Previous Session Recap

Trading volume at PSX floor dropped by 37.51 million shares or 17.74% on DoD basis, whereas the benchmark KSE100 index opened at 43,245.13, posted a day high of 43,302.61 and a day low of 42,632.58 points during last trading session while session suspended at 42,747.63 points with net change of -420.13 points and net trading volume of 116.37 million shares. Daily trading volume of KSE100 listed companies also dropped by 8.96 million shares or 7.15% on DoD basis.

Foreign Investors remained in net selling positions of 7.18 million shares and net value of Foreign Inflow dropped by 1.53 million US Dollars. Categorically, Foreign Individuals and Overseas Pakistani remained in net buying positions of 0.02 and 2.06 million shares but Foreign Corporate investors remained in net selling positions of 9.26 million shares. While on the other side Local Individuals, Banks, NBFC and Insurance Companies remained in net buying positions of 12.61, 0.65, 0.13 and 0.99 million shares but Local Companies, Mutual Fund and Brokers remained in net selling positions of 1.45, 1.22 and 3.31 million shares respectively.

Analytical Review

Asia shares lurch lower, flu concerns a possible culprit

Asian shares took a sudden lurch lower on Tuesday as a ripple of risk aversion swept markets, though analysts could find no obvious trigger for the move. Safe-haven bonds and the yen edged higher in what was very thin trade, leading dealers to look for likely culprits. Some thought mounting concerns over the coronavirus outbreak in China might be having an impact given the threat of contagion as hundreds of millions travel for the Lunar New Year holidays. “It’s an essential enough development that markets will monitor it on the risk radar, as if things turn critical it could provide a massive blow to the airline industry and a knockout punch to local tourism,” said Stephen Innes, Asia Pacific market strategist at AxiCorp. While the trigger was uncertain, the price action was clear enough with MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS slipping 0.9%.

Reconstitution of cotton committee directed

Prime Minister Imran Khan on Monday directed changes in the Seed (Amendment) Act 2015 and reconstitution of the Cotton Committee on an urgent basis. Chairing a high-level meeting to review cotton policy and cultivation of the cash crop in the country, he directed the Ministry of Finance, Ministry of National Food Security and Research and the Commerce Division to share proposals on fixing the support price of cotton. The prime minister said steps for promotion of cotton yield, in consultation with farmers and relevant authorities, were on the cards The meeting discussed share of cotton crop in overall produce of the country and other related matters including import, export and challenges.

Competition watchdog earns PM’s ire over wheat fiasco

Prime Minister Imran Khan on Monday expressed his displeasure over Competition Commission of Pakistan’s (CCP) unsatisfactory performance to check cartelisation of flour millers. The prime minister further directed the Finance Division to review CCP’s performance against prescribed benchmarks. The direction came from the premier at a time when the CCP has already imposed a penalty of Rs75 million on Pakistan Flour Mills Association for fixing the price and quantity of wheat flour in violation of Section 4 of the Competition Act 2010. The said section prohibits associations from entering into any agreement or making any decision in respect of the production, supply, distribution, acquisition or control of goods or the provision of services, which have the object or effect of preventing, restricting, reducing, or distorting competition within the relevant market.

Rice exports grow 26.30pc

Rice exports from the country during first half of current financial year grew by 26.30% as compared the exports of the corresponding period of last year. During the period from July-December 2019-20, rice over 2.020 million metric tons worth $1.033 billion exported as compared to the exports of 1.587 million tons valuing $817.923 million of same period of last year. According the latest trade data released by the Pakistan Bureau of Statistics, exports of Basmati rice witnessed overwhelming growth of 55.89% as about 415,083 metric tons of above mentioned commodity worth $380.623 million exported as compared to the exports of 241,491 metric tons valuing $244.169 million of same period of last year. Meanwhile, exports of rice other then Basmati also grew by 13.71% during the period under review as 1,605,613 metric tons of rice worth $652.428 million exported as against 1,345,961 metric tons valuing $573.754 million of same period of last year. However, on month on month basis, rice exports decreased by 8.19% in December, 2019 as 403,923 metric tons of rice valuing $197.185 million against exports of 431,744 metric tons of same month of last year.

USC to procure 53,333 tonnes of wheat flour, NA body told

The National Assembly Standing Committee on Industries and Production was informed on Monday that the Utility Stores Corporation (USC) was in the process of procuring 53,333 tonnes of wheat flour which would be sold at subsidised rates. However, the committee was informed by USC Managing Director Umer Lodhi that currently 1,103 tonnes of wheat flour was available with the corporation. He said 200,000 tonnes of wheat was provided to the USC by the government and after grinding it, flour had been distributed to all USC outlets. The chairman of the NA committee, Sajid Hussain Turi, inquired about the price difference between the commodities, mainly wheat flour, being sold at USC outlets and the open market.

Asian shares took a sudden lurch lower on Tuesday as a ripple of risk aversion swept markets, though analysts could find no obvious trigger for the move. Safe-haven bonds and the yen edged higher in what was very thin trade, leading dealers to look for likely culprits. Some thought mounting concerns over the coronavirus outbreak in China might be having an impact given the threat of contagion as hundreds of millions travel for the Lunar New Year holidays. “It’s an essential enough development that markets will monitor it on the risk radar, as if things turn critical it could provide a massive blow to the airline industry and a knockout punch to local tourism,” said Stephen Innes, Asia Pacific market strategist at AxiCorp. While the trigger was uncertain, the price action was clear enough with MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS slipping 0.9%.

Prime Minister Imran Khan on Monday directed changes in the Seed (Amendment) Act 2015 and reconstitution of the Cotton Committee on an urgent basis. Chairing a high-level meeting to review cotton policy and cultivation of the cash crop in the country, he directed the Ministry of Finance, Ministry of National Food Security and Research and the Commerce Division to share proposals on fixing the support price of cotton. The prime minister said steps for promotion of cotton yield, in consultation with farmers and relevant authorities, were on the cards The meeting discussed share of cotton crop in overall produce of the country and other related matters including import, export and challenges.

Prime Minister Imran Khan on Monday expressed his displeasure over Competition Commission of Pakistan’s (CCP) unsatisfactory performance to check cartelisation of flour millers. The prime minister further directed the Finance Division to review CCP’s performance against prescribed benchmarks. The direction came from the premier at a time when the CCP has already imposed a penalty of Rs75 million on Pakistan Flour Mills Association for fixing the price and quantity of wheat flour in violation of Section 4 of the Competition Act 2010. The said section prohibits associations from entering into any agreement or making any decision in respect of the production, supply, distribution, acquisition or control of goods or the provision of services, which have the object or effect of preventing, restricting, reducing, or distorting competition within the relevant market.

Rice exports from the country during first half of current financial year grew by 26.30% as compared the exports of the corresponding period of last year. During the period from July-December 2019-20, rice over 2.020 million metric tons worth $1.033 billion exported as compared to the exports of 1.587 million tons valuing $817.923 million of same period of last year. According the latest trade data released by the Pakistan Bureau of Statistics, exports of Basmati rice witnessed overwhelming growth of 55.89% as about 415,083 metric tons of above mentioned commodity worth $380.623 million exported as compared to the exports of 241,491 metric tons valuing $244.169 million of same period of last year. Meanwhile, exports of rice other then Basmati also grew by 13.71% during the period under review as 1,605,613 metric tons of rice worth $652.428 million exported as against 1,345,961 metric tons valuing $573.754 million of same period of last year. However, on month on month basis, rice exports decreased by 8.19% in December, 2019 as 403,923 metric tons of rice valuing $197.185 million against exports of 431,744 metric tons of same month of last year.

The National Assembly Standing Committee on Industries and Production was informed on Monday that the Utility Stores Corporation (USC) was in the process of procuring 53,333 tonnes of wheat flour which would be sold at subsidised rates. However, the committee was informed by USC Managing Director Umer Lodhi that currently 1,103 tonnes of wheat flour was available with the corporation. He said 200,000 tonnes of wheat was provided to the USC by the government and after grinding it, flour had been distributed to all USC outlets. The chairman of the NA committee, Sajid Hussain Turi, inquired about the price difference between the commodities, mainly wheat flour, being sold at USC outlets and the open market.

Market is expected to remain volatile during current trading session.

Technical Analysis

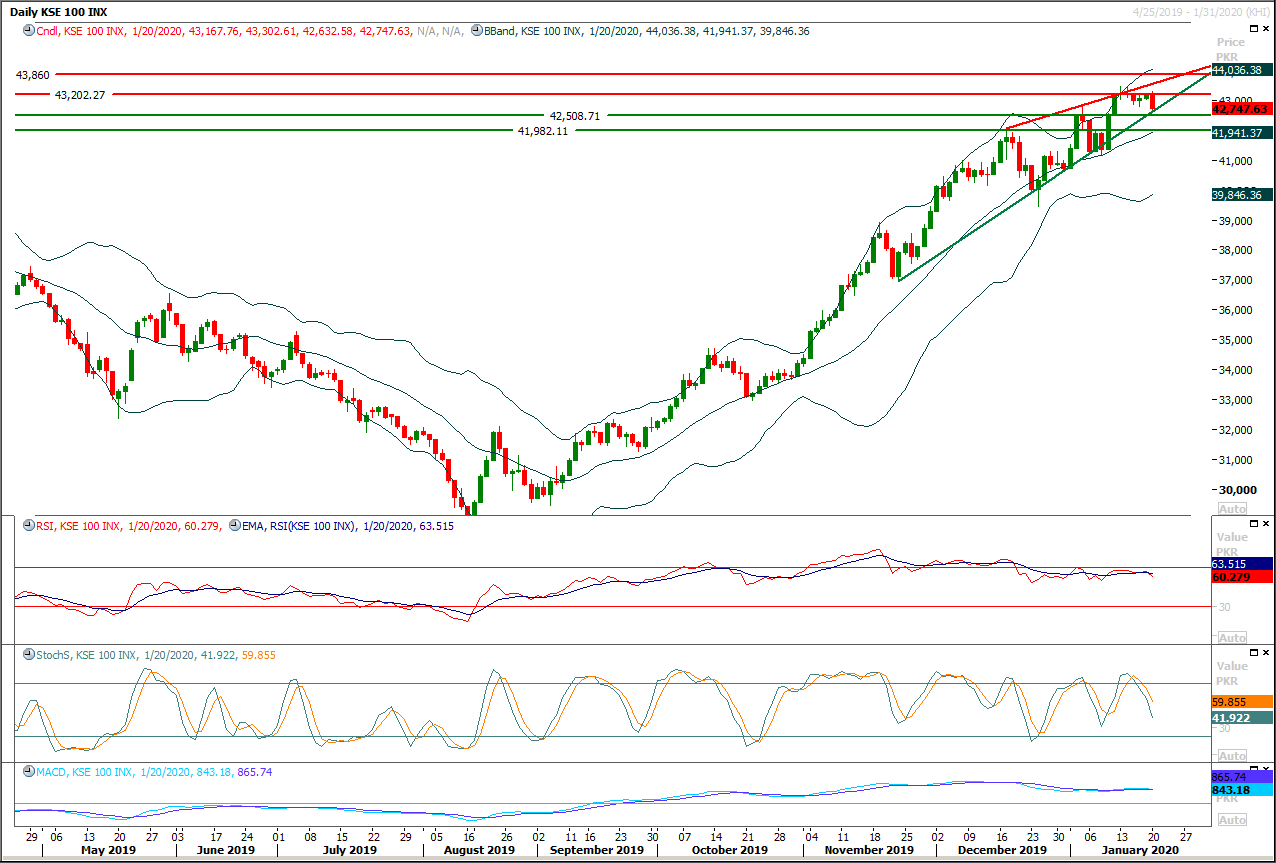

The Benchmark KSE100 index still have not succeeded in giving a breakout of its rising wedge on aily chart and right now index closed at supportive trend line of that wedge. As of now index have supportive regions ahead at 42,500 points and 42,000 points on intraday basis. As of now it's expected that index would try to take spike on intraday basis if it would succeed in maintaining above 42,500pts and would try to retest 43,000pts but at that region it would face strong resistance from a horizontal resistant region. It's recommended to stay cautious because if index would face rejection from 43,000pts then it would try to extend its previous session's low towards 42,500 or 42,000 points in coming days. Index would remain bearish until it would not succeed in closing above 43,860 points.

While in case of breakout above 43,000 points index would try to target 43,450 and 43,860 points in coming day but daily momentum indicators are still in bearish mode and these would try to add pressure on index if it would not succeed in recovering above 43,000 points today. Therefore it's recommended to post trailing stop loss on existing long positions.

While in case of breakout above 43,000 points index would try to target 43,450 and 43,860 points in coming day but daily momentum indicators are still in bearish mode and these would try to add pressure on index if it would not succeed in recovering above 43,000 points today. Therefore it's recommended to post trailing stop loss on existing long positions.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.