Previous Session Recap

The Bench Mark KSE100 Index Opened at 46993.31, posted day high of 4722.02 and day low of 46665.52 during last trading session. The session suspended at 46699.78 points with net change of -293.53 points and net trading volume of 133.71 million shares. Daily trading volume of KSE100 listed companies dropped by 43.10 million shares or 24.38% on DOD bases.

Foreign Investors remained in net selling position of 1.87 million shares and net value of Foreign Inflow dropped by 1.19 million US Dollars. Categorically Foreign Individuals and Overseas Pakistanis remained in net buying position of 9000 shares and 2.42 million shares respectively but Foreign Corporate Investors remained in net selling position of 4.31 million shares. While on the other side, Local Individuals, Banks and NBFCs remained in net buying position of 41.73, 2.18 and 0.2 million shares respectively. Local Companies, Mutual Funds and Brokers remained in net selling position of 32.76, 3.98 and 4.69 million shares respectively.

Analytical Review

Asian stocks stepped back in subdued trade on Friday as Wall Street took a breather from its relentless rise since the U.S. election, while the dollar hovered below its 14-year high set earlier this week. MSCI broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS, which touched a five-month low on Thursday, eased 0.1 percent, and is headed for a weekly drop of 1.4 percent. Japanese Nikkei .N225 also lost 0.1 percent, but is set to end the week with a small 0.1 percent gain. Overnight, U.S. equities posted their first back-to-back daily declines of the month in light trading as investors took time out ahead of the Christmas weekend. U.S. indices fell as much as 0.4 percent on Thursday. Wall Street stocks have been on a tear since the U.S. election on expectations that President-elect Donald Trump promised fiscal stimulus will boost economic growth and company profits. The Dow Jones Industrial Average .DJI has surged 8.7 percent since before the election.

The Pakistan Stock Exchange (PSX) sold 40 per cent strategic shares on Thursday to a Chinese consortium that made the highest bid of Rs28 per share for 320 million shares on offer. The value of the transaction is calculated to be Rs8.96 billion ($85 million). The Chinese consortium comprises three Chinese exchanges — China Financial Futures Exchange Company Limited (lead bidder), Shanghai Stock Exchange and Shenzhen Stock Exchange. Together they will take up 30pc of the strategic stock while two local financial institutions — Pak-China Investment Company Limited and Habib Bank Limited — will pick up 5pc each, the maximum permitted to a single institution under the regulations.

A 21-member delegation of Chinese companies showed keen interest to enhance business collaborations in textile sector with Pakistani counterparts.The Chinese delegation led by Zhang Shaoyun, Deputy Director General, Department of Commerce, Government of Xinjiang Uygur Autonomous Region visited Islamabad Chamber of Commerce and Industry (ICCI).

The textile exports from the country on year-on-year basis increased by 9.71 percent during the November 2016 compared to the same month so the last year.According to the latest data released by the Pakistan Bureau of Statistics (PBS), the textile exports during November 2016 were recorded at $1,048.708 million compared to the exports of $955.859 million during November 2015.

The repatriation of foreign exchange in the form of profits and dividends on foreign direct investment (FDI) surpassed the net FDI inflow by 28 per cent in the first five months of the current fiscal year. Data released by the State Bank of Pakistan (SBP) on Thursday shows that the outflow in the form of profits and dividends on FDI was $591 million in July-Nov. The country received a total FDI of $460m during the same five months, which shows the outflow was higher than the inflow by $131m or 28pc. FDI fell 45pc year-on-year in the five months, putting pressure on the government that is already facing rising debt servicing and declining foreign exchange inflows. The total outflow, including the payment on the foreign portfolio investment, was even higher. The total payment rose to $727m, although it was lower than $802m paid in the same period of the last fiscal year.

ENGRO, SEARL, LUCK and HBL can lead market in positive direction.

Technical Analysis

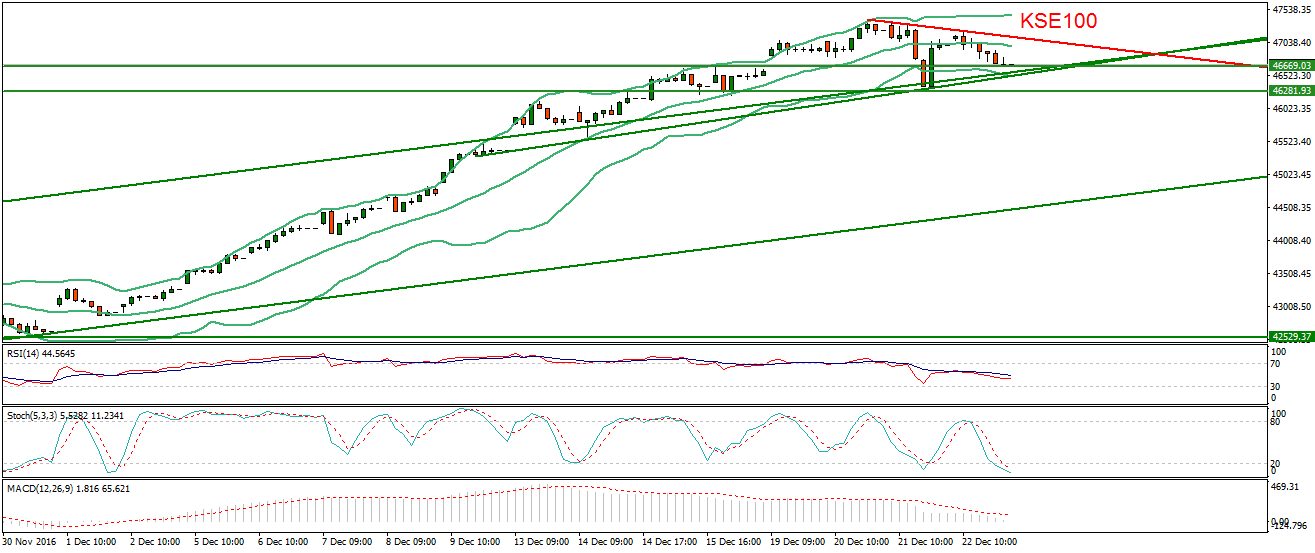

The Bench Mark KSE100 Index has completed 61.8% correction of its previous correction and right now it is getting support from horizontal supportive region along with a trend line, hourly stochastic and MAORSI also have generated bullish crossovers which can push index in further advance mode. Right now index has resistant region around 47325 points and if it will be able to close above that level then it can move further upward for an expansion while supportive regions stand at 46616 and 46274 points. Trading with strict stop loss would be beneficial if market is able to close above resistant region otherwise cut and reverse strategy can be adopted on intraday and short term bases.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.