Previous Session Recap

Trading volume at PSX floor increased by 51.5% million shares, DoD basis, whereas KSE100 Index opened at 44914.45, posted a day high of 45765.35 and a day low of 43826.67 points during the last trading session while the session suspended at 45474.46 with a net change of 60.02 points. The net trading volume clocked in at 187.88 million shares. Daily trading volume of KSE100 listed companies increased by 52.67 million shares or 38.97% DoD basis.

Foreign Investors remained in a net buying position of 17.20 million shares and the net value of Foreign Inflow increased by 9.52 million US Dollars. Categorically, Foreign Individual and Corporate investors remained in net selling positions of 0.043 and 1.84 million shares but Overseas Pakistanis remained in a net buying position of 19.08 million shares. While on the other side, Local Individuals, Companies and NBFCs remained in net selling positions of 5.93, 14.0 and 1.62 million shares, respectively. Local Banks, Mutual Funds and Brokers remain in net buying positions of 1.06, 3.45 and 12.33 million shares.

Analytical Review

Asian stocks advanced on Thursday as oil prices struggled to climb off a 10-month low hit overnight on concerns over a supply glut and falling demand. MSCI broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS climbed 0.3 percent. Japanes Nikkei .N225 fell 0.1 percent, with shares in auto air bag maker Takata Corp plunging 50 percent as they exchanged hands for the first time since sources said last week it was preparing to file for bankruptcy. South Korean KOSPI .KS11 added 0.2 percent, while Australian shares jumped 0.6 percent. Chinese shares added to gains made on Wednesday after MSCI included mainland shares in its emerging market indexes. The blue-chip index .CSI300 rose 0.4 percent. Hang Seng was flat. MSCI Pakistan Standard (Large and Middle Capp) have recovered 1.66% while MSCI Pakistan IMI Index (Small, Middle and Large Cap) have gained strength and recoverd 1.94% on DoD basis during last trading session.

Pakistan textile and clothing exports fell 1.98 per cent year-on-year to $11.234 billion during the first 11 months of the current fiscal year mainly due to lower proceeds from raw material and low value-added products, such as cotton yarn and fabrics. Data released by the Pakistan Bureau of Statistics on Tuesday showed the decline in export proceeds was also evident in rupee terms during the July-May period of 2016-17. On a month-on-month basis, the export proceeds fell 12.24pc in May negating the government claim of reviving the growth in the sector despite offering huge subsidies.

Asserting that no deal had been reached between the prime minister and Pakistan Peoples Party leader Asif Ali Zardari over the Panama Papers case, former interior minister Rehman Malik has said he will speak the truth before the Joint Investigation Team (JIT) probing money laundering allegations against Nawaz Sharif on Friday (tomorrow). “I will say what the law and the documents available with me say,” he told a press conference after cutting a cake to mark the 64th birth anniversary of former prime minister Benazir Bhutto at a ceremony here on Wednesday.

Pakistan and France on Wednesday signed 100 million Euros Credit Facility Agreement for the Sustainable Energy Sector Reform Programme. Economic Affairs Division (EAD) Secretary Tariq Mahmood Pasha, France Embassy Chargé d Affaire René Consolo, and French Agency for Development (AFD) Country Director Jacky Amprou signed the agreement. The Asian Development Bank (ADB) has also approved $300 million in co-financing of the programme.

In view of the changing market requirements, the State Bank of Pakistan (SBP) has recently initiated revision of the Foreign Exchange Manual. The revision is mainly aimed at introduction of new regulations, simplification of the existing instructions, removal of redundancies and gradual delegation of powers to the Authorized Dealers for facilitation of the stakeholders. In the first phase, seven chapters of the Manual covering regulations on Authorized Dealers, Authorized Rates of Foreign Exchange, Forward Exchange Facilities, Foreign Currency Accounts of Authorized Dealers and Purchase and Sale of Foreign Currencies, Non-Resident Rupee Accounts of Foreign Bank Branches and Correspondents and Loans, Overdrafts and Guarantees stand revised.

Today DSL , EFERT, ENGRO and PSO may lead the market in positive direction.

Technical Analysis

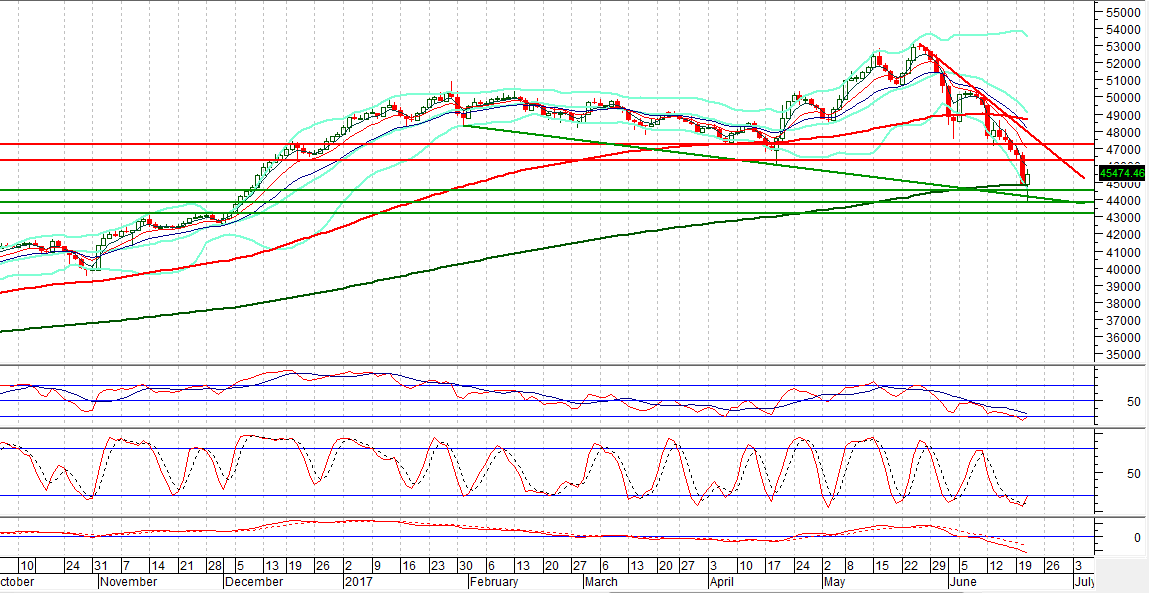

The Benchmark KSE100 Index bounced back after completing its 100% expansion of the last 50% bearish correction and is currently finding support from a supportive trend line of a bearish wedge. Daily Stochastic generated a bullish crossover and MAORSI pulled back for that. As of now, the index is trying to pull back towards 46320 and 47200 to take a correction of its bearish expansion rally, but for the current trading session it may resist ahead at 46320 and 46500, at its 38.2% correction along with a horizontal resistant region. Bearish momentum is still intact until index closes above 48000 points, but if the index sustains and closes above 46500 points today, then a morning star would be generated on daily chart and a weekly hammer formation would occur, which will resist against current bearish momentum. Hence, until the index does not close above its correction levels, the bearish momentum would remain intact which could lead the index towards a new low, therefore trading with strict stop loss is recommended.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.