Previous Session Recap

Trading volume at PSX floor increased by 84.88 million shares or 40.52% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 44225.24, posted a day high of 44951.21 and a day low of 44121.97 during last trading session. The session suspended at 44897.69 with net change of 718.86 and net trading volume of 135.8 million shares. Daily trading volume of KSE100 listed companies increased by 38.44 million shares or 39.48% on DoD basis.

Foreign Investors remained in net selling position of 5.19 million shares and net value of Foreign Inflow dropped by 3.62 million US Dollars. Categorically, Foreign Individuals remained in net buying position of 0.13 million shares but Foreign Corporate and Overseas Pakistanis remained in net selling position of 4.68 and 0.63 million shares. While on the other side Local Individuals, Banks and NBFCs remained in net selling positions of 5.66, 10.55 and 0.17 million shares but Local Companies, Mutual Funds, Brokers and Insurance Companies remained in net buying positions of 4.5, 10.13, 4.47 and 0.34 million shares respectively.

Analytical Review

Asian stocks advanced on Tuesday after U.S. senators struck a deal to end a three-day government shutdown, sending Wall Street’s main indexes to record highs and keeping the dollar well supported. U.S. lawmakers passed a short-term measure on Monday to fund the federal government through Feb. 8. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS rose 0.2 percent to a fresh record peak. Australian stocks climbed 0.7 percent and South Korea's KOSPI .KS11 added 0.5 percent. Japan's Nikkei .N225 was 0.45 percent higher. World equity markets have been on a tear over the past year, buoyed by a synchronized uptick in global economic growth in a boon to corporate profits and stock valuations.

Pakistan has acquired $5.9 billion foreign loans in only six months to meet the increasing external account requirement and maintaining foreign exchange reserves. The government borrowed almost 73 percent of the annual estimates of loans of $8.1 billion during July-December period of the ongoing fiscal year 2017-18. Keeping in view the current pace of borrowing, the government is all set to breach the $8.1 billion target of loans during current financial year. It would be the second consecutive year when government would make record of taking foreign loans . Last year, the government had borrowed $10.2 billion from external sources as against the target of $8 billion. The PML-N government had borrowed almost $40 billion in last four and a half years from bilateral/multilateral as well as commercial banks. Despite taking massive foreign loans , Pakistan’s foreign exchange reserves are sharply eroding due to the widening of current account deficit (CAD) and repayment of previous loans .

National Database and Registration Authority (NADRA) has reduced the cost of its verification for microinsurance policies on the recommendation of technical committee on insurance, formed under the National Financial Inclusion Strategy (NFIS). This will apply to the microinsurance policies sold through mobile, Internet, digital and/or non-digital modes. The cut in the Nadra verification cost will reduce the premium for microinsurance policies, making it affordable for the low-income segments. It is expected that this will pave the way for development of the microinsurance segment thereby achieving the objectives of the NFIS, according to the official handout issued by the Securities and Exchange Commission of Pakistan (SECP).

Pakistan was ranked at the 47 place among emerging economies on an Inclusive Development Index, while India is behind Pakistan at the 62 rank, according to World Economic Forum (WEF). Norway remains the world’s most inclusive advanced economy, while Lithuania again tops the list of emerging economies, the World Economic Forum (WEF) said while releasing the yearly index here before the start of its annual meeting, to be attended by several world leaders including US President Donald Trump. The index takes into account the “living standards, environmental sustainability and protection of future generations from further indebtedness,” the WEF said. It urged the leaders to urgently move to a new model of inclusive growth and development, saying reliance on GDP as a measure of economic achievement is fuelling short-termism and inequality.

The government has drafted a new plan to broaden the tax net in phases as part of a revenue drive. “We have finalised a comprehensive plan in this regard,” a senior tax official told Dawn on Monday. The plan will soon be submitted to Prime Minister Shahid Khaqan Abbasi for approval after getting further feedback in the last meeting on broadening of the tax base. The list of potential taxpayers is being finalised on the basis of financial transactions and data collected from various sources including National Data and Registration Authority (NADRA).

Its recommended to practice caution as market is expected to remain volatile.

Technical Analysis

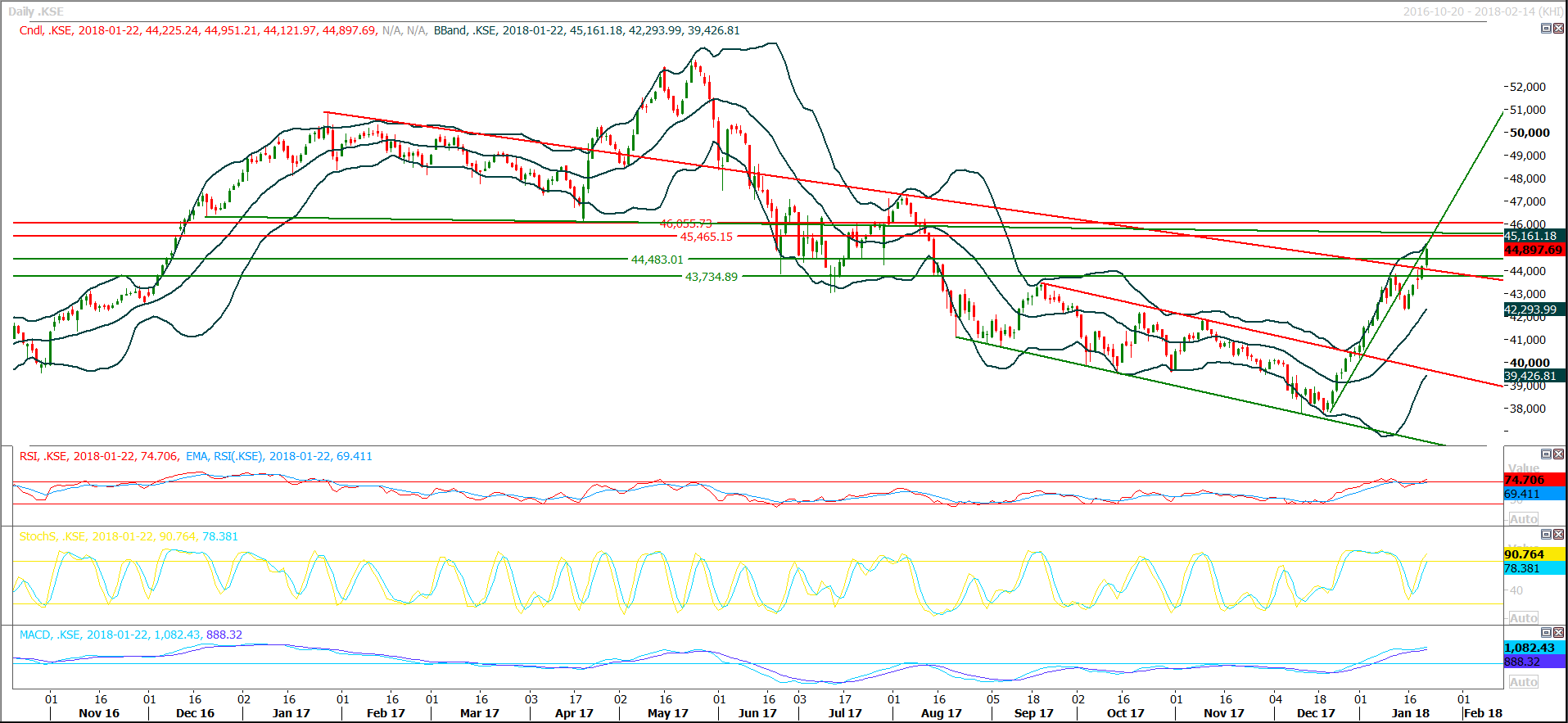

The Benchmark KSE100 Index have maintained its previous resistant trend line as a support during last trading session and right now its heading towards 50% correction of its whole bearish move which started from 53127.24 and ended up at 37736.73. Said correction is being completed at 45465 where index also have resistance from a horizontal resistant region along with a trend line which was a support priviously.Its expected that market can start a correction any time therefore its recommeneded to initiate positions very carefully. For current trading session index have resistances at 45465 and 46055 while supportive regioins are standing at 44483 and 43760.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.