Previous Session Recap

The Bench Mark KSE100 Index Opened at 42324.94, posted day high of 42546.53 and day low of 42324.94. The session suspended at 42439.04 points during last trading session with net trading volume of 100.51 million shares. Daily trading volume of KSE100 listed companies dropped by 5.5 million shares or 5.2% on DOD bases.

Foreign Investors have turned back to buying and they remained in net buying position of 0.72 million shares. But net value of Foreign Inflow dropped by 5.04 million US Dollars. Categorically, Foreign Corporates and Overseas Pakistanis remained in net buying position of 0.41 and 1.1 million shares but Foreign Individuals remained in net selling of 0.79 million shares. While on the other hand, Local Individuals, Banks and Brokers remained in net selling position of 0.49, 3.8 and 5.9 million shares respectively but Local Companies and Mutual Funds remained in net buying position of 8.07 and 0.32 million shares respectively.

Analytical Review

Asian stocks struck one-week highs with investors undeterred by a powerful earthquake in Japan on Tuesday, but after Wall Street closed at a record peak they were also wary of chasing prices higher until President-elect Donald Trump picks his economic team. Crude oil extended gains in Asian trading with U.S. West Texas Intermediate (WTI) up 1 percent in early deals as the dollar pulled back. Prices surged 4 percent to a three-week high on Monday, after comments from Russian President Vladimir Putin raised hopes that producer countries will reach a deal to limit output at a meeting next week.

Punjab Law Minister Rana Sanaullah Monday said that Pakistan-Turkey trade would be further enhanced in different sectors including agriculture and health.He was addressing the participants of International Conference on Forestry and Environment at the University of Agriculture Faisalabad (UAF) in which Turkish Consul General Serdar Deniz and other Turkish delegates participated.

Takashi Harada, Head of Economic & Trade Section Embassy of Japan in Islamabad has stressed upon the need of making collective efforts for development of the SMEs. Addressing a meeting with exporters of Sialkot at Sialkot Chamber of Commerce and Industry (SCCI) on Monday, he said Japan was intending to develop its strong cultural, trade and diplomatic relations with Pakistan.

The Ministry of Petroleum and Natural Resources is hereby conveying the following factual position regarding the status of oil supplies in the country. At the onset it is clarified that strategic and normal stocks are two different entities. The fuel used for armed forces is sufficiently available but details cannot be made public due to security reasons.

Federal government has acknowledged that coal-fired power plants and a (government) projected double-digit growth during the next 10 years would increase Greenhouse Gas (GHG) emissions, well-informed sources told Business Recorder. Ministry of Climate Change recently informed the Federal Cabinet that the 21st session of the Conference of Parties (COP-21) adopted the Paris Agreement, which has been signed by Pakistan.

SMBL,MUREB, TREETand PKGS are looking attractive on Intra-day along with Oil & Gas and Pharma Secotrs on short term bases, they can lead the market in positive direction. On the other side, Banking, Cement Sector seems under pressure.

Technical Analysis

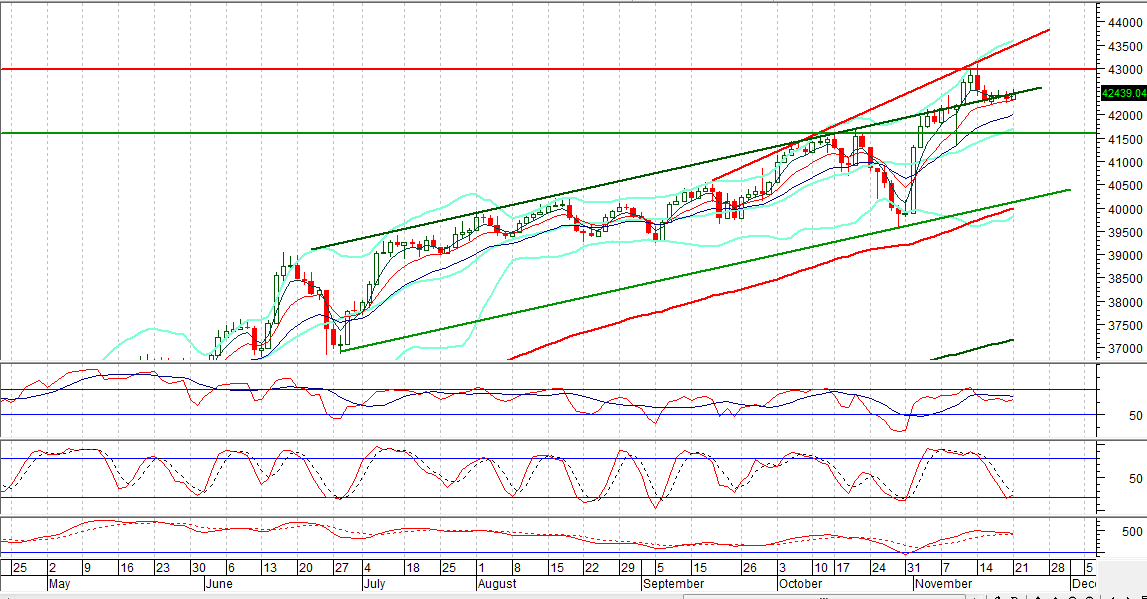

KSE100 Index is capped by a resistant trend line at 43567 on Daily Chart while a horizontal resistance is ahead at 43091 points but right now it has completed its daily correction. The daily RSI and Stochastic are trying to generate a crossover for a short term pullback towards 43000 points. KSE100 Index has confirmed 42128 points as supportive region so as long as this level is maintained its recommended to initiate new buying in selected items with strict stop loss. For Current trading session, Swing trading strategy could be beneficial.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.