Previous Session Recap

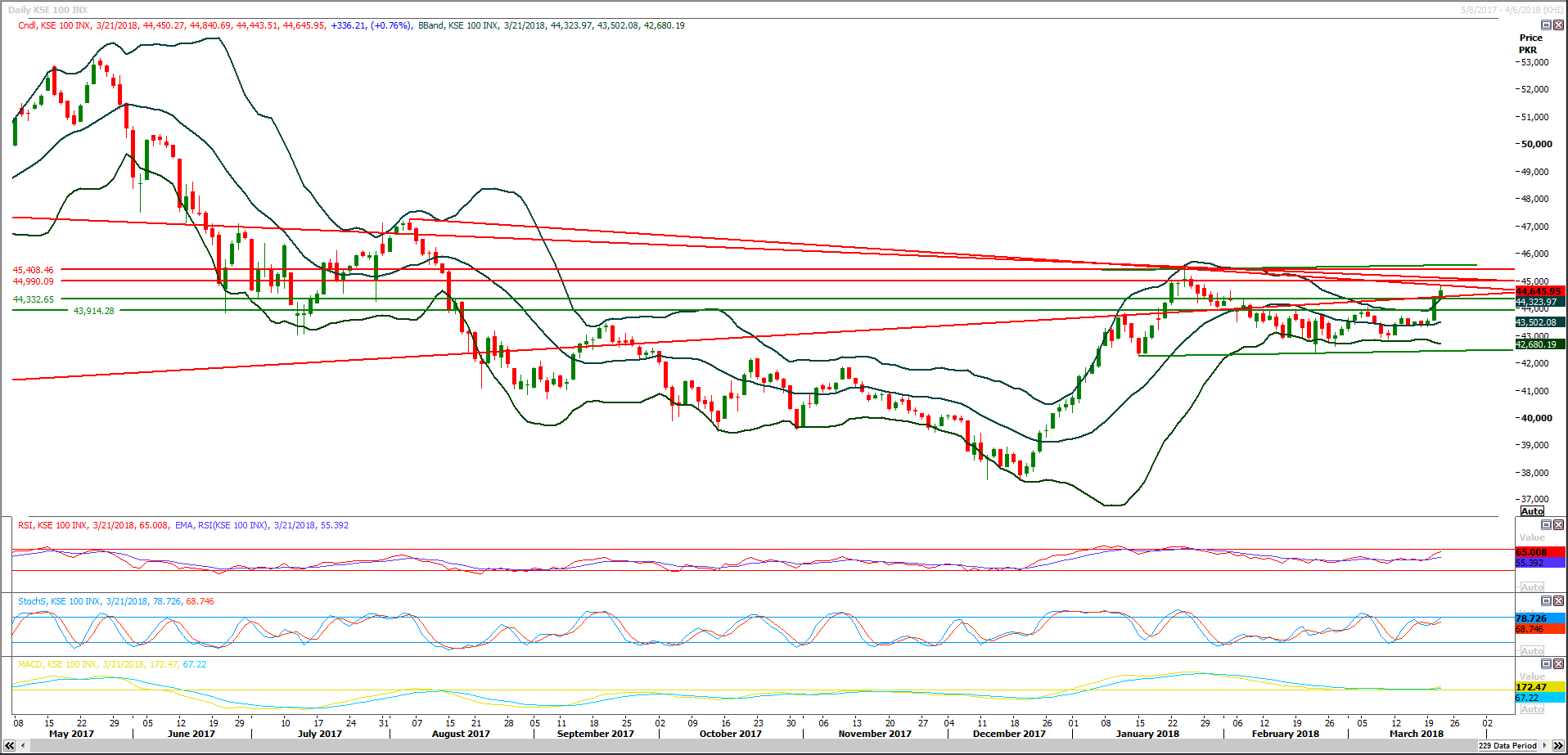

Trading volume at PSX floor dropped by 12.84 million shares or 5.84% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 44,450.27, posted a day high of 44,840.69 and a day low of 44,443.51 during last trading session. The session suspended at 44,645.95 with net change of 336.21 and net trading volume of 82.64 million shares. Daily trading volume of KSE100 listed companies dropped by 9.97 million shares or 10.77% on DoD basis.

Foreign Investors remained in net selling position of 0.61 million shares and net value of Foreign Inflow dropped by 0.88 million US Dollars. Categorically, Foreign Individual and Corporate Investors remained in net selling positions of 0.17 and 2.16 million shares but Overseas Pakistanis remained in net buying position of 1.71 million shares. While on the other side Local Individuals and Companies remained in net selling positions of 10.09 and 4.32 million shares but Local Banks, NBFCs, Mutual Funds, Brokers and Insurance Companies remained in net buying positions of 3.06, 2.13, 10.13, 0.23 and 1.8 million shares respectively.

Analytical Review

Dollar on defensive after Fed, trade worries nag shares

The U.S. dollar was on the defensive on Thursday after posting its largest loss in two months when the Federal Reserve turned out to be less hawkish than anticipated. Worries about a potential trade war between China and the United States kept gains in Asian shares in check. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS rose 0.3 percent, with South Korea's Kospi .KS11 hitting six-week high, while Japan's Nikkei .N225 gained 0.2 percent in early trade. The U.S. Federal Reserve raised interest rates on Wednesday and forecast two more hikes for 2018 in its first policy meeting under new Fed Chairman Jerome Powell.

PIA liabilities might have reached Rs480b

Federal Minister for Privatisation Daniyal Aziz on Wednesday said that liabilities of Pakistan International Airline (PIA) might have reached Rs480 billion, saying the government is compiling the fresh data of losses and liabilities of national flag carrier. “The liabilities of PIA were recorded at Rs324 billion by the end of December 2015,” said federal minister in meeting of National Assembly’s standing committee on privatisation, which was held under the chairmanship of Syed Imran Ahmed Shah, MNA. The government is compiling the data of losses and liabilities of PIA occurred by the end of December last year, he added. Giving briefing to the committee, the minister said that liabilities of PIA are around Rs324 billion, according to the available data (2015). However, he said that these liabilities might have now reached Rs480 billion, as the national flag carrier is facing loss of around Rs150 million every day. Aziz shared the plan approved by the Cabinet Committee on Privatisation regarding privatisation of PIA. He briefed regarding the procedural steps and recommendations made by the Financial Advisory Consortium (FAC) for Privatization of PIA and the steps taken by the ministry.

Govt terms Rs115 dollar rate balanced

The federal government on Tuesday termed the dollar value of Rs115 closer to the equilibrium, which would help in increasing country’s exports. “It is unlikely that dollar value will reach Rs120 but we cannot intervene in market,” said Minister of State for Finance Rana Muhammad Afzal Khan said while talking to the media. He termed the current dollar rate of Rs115 a balanced rate, which would help in enhancing country’s exports and controlling widening current account deficit. The dollar would remain between Rs112 to Rs115, he added. Afzal said that foreign exchange reserves held by State Bank of Pakistan (SBP) are around $12 billion. Meanwhile, the government would have to repay $3 billion against previous loans and interest payment before June this year. The government has no problem in repaying $3 billion as several options are under consideration to generate this amount before June.

Govt borrowed $7.6b in 8 months

The federal government borrowed $7.6 billion in eight months (July to February) of the ongoing financial year, which further increased the overall external debt of the country. The government has borrowed 94 percent of the annual borrowing in just eight months to sustain the foreign exchange reserves. The country’s reserves are depleting due to widening of current account deficit and repayment of previous loans. For the current fiscal year, the government had estimated to receive $8.094 billion in foreign loans, including $7.692 billion loans and $401.78 million grants. However, the government has borrowed 94 percent only in eight months, which indicated that government would break the previous year’s record of borrowing around $10 billion in a single year. The International Monetary Fund (IMF) recently estimated Pakistan’s external debt and liabilities could peak to $144 billion in the next five years from $93 billion in the current financial year of 2018. The IMF also estimated that total external debt servicing would reach $19.7 billion by 2023 against $7.739 billion in the FY 2018.

ISGSL gets over 150 bids for 427km oil pipeline

Inter State Gas Systems (Pvt) Limited (ISGSL) Wednesday confirmed receiving of over 150 bids against the tender it floated last month for the construction of three-segmented 427 kilometers long Machike-Tarujabba oil pipeline. "The company got a tremendous response in the bidding process from local as well foreign companies and the contract is likely to be awarded next week," ISGS Managing Director Mobin Saulat told state-run media. He said the ISGS had given satisfactory response to various queries of the bidders regarding award of construction contract for the pipeline, which would help ensure smooth and safe transportation of oil.

Market is expected to remain volatile therfore its recommended to stay cautious while trading today.

The U.S. dollar was on the defensive on Thursday after posting its largest loss in two months when the Federal Reserve turned out to be less hawkish than anticipated. Worries about a potential trade war between China and the United States kept gains in Asian shares in check. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS rose 0.3 percent, with South Korea's Kospi .KS11 hitting six-week high, while Japan's Nikkei .N225 gained 0.2 percent in early trade. The U.S. Federal Reserve raised interest rates on Wednesday and forecast two more hikes for 2018 in its first policy meeting under new Fed Chairman Jerome Powell.

Federal Minister for Privatisation Daniyal Aziz on Wednesday said that liabilities of Pakistan International Airline (PIA) might have reached Rs480 billion, saying the government is compiling the fresh data of losses and liabilities of national flag carrier. “The liabilities of PIA were recorded at Rs324 billion by the end of December 2015,” said federal minister in meeting of National Assembly’s standing committee on privatisation, which was held under the chairmanship of Syed Imran Ahmed Shah, MNA. The government is compiling the data of losses and liabilities of PIA occurred by the end of December last year, he added. Giving briefing to the committee, the minister said that liabilities of PIA are around Rs324 billion, according to the available data (2015). However, he said that these liabilities might have now reached Rs480 billion, as the national flag carrier is facing loss of around Rs150 million every day. Aziz shared the plan approved by the Cabinet Committee on Privatisation regarding privatisation of PIA. He briefed regarding the procedural steps and recommendations made by the Financial Advisory Consortium (FAC) for Privatization of PIA and the steps taken by the ministry.

The federal government on Tuesday termed the dollar value of Rs115 closer to the equilibrium, which would help in increasing country’s exports. “It is unlikely that dollar value will reach Rs120 but we cannot intervene in market,” said Minister of State for Finance Rana Muhammad Afzal Khan said while talking to the media. He termed the current dollar rate of Rs115 a balanced rate, which would help in enhancing country’s exports and controlling widening current account deficit. The dollar would remain between Rs112 to Rs115, he added. Afzal said that foreign exchange reserves held by State Bank of Pakistan (SBP) are around $12 billion. Meanwhile, the government would have to repay $3 billion against previous loans and interest payment before June this year. The government has no problem in repaying $3 billion as several options are under consideration to generate this amount before June.

The federal government borrowed $7.6 billion in eight months (July to February) of the ongoing financial year, which further increased the overall external debt of the country. The government has borrowed 94 percent of the annual borrowing in just eight months to sustain the foreign exchange reserves. The country’s reserves are depleting due to widening of current account deficit and repayment of previous loans. For the current fiscal year, the government had estimated to receive $8.094 billion in foreign loans, including $7.692 billion loans and $401.78 million grants. However, the government has borrowed 94 percent only in eight months, which indicated that government would break the previous year’s record of borrowing around $10 billion in a single year. The International Monetary Fund (IMF) recently estimated Pakistan’s external debt and liabilities could peak to $144 billion in the next five years from $93 billion in the current financial year of 2018. The IMF also estimated that total external debt servicing would reach $19.7 billion by 2023 against $7.739 billion in the FY 2018.

Inter State Gas Systems (Pvt) Limited (ISGSL) Wednesday confirmed receiving of over 150 bids against the tender it floated last month for the construction of three-segmented 427 kilometers long Machike-Tarujabba oil pipeline. "The company got a tremendous response in the bidding process from local as well foreign companies and the contract is likely to be awarded next week," ISGS Managing Director Mobin Saulat told state-run media. He said the ISGS had given satisfactory response to various queries of the bidders regarding award of construction contract for the pipeline, which would help ensure smooth and safe transportation of oil.

Technical Analysis

The Benchmark KSE100 Index is capped by a resistant trend line on daily chart and during last trading session it had bounced back after getting resistance from that region and closed below its major resistant region of 44771 points. The Index had opened above its initial resistance with a positive gap but the positive momentum could not be maintained till day end and hourly stochastic slipped below 80 in last three trading hours after posting a double top on hourly chart which indicates that maybe a false breakout of 44570 points have happened which would be confirmed today. To move further advance Index need a closing above 44771 and 44990 points during current trading session, but as its discussed above that index have started a bearish momentum on hourly chart and if it would slide below 44330 on hourly closing basis then bullish momentum would start expiring and bears would start riding the market with some fresh blood at higher prices. Its recommended to practice caution or adopt swing trading strategy for current trading session until unless index close above 44770 points.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.