Previous Session Recap

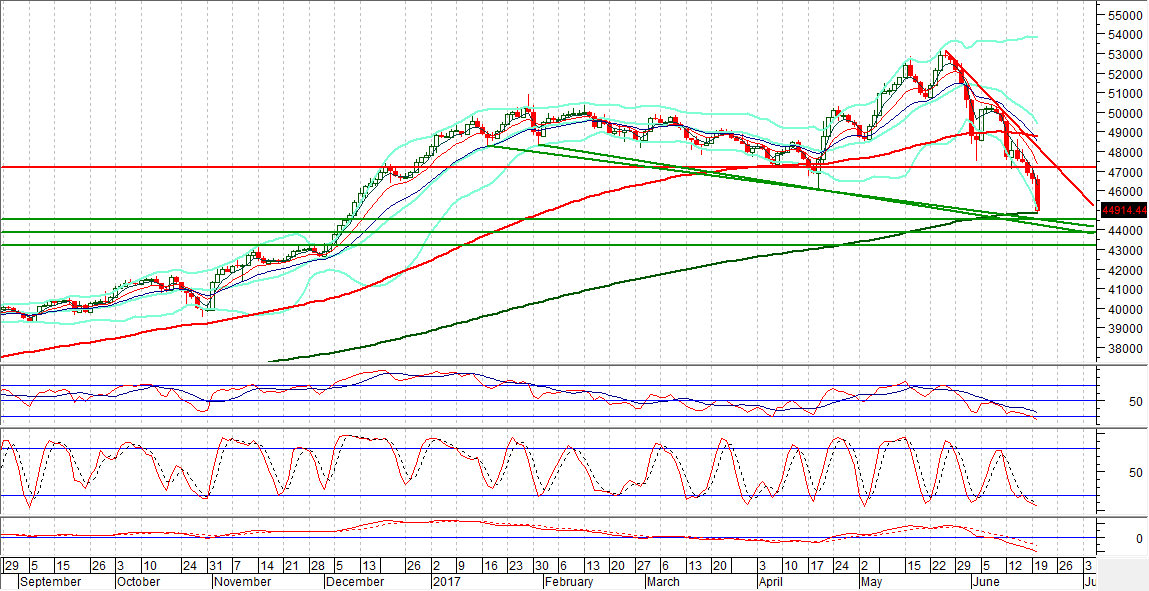

Trading volume at PSX floor increased by 124.71 million shares or 73.25%, DoD basis. Whereas, KSE100 Index opened at 46593.34, posted a day high of 46777.33 and a day low of 44823.56 during the last trading session. The session suspended at 44914.44 points with a net change of -1678.90 points and a net trading volume of 135.2 million shares. Daily trading volume of KSE100 listed companies increased by 60.36 million shares or 80.67%, DoD basis.

Foreign Investors remained in a net selling position of 4.36 million shares but the net value of Foreign Inflow increased by 2.3 million US Dollars. Categorically, Foreign Individual and Overseas Pakistani investors remained in a net buying position of 0.12 and 3.08 million shares but Foreign Corporate investors remained in a net selling position of 7.56 million shares. While on the other side, Local Individuals, Companies, Banks and NBFCs remained in net buying positions of 18.27, 9.27, 2.02 and 0.51 million shares, respectively, However, Mutual Funds and Brokers remained in net selling positions of 7.56 and 1.76 million shares.

Analytical Review

A renewed slump in oil prices to seven-month lows put Asian investors on edge on Wednesday, overshadowing a decision by U.S. index provider MSCI to add mainland Chinese stocks to one of its popular benchmarks. MSCI broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS slipped 0.7 percent, with Australian commodity-heavy market down 1.1 percent . Japanese Nikkei .N225 eased 0.2 percent. Oil had shed 2 percent on Tuesday as increased supply from several key producers overshadowed high compliance by OPEC and non-OPEC producers on a deal to cut global output. The drop took U.S. crude down 20 percent from its recent high and thus into official bear territory, a red flag to investors who follow technical trends. The acceptance of some Chinese A shares into MSCI Emerging Markets Index was seen as a symbolic win for Beijing after three failed attempts. Yet the step is still a small one. Only 222 stocks are being included and, with a weighing of just 5 percent, they will account for only 0.73 percent of the Emerging Markets Index .MSCIEF. MSCI estimated the change, which does not happen until June next year, would drive inflows of between $17 billion and $18 billion. Chinese market cap is roughly $7 trillion. The index provider set out a laundry list of liberalization requirements before it would consider further expansion. MSCI Pakistan Standard (Large and Middle Capp) droppped by 3.99% while MSCI Pakistan IMI Index (Small, Middle and Large Cap) dropped by 3.95% on DoD basis during last trading session.

The National Electric Power Regulatory Authority (Nepra) on Tuesday approved Rs1.90 per unit reduction in power tariff for the Ex-Wapda distribution companies (Discos) for May under monthly fuel adjustment formula. In a public hearing, on the petition filed by Central Power Purchase Agency (CPPA), presided over by Nepra Chairman Tariq Saddozai, the power regulator concluded that the distribution companies had charged Rs6.776 per unit in May on account of fuel cost to consumers but the actual fuel cost was Rs4.8 per unit. This amount will be adjusted in consumers’ electricity bills of June 2017 and would have accumulative impact of around Rs19 billion.

The Punjab Provincial Development Working Party (PDWP) has approved three development schemes of Health and Agriculture sectors with an estimated cost of Rs6,016.35 million. The approved development schemes included: Construction of 128 Bed Mother & Child Care Hospital, Murree at the cost of Rs4157.000 million, Construction of Cardiology & Cardiac Surgery Block at BV Hospital Bahawalpur (Revised) at the cost of Rs1707.684 million Effective Pest Management in Cotton Crop through Subsidised Provision of Spray Machines in Core Cotton District of Punjab at the cost of Rs151.666 million.

The business community has expressed concern over historic trade deficit and urged the Ministries of Finance and Commerce to take instantaneous measures to sustain balance between imports and exports. LCCI Acting President Amjad Ali Jawa said that issue of trade deficit must be controlled immediately otherwise this important economic indicator would shatter the confidence of investors. He said that Pakistan’s trade deficit has sharply swelled by around $30 billion or 42.12 percent during first eleven months of current fiscal year as compared to the deficit of $21.1 billion in the corresponding months of the last fiscal year. The widening of trade deficit is due to significant increase in imports by 20.6 percent to $48.53 billion during July–May 2016-17 as compared to $40.25 billion in the same period of the last fiscal year.

An inter-ministerial committee meeting on Tuesday recommended export of 0.6 million tons sugar without giving any subsidy. The committee headed by Commerce Minister Khurram Dastgir Khan has recommended the Economic Coordination Committee (ECC) to allow further 0.6 million tons exports without giving any subsidy to the exporters. The committee has also suggested that export of sugar would be without making it time-bound.

The Market is expected to remain volatile today. We advise Traders to exercise caution. Buying on dips and booking gains on strength is recommended.

Technical Analysis

The Benchmark KSE100 Index is about to complete 100% expansion of its last daily 50% correction. As of now, it has touched its 280 days moving average and have supports ahead at 44600 and 44511 at its 100% expansion level along with a supportive trend line. While another supportive trend line is falling at 44245 which could also become a strong support. For the current trading session buying on dip with strict stop loss and selling on strength is recommended as index may attempt to bounce back after a dip and testing its supportive regions for a correction of around 6000 points which are wiped out during the last 10 trading sessions.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.