Previous Session Recap

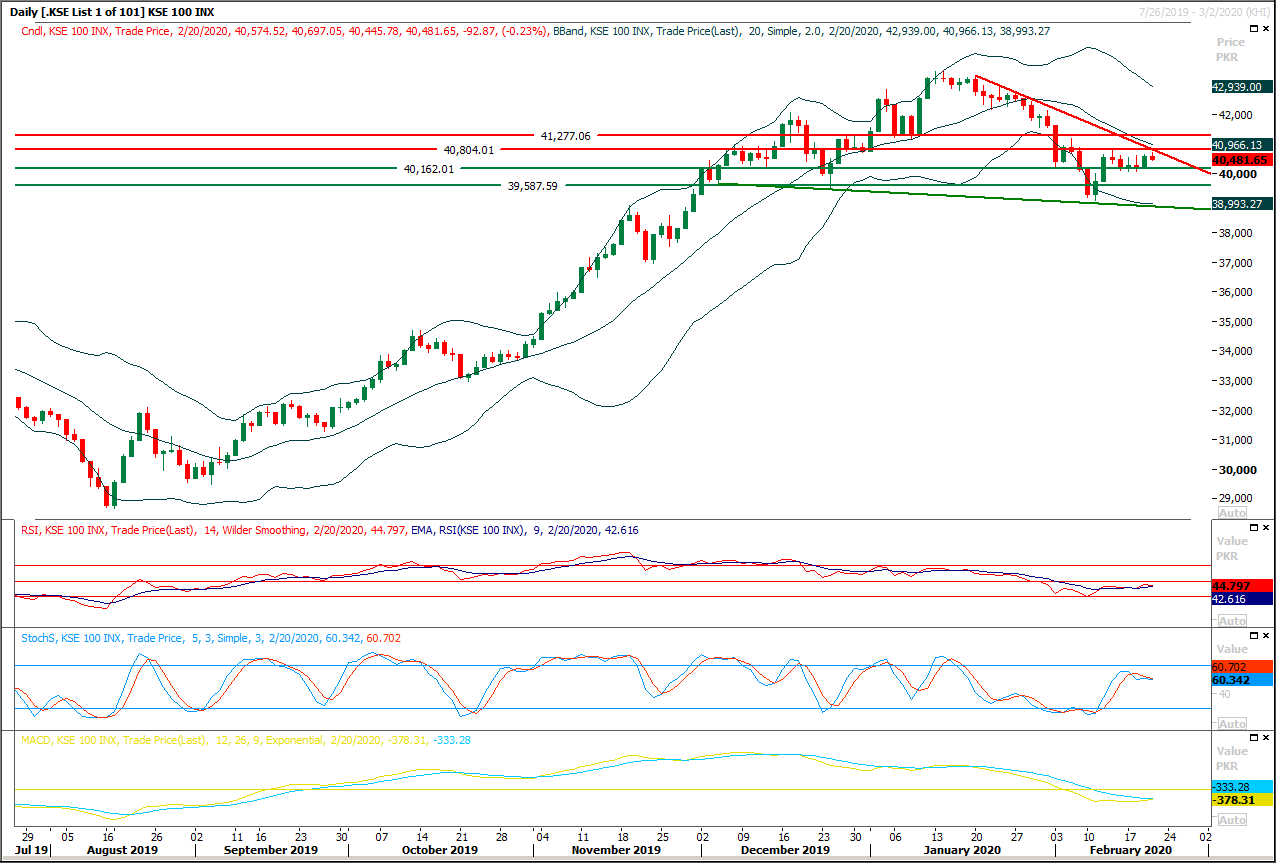

Trading volume at PSX floor dropped by 30.88 million shares or 21.60% on DoD basis, whereas the benchmark KSE100 index opened at 40,660.52, posted a day high of 40,697.05 and a day low of 40,445.78 points during last trading session while session suspended at 40,481.65 points with net change of -92.87 points and net trading volume of 92.87 million shares. Daily trading volume of KSE100 listed companies also dropped by 26.01 million shares or 23.74% on DoD basis.

Foreign Investors remained in net selling positions of 2.67 million shares and value of Foreign Inflow dropped by 1.36 million US Dollars. Categorically, Foreign Individuals, Corporate and Overseas Pakistani remained in net selling positions of 0.002, 2.40 and 0.25 million shares respectively. While on the other side Local Companies, Banks, NBFCs, Mutual Fund and Insurance Companies remained in net long positions of 1.92, 0.77, 1.87, 0.83 and 2.75 million shares but Local Individuals and Brokers remained in net selling positions of 5.00 and 0.93 million shares respectively.

Analytical Review

Asia looks to safer shores in U.S. assets as virus spreads

Asian shares were under water on Friday as fears over the creeping spread of the coronavirus sent funds fleeing to the sheltered shores of U.S. assets, lofting the dollar to three-year highs.Even Wall Street turned soggy late on Thursday on news of increased infections in Beijing and abroad. South Korea reported 52 new confirmed cases on Friday. Corporate earnings are increasingly under threat as U.S. manufacturers, like many others, scramble for alternative sources as China’s supply chains seize up. The International Air Transport Association (IATA) estimated losses for Asian airlines alone could amount to almost $28 billion this year, with most of that in China. “COVID-19 anxiety has risen to a new level amid concerns of virus outbreaks in Beijing and outside of China,” said Rodrigo Catril, a senior FX strategist at NAB.

Gas, electricity rates frozen till June

he federal cabinet on Thursday decided to keep gas and electricity prices unchanged for the next four months [till the announcement of next fiscal budget] and tasked the ministries concerned with reducing taxes on utility bills to provide some relief to the inflation-hit people. The prime minister, while presiding over a meeting of the cabinet, directed the Utility Stores Corporation (USC) managing director to get edible oil and ghee from the factories set up in the erstwhile Federally Administered Tribal Areas and Azad Jammu and Kashmir as these factories were exempted from all taxes and the USC could get their [factories] products at lower rates for consumers in other parts of the country.

Pakistan set to get four-month FATF breather

The Financial Action Task Force is set to give Pakistan another four months (until June 2020) to achieve full compliance with its 27-point action plan and secure exit from the FATF grey list. Informed sources told Dawn from Paris that Pakistan’s progressive performance vis-à-vis the action plan had been appreciated at the working group meetings, but all the members, barring a couple of friendly nations, called for “full compliance” with the action plan. “We are satisfied with the progress so far. There was no case at all for blacklisting us,” a source said. The FATF will issue a formal statement on Friday (today) on conclusion of the group meetings and plenary from Feb 16 to 21. There would be no presser this time, the source said. The Pakistani delegation was led by Revenue Minister Hammad Azhar.

Legal opinion sought in Centre-Balochistan dispute over Sui field ownership

The government on Thursday sought legal opinion of the Law Division to settle difference of opinion over shareholding of hydrocarbon resources between the centre and Balochistan that has hampered signing of a legal instrument over Sui field for almost five years. The decision to this effect was taken at a meeting presided over by Finance Adviser Dr Abdul Hafeez Shaikh and attended by Minister for Energy Omar Ayub Khan, Special Assistant to Prime Minister on Petroleum Nadeem Babar, Balochistan’s Secretary Energy and representatives of the Ministry of Inter-Provincial Coordination.

Exporters criticise onion ban

Exporters have criticised the government’s decision of banning onion exports till May 30, saying it will result in major financial losses due to the vegetable’s short life. Expressing surprise over the move, they said the exporter community were not consulted with. All Pakistan Fruit and Vegetable Exporters, Importers and Merchants Association (PFVA) Patron-in-Chief Waheed Ahmed in a letter to Commerce Advisr Abdul Razak Dawood on Thursday said the country has surplus quantity of onion to ensure price stability in the market and a ban on its export would deprive from foreign exchange earnings.

Asian shares were under water on Friday as fears over the creeping spread of the coronavirus sent funds fleeing to the sheltered shores of U.S. assets, lofting the dollar to three-year highs.Even Wall Street turned soggy late on Thursday on news of increased infections in Beijing and abroad. South Korea reported 52 new confirmed cases on Friday. Corporate earnings are increasingly under threat as U.S. manufacturers, like many others, scramble for alternative sources as China’s supply chains seize up. The International Air Transport Association (IATA) estimated losses for Asian airlines alone could amount to almost $28 billion this year, with most of that in China. “COVID-19 anxiety has risen to a new level amid concerns of virus outbreaks in Beijing and outside of China,” said Rodrigo Catril, a senior FX strategist at NAB.

he federal cabinet on Thursday decided to keep gas and electricity prices unchanged for the next four months [till the announcement of next fiscal budget] and tasked the ministries concerned with reducing taxes on utility bills to provide some relief to the inflation-hit people. The prime minister, while presiding over a meeting of the cabinet, directed the Utility Stores Corporation (USC) managing director to get edible oil and ghee from the factories set up in the erstwhile Federally Administered Tribal Areas and Azad Jammu and Kashmir as these factories were exempted from all taxes and the USC could get their [factories] products at lower rates for consumers in other parts of the country.

The Financial Action Task Force is set to give Pakistan another four months (until June 2020) to achieve full compliance with its 27-point action plan and secure exit from the FATF grey list. Informed sources told Dawn from Paris that Pakistan’s progressive performance vis-à-vis the action plan had been appreciated at the working group meetings, but all the members, barring a couple of friendly nations, called for “full compliance” with the action plan. “We are satisfied with the progress so far. There was no case at all for blacklisting us,” a source said. The FATF will issue a formal statement on Friday (today) on conclusion of the group meetings and plenary from Feb 16 to 21. There would be no presser this time, the source said. The Pakistani delegation was led by Revenue Minister Hammad Azhar.

The government on Thursday sought legal opinion of the Law Division to settle difference of opinion over shareholding of hydrocarbon resources between the centre and Balochistan that has hampered signing of a legal instrument over Sui field for almost five years. The decision to this effect was taken at a meeting presided over by Finance Adviser Dr Abdul Hafeez Shaikh and attended by Minister for Energy Omar Ayub Khan, Special Assistant to Prime Minister on Petroleum Nadeem Babar, Balochistan’s Secretary Energy and representatives of the Ministry of Inter-Provincial Coordination.

Exporters have criticised the government’s decision of banning onion exports till May 30, saying it will result in major financial losses due to the vegetable’s short life. Expressing surprise over the move, they said the exporter community were not consulted with. All Pakistan Fruit and Vegetable Exporters, Importers and Merchants Association (PFVA) Patron-in-Chief Waheed Ahmed in a letter to Commerce Advisr Abdul Razak Dawood on Thursday said the country has surplus quantity of onion to ensure price stability in the market and a ban on its export would deprive from foreign exchange earnings.

Market is expected to remain volatile during current trading session.

Technical Analysis

The Benchmark KSE100 index is being caged in a descending wedge on daily chart and right now it's moving beside its resistant trend line and if it would not succeed in giving a breakout above this line or 40,800 points then some serious pressure would be witnessed which may push index towards 40,000pts initially and breakout below that region would call for 39,500 points and then 38,800 points. It's recommended to trade with strict stop loss because if index would succeed in closing above 40,800 points the a morning star formation would take place on weekly chart and this formation would try to push index towards 41,000 points and 41,200 points where once again index would face strong resistance.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.