Previous Session Recap

Trading volume at PSX floor increased by 63.85 million shares or 41.69%, DoD basis, whereas, the benchmark KSE100 Index opened at 42073.08, posted a day high of 42291.15 and a day low of 41062.73 during the last trading session while session suspended at 41983.16 with a net change of -170.22 points and a net trading volume of 112.24 million shares. Daily trading volume of KSE100 listed companies increased by 33.35 million shares or 42.27%, DoD basis.

Foreign Investors remained in a net selling position of 3.19 million shares and the net value of Foreign Inflow dropped by 6.83 million US Dollars. Categorically, Foreign Corporate Investors remain in a net selling position of 3.6 million shares but Overseas Pakistanis remained in a net buying position of 0.36 million shares. While on the other side, Local Individuals, Banks and Brokers remained in net buying positions of 5.65, 4.32 and 0.46 million shares, respectively but Local Banks and Mutual Funds remained in net selling of 0.72 and 6.68 million shares.

Analytical Review

SANY Group, one of the Chinas top construction machinery manufacturers, plans to invest $1.5 billion in the development of wind energy in Punjab. SANY Group, together with the Punjab Board of Investment and Trade, is considering sites for wind farms. Ryan Zhao, a top representative of SANY Group, said that SANY Group continues to make sustainable efforts to develop business in Punjabs emerging economy. He was visiting Punjab Board of Investment and Trade to discuss SANY groups plans and to supplement the status of proposed sites and the further procedure to initiate their projects with Punjab Power Development Board (PPDB).

Pakistan Stock Exchange (PSX) continued its downward trend on second consecutive day as benchmark 100-shares index lost another 170 points and closed at 41,983 points. Market continued its steep decline during the initial hours of yesterdays trading session, making an intra-day low of 1,091 points. However, hefty buying in heavyweight stocks during the latter hours resulted in major recovery in the KSE-100, brokers said. Top 5 index point contributors included ENGRO (up 1.9%), DAWH (3%), BAHL (2.8%), PPL (1.2%) & EFERT (2.8%) which added 113 points. On the contrary, LUCK (down 3.4%), DGKC (4.8%), FFC (3.2%), SEARL (4.2%) & HUBC (1.3%) led to decline of 165 points. Cement sector continued to remain under pressure as it contributed 128 points to index decline following concerns of cement pricing pressure.

Former governor of State Bank of Pakistan Dr Ishrat Hussain has called upon the government to reduce the cost of doing business by slashing the power tariff for making Pakistan competitive in international market. Pakistans exports drastically came down to $20.45 billion during last fiscal year 2016-17 from the level of $25 billion achieved a few years back. The governments external sector is under severe pressure due to decline in exports and increase in imports. Pakistans current account deficit widened to $2.1 billion in July this year against just $662 million in the same period last year due to increase in trade deficit.

Former Governor of the State Bank of Pakistan Dr. Ishrat Hussain has said that exports play a very important role in keeping the economy stable therefore this sector should be facilitated. Reasons behind dwindled exports include cost and availability of energy, want of skilled labour and lack of interest in imparting training to the staff on the part of export industries, he said. Dr. Ishrat Hussain who has also served as Advisor to the government said this while speaking at a seminar regarding export competitiveness in the FPCCI, says statement issued here on Tuesday. Prof. Dr. Sarosh Hashmat Lodi, Vice Chancellor, NED University of Engineering.and Technology, Prof. Dr. Javed Ashraf, Vice Chancellor, Quid-e-Azam University, Islamabad, Prof. Sikandar Mehdi, Senator Javed Jabbar, former federal minister, leaders of the business community and others were also present on the occasion.

Today ATRL, DSL, GATM and ISL may lead the market in positive direction.

Technical Analysis

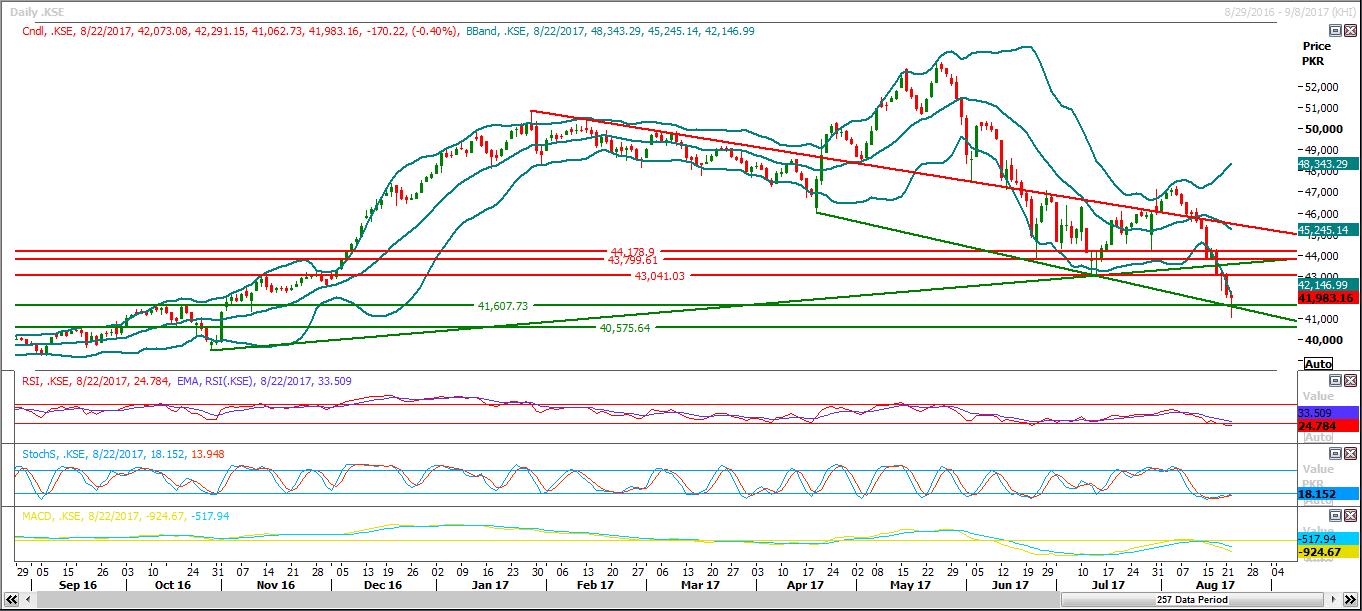

The Bench Mark KSE100 Index have formatted a bearish trend channel and its trying to bounce back after retesting supportive trend line of said channel. A short term pull back is expected in coming days towards 43041 and 44200 points therefore buying on dips is recommended but as index dont have a larger space in bullish direction therefore its not recommended to initiate trades for mid or longer term. Buying on dip and selling on strength is recommended untill index close above 44200 but before that region index have resistances ahead at 43041 and 43800 points therefore its recommended to post trailing stop losses around those regions. The pullback which could be witnessed in coming days could be categorized as a correction of last bearish run of index. Index have strong supports around 41000 and 40500 points.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.