Previous Session Recap

Trading volume at PSX floor increased by 3.67 million shares or 2.11% on DoD basis, whereas the benchmark KSE100 index opened at 42,816.68, posted a day high of 42,965.41 and a day low of 42,626.48 points during last trading session while session suspended at 42,626.48 points with net change of -121.14 points and net trading volume of 122.51 million shares. Daily trading volume of KSE100 listed companies also increased by 6.14 million shares or 5.27% on DoD basis.

Foreign Investors remained in net selling positions of 3.60 million shares but net value of Foreign Inflow increased by 0.90 million US Dollars. Categorically, Foreign Individuals and Overseas Pakistani remained in net buying positions of 0.022 and 0.25 million shares but Foreign Corporate investors remained in net selling positions of 3.65 million shares. While on the other side Local Individuals, Companies and Brokers remained in net selling positions of 1.98, 0.62 and 2.93 million shares but Local Banks, NBFCs, Mutual Fund and Insurance Companies remained in net buying positions of 3.09, 0.31, 6.05 and 0.09 million shares respectively.

Analytical Review

Asian stocks arrest slide but investors on edge over China virus

Asian share markets steadied on Wednesday as investors took stock of the spread of a new strain of coronavirus from China and weighed the possible consequences of a global pandemic.Fears of contagion, particularly as millions travel for Lunar New Year festivities, knocked stocks from record levels on Tuesday as investors swapped them for safer assets. The outbreak has revived memories of the Severe Acute Respiratory Syndrome (SARS) epidemic in 2002-03, a coronavirus outbreak that killed nearly 800 people and hurt world travel. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS spent the morning trading either side of flat. Japan's Nikkei .N225 opened 0.1% lower, before steadying to trade flat, as did Korea's Kospi index .KS11. Australia's S&P/ASX 200 inched 0.3% higher, while the safe havens of gold and U.S. 10-year government bonds handed back some gains.

Don’t expect uniform cut, fertiliser makers warn govt after GIDC waiver

The government’s efforts for an across-the-board reduction in urea prices could face resistance from some manufacturers as the impact of cuts in Gas Infrastructure Development Cess (GIDC) on industry’s cost of production will vary from company to company. The Economic Coordination Committee (ECC) on Monday slashed the GIDC on fertiliser sector by almost 99 per cent ie from Rs405 a bag to Rs5 with a view of providing relief to farmers reeling under spiking input costs. The government expects all manufacturers to uniformly revise their prices down by Rs400 per bag after the GIDC cut. However, a senior Engro Fertiliser executive told Dawn that they would not be able to meet government’s expectations.

Real estate still attractive place to park grey money: FBR chief

In his first public appearance since returning from a leave over health issues, Federal Board of Revenue (FBR) Chairman Shabbar Zaidi laid emphasis on documentation measures, saying money whitening channels continued to flourish despite the government’s efforts to shut them down. Mr Zaidi, who was one of the speakers at the All Pakistan Chambers Presidents’ Conclave 2020 on Tuesday, said the present government had taken several measures to curb the menace of undocumented flow of tax-evaded wealth, but he believed that real estate was still the preferred avenue for whitening ‘grey money’, along with bearer prize bonds and dollars remitted outside to purchase properties. However, he said, the government had taken some measures to curb these practices. The event was also addressed by President Dr Arif Alvi, Planning and Development Minister Asad Umar and Adviser to the Prime Minister on Institutional Reforms Dr Ishrat Hussain.

Pakistan approves structure for $2b North-South Gas Pipeline

Pakistan has approved in principle the structure recommended by two Russian companies Eurasian Pipeline Consortium and Federal State Unitary Enterprise (FSUE) for the construction of $2 billion North-South Gas Pipeline. In 7th JCC session on the North South Gas Pipeline it was also decided to sign the commercial agreement for the pipeline by April 2020 while the ground breaking of the project to be held in June or July this year, official source told The Nation. The 7th JCC session on the North South Gas Pipeline held here Tuesday between Pakistan and Russia. In the JCC Russian delegation was headed by Russia’s Deputy Energy Minister, Anatoli Tikhinov while Pakistan’s side was headed by Petroleum Division Secretary Asad Hayaud Din. The officials of both the ISGL and Russian JV were also present in the meeting.

Exports surge by 25pc in 5 months

The exports from the country, in rupee term, surged by 24.82 percent during the first half of the current fiscal year compared to the corresponding period of last year, Pakistan Bureau of Statistics (PBS) reported. The exports from the country during July-December (2019-20) were recorded at Rs1,805,074 million against the exports of Rs1,446,166 million during July-December (2018-19), showing growth of 24.82 percent, according to the provisional figures released by the bureau. Meanwhile, on year-on-year basis, the exports from the country increased by 7.63 percent during the month of December 2019 and amounted to Rs308,697 million compared to the exports of Rs286,802 million in December 2018.

Asian share markets steadied on Wednesday as investors took stock of the spread of a new strain of coronavirus from China and weighed the possible consequences of a global pandemic.Fears of contagion, particularly as millions travel for Lunar New Year festivities, knocked stocks from record levels on Tuesday as investors swapped them for safer assets. The outbreak has revived memories of the Severe Acute Respiratory Syndrome (SARS) epidemic in 2002-03, a coronavirus outbreak that killed nearly 800 people and hurt world travel. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS spent the morning trading either side of flat. Japan's Nikkei .N225 opened 0.1% lower, before steadying to trade flat, as did Korea's Kospi index .KS11. Australia's S&P/ASX 200 inched 0.3% higher, while the safe havens of gold and U.S. 10-year government bonds handed back some gains.

The government’s efforts for an across-the-board reduction in urea prices could face resistance from some manufacturers as the impact of cuts in Gas Infrastructure Development Cess (GIDC) on industry’s cost of production will vary from company to company. The Economic Coordination Committee (ECC) on Monday slashed the GIDC on fertiliser sector by almost 99 per cent ie from Rs405 a bag to Rs5 with a view of providing relief to farmers reeling under spiking input costs. The government expects all manufacturers to uniformly revise their prices down by Rs400 per bag after the GIDC cut. However, a senior Engro Fertiliser executive told Dawn that they would not be able to meet government’s expectations.

In his first public appearance since returning from a leave over health issues, Federal Board of Revenue (FBR) Chairman Shabbar Zaidi laid emphasis on documentation measures, saying money whitening channels continued to flourish despite the government’s efforts to shut them down. Mr Zaidi, who was one of the speakers at the All Pakistan Chambers Presidents’ Conclave 2020 on Tuesday, said the present government had taken several measures to curb the menace of undocumented flow of tax-evaded wealth, but he believed that real estate was still the preferred avenue for whitening ‘grey money’, along with bearer prize bonds and dollars remitted outside to purchase properties. However, he said, the government had taken some measures to curb these practices. The event was also addressed by President Dr Arif Alvi, Planning and Development Minister Asad Umar and Adviser to the Prime Minister on Institutional Reforms Dr Ishrat Hussain.

Pakistan has approved in principle the structure recommended by two Russian companies Eurasian Pipeline Consortium and Federal State Unitary Enterprise (FSUE) for the construction of $2 billion North-South Gas Pipeline. In 7th JCC session on the North South Gas Pipeline it was also decided to sign the commercial agreement for the pipeline by April 2020 while the ground breaking of the project to be held in June or July this year, official source told The Nation. The 7th JCC session on the North South Gas Pipeline held here Tuesday between Pakistan and Russia. In the JCC Russian delegation was headed by Russia’s Deputy Energy Minister, Anatoli Tikhinov while Pakistan’s side was headed by Petroleum Division Secretary Asad Hayaud Din. The officials of both the ISGL and Russian JV were also present in the meeting.

The exports from the country, in rupee term, surged by 24.82 percent during the first half of the current fiscal year compared to the corresponding period of last year, Pakistan Bureau of Statistics (PBS) reported. The exports from the country during July-December (2019-20) were recorded at Rs1,805,074 million against the exports of Rs1,446,166 million during July-December (2018-19), showing growth of 24.82 percent, according to the provisional figures released by the bureau. Meanwhile, on year-on-year basis, the exports from the country increased by 7.63 percent during the month of December 2019 and amounted to Rs308,697 million compared to the exports of Rs286,802 million in December 2018.

Market is expected to remain volatile during current trading session.

Technical Analysis

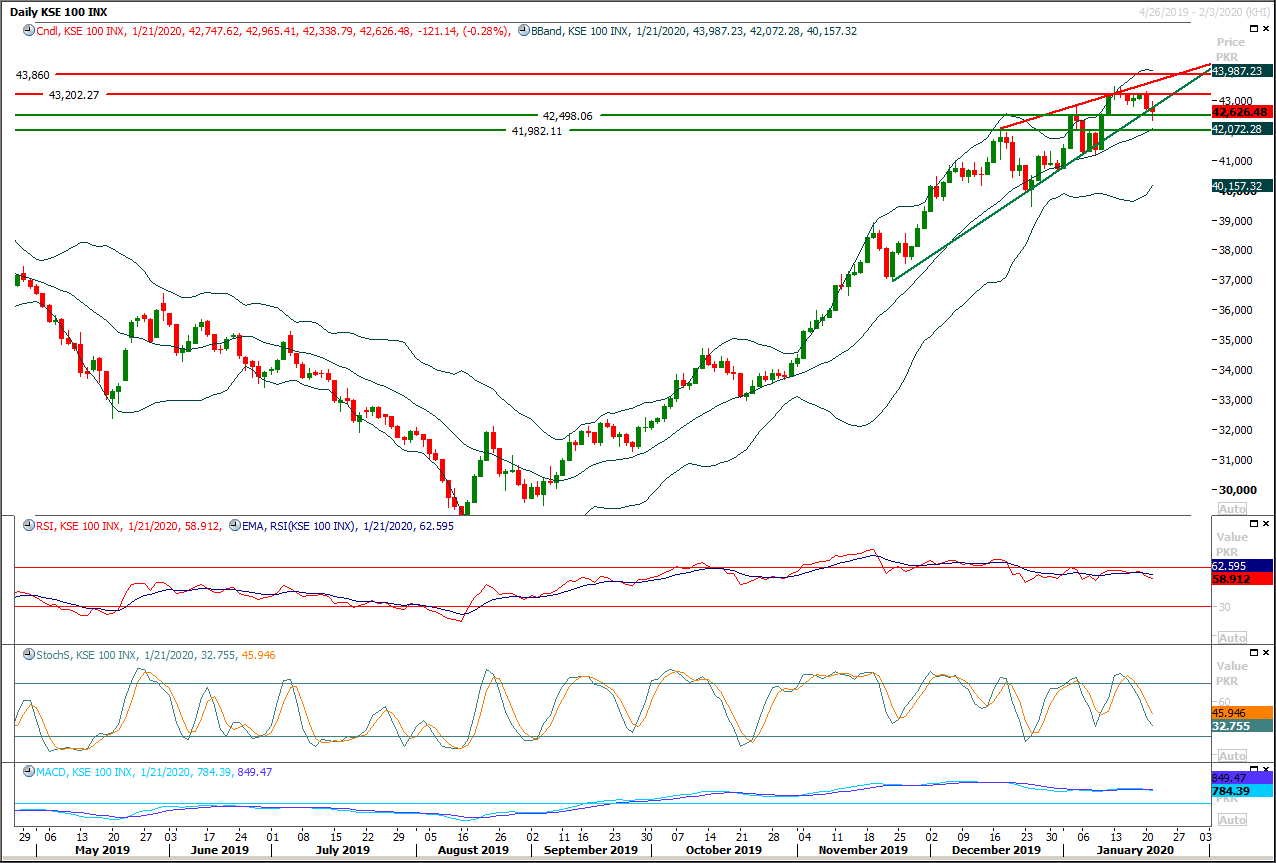

The Benchmark KSE100 index is still hanged in a hanging man region and it's trying to penetrate supportive trend line of its rising wedge in downward direction, mean while its being supported by a horizontal supportive region at 42,500 points and this region would try to push index in upward direction if index would not succeed in closing below this during current trading session. It's recommended to practice caution and post trailing stop loss on existing long positions because index would try to add some pressure on this region after an intraday spike today. Daily closing below 42,500 points would call for 42,000 points and index would enter into bearish zone once it would succeed in sliding below 42,000 points. While on flip side index would face strong resistances at 42,950 points and 43,200 points in case of reversal.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.