Previous Session Recap

Trading volume at PSX floor dropped by 21.51 million shares or 18.6%, DoD basis, whereas, the benchmark KSE100 Index opened at 40843.94, posted a day high of 40923.09 and a day low of 40260.05 during the last trading session. The session suspended at 40316.93 with a net change of -527.47 and net trading volume of 44.35 million shares. Daily trading volume of KSE100 listed companies dropped by 13.67 million shares or 23.57%, DoD basis.

Foreign Investors remained in a net buying position of 1.24 million shares and net value of Foreign Inflow increased by 1.79 million US Dollars. Categorically, Foreign Corporate investors remained in a net selling position of 0.86 million shares but Overseas Pakistanis remained in a net buying position of 2.03 million shares. While on the other side Local Individuals, Mutual Funds and Brokers remained in net selling positions of 1.59, 1.59 and 0.89 million shares respectively but Local Companies and Banks remained in a net buying position of 2.2 and 0.62 million shares.

Analytical Review

Asian stocks edged higher on Tuesday as investors took heart from further evidence of strength in the global economy, while the dollar hovered near a one-week high against its peers thanks to higher U.S. yields and a floundering euro. Gains on Wall Street overnight also helped MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS rise 0.5 percent and back towards a decade-high struck earlier this month. South Korea's KOSPI .KS11 rose 0.3 percent, Australian stocks climbed 0.2 percent and Japan's Nikkei .N225 advanced 1.1 percent. Shanghai .SSEC added 0.2 percent and Hong Kong's Hang Seng .HSI was 0.7 percent higher. Equity markets have enjoyed strong support this year thanks to rising corporate earnings on the back of an improving global economy.

Amreli Steels, Pakistan’s leading manufacturer of reinforcement bars, planned a joint venture with a Chinese company to produce and sell electrical transmission equipment in the country seeing a raft of new power projects on their way to meet growing energy demand. The board of directors of Amreli Steels Limited in the meeting on 17 November considered and approved participating in an investment opportunity in electrical transmission business through a joint venture with a Chinese company Qingdao Huijintong Power Equipment Company Limited (HJT),” the steelmaker said in a stock filing on Monday.

Textile exports rose eight percent to $4.39 billion in the first four months of the current fiscal 2017/18 as the industry’s value-added sector continued to post recovery in export earnings during the period, official data revealed on Monday. Pakistan Bureau of Statistics (PBS) data showed that textile exports amounted to $4.075 billion in the July-October period of the past fiscal year. Knitwear exports stood at $873.023 million during the July-October period of FY2018, depicting a 10.62 percent increase as compared to the corresponding period a year ago.

National Assembly Monday passed ''The Regulation of Generation, Transmission and Distribution of Electric Power (Amendment) Bill, 2017'' to check overbilling, ensure open market competitive regime for energy exchange and empower the regulator to investigate the complaints and punish violators. Minister for Power Sardar Awais Khan Leghari moved the bill and faced a tough resistance from the opposition members in the beginning for not giving them time to read the bill. Later, the opposition agreed to support the bill following detailed explanation by the minister about the urgency of the issue. The opposition also rejected an amendment in the bill relating to empowering the federal government to impose surcharge on consumers from time to time to improve provision of electric power services and subsidy management. The bill says that the federal government shall, from time to time, with the approval of the Council of Common Interests, prepare and prescribe a national electricity policy for development of the power markets.

The market is expected to remain volatile today. We advise traders to exercise caution. Buying on dips and booking gains on strength is recommended.

Technical Analysis

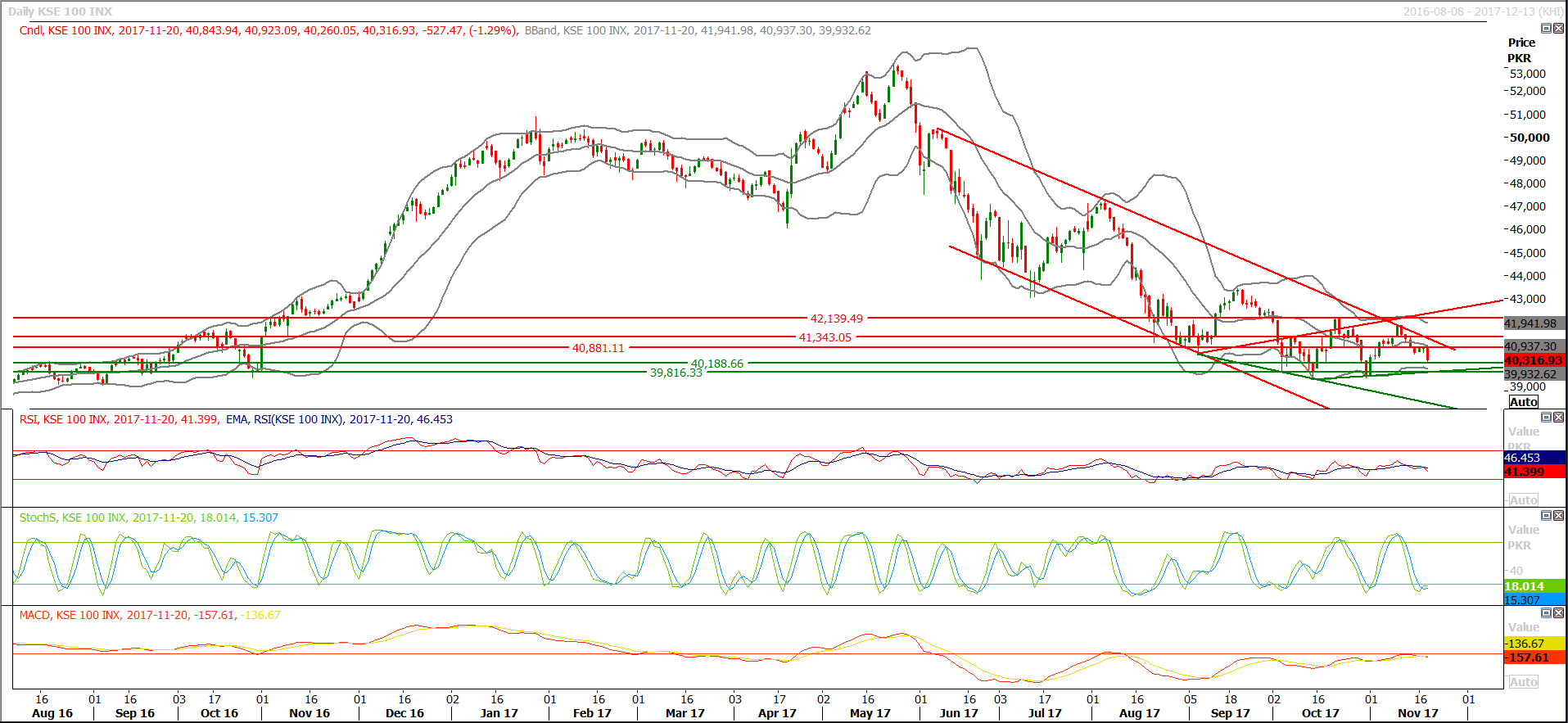

The Benchmark KSE100 Index has failed to open with a positive gap above 40860 during the last trading session and in response to that failure index has dropped by 527 point as that region reacted as a strong resistance and pushed the index in a negative zone. As of right now index has supportive regions at 40135 and 39816 while resistance regions are standing at 40880 and 41340. For new buying it’s recommended to post stop loss at 39816 for t current trading the session.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.