Previous Session Recap

Trading volume at PSX floor dropped by 76.85 million shares or 63.23% on DoD basis, whereas the benchmark KSE100 index opened at 32,625.27, posted a day high of 32,723.68 and a day low of 32,391.55 points during last trading session while session suspended at 32,584.55 points with net change of 125.78 points and net trading volume of 38.19 million shares. Daily trading volume of KSE100 listed companies dropped by 68.19 million shares or 64.1% on DoD basis.

Foreign Investors remained in net buying positions of 0.79 million shares and net value of Foreign inflow increased by 0.34 million US Dollars. Categorically, Foreign Corporate and Overseas Pakistani Investors remained in net buying positions of 0.34 and 0.43 million shares. While on the other side Local Individuals, Banks and Insurance Companies remained in net buying positions of 5.03, 0.87 and 0.81 million shares respectively but Local Companies, Mutual Funds and Brokers remained in net selling positions of 3.75, 1.57 and 2.3 million shares respectively.

Analytical Review

Hopes of ECB, Fed rate cuts boost stocks, British pound sags

Expectations that the European Central Bank and Federal Reserve will cut interest rates boosted stocks globally, while the pound sagged on worries that likely new prime minister Boris Johnson would lead Britain into a no-deal exit from the European Union. MSCI’s broadest index of Asia-Pacific shares outside Japan gained 0.15%. Japan’s Nikkei rose 0.95%. The Shanghai Composite Index edged up 0.2%. Australian stocks added 0.4% and South Korea’s KOSPI gained 0.45%. The S&P 500 edged up toward a record high overnight, supported by expectations that the Federal Reserve would cut interest rates at its July 30-31 policy meeting.

PM invites Pakistani-American businessmen to invest in country

Prime Minister Imran Khan on Monday invited the Pakistani-American businessmen to explore the new encouraging environment in Pakistan that offered ease of doing business and encouraged attractive profit-making. Addressing at the Trade and Investment Conference, the prime minister said the government of Pakistan Tehreek-e-Insaf had introduced a new mindset of wealth creation and promoted foreign investment. “This is the mindset of Naya Pakistan where facilitation of businessmen is a priority,” he said at the forum, attended by leading businessmen and investors belonging to Pakistani-origin community. The prime minister said most of the North Americans-Pakistanis in particular were self-made and had special place in his heart for their hard work.

Cement exports rise 21pc

The export of cement during the financial year 2018-19 witnessed increase of 21.94 percent as compared to the corresponding period of last year. The cement exports from the country were recorded at $271.726 million during July-June 2018-19 as against the exports of $ 222.841 million during July-June 2017-18, showing growth of 21.94 percent, according to the latest data issued by Pakistan Bureau of Statistics. In terms of quantity, the export of the cement witnessed an increase of 40.41 percent from 4,562,634 metric tons to 6,406,418 metric ton, according to the data. Meanwhile, on year-on-year basis, the cement exports, however witnessed decline of 29.17 percent during the month of June 2019 when compared to the same month of last year.

Debt probe body quizzes independent power producers over ‘higher’ profits

With the power sector circular debt in excess of Rs900 billion, independent power producers (IPPs) were questioned by the Inquiry Commission on Debt (ICD) on Monday about their purported higher than permissible profit margins. The ICD was constituted by Prime Minister Imran Khan to probe increase in the country’s debt during the tenure of the previous two governments. Claiming that the IPPs had a zero contribution to increase in the country’s debt in the past decade, a representative of the IPPs’ Advisory Council (IPPAC) told a news conference after a session with the inquiry commission that they had contractual rights to settle any dispute through international arbitration.

Govt to promote info, communication tech facilities

Federal Minister for Information Technology and Telecommunication Dr Khalid Maqbool Siddiqui has said that the government is committed to promotion of Information and Communication Technologies (ICTs) facilities across the country. The minister was addressing the contract signing ceremony of Universal Service Fund (USF) projects “Broadband Coverage on National Highways & Motorways (Balochistan) and Next Generation – Broadband for Sustainable Development projects in Dadu and Hyderabad”. Universal Service Fund has awarded contracts to Telenor Pakistan for broadband coverage on national highways and motorways in Balochistan, and provision of services in Dadu and Hyderabad.

Expectations that the European Central Bank and Federal Reserve will cut interest rates boosted stocks globally, while the pound sagged on worries that likely new prime minister Boris Johnson would lead Britain into a no-deal exit from the European Union. MSCI’s broadest index of Asia-Pacific shares outside Japan gained 0.15%. Japan’s Nikkei rose 0.95%. The Shanghai Composite Index edged up 0.2%. Australian stocks added 0.4% and South Korea’s KOSPI gained 0.45%. The S&P 500 edged up toward a record high overnight, supported by expectations that the Federal Reserve would cut interest rates at its July 30-31 policy meeting.

Prime Minister Imran Khan on Monday invited the Pakistani-American businessmen to explore the new encouraging environment in Pakistan that offered ease of doing business and encouraged attractive profit-making. Addressing at the Trade and Investment Conference, the prime minister said the government of Pakistan Tehreek-e-Insaf had introduced a new mindset of wealth creation and promoted foreign investment. “This is the mindset of Naya Pakistan where facilitation of businessmen is a priority,” he said at the forum, attended by leading businessmen and investors belonging to Pakistani-origin community. The prime minister said most of the North Americans-Pakistanis in particular were self-made and had special place in his heart for their hard work.

The export of cement during the financial year 2018-19 witnessed increase of 21.94 percent as compared to the corresponding period of last year. The cement exports from the country were recorded at $271.726 million during July-June 2018-19 as against the exports of $ 222.841 million during July-June 2017-18, showing growth of 21.94 percent, according to the latest data issued by Pakistan Bureau of Statistics. In terms of quantity, the export of the cement witnessed an increase of 40.41 percent from 4,562,634 metric tons to 6,406,418 metric ton, according to the data. Meanwhile, on year-on-year basis, the cement exports, however witnessed decline of 29.17 percent during the month of June 2019 when compared to the same month of last year.

With the power sector circular debt in excess of Rs900 billion, independent power producers (IPPs) were questioned by the Inquiry Commission on Debt (ICD) on Monday about their purported higher than permissible profit margins. The ICD was constituted by Prime Minister Imran Khan to probe increase in the country’s debt during the tenure of the previous two governments. Claiming that the IPPs had a zero contribution to increase in the country’s debt in the past decade, a representative of the IPPs’ Advisory Council (IPPAC) told a news conference after a session with the inquiry commission that they had contractual rights to settle any dispute through international arbitration.

Federal Minister for Information Technology and Telecommunication Dr Khalid Maqbool Siddiqui has said that the government is committed to promotion of Information and Communication Technologies (ICTs) facilities across the country. The minister was addressing the contract signing ceremony of Universal Service Fund (USF) projects “Broadband Coverage on National Highways & Motorways (Balochistan) and Next Generation – Broadband for Sustainable Development projects in Dadu and Hyderabad”. Universal Service Fund has awarded contracts to Telenor Pakistan for broadband coverage on national highways and motorways in Balochistan, and provision of services in Dadu and Hyderabad.

Market is expected to remain volatile during current trading session.

Technical Analysis

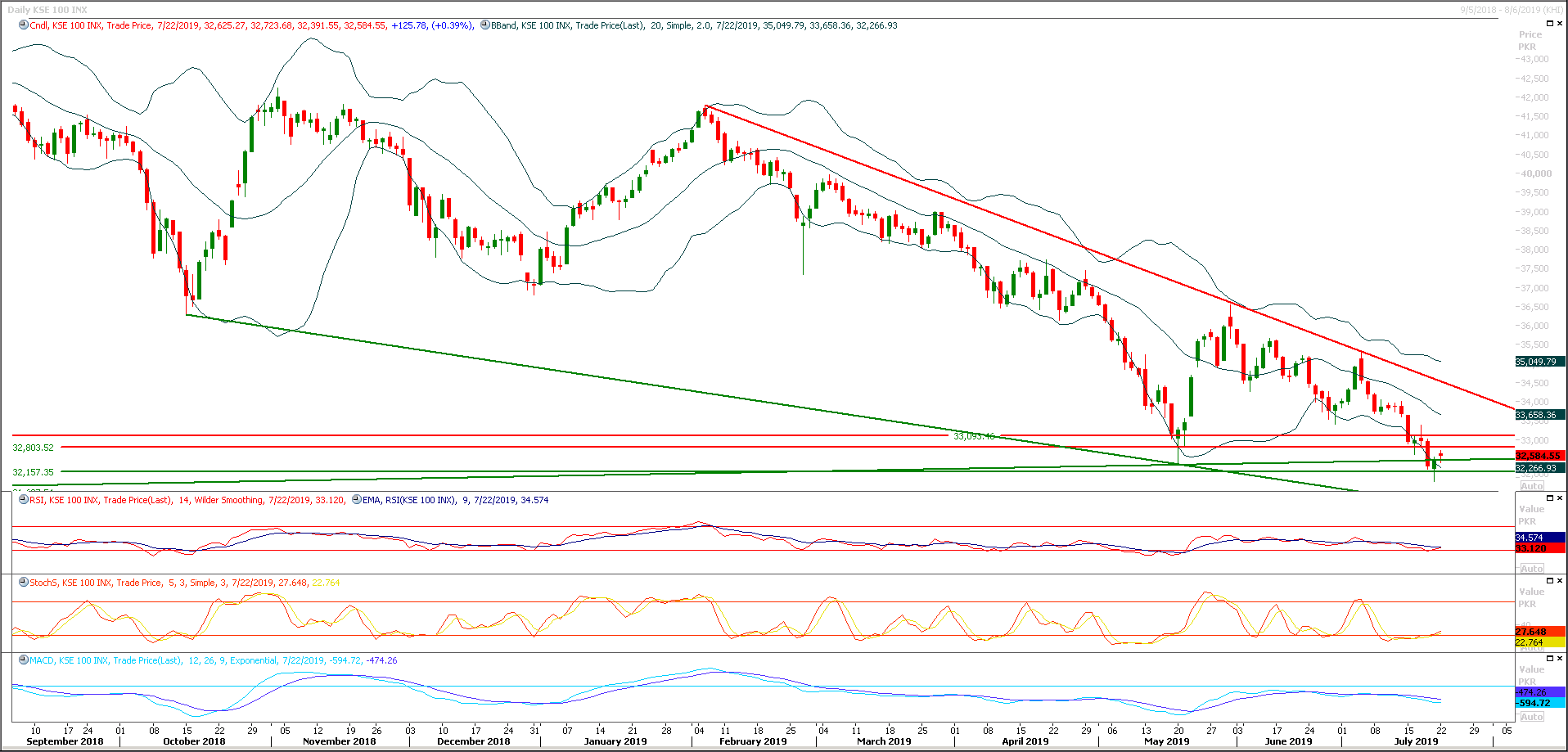

The Benchmark KSE100 index is trying to maintain its upward direction since two trading sessions but have faced a strong resistance on its way towards 34,000 points. As of now it's expected that index would face strong resistances at 32,800 and 33,063 points during current trading session, it's also expected that index would start losing momentum if it would not succeed in penetration above 32,800 points till day end today. On flipside index would try to find support at 32,300 and 32,150 points before falling towards 31,700 points in case of any bearish pressure. It's recommended to start buying on dip as daily and hourly momentum indicators are still in bullish mode and these would try to push index towards 32,800 initially and then onward.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.