Previous Session Recap

Trading volume at PSX floor dropped by 79.44 million shares or 30.54% on DoD basis, whereas the benchmark KSE100 index opened at 40,655.37, posted a day high of 41,054.42 and a day low of 41,493.99 points during last trading session while session suspended at 40,832.99 points with net change of 177.62 points and net trading volume of 104.45 million shares. Daily trading volume of KSE100 listed companies dropped by 65.47 million shares or 38.53% on DoD basis.

Foreign Investors remained in net selling positions of 2.48 million shares and value of Foreign Inflow dropped by 0.67 million US Dollars. Categorically, Foreign Individuals remained in net buying positions of 0.12 million shares but Foreign Corporate and Overseas Pakistanis remained in net selling positions of 1.47 and 1.12 million shares. While on the other side Local Individuals, Banks, NBFCs and Insurance Companies remained in net buying positions of 4.42, 8.68, 0.31 and 2.56 million shares but Local Companies, Mutual Fund and Brokers remained in net selling positions of 6.51, 7.10 and 0.62 million shares respectively.

Analytical Review

Asian shares hold near 18-month highs in holiday lead-up

Asian markets idled near 18-month highs on Monday as volumes weakened ahead of the Christmas holiday break and investors squared off their positions, taking home hefty gains made earlier this month.MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was steady after rising 1.4% last week and over 5% this month. For the final quarter of the year, the index is up nearly 10% so far. Japan's Nikkei .N225 climbed 0.1% after reaching a 14-month top last week. It was ahead by 2.3% for the month so far. South Korea's market .KS11 was a shade weaker after adding 5.5% so far in December. Chinese shares were slightly lower with the blue-chip CSI300 .CSI300 down 0.1%. E-Mini futures for the S&P 500 ESc1 held at all-time highs having put on 2.7% for the month.

Egypt to begin gas imports from Israel next month

Egypt will begin importing natural gas from Israel by mid-January 2020, Israeli Energy Minister Yuval Steinitz told Israel Radio on Sunday. “(The exports) will begin in the middle of next month and perhaps even earlier,” he said. Israeli gas exports to Egypt will gradually reach 7 billion cubic metres, a senior industry source, who earlier in the day disclosed a mid-January starting date, said. Steinitz said Egyptian petroleum minister Tarek El Molla had spoken to him two days ago and congratulated him on signing export permits for the gas.

Govt springs into action as gas crisis deepens

With a sudden drop in temperature across the country, the ongoing gas crisis deepened on Sunday as the total shortfall surged to 600 million metric cubic feet a day (MMCFD) that may compel the Sui Northern Gas Pipelines Limited (SNGPL) and Sui Southern Gas Company (SSGC) to curtail the supply to sectors other than domestic consumers. The shortfall has affected not only the supply to domestic consumers but also to the Compressed Natural Gas (CNG) sector for the past several days. Addressing a press conference in Sialkot on Sunday, Special Assistant to the Prime Minister on Information Dr Firdous Ashiq Awan told the media that the government had directed the authorities concerned to ensure gas supply to households even at the cost of the CNG sector.

FATF response to Pakistan progress report received

Responding to the Pakistan progress report, a regional affiliate of the Financial Action Task Force (FATF) has forwarded 150 comments and clarifications in all sectors, but mostly related to the action taken by the country against banned groups and proscribed persons. Pakistan had submitted the initial progress report to the Asia Pacific Group (APG) of the FATF on Dec 3 regarding implementation of the action plan, which related to shortcomings pointed out at the previous review. “The FATF response was received on Friday night and forwarded to relevant departments on Saturday,” an official of the finance ministry told Dawn. According to sources privy to the development, it has been decided that initially an internal meeting, to be chaired by the director general of the Financial Monitoring Unit (FMU), will be held in Islamabad on Sunday (today) and the replies will be collected next week.

7 agri, livestock projects worth Rs4.20b approved for erstwhile Fata

The Khyber Pakhtunkhwa Government has approved seven gigantic projects worth Rs4.20 billion to promote agriculture, livestock and fisheries sectors in erstwhile Fata. An Official of Agriculture and Livestock Department told APP on Sunday that 10 new projects focusing on enhancement of meat and milk production, water conservation, livestock and dairy development have been prepared after consultation with all stakeholders to alleviate poverty and generate employment opportunities for the tribesmen. Out of these projects, seven were approved by the competent forum on which around Rs4. 20billion would be spent during current fiscal year.

Asian markets idled near 18-month highs on Monday as volumes weakened ahead of the Christmas holiday break and investors squared off their positions, taking home hefty gains made earlier this month.MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was steady after rising 1.4% last week and over 5% this month. For the final quarter of the year, the index is up nearly 10% so far. Japan's Nikkei .N225 climbed 0.1% after reaching a 14-month top last week. It was ahead by 2.3% for the month so far. South Korea's market .KS11 was a shade weaker after adding 5.5% so far in December. Chinese shares were slightly lower with the blue-chip CSI300 .CSI300 down 0.1%. E-Mini futures for the S&P 500 ESc1 held at all-time highs having put on 2.7% for the month.

Egypt will begin importing natural gas from Israel by mid-January 2020, Israeli Energy Minister Yuval Steinitz told Israel Radio on Sunday. “(The exports) will begin in the middle of next month and perhaps even earlier,” he said. Israeli gas exports to Egypt will gradually reach 7 billion cubic metres, a senior industry source, who earlier in the day disclosed a mid-January starting date, said. Steinitz said Egyptian petroleum minister Tarek El Molla had spoken to him two days ago and congratulated him on signing export permits for the gas.

With a sudden drop in temperature across the country, the ongoing gas crisis deepened on Sunday as the total shortfall surged to 600 million metric cubic feet a day (MMCFD) that may compel the Sui Northern Gas Pipelines Limited (SNGPL) and Sui Southern Gas Company (SSGC) to curtail the supply to sectors other than domestic consumers. The shortfall has affected not only the supply to domestic consumers but also to the Compressed Natural Gas (CNG) sector for the past several days. Addressing a press conference in Sialkot on Sunday, Special Assistant to the Prime Minister on Information Dr Firdous Ashiq Awan told the media that the government had directed the authorities concerned to ensure gas supply to households even at the cost of the CNG sector.

Responding to the Pakistan progress report, a regional affiliate of the Financial Action Task Force (FATF) has forwarded 150 comments and clarifications in all sectors, but mostly related to the action taken by the country against banned groups and proscribed persons. Pakistan had submitted the initial progress report to the Asia Pacific Group (APG) of the FATF on Dec 3 regarding implementation of the action plan, which related to shortcomings pointed out at the previous review. “The FATF response was received on Friday night and forwarded to relevant departments on Saturday,” an official of the finance ministry told Dawn. According to sources privy to the development, it has been decided that initially an internal meeting, to be chaired by the director general of the Financial Monitoring Unit (FMU), will be held in Islamabad on Sunday (today) and the replies will be collected next week.

The Khyber Pakhtunkhwa Government has approved seven gigantic projects worth Rs4.20 billion to promote agriculture, livestock and fisheries sectors in erstwhile Fata. An Official of Agriculture and Livestock Department told APP on Sunday that 10 new projects focusing on enhancement of meat and milk production, water conservation, livestock and dairy development have been prepared after consultation with all stakeholders to alleviate poverty and generate employment opportunities for the tribesmen. Out of these projects, seven were approved by the competent forum on which around Rs4. 20billion would be spent during current fiscal year.

Market is expected to remain volatile during current trading session.

Technical Analysis

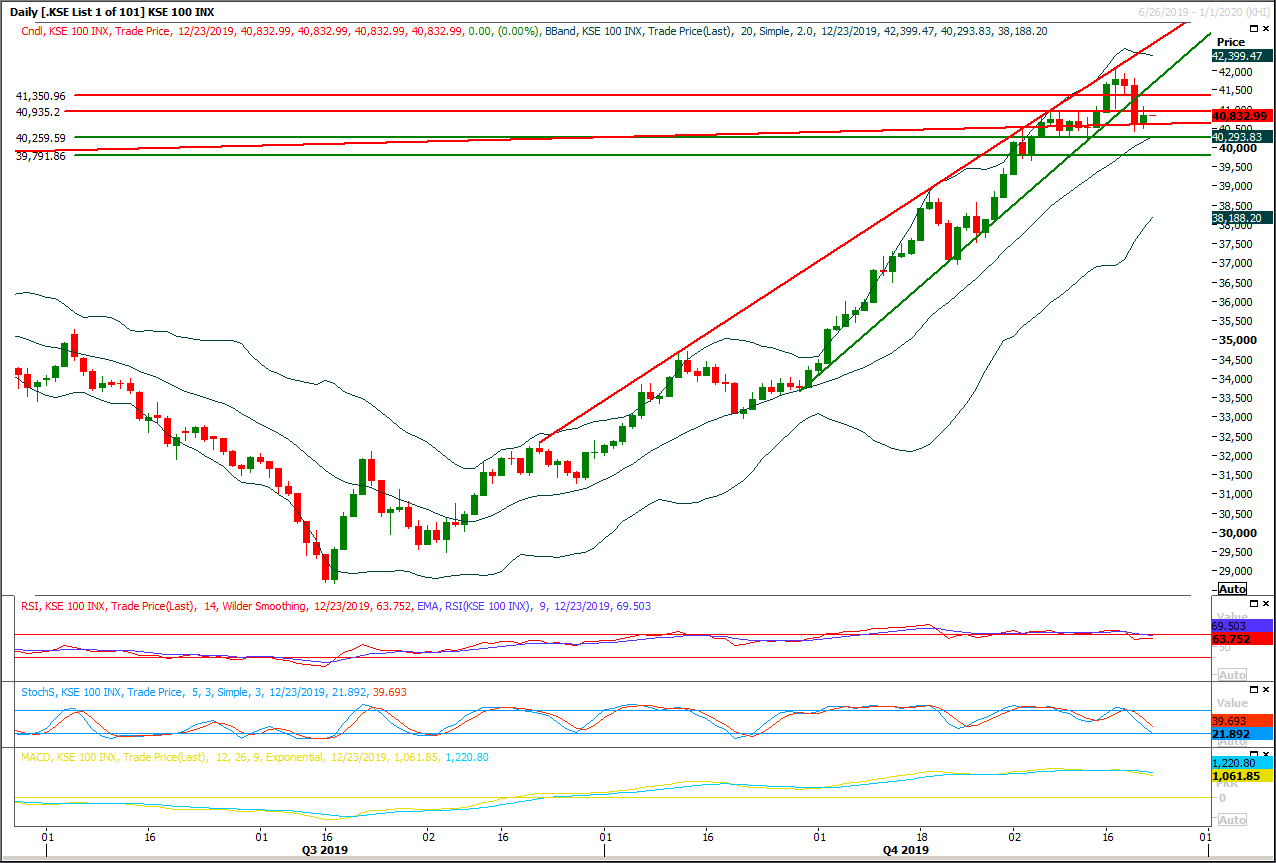

The Benchmark KSE100 index have posted a double bottom on daily chart after breakout of a bullish wedge in downward direction and right now it's trying to find support at a rising trend line but daily momentum indicators are still in bearish mode and these would try to add pressure on index. It's expected that index would try to retest supportive region of its bullish wedge mean while completing correction of its last bearish rally where it would face strong resistance. As of now it's expected that index be considered bearish until it would not succeed in closing above 41,350 points. It's recommended to stay cautious during current trading session because if index would not succeed in closing above its resistant regions then pressure would start increasing. On intraday basis index have supportive regions standing at 40,260 and 39,800 points while on flipside it would face strong resistances at 41,000 and 41,350 points.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.