Previous Session Recap

The Bench Mark KSE100 Index Opened at 49119.81, posted day high of 49331.54 and day low of 48710.29 during last trading session while session suspended at 48981.65 with net change of -33.44 points and net trading volume of 178.28 million shares. Daily trading volume of KSE100 Index listed companies increased by 59.31 million shares or 49.85% on DOD bases.

Foreign Investors remain in net selling position of 27.98 million shares and net value of Foreign Inflow dropped by 1.19 million US Dollars. Categorically Foreign Individuals remain in net buying position of 0.10 million shares but Foreign Corporate and Overseas Paksitani investors remain in net selling position of 23.67 and 4.42 million shares respectively. While on the other side Local Individuals and Brokers remain in net selling position of 8.16 and 7.98 million shares but Local Companies, Banks, NBFCs and Mutual Funds remain in net buying position of 29.12, 6.50, 1.03 and 6.42 million shares respectively.

Analytical Review

Asian stocks eased from a 19-month high on Thursday, while the dollar made an uneven recovery from losses suffered after Federal Reserve minutes indicated a cautious approach to raising U.S. interest rates. MSCI broadest index of Asia-Pacific shares outside Japan edged down almost 0.1 percent having jumped to its highest level on Wednesday since July 2015. Japanese Nikkei slipped 0.35 percent, while Australian shares retreated 0.2 percent. South Korean shares were flat after the central bank kept interest rates unchanged, at 1.25 percent, as expected, for an eighth straight month. Overnight on Wall Street, the Dow Jones Industrial Average ended up almost 0.2 percent, its ninth straight record-close. That optimism however, did not flow through to other indexes, with the S&P 500 and the Nasdaq both closing about 0.1 percent lower. The dollar edged higher as investors parsed the Fed January meeting minutes, which said that it may be appropriate to raise rates again fairly soon should jobs and inflation data be in line with expectations.

Dissatisfied with the tariff approved by the regulator, the government on Wednesday allowed blanket exemption from withholding tax on dividends to $1.5 billion Matiari-Lahore Transmission Line Project to be built by a Chinese firm under the China-Pakistan Economic Corridor (CPEC). The government had earlier asked the National Electric Power Regulatory Authority (Nepra) to allow withholding tax on dividends to the 878-kilometre transmission line as a pass-through item in the tariff to ensure guaranteed 17 per cent return on equity to China Electric Power Equipment Technology Company (CET). Nepra did not oblige while citing a lack of precedent. The government last week authorised the Private Power and Infrastructure Board (PPIB) to issue a formal letter of interest (LoI) to a Chinese company for the transmission line considered crucial to transport more than 4,000 megawatts of electricity from Thar, Port Qasim and Hub.

Bestway Cement Ltd on Wednesday entered into a non-binding memorandum of understanding with Dewan Cement Ltd (DCL) for the proposed acquisition of its north plant, including land, production facility and mining leases/licences. In doing so, the company of Pakistan-born British businessman Anwar Pervez appears to have outbid several contestants, including Lucky, Kohat and Fecto. However, both companies in their notices to the Pakistan Stock Exchange on Wednesday did not disclose the price of the acquisition. A bit of furore was noticeable in the industry last September when an unnamed Chinese company also expressed intention to conduct due diligence of the DCL plant.

The government raised Rs59.7 billion through Pakistan Investment Bonds (PIBs) on Wednesday against banks’ bids of Rs115.2bn. The auction was not encouraging for banks as the government continued to raise small amount of money. The highest amount of Rs93bn was offered by banks for three-year PIBs, but the government raised Rs59.6bn at a not-so-attractive cut-off yield of 6.4 per cent. The banks have been investing heavily in the market treasury bills with low returns compared to PIBs which hit the profitability of almost all banks in 2016.

Today market is expected to remain volatile again, Traders are advised to exercise cautiously, Accumulate Banks on dips and take profit on higher levels.

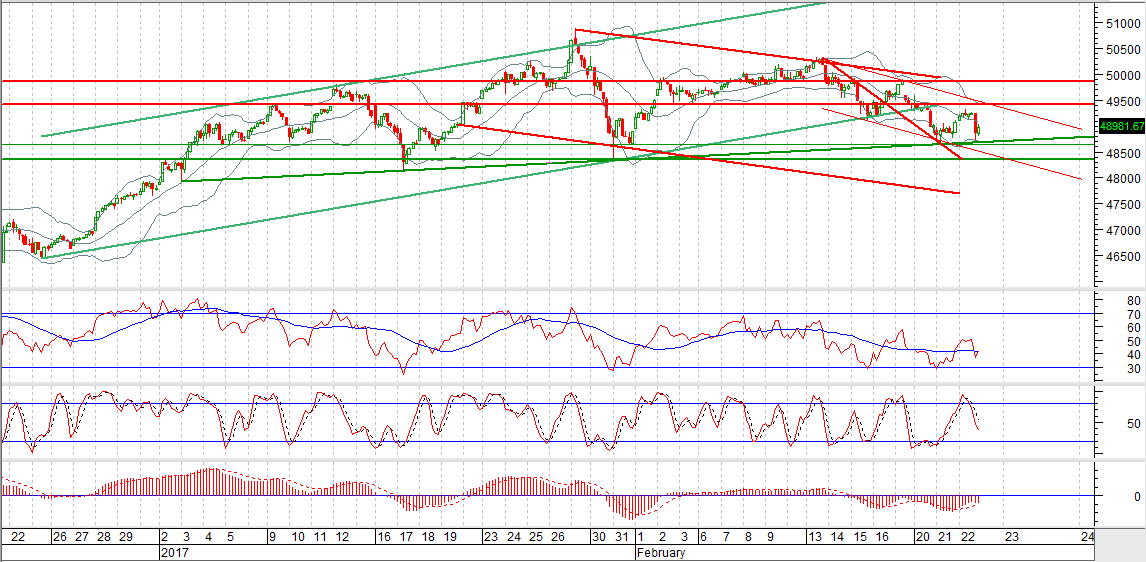

Technical Analysis

The Bench Mark KSE100 Index once again have been pushed back from its 50% intraday correction which is an alarming for bulls. Right now market is supported by a rising trend line around low of its second last trading session, breakout of that region will call for new bearish rally for expansion of current 50% correction. Index is not able to recover fom bearish corrections and today is the last day of the week if index would not be able to close above 49440 then sentiments will remain bearish for comming week. As Index has closed below 49105 after opening with a positive gap above that region during last trading session so that region is also becoming strong resistance. Market will remain volatile so swing trading with strict stop losses could be beneficial.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.