Previous Session Recap

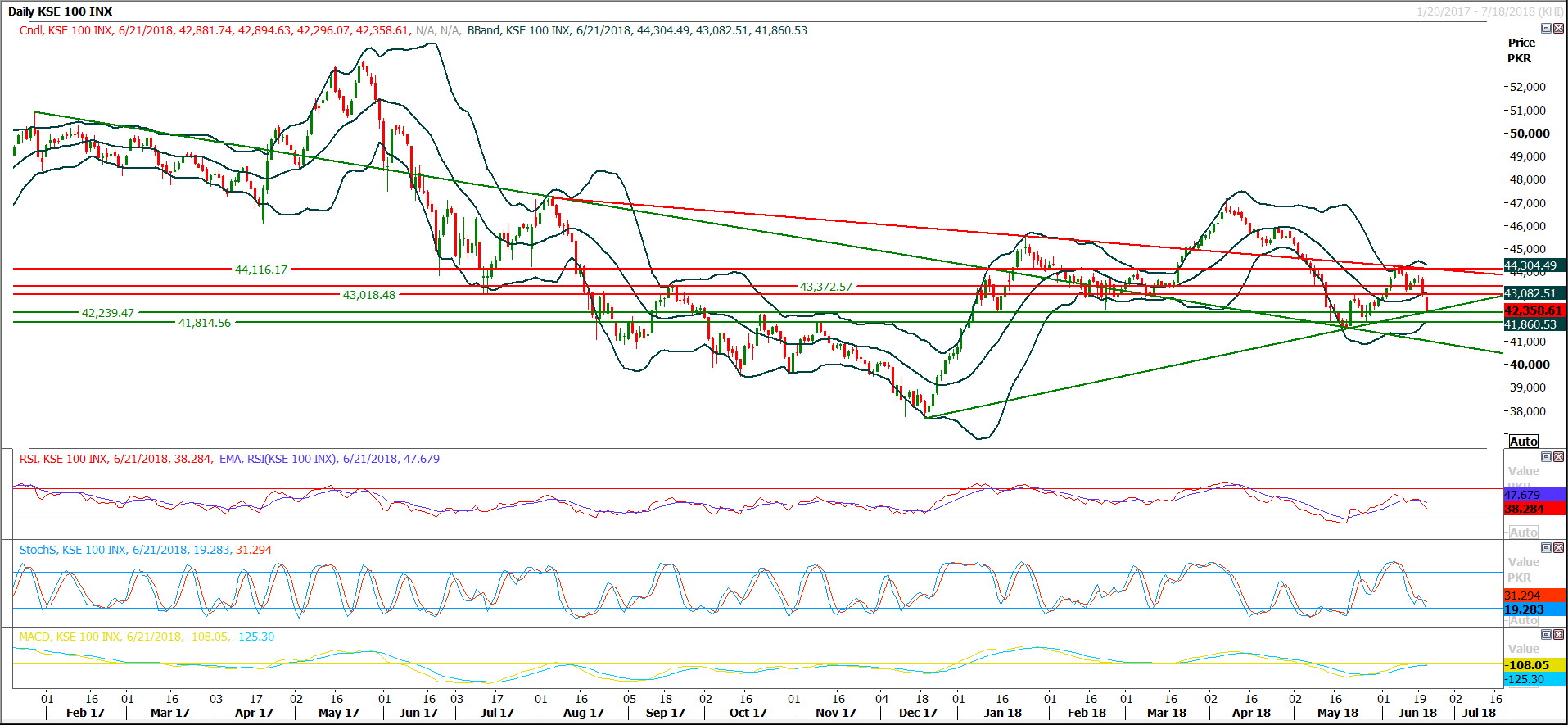

Trading volume at PSX floor increased by 105.30 million shares or 77.22% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 42,881.74, posted a day high of 42,890.80 and a day low of 42,298.87 during last trading session. The session suspended at 42,358.61 with net change of -644.23 and net trading volume of 153.72 million shares. Daily trading volume of KSE100 listed companies increased by 62.20 million shares or 67.96% on DoD basis.

Foreign Investors remained in net selling position of 15.80 million shares and net value of Foreign Inflow dropped by 11.47 million US Dollars. Categorically, Foreign Individual remained in net buying positions of 0.02 million shares but Foreign Corporate and Overseas Pakistanis investors remained in net selling positions of 15.41 and 0.41 million shares. While on the other side Local Companies, Mutual Fund, Brokers and Insurance Companies remained in net buying positions of 9.14, 1.00, 8.30 and 7.49 million shares but Local Individuals, Banks and NBFCs remained in net selling positions of 10.18, 0.28 and 0.85 million shares respectively.

Analytical Review

Asian shares flirt with six-month lows as signs of tariff effects appear

Asian shares were under pressure on Friday on signs U.S. trade battles with China and many other countries are starting to chip away at corporate profits, with oil prices choppy ahead of major producers meeting to discuss raising output. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was little changed in early trade, stuck barely above its six-month low hit on Tuesday. Japan's Nikkei .N225 lost 1.0 percent. On Wall Street, the Dow Jones Industrial Average .DJI fell for an eighth straight session on Thursday and the S&P 500 .SPX lost 0.63 percent, with industrials .SPLRCI and materials shares .SPLRCM hit hard.

Oil, food import bill up by 20pc

Pakistan's oil and food import bill has increased by nearly 20 percent on annual basis to $18.6 billion in the first eleven months (July to May) of the current fiscal year owing to an increase in global prices of crude oil and grains. The massive increase in oil and food import bill has pushed the overall import bill to $55.2 billion during eleven months. The increase in imports has widened the trade deficit by 13.4 percent in one year. The trade deficit has recorded at $33.89 billion during July to May period of FY2018 as against $29.9 billion of the corresponding period of the previous year. According to Pakistan Bureau of Statistics, the country spent $12.9 billion on imports of petroleum group, which is 30.43 percent higher over a year ago. In petroleum products, the government had imported petroleum products worth $6.8 billion and spent $3.7 billion on petroleum crude.

Aptma wants power, gas at cheaper rates

All Pakistan Textile Mills Association [APTMA) has said that electricity and gas is being supplied at much cheaper rates to industry in neighbouring countries like India and Bangladesh as compared to Pakistan. In a meeting with Minister of Energy, Syed Ali Zafar, Aptma representatives requested that their quota of system gas should be increased. The representative of Aptma made a detailed presentation on textile sector and different issues relating to energy supply to the sector were also discussed in detail. The minister apprised the participants that he is committed to facilitate the industry within the mandate of caretaker government.

Genco-III faces Rs5m fine for power breakdown

After a lapse of two and a half years National Electric Power Regulatory Authority (Nepra) has finally imposed a fine of Rs5 million on Northern Power Generation Company Limited Genco-III on account of negligence in maintenance of 220KV switchyard of TPS Muzaffargarh and non-operation of protection system which resulted in power breakdown on January 15, 2016. After reviewing the inquiry reports of NTDC and Ministry of Energy, Nepra held Genco-III responsible for the power breakdown of January 15, 2016, in northern network of country ie Punjab and Khyber Pakhtunkhwa. Taking serious notice of power breakdown the Nepra has initiated legal proceedings against Genco-III and directed NTDC to investigate the matter and submit a report.

Rs40b surge in circular debt riles traders

The Islamabad Chamber of Commerce and Industry has shown great concerns over the increase of Rs40 billion in circular debt in the last three weeks as it would worsen the power crisis in the country, badly affect business and industrial activities and further weaken the economy. It called upon the government to take drastic remedial measures to overcome the rising circular debt in order to save the economy from further troubles. Islamabad Chamber of Commerce and Industry President Sheikh Amir Waheed said that the circular debt was Rs507 billion on 31st May 2018 which has now gone up to Rs547 billion and if this trend continued, the country would face worst kind of power loadshedding in coming days that would badly damage the overall economy.

Asian shares were under pressure on Friday on signs U.S. trade battles with China and many other countries are starting to chip away at corporate profits, with oil prices choppy ahead of major producers meeting to discuss raising output. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was little changed in early trade, stuck barely above its six-month low hit on Tuesday. Japan's Nikkei .N225 lost 1.0 percent. On Wall Street, the Dow Jones Industrial Average .DJI fell for an eighth straight session on Thursday and the S&P 500 .SPX lost 0.63 percent, with industrials .SPLRCI and materials shares .SPLRCM hit hard.

Pakistan's oil and food import bill has increased by nearly 20 percent on annual basis to $18.6 billion in the first eleven months (July to May) of the current fiscal year owing to an increase in global prices of crude oil and grains. The massive increase in oil and food import bill has pushed the overall import bill to $55.2 billion during eleven months. The increase in imports has widened the trade deficit by 13.4 percent in one year. The trade deficit has recorded at $33.89 billion during July to May period of FY2018 as against $29.9 billion of the corresponding period of the previous year. According to Pakistan Bureau of Statistics, the country spent $12.9 billion on imports of petroleum group, which is 30.43 percent higher over a year ago. In petroleum products, the government had imported petroleum products worth $6.8 billion and spent $3.7 billion on petroleum crude.

All Pakistan Textile Mills Association [APTMA) has said that electricity and gas is being supplied at much cheaper rates to industry in neighbouring countries like India and Bangladesh as compared to Pakistan. In a meeting with Minister of Energy, Syed Ali Zafar, Aptma representatives requested that their quota of system gas should be increased. The representative of Aptma made a detailed presentation on textile sector and different issues relating to energy supply to the sector were also discussed in detail. The minister apprised the participants that he is committed to facilitate the industry within the mandate of caretaker government.

After a lapse of two and a half years National Electric Power Regulatory Authority (Nepra) has finally imposed a fine of Rs5 million on Northern Power Generation Company Limited Genco-III on account of negligence in maintenance of 220KV switchyard of TPS Muzaffargarh and non-operation of protection system which resulted in power breakdown on January 15, 2016. After reviewing the inquiry reports of NTDC and Ministry of Energy, Nepra held Genco-III responsible for the power breakdown of January 15, 2016, in northern network of country ie Punjab and Khyber Pakhtunkhwa. Taking serious notice of power breakdown the Nepra has initiated legal proceedings against Genco-III and directed NTDC to investigate the matter and submit a report.

The Islamabad Chamber of Commerce and Industry has shown great concerns over the increase of Rs40 billion in circular debt in the last three weeks as it would worsen the power crisis in the country, badly affect business and industrial activities and further weaken the economy. It called upon the government to take drastic remedial measures to overcome the rising circular debt in order to save the economy from further troubles. Islamabad Chamber of Commerce and Industry President Sheikh Amir Waheed said that the circular debt was Rs507 billion on 31st May 2018 which has now gone up to Rs547 billion and if this trend continued, the country would face worst kind of power loadshedding in coming days that would badly damage the overall economy.

Market is expected to remain volatile therefore it's recommended to stay cautious while trading today.

Technical Analysis

The Benchmark KSE100 Index is trying to find support on a rising trend line along with a horizontal supportive region after completing its expansion on daily chart, but momentum indicators are still in bearish mode and index would slide further if it would succeed in closing below 41,800 points on daily basis. As of right now index have resistant regions around 43,018 and 43,370 points. If index would not pull back during current trading session then an evening star would be formatted on weekly chart which would lead index towards 41,500 and 39,200 finally, therefore its recommended to avoid initiating new buying during current trading session and start selling on strength once index take a spike on intraday basis.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.