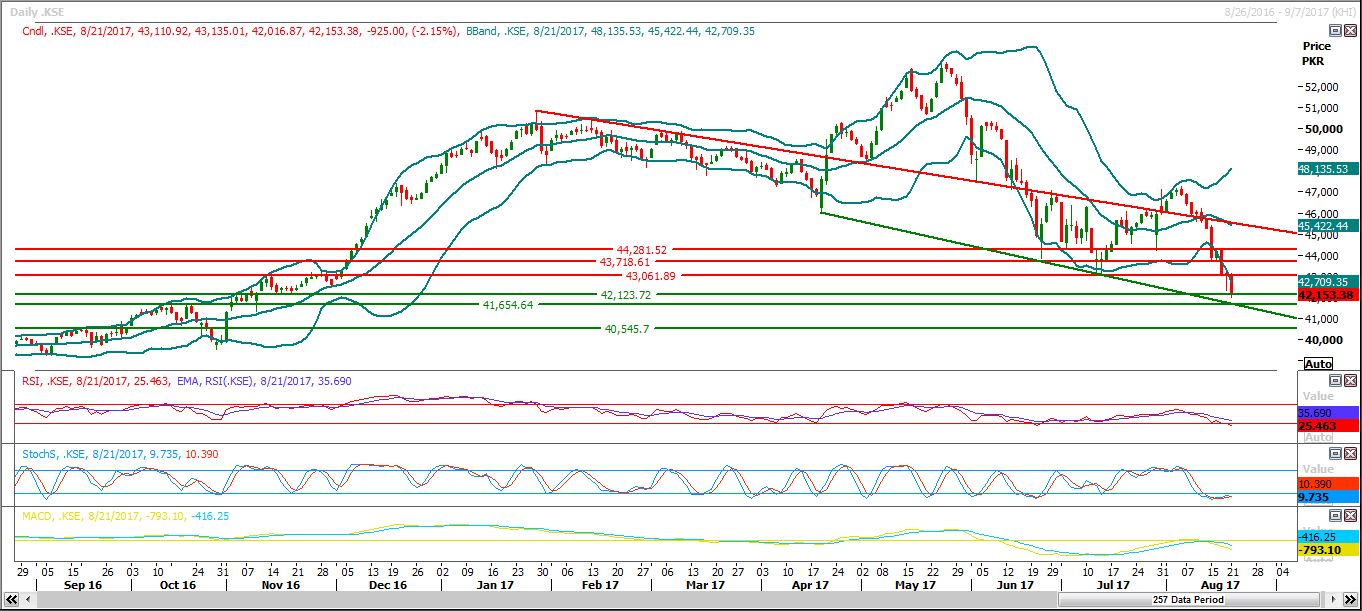

Trading volume at PSX floor dropped by 34.98 million shares or 18.59%, DoD basis, whereas, the benchmark KSE100 Index opened at 43110.92, posted a day high of 43135.01 and day low of 42016.87 during the last trading session while the session suspended at 42153.38 with a net change of -925 points and net trading volume of 78.89 million shares. Daily trading volume of KSE100 listed companies dropped by 9.24 million shares or 10.49%, DoD basis.

Foreign Investors remained in a net selling position of 0.57 million shares and the net value of Foreign Inflow dropped by 0.44 million US Dollars. Categorically, Foreign Corporate and Overseas Pakistani Investors remained in net selling positions of 0.21 and 0.34 million shares. While on the other side, Local Individuals, Mutual Funds and Brokers remained in net selling positions of 13.36, 4.49 and 0.84 million shares, respectively. Local Companies and Banks remained in net buying positions of 12.72 and 3.74 million shares.

Asian shares edged higher on Tuesday, taking solace from modest gains on Wall Street even as investors remained wary ahead of the annual central banking conference in Jackson Hole later this week. MSCIs broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS edged up 0.1 percent. South Korean shares .KS11 added 0.5 percent, despite lingering worries about tensions on the Korean peninsula. Te countrys forces began computer-simulated military exercises with the United States on Monday, which Pyongyang has denounced as a "reckless" step toward a nuclear war. Japans Nikkei stock index .N225 dipped 0.1 percent, while Australian shares added 0.2 percent. On Wall Street on Monday, the Dow Jones Industrial Average .DJI and the S&P 500 .SPX marked modest gains, though the Nasdaq Composite .IXIC edged down slightly.

With 5.39 percent spread in production of jeeps and cars and 20.74 percent in motorcycles, the countrys total automobiles output witnessed impressive growth during the fiscal year 2016-17. As many as 190,466 jeeps and cars were manufactured during the period from July-June (2016-17) compared to the production of 180,717 during July-May (2015-16), according to Pakistan Bureau of Statistics (PBS). The production of motorcycles during the fiscal year under review also increased by 20.74 percent as it witnessed positive growth from 2,071,123 units in FY2016 to 2,500,650 units in FY2017. The production of tractors also increased from 34,814 units to 53,975 units, showing increase of 54.59 percent while the output of trucks increased from 5,666 units to 7,712 units, an increase of 36.11 percent. According to the data, the production of buses increased by 4.49 percent during the year under review by going up from the production of 1,070 units to 1,118 units. However, the production of light commercial vehicles (LCVs) witnessed negative growth of 32 percent by declining from 35,836 units to 24,265 units.

Cement manufacturers in the northern region (comprising Khyber Pakhtunkhwa and Punjab) have slashed prices of the commodity by Rs10-25 per 50kg bag. Lucky Cement slashed the price by Rs25 per bag on Aug 17. However, cement players in the southern region have kept the prices intact so far, said a manufacturer.

The Central Development Working Party (CDWP) on Monday cleared a total of 15 development projects at an estimated cost of Rs42.7 billion. Presided over by the Deputy Chairman of Planning Commission, Sartaj Aziz, the meeting formally approved 13 projects with a total cost of Rs12.3bn. Because of limitations of financial powers, the CDWP also recommended to the Executive Committee of the National Economic Council (Ecnec) to approve three more projects involving a total cost of Rs30.6bn. Under the current financial powers rules, the CDWP can itself approve projects costing no more than Rs3bn while projects of higher estimated costs are approved by the Ecnec on the clearance of the CDWP on technical grounds.

A high-level meeting on Monday failed to reach a consensus on the exporters demand for the continuation of an unconditional cash subsidy on exports in 2017-18 under the premiers Rs180 billion incentives package. The meeting was called to discuss ways to rectify a deteriorating external sector. Data released on the same day showed the current account deficit for July tripled to $2.05bn year-on-year. An official source told Dawn that the meeting headed by Finance Minister Ishaq Dar directed the secretaries of three divisions – commerce, textile and finance – to work on the continuation proposal for an unconditional subsidy to support exports. The meeting was attended by Commerce Minister Pervaiz Malik and other senior officials.

Today DGKC, GATM, MLCF and TRG may lead the market today in the positive direction.

The Benchmark KSE100 Index has a supportive region at 41500 from where it may bounce back for a correction, after retesting its supportive trend line and a horizontal supportive level. For day trading, buying above 41654 with a strict stop loss at 41500 could be initiated but closing below 41500 will call for 41000 and 40500 from where a temporary pull back could be witnessed in the coming days. On upper side, 43000 and 44200 are becoming stronger resistances with every passing day and would try to push index back in bearish direction after a short term pull back, if started.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.