Previous Session Recap

Trading volume at PSX floor increased by 13.11 million shares or 10.63% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 43,683.32, posted a day high of 43,745.91 and a day low of 42,960.11 during last trading session. The session suspended at 43,002.83 with net change of -680.01 and net trading volume of 91.52 million shares. Daily trading volume of KSE100 listed companies increased by 27.79 million shares or 43.60% on DoD basis.

Foreign Investors remained in net selling position of 0.03 million shares and net value of Foreign Inflow dropped by 2.65 million US Dollars. Categorically, Foreign Individual and Foreign Corporate remained in net selling positions of 0.07 and 2.23 million shares but Overseas Pakistanis investors remained in net buying positions of 2.27 million shares. While on the other side Local Companies, Banks, NBFCs, Mutual Fund and Brokers remained in net buying positions of 37.51, 0.96, 0.81, 1.84 and 5.43 million shares but Local Individuals and Insurance Companies remained in net selling positions of 44.63 and 1.76 million shares respectively.

Analytical Review

Asian shares edge ahead, oil subdued before OPEC meeting

Asian shares crept ahead on Thursday as a lull in the Sino-U.S. trade tussle and talk of more Chinese stimulus helped calm nerves, while tensions in the oil market grew ahead of an OPEC meeting that could expand the supply of crude. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS gained 0.4 percent, while Japan's Nikkei .N225 added 0.7 percent. Australia’s main index had another strong day, rising 1 percent on fund manager demand before the end of the local financial year next week. Futures for the S&P 500 ESc1 added 0.4 percent as investors waited for new developments on global trade. After a hesitant start, Chinese markets moved into positive territory as Shanghai blue chips rose 0.6 percent .CSI300. The mere absence of new threats from President D

Moody's changes outlook on Pakistan's rating to negative

Moody's Investors Service on Wednesday has changed the outlook on Pakistan's rating to negative from stable and affirmed the B3 local and foreign currency long-term issuer and senior unsecured debt ratings. The decision to change the outlook to negative is driven by heightened external vulnerability risk. Foreign exchange reserves have fallen to low levels and, absent significant capital inflows, will not be replenished over the next 12-18 months. Low reserve adequacy threatens continued access to external financing at moderate costs, in turn potentially raising government liquidity risks. The decision to affirm the B3 rating reflects Pakistan's robust growth potential, supported by ongoing improvements in energy supply and physical infrastructure, which are likely to raise economic competitiveness over time. These credit strengths balance Pakistan's fragile external payments position and very weak government debt affordability owing to low revenue generation capacity.

Govt joins hands with FAO to control FMD

The government of Pakistan has approved a project to improve food security and increase the resilience of livelihood of the livestock farmers to animal disease threats. Food and Agriculture Organisation of the United Nations (FAO) and Ministry of National Food Security and Research signed the $6.6 million project agreement in Islamabad titled "Risk based control of Foot and Mouth Disease in Pakistan, said a press release. FMD is the most prevalent and economically the deadliest infectious disease of cattle and buffaloes in Pakistan. Annual losses are estimated to exceed USD 692 million in terms of loss of milk production, treatment cost, body weight loss and mortality in calves. FAO has been working for the control of FMD in Pakistan since 2008. On a FAO-OIE FMD Progressive Control Pathway, Pakistan moved from stage 0 to stage 1 in 2009 and to stage 2 in 2015. The current project will move Pakistan to stage 3, opening up further international markets for the export of meat and other livestock products.

FDI declines by 26pc to $237.9m in May

Foreign direct investment in Pakistan declined in May by 26 percent to $237.9 million compared with $322.7 million in the same month of the previous year. The accumulated FDI during first 11 months of current fiscal year also witnessed a slight decrease of 1.3 percent as it went down to $2.47 billion in July-May (2017-18) period from $2.5 billion in same period of fiscal year 2016-17, State Bank of Pakistan (SBP) reported on Wednesday. According to the central bank data, China remained the largest foreign investor with net investment of $95.6 million in May, followed by the Norway $84.6 million, the United Kingdom $15.1 million, Japan $9.1 million, Singapore $8.9 million, Switzerland $7.9 million, and United Arab Emirates (UAE) 7.7 million.

Dollar surge added over Rs600b to debt: FPCCI

Chairman Coordination of FPCCI Malik Sohail on Wednesday said continuous erosion in the exchange rate has emerged as the biggest threat to the economy. Increasing value of the dollar is sinking the masses in the sea of inflation while policymakers seem unconcerned which is cruelty, he said. Malik Sohail said that the US dollar has jumped to Rs125 in the open market and has become scarce as there are no sellers but a lot of buyers. The shortage of dollars has created problems for those who want to travel abroad. He noted that the value of the dollar has increased by over Rs17 since Dec 2017 which indicates failure of the policymakers. The exchange rate erosion has broken the back of masses, increased cost of production, cost of CPEC and all other developmental projects while added over Rs600 billion to the foreign debt.

Asian shares crept ahead on Thursday as a lull in the Sino-U.S. trade tussle and talk of more Chinese stimulus helped calm nerves, while tensions in the oil market grew ahead of an OPEC meeting that could expand the supply of crude. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS gained 0.4 percent, while Japan's Nikkei .N225 added 0.7 percent. Australia’s main index had another strong day, rising 1 percent on fund manager demand before the end of the local financial year next week. Futures for the S&P 500 ESc1 added 0.4 percent as investors waited for new developments on global trade. After a hesitant start, Chinese markets moved into positive territory as Shanghai blue chips rose 0.6 percent .CSI300. The mere absence of new threats from President D

Moody's Investors Service on Wednesday has changed the outlook on Pakistan's rating to negative from stable and affirmed the B3 local and foreign currency long-term issuer and senior unsecured debt ratings. The decision to change the outlook to negative is driven by heightened external vulnerability risk. Foreign exchange reserves have fallen to low levels and, absent significant capital inflows, will not be replenished over the next 12-18 months. Low reserve adequacy threatens continued access to external financing at moderate costs, in turn potentially raising government liquidity risks. The decision to affirm the B3 rating reflects Pakistan's robust growth potential, supported by ongoing improvements in energy supply and physical infrastructure, which are likely to raise economic competitiveness over time. These credit strengths balance Pakistan's fragile external payments position and very weak government debt affordability owing to low revenue generation capacity.

The government of Pakistan has approved a project to improve food security and increase the resilience of livelihood of the livestock farmers to animal disease threats. Food and Agriculture Organisation of the United Nations (FAO) and Ministry of National Food Security and Research signed the $6.6 million project agreement in Islamabad titled "Risk based control of Foot and Mouth Disease in Pakistan, said a press release. FMD is the most prevalent and economically the deadliest infectious disease of cattle and buffaloes in Pakistan. Annual losses are estimated to exceed USD 692 million in terms of loss of milk production, treatment cost, body weight loss and mortality in calves. FAO has been working for the control of FMD in Pakistan since 2008. On a FAO-OIE FMD Progressive Control Pathway, Pakistan moved from stage 0 to stage 1 in 2009 and to stage 2 in 2015. The current project will move Pakistan to stage 3, opening up further international markets for the export of meat and other livestock products.

Foreign direct investment in Pakistan declined in May by 26 percent to $237.9 million compared with $322.7 million in the same month of the previous year. The accumulated FDI during first 11 months of current fiscal year also witnessed a slight decrease of 1.3 percent as it went down to $2.47 billion in July-May (2017-18) period from $2.5 billion in same period of fiscal year 2016-17, State Bank of Pakistan (SBP) reported on Wednesday. According to the central bank data, China remained the largest foreign investor with net investment of $95.6 million in May, followed by the Norway $84.6 million, the United Kingdom $15.1 million, Japan $9.1 million, Singapore $8.9 million, Switzerland $7.9 million, and United Arab Emirates (UAE) 7.7 million.

Chairman Coordination of FPCCI Malik Sohail on Wednesday said continuous erosion in the exchange rate has emerged as the biggest threat to the economy. Increasing value of the dollar is sinking the masses in the sea of inflation while policymakers seem unconcerned which is cruelty, he said. Malik Sohail said that the US dollar has jumped to Rs125 in the open market and has become scarce as there are no sellers but a lot of buyers. The shortage of dollars has created problems for those who want to travel abroad. He noted that the value of the dollar has increased by over Rs17 since Dec 2017 which indicates failure of the policymakers. The exchange rate erosion has broken the back of masses, increased cost of production, cost of CPEC and all other developmental projects while added over Rs600 billion to the foreign debt.

Market is expected to remain volatile therefore it's recommended to stay cautious while trading today.

Technical Analysis

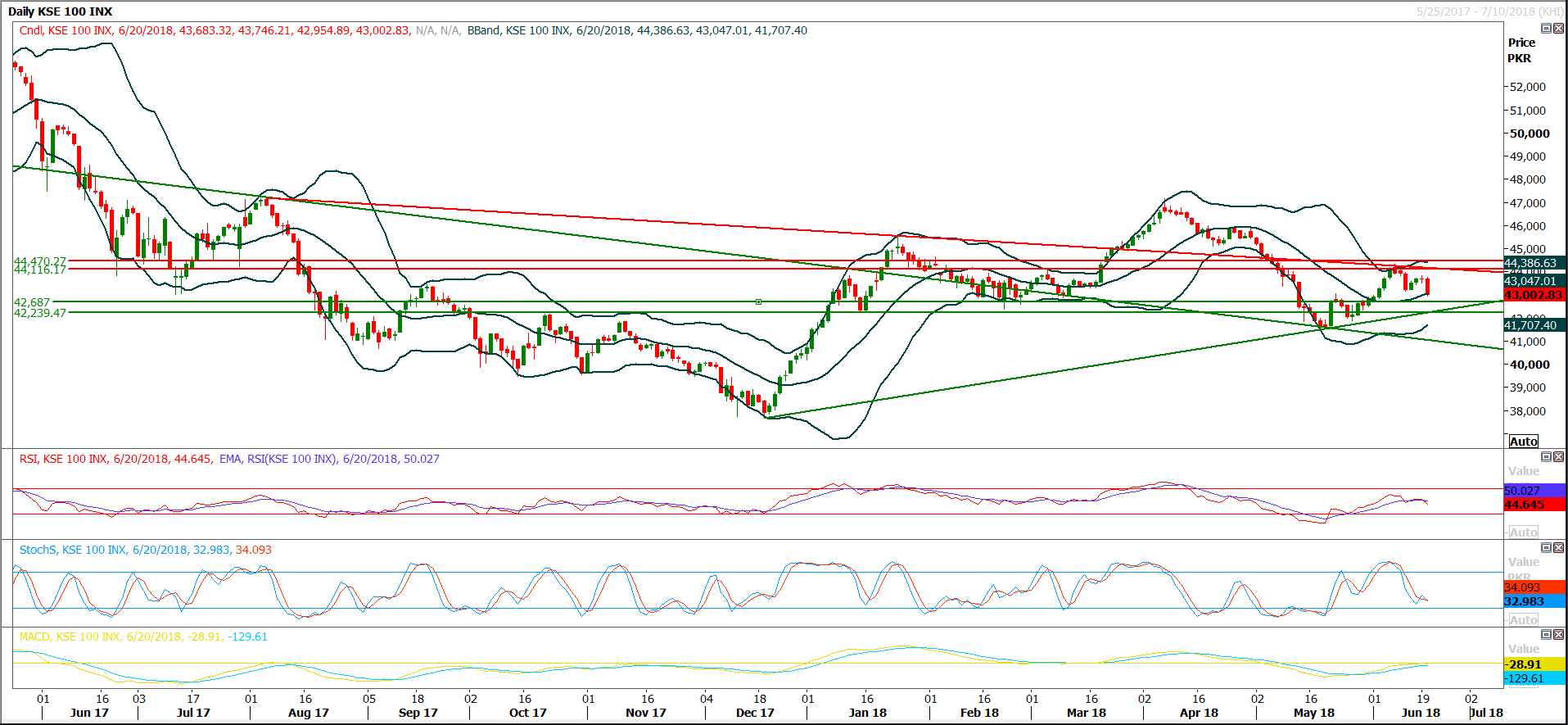

The Benchmark KSE100 Index have been pushed downward after completing its 50% correction on hourly chart and right now its heading for an expansion of said correction towards 42,687 points. Before that region index have support around 42,800 and if index would close below 42,687 points on hourly basis then it can target 42,200 where it would found some ground against current bearish rally. Daily Momentum indicators have changed their directions to bearish and on weekly chart index is already trying to expand its bearish correction. If index would slide below 42,200 then next targets would be 41,500 and 39,200 points on short term basis. Market is expected to remain volatile during current trading session and some serious pressure could be witnessed on blue chip scripts therefore its recommended to stay cautious and swing trading strategy is recommended for day trading, while new buying is not recommended on current levels.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.