Previous Session Recap

Trading volume at PSX floor increased by 7.69 million shares or 8.17% on DoD basis, whereas, the benchmark KSE100 Index opened at 40329.90, posted a day high of 40603.55 and a day low of 40271.53 during last trading session. The session suspended at 40548.83 with net change of 231.9 and net trading volume of 43.46 million shares. Daily trading volume of KSE100 listed companies dropped by 0.89 million shares or 2% on DoD basis.

Foreign Investors remained in net selling position of 1.66 million shares and net value of Foreign Inflow dropped by 0.54 million US Dollars. Categorically, Foreign Individual, Corporate and Overseas Pakistani Investors remained in net selling position of 0.02, 1.39 and 0.24 million shares respectively. While on the other side Local Individuals, Mutual Funds and Brokers remained in net selling positions of 0.49, 0.3 and 4.6 million shares but Local Companies, Banks and Insurance companies remianed in net buying of 0.48, 1.57 and 3.73 million shares respectively.

Analytical Review

Asian shares scaled a fresh decade peak on Wednesday thanks to surging markets in Europe and America, as strong global growth and rising corporate profits lured hordes of investors into equities. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS added 0.3 percent to Wednesday’s 1.3 percent rise - the biggest gain in eight months. The index has been on an uptrend most of this year, posting a monthly loss only once in 2017. For the year, it is up about 33 percent so far, on track for its best annual performance since a 68 percent jump in 2009. Robust global growth, low interest rates, strong corporate profits and expectations of U.S. corporate tax cuts have boosted equities around the world.

The Joint Cooperation Committee (JCC) of the China-Pakistan Economic Corridor (CPEC) approved on Tuesday the Long-Term Plan (LTP 2017-30) envisaging broad parameters for future cooperation, but could not conclude agreements on development projects and special economic/industrial zones. Informed sources said the Chinese delegation complained about the political instability in Pakistan that would negatively impact on the pace of CPEC progress. The two sides took almost four hours longer than the scheduled time to conclude the 7th JCC meeting as they struggled over acceptable phrases and language to sign off minutes of the meeting. They also could not finalise taxation issues and stood short of final agreement on inclusion for financing of special economic zones.

The production of petroleum products increased by 13.74 percent during the first quarter (July-September) of the current fiscal year, compared to the corresponding quarter of the last fiscal year. The petroleum products that contributed in positive growth included kerosene oil, output of which grew by 7.61 percent during the period under review, according to latest data of Pakistan Bureau of Statistics (PBS). The production of motor spirits grew by 16.28 percent, high speed diesel by 12.43 percent, diesel oil by 80.47 percent while the output of furnace oil witnessed growth of 16.64 percent during the period under review. Similarly, the output of jute batching oil increased by 62.88 percent, solvent Naptha by 16.90 percent while the production of LPG increased by 38.70 percent, according to the data. The petroleum products that witnessed negative growth in production included jet fuel, output of which decreased by 2.55 percent while the production of lubricating oil declined by 13.05 percent.

Pakistan is all set to generate up to $3 billion by issuing euro and sukuk Bonds in international debt market, as road shows for introducing bonds will start in United Arab of Emirates (UAE), Europe and United States from today (Wednesday). The federal cabinet in early November had given approval to borrow up to $3 billion from international debt markets by floating three sovereign bonds to sustain depleting foreign exchange reserves. The government’s plans to raise loans from the international market by issuing bonds would support the foreign exchange reserves, which are under pressure due to widening trade deficit.

Despite subdued inflation, drug prices rose 15.68 per cent in October on a year-on-year basis. The Inflation Monitor for October issued recently by the State Bank of Pakistan (SBP) showed prices of medicines recorded the highest increase among all non-food contributors to headline inflation. Overall inflation in October, measured through the Consumer Price Index (CPI), slowed down to 3.8pc on an annual basis. But inflation in the drug segment alone was over 15pc year-on-year. It was 7.8pc in October 2016. Medical tests recorded inflation of 6.23pc in October while the clinic fee rose 5.75pc year-on-year, both higher than headline inflation.

Today ATRL, PAEL and NML may lead the market in the positive direction.

Technical Analysis

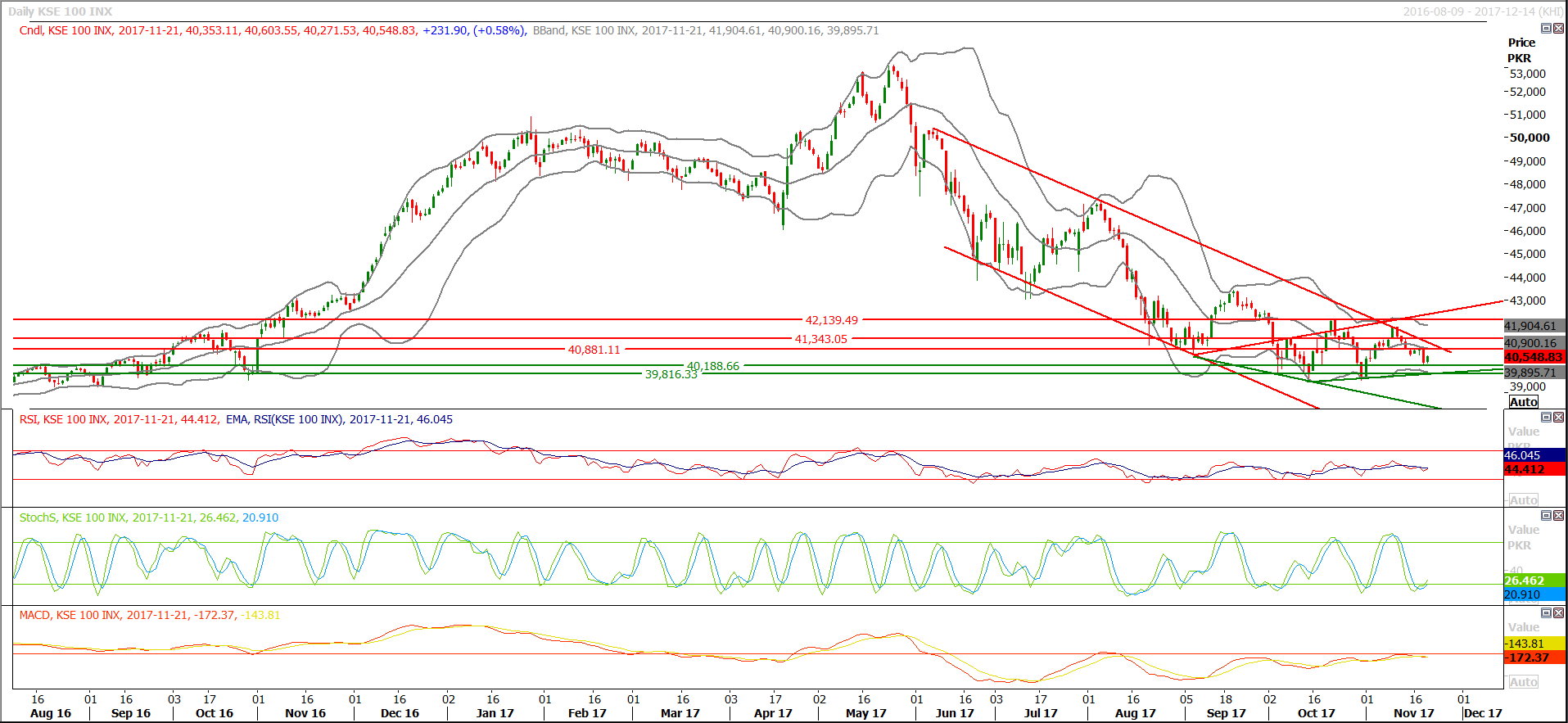

The Benchmark KSE100 Index is trying to format a bottom at a horizontal supportive region and daily MAORSI is trying to match pace with Stochastic for a bullish crossover which would change short term trend if succeeded. As of right now index has supportive regions at 40200 and 39816 while resistant regions are standing at 40881 and 41340 points. For current trading session its recommended to buy on dip with strict stop loss and sell on strenght.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.