Previous Session Recap

Trading volume at PSX floor dropped by 57.68 million shares or 14.97% on DoD basis, whereas the benchmark KSE100 index opened at 38,564.37, posted a day high of 38,661.71 and a day low of 37,977.63 points during last trading session while session suspended at 38,037.68 points with net change of -526.69 points and net trading volume of 186.50 million shares. Daily trading volume of KSE100 listed companies dropped by 59.59 million shares or 24.21% on DoD basis.

Foreign Investors remained in net buying positions of 5.82 million shares and net value of Foreign Inflow increased by 3.28 million US Dollars. Categorically, Foreign Individual, Corporate and Overseas Pakistanis remained in net buying positions of 0.03, 0.92 and 4.87 million shares but. While on the other side Local Companies, Banks, NBFCs and Mutual Funds remained in net selling positions of 26.73, 30.98, 4.83 and 14.25 million shares but Local Individuals, Brokers and Insurance Companies remained in net buying positions of 38.36, 24.37 and 5.75 million shares respectively.

Analytical Review

Shares stumble as China-U.S. row over Hong Kong clouds trade deal outlook

Global shares slid on Thursday as a fresh row between Washington and Beijing over U.S. bills on Hong Kong could complicate their trade negotiation and delay a “phase one” deal that investors had initially hoped to be inked by now. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS fell 1.2%, with Hong Kong's Hang Seng .HSI shedding 2% while Japan's Nikkei .N225 dropped 1.6%. Chinese mainland shares dropped 0.6% .SSEC. U.S. S&P500 futures ESc1 dropped 0.5% in Asian trade, a day after MSCI's broadest gauge of world stocks fell 0.4%, the biggest fall since early October. On Wall Street, all three major indexes fell, with the S&P 500 .SPX losing 0.38%. The U.S. House of Representatives on Wednesday passed two bills intended to support protesters in Hong Kong and send a warning to China about human rights. The legislation, which has angered Beijing, has been sent to the White House for President Donald Trump’s approval. A person familiar with the matter said Trump was expected to sign it.

Govt’s long-term policies to boost tax culture, economy: Imran

Prime Minister Imran Khan has said his government’s long-term policies will strengthen tax culture and bring economic stability to the country. Addressing a ceremony here on Wednesday to distribute refund cheques among prominent exporters, he said this disbursement of Rs30 billion would result in improved cash flow for taxpayers in general and export-oriented sectors in particular. “We will further facilitate exporters to boost the country’s exports,” he added. The prime minister expressed satisfaction over the rise in volume of exports and said it would further increase in the months ahead. He said he believed that the country’s image would also improve in the wake of long-term economic policies, leading to more local and foreign investments.

TGovt raises Rs239bn through T-bills

The government has raised less than half of its target through the Market Treasury Bill auction on Wednesday. The State Bank of Pakistan reported the government raised Rs239.7 billion through T-bills, as against the target of Rs500bn. For the last several auctions, the government has been raising liquidity less than its target amounts, reflecting its fiscal concerns. It has also stopped borrowing from SBP, which was a major source of financing for the past few years. However, investors were willing to buy more than Rs500bn of security papers as total bids came in at Rs518.2bn. The maturing amount for this auction was Rs175.77bn.

Nepra reserves judgment to hike power tariff by 17 paisas per unit

The government has Wednesday acknowledged that the tariff increase due to multiple adjustments has become unaffordable for the power consumers, however said that these increase are as per the law and rules. In a public hearing over the ex-Wapda distribution companies (Discos) petition for the transfer the burden of Rs17.2 billion to power consumers on account of power purchase price (PPP) for the first quarter of 2019, the National Electric Power Regulatory Authority (Nepra) reserved its judgment. The government has requested to increase electricity tariff by 17 paisa per unit to generate Rs17.2 billion additional revenue for Discos.

Emirates announces $16b order for 50 A350 XWBs at Dubai Airshow

Emirates, the world’s largest international airline, has announced a firm order for 50 A350-900 XWB aircraft worth $16 billion (AED 58.7 billion) at list prices at the Dubai Airshow 2019. Powered by Rolls-Royce Trent XWB engines, delivery of the first Emirates A350 XWB is expected in May 2023, and will continue until 2028. HH Sheikh Ahmed bin Saeed Al Maktoum, Emirates Chairman and Chief Executive, signed the deal with Guillaume Faury, Chief Executive Officer from Airbus. This purchase agreement replaces the heads of agreement signed in February where Emirates announced its intent to purchase 30 A350s and 40 A330Neos.

Global shares slid on Thursday as a fresh row between Washington and Beijing over U.S. bills on Hong Kong could complicate their trade negotiation and delay a “phase one” deal that investors had initially hoped to be inked by now. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS fell 1.2%, with Hong Kong's Hang Seng .HSI shedding 2% while Japan's Nikkei .N225 dropped 1.6%. Chinese mainland shares dropped 0.6% .SSEC. U.S. S&P500 futures ESc1 dropped 0.5% in Asian trade, a day after MSCI's broadest gauge of world stocks fell 0.4%, the biggest fall since early October. On Wall Street, all three major indexes fell, with the S&P 500 .SPX losing 0.38%. The U.S. House of Representatives on Wednesday passed two bills intended to support protesters in Hong Kong and send a warning to China about human rights. The legislation, which has angered Beijing, has been sent to the White House for President Donald Trump’s approval. A person familiar with the matter said Trump was expected to sign it.

Prime Minister Imran Khan has said his government’s long-term policies will strengthen tax culture and bring economic stability to the country. Addressing a ceremony here on Wednesday to distribute refund cheques among prominent exporters, he said this disbursement of Rs30 billion would result in improved cash flow for taxpayers in general and export-oriented sectors in particular. “We will further facilitate exporters to boost the country’s exports,” he added. The prime minister expressed satisfaction over the rise in volume of exports and said it would further increase in the months ahead. He said he believed that the country’s image would also improve in the wake of long-term economic policies, leading to more local and foreign investments.

The government has raised less than half of its target through the Market Treasury Bill auction on Wednesday. The State Bank of Pakistan reported the government raised Rs239.7 billion through T-bills, as against the target of Rs500bn. For the last several auctions, the government has been raising liquidity less than its target amounts, reflecting its fiscal concerns. It has also stopped borrowing from SBP, which was a major source of financing for the past few years. However, investors were willing to buy more than Rs500bn of security papers as total bids came in at Rs518.2bn. The maturing amount for this auction was Rs175.77bn.

The government has Wednesday acknowledged that the tariff increase due to multiple adjustments has become unaffordable for the power consumers, however said that these increase are as per the law and rules. In a public hearing over the ex-Wapda distribution companies (Discos) petition for the transfer the burden of Rs17.2 billion to power consumers on account of power purchase price (PPP) for the first quarter of 2019, the National Electric Power Regulatory Authority (Nepra) reserved its judgment. The government has requested to increase electricity tariff by 17 paisa per unit to generate Rs17.2 billion additional revenue for Discos.

Emirates, the world’s largest international airline, has announced a firm order for 50 A350-900 XWB aircraft worth $16 billion (AED 58.7 billion) at list prices at the Dubai Airshow 2019. Powered by Rolls-Royce Trent XWB engines, delivery of the first Emirates A350 XWB is expected in May 2023, and will continue until 2028. HH Sheikh Ahmed bin Saeed Al Maktoum, Emirates Chairman and Chief Executive, signed the deal with Guillaume Faury, Chief Executive Officer from Airbus. This purchase agreement replaces the heads of agreement signed in February where Emirates announced its intent to purchase 30 A350s and 40 A330Neos.

Market is expected to remain volatile during current trading session.

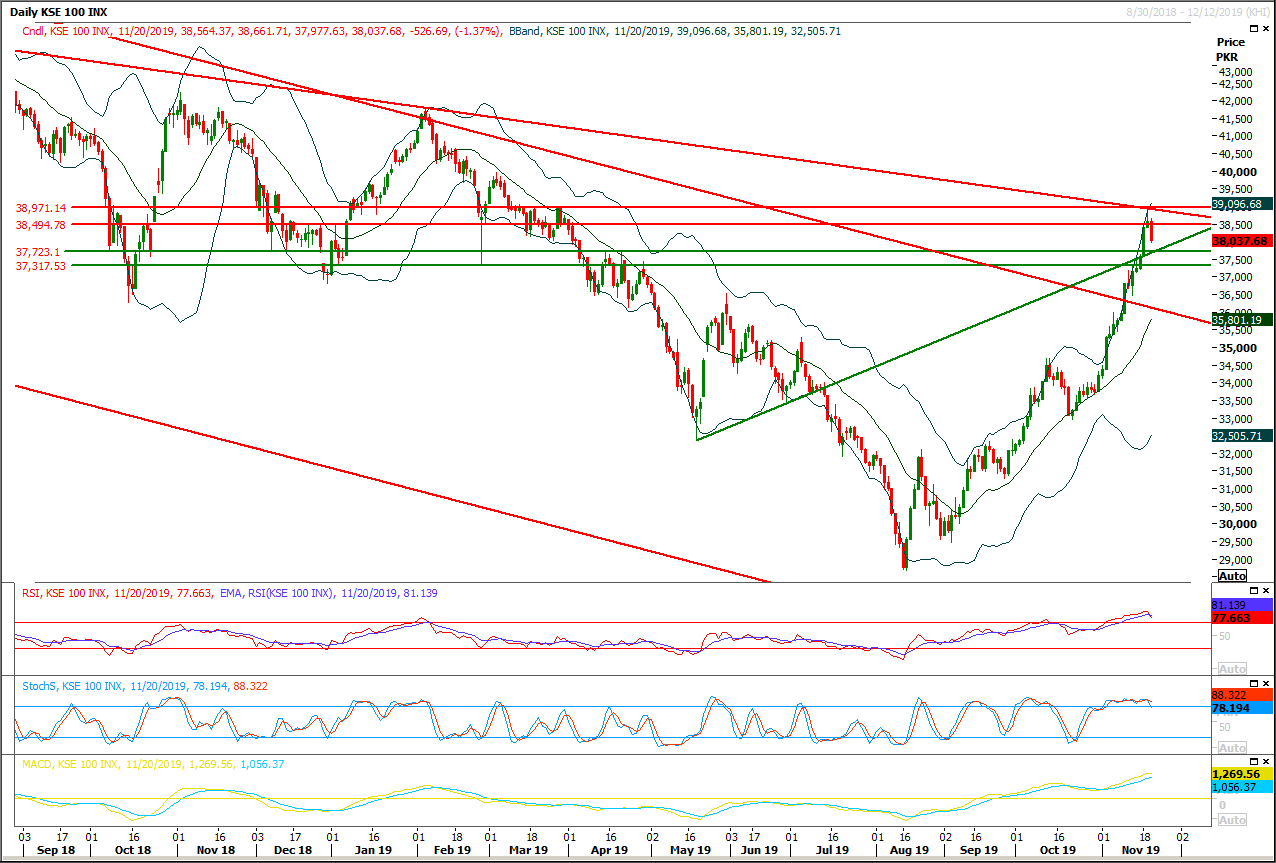

Technical Analysis

The Benchmark KSE100 index is coming back after getting resistance from a resistant trend line along with a horizontal resistant region, as of now index have a supportive region ahead at 37,800 points and if it would succeed in penetration below that region then next target would be 37,500 points. Daily closing below 37,500 points would call for a bearish rally towards 34,500 points. Daily momentum indicators have changed their direction towards bearish side and Stochastic and MAORSI have generated bearish crossovers on same time therefore it's expected that index would remain under pressure during current trading session.

While on flipside in case if index would try to recover on bullish side then it would face resistances at 38,400 points and 38,981 points. It's expected that index would remain bearish until it would succeed in closing above 39,200 points. It's recommended to stay cautious and post trailing stop loss on existing positions and swing trading would be preferred till breakout on either side.

While on flipside in case if index would try to recover on bullish side then it would face resistances at 38,400 points and 38,981 points. It's expected that index would remain bearish until it would succeed in closing above 39,200 points. It's recommended to stay cautious and post trailing stop loss on existing positions and swing trading would be preferred till breakout on either side.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.