Previous Session Recap

The Bench Mark KSE100 Index Opened with a gap of 76.69 points at 47286.75, posted day high of 47325.91 and day low of 46344.88 during last trading session while session suspended at 46993.31 points with net change of -216.75 points and trading volum of 176.81 million shares. Daily trading volume of KSE100 listed companies dropped by 24.38 million shares or 12.12% on DOD bases.

Foreign Investors remain in net buying of 0.4 million shares but net value of Foreign Inflow dropped by 11.85 milion US Dollars. Categorically Foreign Individuals and Overseas Paksitani Investors remain in net buying of 0.09 and 2.21 million shares but Foreign Corporate Investors remain in net selling of 1.9 million shares. While on the other side Local Individuals and Mutual Funds remain in net buying of 3.54 and 1.79 million shares but Local Companies, Banks and Brokers remain in net selling of 1.33, 4.45 and 3.85 million shares respectively.

Analytical Review

Asian shares struggled on Thursday, taking their cues from a lackluster day on Wall Street as investors locked in gains in thin trade ahead of the upcoming holidays. MSCI broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was slightly higher in early trade, while Japanese Nikkei stock index .N225 slumped 0.6 percent. U.S. stocks, which have been on a tear since the Nov. 8 election on bets that the incoming Trump Administration will embark on growth-stimulating, inflation-stoking policies, pulled back from the record highs logged in the previous session. There were not any major market-making data points coming out, and I think that is why the markets are kind of taking a breather, said Jennifer Vail, head of fixed income research at U.S. Bank Wealth Management in Portland, Oregon. Later on Thursday, the United States will release a third revision of U.S. third quarter gross domestic product.

Soon after handing over the administrative control of Nepra to the Ministry of Water and Power, Economic Co-ordination Committee (ECC) of the Cabinet has directed the regulator to allow 17 percent IRR of withholding tax on dividend as a pass-through item to a Chinese company in the transmission tariff as per actual payment.

Prices of petroleum products are likely to increase up to Rs 3.50 per litre from January 1, 2017, it is learnt. According to sources privy to the developments, petrol price is expected to go up by Rs 1.50 per litre, while Light Diesel Oil (LDO) price could go up by Rs 1.30, High Speed Diesel (HSD) by Rs 1.40, High Octane Blending Component (HOBC) by Rs 3.50 and Kerosene Oil (KO) price may go up by Rs 1.60 per litre.

Two-thirds of the tax revenue collected in the first quarter of 2016-17 was used for debt servicing, leaving the government with less than 34 per cent of the total collection to run the country. The Statistical Bulletin for December recently issued by the State Bank of Pakistan (SBP) said the country paid Rs414 billion in debt servicing during July-September. The report showed the tax collection during the same quarter was Rs625bn. This means the government had to use 66pc of its entire tax collection for debt servicing in the first three months of the fiscal year.

Some people are demanding zero duty on cement imports, which will be devastating for the local industry, All Pakistan Cement Manufacturers Association (APCMA) Chairman Sayeed Tariq Saigol said on Wednesday, according to a press release. He said the people demanding the removal of the duty should see the fate of local industries like tiles and tyres in the wake of the reduction in import tariffs because energy costs in Pakistan are the highest in the region. Abolishing the import duty will not only hurt investments by existing manufacturers and new entrants, but also endanger the livelihood of workers, he said. Growth in the cement industry has already been ‘vulnerable’ owing to the smuggled and under-invoiced import of cement while its exports declined to the lowest level in November, he said. Cement smuggling from Iran has been causing a substantial loss to the national exchequer, he added.

PSO, FATIMA, LUCK and HBL can lead market in positive direction.

Technical Analysis

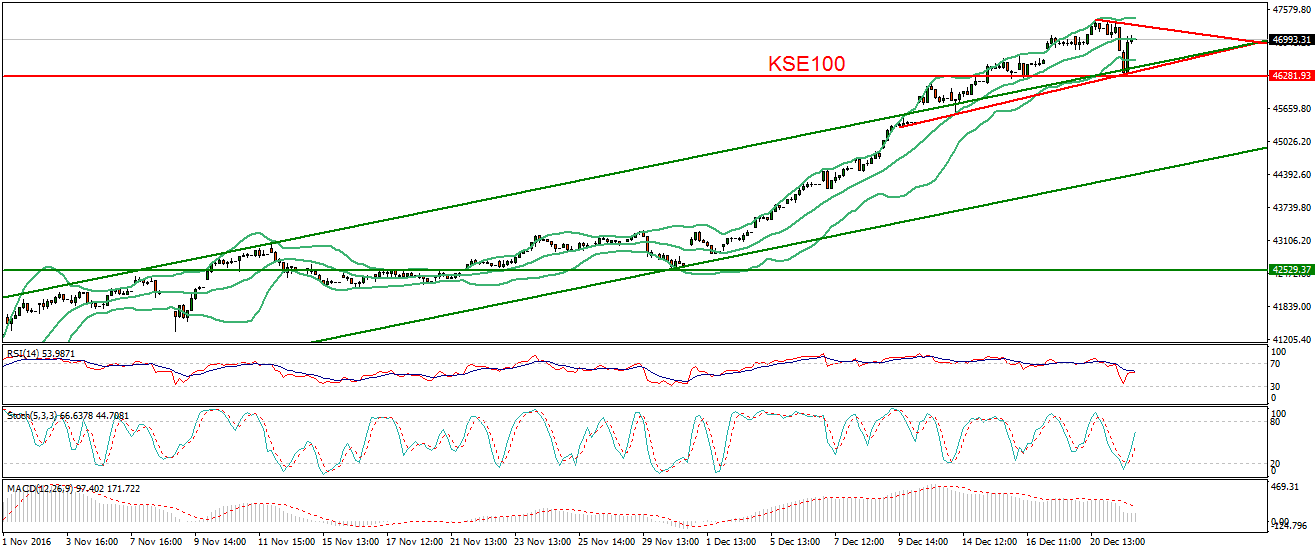

The Bench Mark KSE100 Index have got support from a crossover of a supportive trend line and a horizontal support along with resistant trend line of its previous bullish trend channel, also it have completed 61.8% Intraday retracement during bearish rally of last trading session. but right now it have genereated some very storng signals of further advance move, as it have created bullish engulfing pattern on hourly chart before closing of last trading session and hourly stochastic and MAORSI also have generated bullish crossovers which can push index in further advance mode. Right now index have resistant region around 47325 points and if it will become able to close above that level then it can move further upward for an expansion while supportive regions stands at 46274 points. Trading with strict stop loss would be beneficial if market can become able to close above resistant region otherwise cut and reverse strategy can be adopted on intraday and short term bases.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.