Previous Session Recap

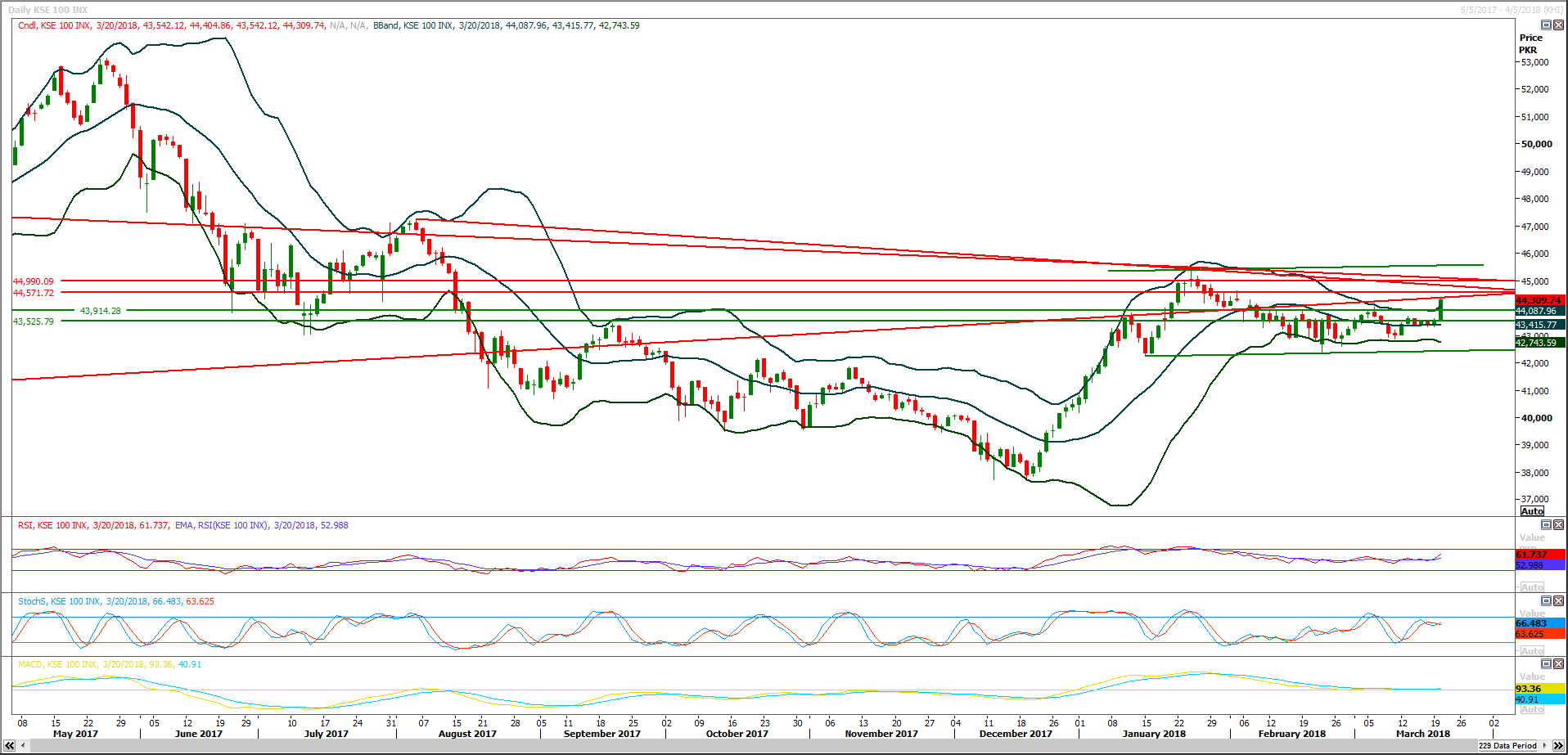

Trading volume at PSX floor increased by 103.94 million shares or 89.63% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 43542.12, posted a day high of 44404.86 and a day low of 43542.12 during last trading session. The session suspended at 44309.74 with net change of 770.14 and net trading volume of 92.62 million shares. Daily trading volume of KSE100 listed companies increased by 56.51 million shares or 156.49% on DoD basis.

Foreign Investors remained in net selling position of 6.65 million shares and net value of Foreign Inflow dropped by 4.42 million US Dollars. Categorically, Foreign Corporate and Overseas Pakistanis investors remained in net selling positions of 3.81 and 3.02 million shares but Foreign Individuals remained in net buying position of 0.17 million share. While on the other side Local Companies, NBFCS, Mutual Funds, Brokers and Insurance Companies remained in net buying positions of 3.09, 4.76, 9.53, 1.28 and 0.71 million shares respectively but Local Individuals and Banks remained in net selling positions of 8.51 and 2.26 million shares.

Analytical Review

Caution creeps into Asian trading ahead of Fed decision

A hush settled over financial markets on Wednesday as investors waited to hear how often the Federal Reserve might hike U.S. rates this year, while the currencies of exporting nations were rattled by fears of a full-blown trade war. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was barely changed after four straight days of losses. E-Mini futures for the S&P 500 ESc1 were slightly softer. Japan's Nikkei .N225 was closed for a local holiday while Australian shares were up 0.4 percent. Global shares rallied for all of 2017 but have started this year on the back foot, hit by a combination of factors including the risk of faster rate rises in the United States and alarm over protectionism.

Budget deficit to reach 6pc in 2017-18: IMF

Pakistan’s budget deficit for the current fiscal year is likely to reach around 6 per cent of GDP — almost 2pc higher than the 3.9pc budgetary limit — based on varying projections of the government and the International Monetary Fund (IMF). The IMF had put Pakistan’s fiscal deficit for 2016-17 at 6.3pc of GDP — about 0.5pc higher than the official accounts closed at 5.8pc. “The staff estimates the underlying deficit to have been about 0.5pc of GDP higher (6.3pc) after accounting for one-off asset sales,” IMF said in a detailed report on Pakistan’s economy released on the weekend.

Current Account gap widens 50pc to $10.82bn

The country’s current account deficit jumped by 50 per cent in the first eight months of FY18, making it more difficult for the country to meet the gap as its reserves continue to fall. The State Bank of Pakistan reported on Tuesday the current account deficit of the country rose to $10.826 billion during July-February FY18 compared to $7.216bn in the same period. The government is desperately looking for an option to reduce the increased deficit but the trade deficit could not be curtailed despite a 5pc devaluation of local currency in December 2017. During FY17, Pakistan posted a current account deficit of $12.2bn (4pc of GDP) as compared to $2.6bn (0.9 pc of GDP) in FY16 indicating that the deficit has been rising as threat to the economy.

$260m ADB loan to revamp power transmission network

The Asian Development Bank and the Government of Pakistan on Tuesday signed a $260 million loan agreement to improve the power transmission network in Sindh and Balochistan. The agreement is part of the second power transmission enhancement investment programme aimed to improve coverage, reliability, transparency, and quality of the power transmission service in Pakistan by expanding the 220-kilovolt transmission network in Sindh and Balochistan and upgrading the supervisory control and data acquisition (SCADA) and revenue metering systems (RMS) in the country. ADB hopes the new line with increased capacity will also improve system reliability and voltage profile in the two provinces and reduce transmission losses.

Online tax collection system launched

The Federal Board of Revenue (FBR) and State Bank of Pakistan (SBP) on Tuesday launched an online tax collection system, allowing taxpayers to pay taxes and duties using internet banking accounts or ATMs, without the hassle of visiting bank branches. The online tax collection system is live now and the taxpayers can pay their federal taxes including income tax, sales tax, customs duty and federal excise duty through alternative delivery channels — ATM, online banking, phone banking and contact centres — at any time seven days a week. The system is based on the 1Link Biller module, whereby FBR has been added as one of the Billers on the banks’ ‘Bill Payment’ page.

PPL, PSO and ATRLmay lead the market in positive direction

A hush settled over financial markets on Wednesday as investors waited to hear how often the Federal Reserve might hike U.S. rates this year, while the currencies of exporting nations were rattled by fears of a full-blown trade war. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was barely changed after four straight days of losses. E-Mini futures for the S&P 500 ESc1 were slightly softer. Japan's Nikkei .N225 was closed for a local holiday while Australian shares were up 0.4 percent. Global shares rallied for all of 2017 but have started this year on the back foot, hit by a combination of factors including the risk of faster rate rises in the United States and alarm over protectionism.

Pakistan’s budget deficit for the current fiscal year is likely to reach around 6 per cent of GDP — almost 2pc higher than the 3.9pc budgetary limit — based on varying projections of the government and the International Monetary Fund (IMF). The IMF had put Pakistan’s fiscal deficit for 2016-17 at 6.3pc of GDP — about 0.5pc higher than the official accounts closed at 5.8pc. “The staff estimates the underlying deficit to have been about 0.5pc of GDP higher (6.3pc) after accounting for one-off asset sales,” IMF said in a detailed report on Pakistan’s economy released on the weekend.

The country’s current account deficit jumped by 50 per cent in the first eight months of FY18, making it more difficult for the country to meet the gap as its reserves continue to fall. The State Bank of Pakistan reported on Tuesday the current account deficit of the country rose to $10.826 billion during July-February FY18 compared to $7.216bn in the same period. The government is desperately looking for an option to reduce the increased deficit but the trade deficit could not be curtailed despite a 5pc devaluation of local currency in December 2017. During FY17, Pakistan posted a current account deficit of $12.2bn (4pc of GDP) as compared to $2.6bn (0.9 pc of GDP) in FY16 indicating that the deficit has been rising as threat to the economy.

The Asian Development Bank and the Government of Pakistan on Tuesday signed a $260 million loan agreement to improve the power transmission network in Sindh and Balochistan. The agreement is part of the second power transmission enhancement investment programme aimed to improve coverage, reliability, transparency, and quality of the power transmission service in Pakistan by expanding the 220-kilovolt transmission network in Sindh and Balochistan and upgrading the supervisory control and data acquisition (SCADA) and revenue metering systems (RMS) in the country. ADB hopes the new line with increased capacity will also improve system reliability and voltage profile in the two provinces and reduce transmission losses.

The Federal Board of Revenue (FBR) and State Bank of Pakistan (SBP) on Tuesday launched an online tax collection system, allowing taxpayers to pay taxes and duties using internet banking accounts or ATMs, without the hassle of visiting bank branches. The online tax collection system is live now and the taxpayers can pay their federal taxes including income tax, sales tax, customs duty and federal excise duty through alternative delivery channels — ATM, online banking, phone banking and contact centres — at any time seven days a week. The system is based on the 1Link Biller module, whereby FBR has been added as one of the Billers on the banks’ ‘Bill Payment’ page.

Technical Analysis

The Benchmark KSE100 Index had closed after breakout of resistant trendline of a triangle in bullish direction on daily chart and now its heading towards expansion of said triangle which would be completed at 45569 points but before the ultimate expansion level index have resistant regions ahead at 44570, 44800 and 45011 points from different resistant trend lines along with some horizontal resistant regions, therefore it needs to be very cautious while trading during next two trading sessions because Index may format a false breakout of its major resistant region of 44570 points but fall before confirmation of said breakout. Upcoming three resistances are very strong and if index would start a reversal from current prices then it would result in a very sharp bearish rally as it had closed during last trading session at its 61.8% correction of its last bearish rally which was started from 45494 and ended up at 42384 points. For new buying its recommended to wait for a confirmation call by closing above 44771 points.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.