Previous Session Recap

Trading volume at PSX floor dropped by 57.28 million shares or 25.69%, DoD basis, whereas, the benchmark KSE100 Index opened at 43338.68, posted a day high of 43386.73 and a day low of 42705.66 during the last trading session. The session suspended at 42775.04 with a net change of -571.99 points and net trading volume of 82.28 million shares. Daily trading volume of KSE100 listed companies dropped by 23.34 million shares or 22.1%, DoD basis.

Foreign Investors remained in net selling position of 3.59 million shares and net value of Foreign Inflow dropped by 1.61 million US Dollars. Categorically, Foreign Corporate and Overseas Pakistani investors remained in net selling position of 3.54 and 0.29 million shares but Foreign Individuals remained in net buying position of 0.25 million shares.On the other side Local Individuals, Banks, NBFCs and Mutual Funds remained in net selling positions of 1.54, 0.27, 0.31 and 2.04 million shares respectively but Local Companies, Brokers and Insurance Companies remained in net buying position of 1.37, 4.98 and 1.13 million shares.

Analytical Review

Asian stocks fell and the Japanese yen and Swiss franc gained on the mooted possibility of North Korea conducting another hydrogen bomb test, this time in the Pacific Ocean. North Korean Foreign Minister Ri Yong Ho said on Friday he believes the North could consider a nuclear test on an “unprecedented scale” in the Pacific Ocean, South Korea’s Yonhap news agency reported. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS handed back earlier gains and was down 0.4 percent after falling 0.7 percent the previous day. The index had risen to a decade high on Tuesday, lifted as Wall Street advanced to record levels before falling back after the Fed heightened expectations for a third interest rate hike this year. Japan's Nikkei .N225 slipped 0.2 percent and Australian stocks advanced 0.2 percent. South Korea's KOSPI .KS11 fell 0.5 percent on the latest bout of geopolitical tensions.

The government is trying to downplay the international arbitration loss in a rental power project case to Turkish firm Karkey Karadeniz, which claims to have secured an $800 million compensation award. The office of the Attorney General of Pakistan (AGP), which coordinated the arbitration proceedings, and the Power Division under the Ministry of Energy separately confirmed on Thursday that the arbitration by the International Centre for Settlement of Investment Disputes (ICSID) of the World Bank had gone against Pakistan.

Pakistan’s foreign debt servicing amounted to $8.16 billion in 2016-17, up 53 per cent from the preceding fiscal year. The State Bank of Pakistan (SBP) reported on Thursday that the country paid $6.54bn in principal and $1.62bn in interest during the last fiscal year. Foreign debt servicing amounted to $5.32bn in 2015-16. In the first, second and third quarters of 2016-17, debt servicing payments were $1.55bn, $1.25bn and $2.43bn, respectively. In the last quarter, the country paid $2.92bn.

Large-scale manufacturing (LSM) posted a robust growth of nearly 13 per cent year-on-year in the first month of this fiscal year against the projected target of 6.3pc, the Pakistan Bureau of Statistics (PSB) data showed on Thursday. The higher-than-expected LSM growth suggests that the government is likely to achieve the 6pc GDP growth target set for the current fiscal year. In 2016-17, the LSM expanded 5.6pc.

Stakeholders in the oil industry have ruled out any shortage of petrol in the country saying that stocks are enough and imports are already lined up for arrival within this month. Oil Companies Advisory Council (OCAC) Chief Executive Officer Ilyas Fazil said total petrol stocks stand at 200,000 tonnes while another 220,000 tonnes of imported petrol is arriving in the next 10 days. He said the public should rest assured that the country has adequate stocks and there is no shortage and no need for panic buying. On reports of impending petrol shortage in some upcountry destinations especially Lahore, Mr Ilyas said these reports began last week and caused consumers to resort to panic buying at various outlets.

The market is expected to remain volatile today. We advise traders to exercise caution. Buying on dips and booking gains on strength is recommended.

Technical Analysis

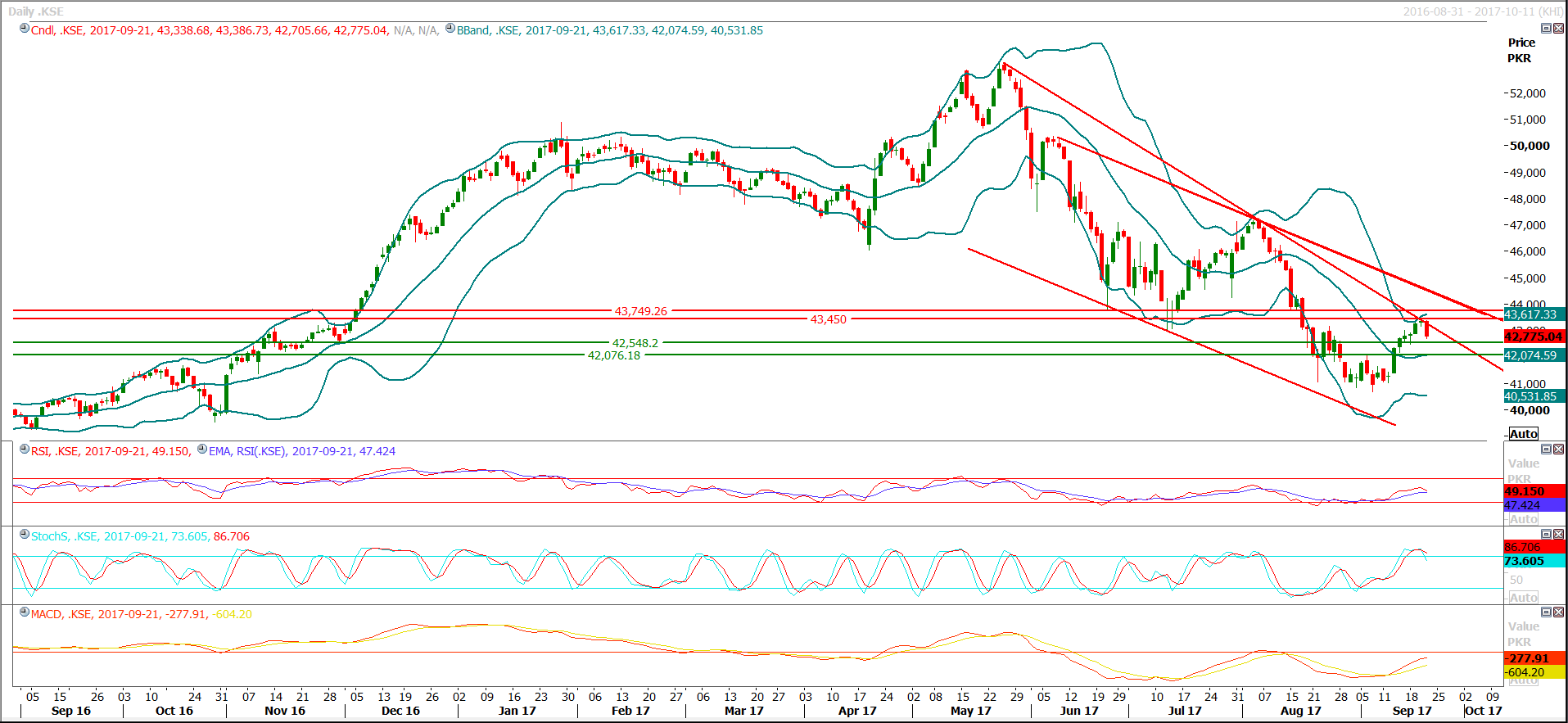

The Benchmark KSE100 Index has formatted an evening star on daily chart after being pushed back by a crossover of horizontal and trend line which reacted as a strong resistance. Daily Stochastic and MAORSI have generated a bearish crossover which may try to push index in a negative zone again and this formation might try to expire, as the impact of weekly morning star which was formatted on last Friday’s closing. To complete expire impact of the weekly morning star market needs to be closed below 42500 today. For the current trading session index have supportive regions around 42500 and 42060 while resistant regions are standing at 43200 and 43450. A cautious trading strategy is recommended for current trading session.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.