasing imports and falling exports.

The All Pakistan Textile Mills Association (APTMA) Punjab held an emergent general body meeting at the APTMA Punjab office attended largely by the membership from Faisalabad and Multan zone connected to the meeting through video links. The meeting considered to formulate strategy for restoration of viability of textile industry and obtaining one energy price across the country. In a unanimously passed resolution, the house lauded a timely support of the Chief Minister Punjab Shahbaz Sharif averting disparity in gas prices in Punjab against other provinces.

MUGHAL, ASTL, FATIMA, MCB and HBL, along with Banking Sector, Steel Sector and Fertilizer Sector can lead market in positive direction.

Technical Analysis

The Bench Mark KSE100 Index is moving in an upward price channel on Intraday chart and right now it has penetrated said channel in upward direction and right now its getting support from resistant trend line of said channel. It is also supported by a rising trend line inside that bullish channel which is supporting its bullish momentum at 46613 points. Today a slight pressure on intraday bases can be witnessed in KSE100 Index as its Stochastic is trying to pull back towards normal zone. Market is trying to penetrate its ever high on daily bases so trading with strict stop losses is recommended.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.