Previous Session Recap

The Benchmark KSE100 Index Opened at 49027.96, posted day high of 49464.06 and day low of 49013.82 during last trading session. The session suspended at 49364.83 with net change of 351.01 points and net trading volume of 181.24 million shares. Daily trading volume of KSE100 listed companies dropped by 27.3 million shares or 13.09% on DOD bases.

Foreign Investors remained in net selling position of 16.65 million shares and net value of Foreign Inflow dropped by 7.66 million US Dollars. Categorically Foreign Individuals and Corporate Investors remained in net selling position of 0.054 and 18.21 million shares but Overseas Pakistanis remained in net buying position of 1.62 million shares. While on the other side Local Individuals, Banks, Mutual Funds and Brokers remained in net selling position of 2.85, 3.16, 0.42 and 2.79 million shares respectively but Local Companies and NBFCs remained in net buying position of 13.54 and 10.60 million shares.

Analytical Review

The dollar slipped and Asian shares were on the defensive on Monday as worries about President Donald Trump protectionist policies outweighed optimism that he will follow through on promises of tax cuts and other stimulus. Japanese Nikkei dropped 1.3 percent while shares in South Korea and Australia dropped 0.3 percent, though dollar-denominated MSCI broadest index of Asia-Pacific shares outside Japan was flat. U.S. stock futures dipped 0.2 percent, erasing gains made on Friday. In his inaugural address, Trump pledged to end what he called an American carnage of rusted factories and vowed to put America first. His speech sounded protectionist. It was something markets were already expecting but was not really a catalyst for risk-on trading, said Masahiro Ichikawa, senior strategist at Sumitomo Mitsui Asset Management.

Oil and Gas Development Authority (Ogra) granted licence for establishment of Oil Marketing Company (OMC) to 21 companies during the first six months of the current fiscal year. According to the Ogra biannually report, the authority is expecting that establishment of these companies will bring a minimum investment of Rs 10.5 billion in the next three years.

Even before the formal launch of $4.5 billion Dasu hydropower project, the Water and Power Development Authority (Wapda) has terminated two of its key contracts with a Chinese firm, citing fundamental breaches of the agreement. Moving swiftly, Wapda has not only encashed the performance guarantees of the two contracts awarded to China Railway First Group (CRFG) in November 2015 — worth Rs5.4bn — but also ordered the contractor to vacate the project area immediately, while calling for fresh tenders to make up for lost time.

The PML-N government has taken credit for withdrawing the major part of a purported Rs477bn worth of tax exemptions under the recent IMF programme. But tax exemptions now appear to be creeping in again, to support the CPEC Programme. Under a systematic scheme, tax exemptions were first introduced in road projects and then extended to Thar-based power projects.

Textile exports declined by 1.65 percent to $6.156 billion during the first six months of the current fiscal year as compared to $6.2589 billion for the same period a year ago, according to Pakistan Bureau of Statistics (PBS). Provisional exports data of select commodities updated by the PBS on its website noted a 49.87 percent decrease in export of raw cotton during July-December 2016 when compared to the same period of last fiscal year.

SNGP, MTL, APL, AKZO and BOP can lead market in positive direction.

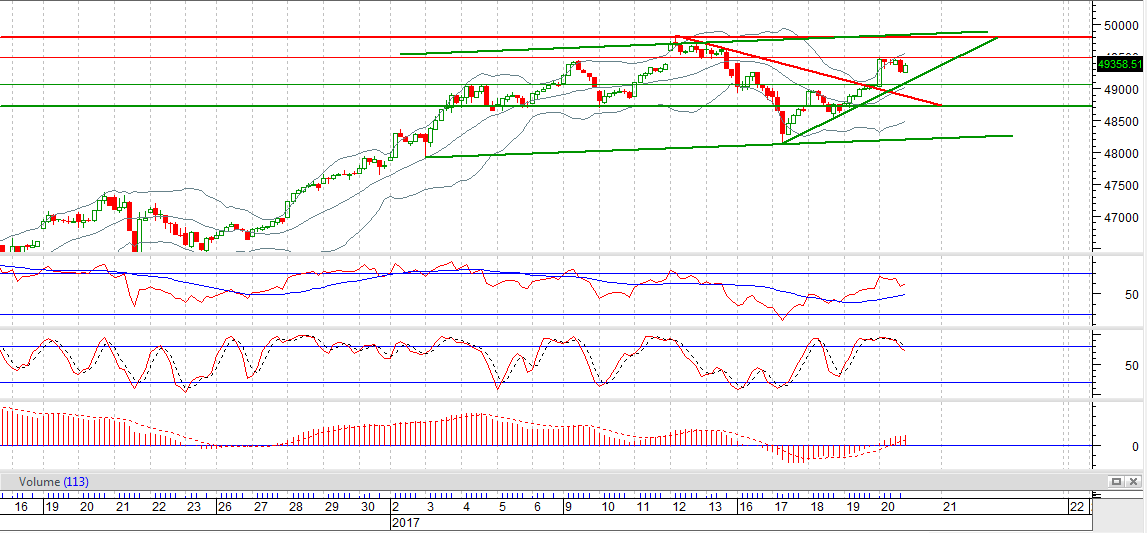

Technical Analysis

The Benchmark KSE100 is attempting to form a Bullish trend after breakout of its hourly triangle and completing 50% correction on hourly chart in bullish direction. As of now, it is being supported by a rising trend line on hourly chart at 49128 while resistant regions stand at 49500. Hourly Stochastic is trying to pull back for an intraday correction from the resistance at 49500. Closing above 49500 may call for a new history high towards 49810. Trading with strict stop loss of 49072 is recommended for current trading session breakout of 49072 will call for 48730.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.