Previous Session Recap

Trading volume at PSX floor increased by 63.68 million shares or 64.10% on DoD basis, whereas the benchmark KSE100 index opened at 34,691.80, posted a day high of 35,061.54 and a day low of 34,645.96 points during last trading session while session suspended at 34,995.91 with net change of 339.79 points and net trading volume of 92.01 million shares. Daily trading volume of KSE100 listed companies increased by 17.81 million shares or 24.00% on DoD basis.

Foreign Investors remained in net selling positions of 3.60 million shares and net value of Foreign Inflow dropped by 1.02 million US Dollars. Categorically Foreign Individuals and Foreign Corporate remained in net selling positions of 0.09 and 4.43 million shares but Overseas Pakistani investors remained in net buying positions of 0.92 million shares. While on the other side Local Companies and Banks remained in net buying positions of 27.20 and 0.80 million shares respectively but Local Individuals, NBFCs, Mutual Fund, Brokers and Insurance Companies remained in net selling positions of 28.06, 0.09, 2.12, 0.006 and 2.16 million shares.

Analytical Review

Global stocks rally, bond yields plunge after Fed hints at rate cuts

A gauge of global stock markets edged near this year’s peak while benchmark U.S. Treasury yields and the dollar dropped after the Federal Reserve signaled possible interest rate cuts later this year. MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.2% while Japan’s Nikkei gained 0.5%. The MSCI ACWI, which incorporates readings of 49 equity markets across the world, gained 0.2%, having recovered a large part of its losses made after U.S. President Donald Trump threatened new tariffs on all of China’s imports last month. Signs that China and the United States are returning to the negotiating table after a six-week hiatus also bolstered risk sentiment. The rally in stocks comes as a host of Asian central banks are scheduled to hold policy meetings later in the day, with most expected to flag moves toward looser monetary settings.

Threat of FATF blacklist averted

Pakistan has survived from falling into the blacklist at Financial Action Task Force (FATF) with the support of more than three countries at the plenary review meeting held in USA. The FATF will formally announce its decision today (Friday). The FATF plenary meeting is being held from June 16 to 21 at Florida, US. Pakistan’s delegation was in the US for attending the meeting. Pakistan had foiled an Indian attempt to downgrade Pakistan from grey to blacklist as New Delhi tabled a resolution against Islamabad. With the support of friendly countries, Pakistan avoided downgrading as Islamabad took measures in the last six months.

Forex reserves drop to $14.639 billion

Pakistan’s foreign exchange reserves fell to $14.639 billion during the week ended June 14 from $14.826 billion in the previous week, the central bank reported on Thursday. The forex reserves held by the State Bank of Pakistan dropped $203 million to $7.604 billion. The decline in the SBP’s reserves was attributed to foreign debt servicing and other official payments.

Senate committee rejects Finance Bill, asks SBP to freeze dollar at Rs150 and interest rate at 12pc

The Senate Standing Committee on Finance on Thursday rejected with majority vote the Finance Bill 2019 which envisages increase in taxes and prices, maintaining that it will badly burden the masses.

ECC takes no decision on wheat export, power rates for industry

The Economic Coordination Committee (ECC) of the Cabinet on Wednesday could not take decisions on continuation of subsidised power rates to industrial sector or ban on export of wheat in order to stop the increase in the price of the commodity. The meeting, presided over by PM’s Adviser on Finance and Revenue Dr Abdul Hafeez Shaikh, agreed in principle on tax exemptions for procurement of additional ships in the country or limiting oil imports only through domestic ships, but concluded that a decision in this regard should be taken by the federal cabinet. Informed sources said that ministers were divided when the Ministry of National Food Security & Research proposed a ban on export of wheat to stop rise in the price of the commodity in local markets.

A gauge of global stock markets edged near this year’s peak while benchmark U.S. Treasury yields and the dollar dropped after the Federal Reserve signaled possible interest rate cuts later this year. MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.2% while Japan’s Nikkei gained 0.5%. The MSCI ACWI, which incorporates readings of 49 equity markets across the world, gained 0.2%, having recovered a large part of its losses made after U.S. President Donald Trump threatened new tariffs on all of China’s imports last month. Signs that China and the United States are returning to the negotiating table after a six-week hiatus also bolstered risk sentiment. The rally in stocks comes as a host of Asian central banks are scheduled to hold policy meetings later in the day, with most expected to flag moves toward looser monetary settings.

Pakistan has survived from falling into the blacklist at Financial Action Task Force (FATF) with the support of more than three countries at the plenary review meeting held in USA. The FATF will formally announce its decision today (Friday). The FATF plenary meeting is being held from June 16 to 21 at Florida, US. Pakistan’s delegation was in the US for attending the meeting. Pakistan had foiled an Indian attempt to downgrade Pakistan from grey to blacklist as New Delhi tabled a resolution against Islamabad. With the support of friendly countries, Pakistan avoided downgrading as Islamabad took measures in the last six months.

Pakistan’s foreign exchange reserves fell to $14.639 billion during the week ended June 14 from $14.826 billion in the previous week, the central bank reported on Thursday. The forex reserves held by the State Bank of Pakistan dropped $203 million to $7.604 billion. The decline in the SBP’s reserves was attributed to foreign debt servicing and other official payments.

The Senate Standing Committee on Finance on Thursday rejected with majority vote the Finance Bill 2019 which envisages increase in taxes and prices, maintaining that it will badly burden the masses.

The Economic Coordination Committee (ECC) of the Cabinet on Wednesday could not take decisions on continuation of subsidised power rates to industrial sector or ban on export of wheat in order to stop the increase in the price of the commodity. The meeting, presided over by PM’s Adviser on Finance and Revenue Dr Abdul Hafeez Shaikh, agreed in principle on tax exemptions for procurement of additional ships in the country or limiting oil imports only through domestic ships, but concluded that a decision in this regard should be taken by the federal cabinet. Informed sources said that ministers were divided when the Ministry of National Food Security & Research proposed a ban on export of wheat to stop rise in the price of the commodity in local markets.

Market is expected to remain volatile therefore it's recommended to stay cautious during current trading session.

Technical Analysis

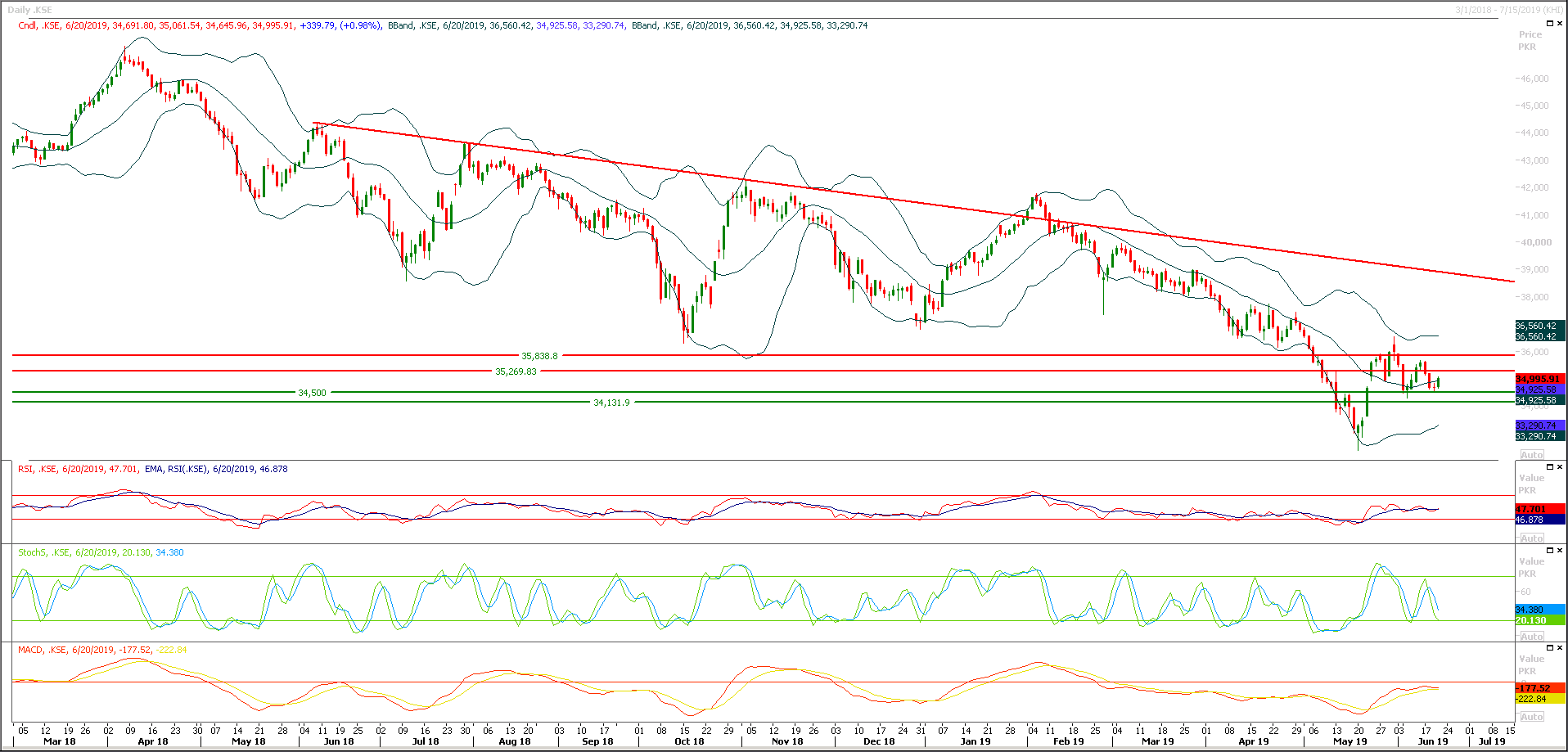

The Benchmark KSE100 Index have formatted a morning star on daily chart after getting support from a double bottom and it's expected that index would now try to continue its bullish momentum if it would succeed in penetration above 35,300 points on daily chart. As of now index would find supports at 34,600 and 34,300 points while on flipside it would face resistances at 35,300 and 35,500 points on intraday basis. It's recommended to continue buying with trailing stop loss or add positions on dip with strict stop loss of 34,500 points. Daily momentum indicators are trying to change their direction and if index would succeed in closing above 35,500 points during current trading session then these indicators would enter into bullish zone which would lead index towards 36,300 & 37,500 points.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.