Previous Session Recap

Trading volume at PSX floor increased by 35.65 million shares or 35.28% on DOD basis whereas the Benchmark KSE100 index opened at 38,070.40, posted a day high of 38,379.69 and day low of 38.014.50 during last trading session while session suspended at 38,236.52 points with net change of 173.37 points and net trading volume of 81.88 million shares. Daily trading volume of KSE100 listed companies increased by 11.46 million shares or 16.27% on DOD basis.

Foreign Investors remained in net selling positions of 9.70 million shares and net value of Foreign Inflow dropped by 2.88 million US Dollars. Categorically, Foreign Corporate and Overseas Pakistanis investors remained in net selling positions of 9.43 and 0.28 million shares. While on the other side Local Individuals, Local Companies, Banks and Mutual Fund remained in net buying positions of 9.54, 9.59, 0.77 and 0.78 million shares respectively but NBFCs, Brokers and Insurance Companies remained in net selling positions of 2.24, 3.70 and 4.69 million shares.

Analytical Review

Asian stocks slide, investors rush to yen and bonds

Global stocks were sailing into Christmas on a sea of red on Friday, as the threat of a U.S. government shutdown and of further hikes in U.S. borrowing costs inflamed investor unease over the economic outlook. The S&P 500 was heading for its worst quarter since the dark days of late 2008, with a loss of 15 percent so far. The Nasdaq has shed 19.5 percent from its August peak, just shy of confirming a bear market. Oil prices slid just over 4 percent overnight, bringing Brent’s losses since its October top to 37 percent. The dollar had suffered its biggest one-day drop on the yen since November 2017 as investors stampeded to safe havens.

Pakistan, China sign MoU for industrial co-op

Pakistan and China signed a memorandum of understanding (MoU) for industrial cooperation at the 8th meeting of the Joint Cooperation Committee (JCC) on China-Pakistan Economic Corridor (CPEC) held here on Thursday. The memorandum was signed by Minister for Planning, Development and Reform Makhdoom Khusro Bakhtiar and Vice Chairman of the National Development and Reform Commission of China, Ning Jizhe who also co-chaired the JCC meeting.

OICCI launches programme to generate 5m jobs, boost GDP

A body of foreign investors has launched National Programme for Digital Transformation that has capacity to generate more than 5 million direct and indirect job opportunities and increasing the GDP by $40-50 billion annually by 2025. The OICCI also proposed to deploy public cloud and introduce open data, adopting Artificial Intelligence (AI) for sustainable development, implement a comprehensive national cybersecurity policy by adopting a risk-based approach and establish a national center for development of blockchain technologies.

CPPA-G seeks 33 paisas decrease in power tariff

Central Power Purchase Agency Guarantee Limited (CPPA-G) Thursday sought 33 paisas decrease in power tariff for the month of November under monthly fuel adjustment formula. In a petition submitted to National Electric Power Regulatory Authority (NEPRA), the CPPA-G maintained the cost of per unit remained at Rs4.71/kWh against the reference fuel charges of Rs5.0497/ kWh per unit fixed for November. The CPPA-G sought an increase of 33 paisas in the tariff. A total 7,545.83 Gwh electricity was generated during the said period and the hydel share stood at 33.98 per cent, coal 13.83 per cent, furnace oil 0.08 per cent, gas 20.04 per cent, RLNG 17.23 per cent, nuclear 10.88 per cent and wind 1.68 per cent, the petition said.

NHA projects to gain momentum with payment of over Rs25b

The pace of ongoing projects executed by the National Highway Authority (NHA) is expected to be increased in coming months as most of the contractors got their pending dues after the release of around Rs25 billion by the Finance Division. The previous government while preparing its last budget for financial year 2018-19 had allocated Rs301.6b for NHA to finance its 121 schemes including 43 ongoing and 78 new projects.

Global stocks were sailing into Christmas on a sea of red on Friday, as the threat of a U.S. government shutdown and of further hikes in U.S. borrowing costs inflamed investor unease over the economic outlook. The S&P 500 was heading for its worst quarter since the dark days of late 2008, with a loss of 15 percent so far. The Nasdaq has shed 19.5 percent from its August peak, just shy of confirming a bear market. Oil prices slid just over 4 percent overnight, bringing Brent’s losses since its October top to 37 percent. The dollar had suffered its biggest one-day drop on the yen since November 2017 as investors stampeded to safe havens.

Pakistan and China signed a memorandum of understanding (MoU) for industrial cooperation at the 8th meeting of the Joint Cooperation Committee (JCC) on China-Pakistan Economic Corridor (CPEC) held here on Thursday. The memorandum was signed by Minister for Planning, Development and Reform Makhdoom Khusro Bakhtiar and Vice Chairman of the National Development and Reform Commission of China, Ning Jizhe who also co-chaired the JCC meeting.

A body of foreign investors has launched National Programme for Digital Transformation that has capacity to generate more than 5 million direct and indirect job opportunities and increasing the GDP by $40-50 billion annually by 2025. The OICCI also proposed to deploy public cloud and introduce open data, adopting Artificial Intelligence (AI) for sustainable development, implement a comprehensive national cybersecurity policy by adopting a risk-based approach and establish a national center for development of blockchain technologies.

Central Power Purchase Agency Guarantee Limited (CPPA-G) Thursday sought 33 paisas decrease in power tariff for the month of November under monthly fuel adjustment formula. In a petition submitted to National Electric Power Regulatory Authority (NEPRA), the CPPA-G maintained the cost of per unit remained at Rs4.71/kWh against the reference fuel charges of Rs5.0497/ kWh per unit fixed for November. The CPPA-G sought an increase of 33 paisas in the tariff. A total 7,545.83 Gwh electricity was generated during the said period and the hydel share stood at 33.98 per cent, coal 13.83 per cent, furnace oil 0.08 per cent, gas 20.04 per cent, RLNG 17.23 per cent, nuclear 10.88 per cent and wind 1.68 per cent, the petition said.

The pace of ongoing projects executed by the National Highway Authority (NHA) is expected to be increased in coming months as most of the contractors got their pending dues after the release of around Rs25 billion by the Finance Division. The previous government while preparing its last budget for financial year 2018-19 had allocated Rs301.6b for NHA to finance its 121 schemes including 43 ongoing and 78 new projects.

Market is expected to remain volatile during current trading session therefore it's recommended to stay cautious while trading

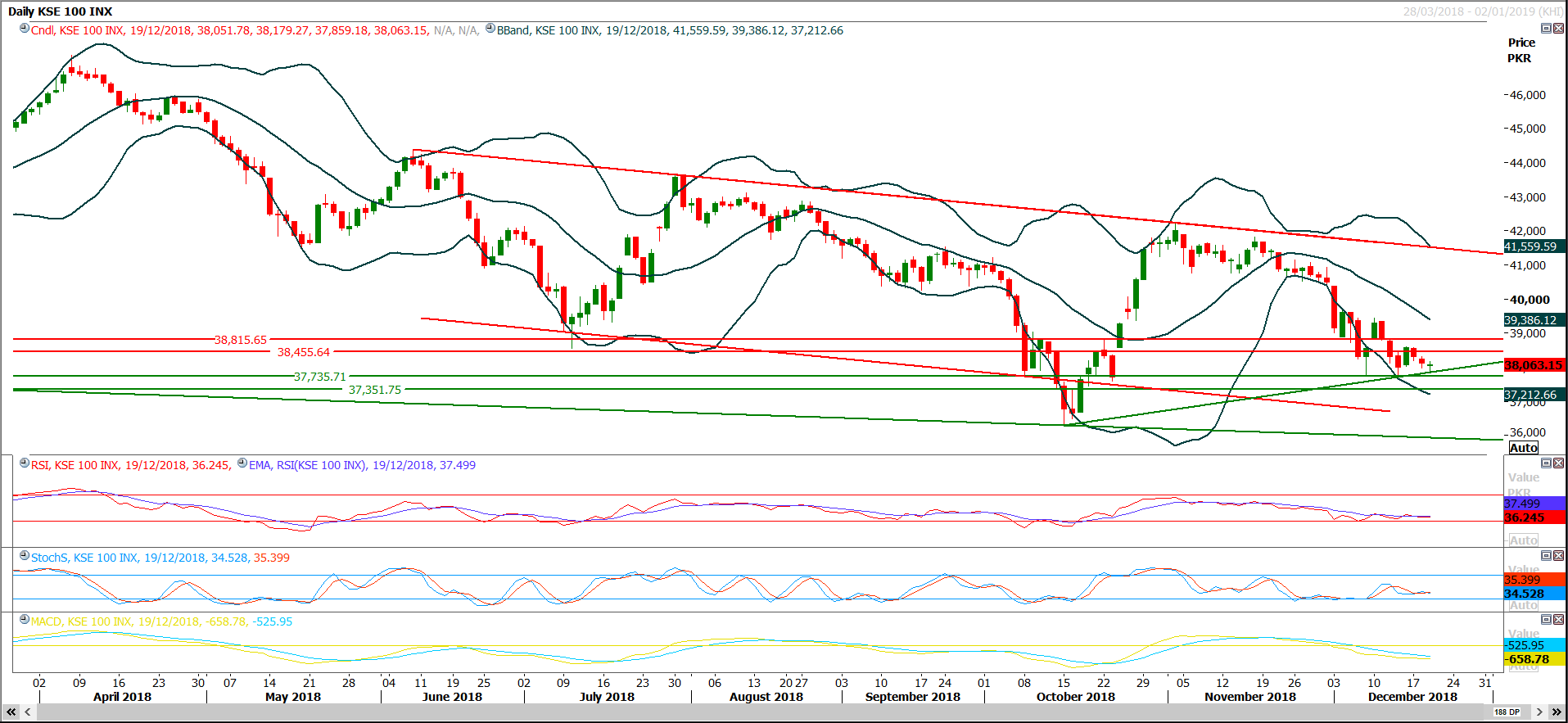

Technical Analysis

The Benchmark KSE100 index is trying to sustain above 38,000 points since last five trading session and on daily closing basis it have been succeeded in doing so but shrinked volumes have created an alarming situation and volatility is increasing due to these circumstances. Index is caged between 37,700 and 38,500 points and breakout of downward side would create a roam for a rally of 2,500-3,000 points while breakout in upward direction would push index towards 39,200 or 39,500 points. It’s recommended to trade very cautiously until index outside this region of 800 points because in this region index would try to remain volatile.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.