Previous Session Recap

The Bench Mark KSE100 Index Opened at 49425.63, posted day high of 49597.33 and day low of 48850.90, during last trading session while session suspended at 48929.12 with net change of -446.59 points and net trading volume of 112.58 million shares. Daily trading volume of KSE100 listed companies dropped by 41.24 million shares or 26.81% on DOD bases.

Foreign Investors remain in net selling of 2.86 million shares but net value of Foreign Inflow increased by 3.50 million US Dollars. Categorically Foreign Individual and Corporate Investors remain in net selling of 0.084 and 5.15 million shares respectively but Overseas Paksitanis remain in net buying of 2.38 million shares. While on the other side Local Individuals, Banks and Brokers remain in net selling of 6.23, 1.59 and 4.85 million shares but Local Companies, NBFCs and Mutaul Funds remain in net buying of 6.66, 0.15 and 4.54 million shares respectively.

Analytical Review

Asian stocks held ground on Tuesday though Chinese equities surged to a fresh two-month high as domestic funds piled into financial counters on expectations the world second biggest economy may have turned a corner. MSCI broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was up 0.2 percent on Tuesday and held below a 19-month peak hit last Thursday. The index is up more than 11 percent since Dec. 23, which marked the trough in a selloff triggered by Donald Trump surprise win at the U.S. election in November. With U.S. markets closed for the Presidents Holiday on Monday, Asian markets have had few global cues off which to trade. Chinese stocks led regional gainers with mainland indexes extending a nearly 7 percent rise over the last month thanks to an influx of fresh funds from domestic institutional investors and a brightening outlook for the domestic economy.

Back-to-back terrorist attacks in all four provinces have cast a pall of gloom in markets across Pakistan. Major markets and shopping malls in all major cities including Karachi, Lahore, Rawalpindi-Islamabad, Peshawar and Quetta wore a deserted look Saturday onwards, with unknown SMS and WhatsApp alert messages, some attributed to the ISPR, warning citizens to stay away from crowded places. Traders in various markets of Karachi complained of depressed sales since the fresh wave of firing, cracker blasts and suicide attacks. Chairman All Karachi Tajir Itehad (AKTI) Atiq Mir said that viral SMS and WhatsApp alert messages attributed to the ISPR are scaring people and affecting sales.

The State Bank of Pakistan (SBP) has started to build its capacity to effectively deal with any adverse situation and resume operations without any major interruption. SBP Governor Ashraf Mahmood Wathra said this on Monday while speaking as chief guest at the inaugural session of Safety and Security Week 2017 being organised at the central bank in which field experts will conduct a number of exercises, trainings and information sessions to educate employees of the SBP and SBP Banking Services Corporation (SBP-BSC) about necessary safety and security procedures.

Expressing serious displeasure over statutory violations, the National Electric Power Regulatory Authority (Nepra) has directed the distribution companies of ex-Wapda to file two annual tariff petitions immediately to pass on lower electricity rates to consumers. The power regulator highlighted that distribution companies were required under the statutory orders to file annual tariff petitions for each fiscal year before Jan 31, but this obligation had not been fulfilled for two years now. A senior official said the distribution companies had in fact secured stay orders from the Islamabad High Court against Nepra’s previous determinations that entailed reduction in base electricity tariff, ranging between Rs2-3 per unit for various consumer categories. This had an estimated revenue impact of Rs228 billion that should have gone to the consumers through tariff reduction.

Water and Power Development Authority (WAPDA) has finalised the main contracts for the civil works of Dasu Hydropower Project and the construction on main works of the 2160 MW Stage-I of the Project will commence very soon. Subsequent to the signing of the agreements, construction of main works of the 2160 MW Stage-I of Dasu Hydropower Project will commence very soon, said WAPDA Chairman Lt Gen Muzammil Hussain (r) during his visit to the hydropower projects namely Dasu, Keyal Khwar, Khan Khwar, Allai Khwar and Duber Khwar on Monday. A press statement issued here stated that in a bid to capitalise on hydropower resource to add low-cost electricity to the National Grid as per the federal government’s resolve, Water and Power Development Authority (WAPDA) has finalised the main contracts of the civil works of Dasu Hydropower Project.

Today market is expected to remain volatile again, traders are advised to exercise cautiously. Take profit on higher level and buy on dips.

Technical Analysis

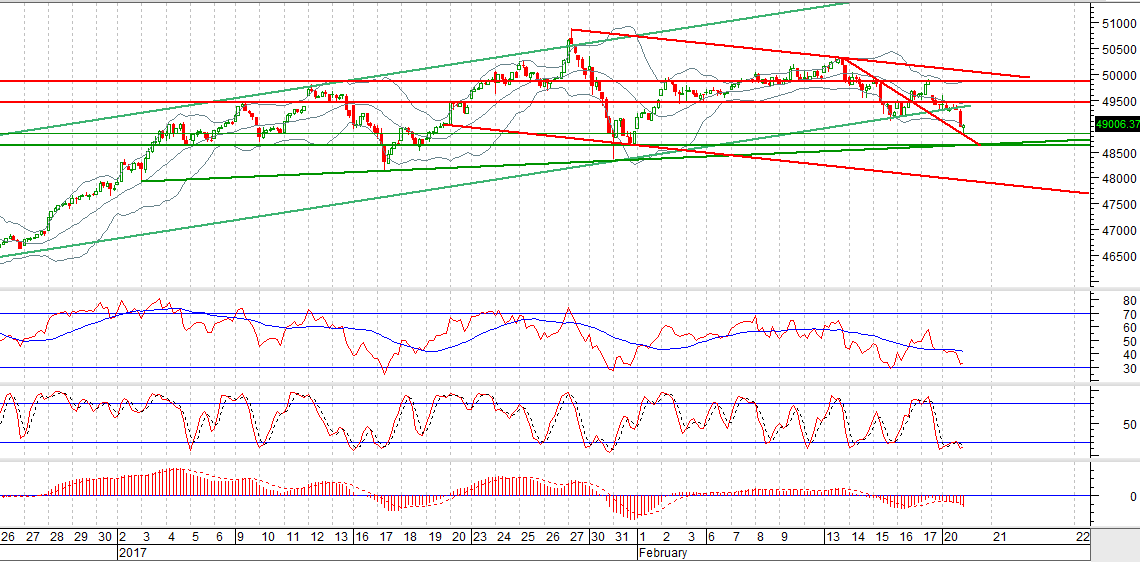

The Bench Mark KSE100 Index is getting support from a former resistant trend line and trying to bounce back after expanding its 50% intraday correction till 61.8%. For current trading session 48760 and 48623 regions would react as supports and market can bounce back on intra day bases after testing these supportive regions. 48623 is a strong supportive region and breakout of that region can call for 47922 . KSE100 Index will face strong resistance from 49440 where its capped by a horizontal resistance during current trading session. Market is not in bullish mode until and unless it close above 49600 so new buying for holding purpose is not recommended on current levels.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.