Previous Session Recap

Trading volume at PSX floor increased by 52.39 million shares or 59.22% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 41,657.60, posted a day high of 42,770.41 and a day low of 41,657.60 during last trading session. The session suspended at 41,744.82 with net change of 1096.17 and net trading volume of 92.27 million shares. Daily trading volume of KSE100 listed companies increased by 39.94 million shares or 76.34% on DoD basis.

Foreign Investors remained in net selling position of 17.20 million shares and net value of foreign Inflow dropped by 11.83 million US Dollars. Categorically, Foreign Individuals and Overseas Pakistanis remained in net buying positions of 0.04 and 4.67 million shares but Foreign Corporate Investors remained in net selling positions of 21.91 million shares. While on the other side Local Individuals, Banks, NBFCs and Mutual Fund remained in net selling positions of 0.20, 0.42, 0.33 and 1.02 million shares but, Local Companies, Brokers and Insurance Companies remained in net buying positions of 5.92, 0.82 and 7.15 million shares respectively.

Analytical Review

Asian shares tentative as Trump tempers Sino-U.S. trade optimism

Asian shares edged up on Wednesday but investors were cautious after U.S. President Donald Trump tempered optimism over progress made so far in trade talks between the world’s two largest economies. MSCI’s broadest index of Asia-Pacific shares outside Japan was up 0.15 percent while Japan’s Nikkei lost 0.2 percent. On Wall Street, the S&P 500 shed 0.31 percent overnight, losing steam after hitting a two-month high. Trump said on Tuesday he was not pleased with recent trade talks between the United States and China, souring the improved market sentiment following weekend comments from U.S. Treasury Secretary Steven Mnuchin that trade war is “on hold”. His remarks followed Beijing’s announcement that it would cut import tariffs for automobiles and car parts.

Ecnec approves Rs506.8b updated cost for NJHP

The Executive Committee of the National Economic Council (ECNEC) on Tuesday has approved updated cost of Rs506.81 billion for the Neelum Jhelum Hydroelectric Project (NJHP). The Ecnec, chaired by Prime Minister Shahid Khaqan Abbasi, has approved projects costing Rs775 billion. The meeting has approved 4th Revised PC-1 of Neelum Jhelum Hydroelectric Project at an updated cost of Rs506.808 billion. The ECNEC in 2002 approved the project at the cost of Rs84.502 billion. The cost of the project scaled up to Rs277.502 billion which the Ecnec approved in 2012. And then the cost of project was revised upward by 86 percent to Rs404 billion mainly because of the inclusion of duties, taxes which further increased up to Rs500.343 billion because of the inclusion of IDC (interests during cost) till completion of the project and the cost of the consultant. The Central Development Working Party (CDWP) has recently approved consultants for third-party validation of the Neelum-Jhelum Hydropower Project at a cost of Rs100 million.

$40 to 50b required to end breakdowns

The Ministry of Energy has Tuesday acknowledged that outdated transmission and grid system is a major cause for power breakdowns which is beyond their control as the up-gradation of the system required $ 40 to 50 billion. The Senate Standing Committee on Power which met here with Senator Fida Muhammad in the chair showed serious concern regarding the power crisis that has engulfed the urban and rural areas of Pakistan during Ramazan. The meeting was attended by Senator Ahmed Khan, Senator Muhammad Akram, Senator Moula Bux Chandio, Senator Sirajul Haq and senior officers of the Ministry of Power Division. "There is surplus electricity in the system but due to outdated transmission, the electricity cannot be supplied to the consumers fearing that the load may melt the transmission lines," said Musadiq A Khan, Joint Secretary Power Division, who is MD Pepco, while briefing the committee.

OICCI Business Confidence Index on downturn trajectory

Overseas Investors Chamber of Commerce and Industry (OICCI) shared the results of its Business Confidence Index (BCI) Survey - Wave 16, which shows that the overall Business Confidence in Pakistan stands at 14 percent positive, a significant decline from the 21 percent positive recorded in the Wave 15 results announced in November, 2017. The survey results were largely influenced by the pessimism in the retail and wholesale trade sector which recorded a sharp decline in Business Confidence to positive 6 percent compared to positive 40 percent in the Wave 15. The confidence of the manufacturing sector was stable at 15 percent positive, while the services sector was bullish at 23 percent positive vs 15 percent in the previous Wave 15 survey.

Pak-UK trade increases to £1.93b

The merchandise trade volume between Pakistan and the United Kingdom during the calendar year 2017 has increased to over £ 1.93 billion showing an increase of 8 percent when compared to 2016, Commercial Counsellor Pakistan High Commission London, Sajid Mehmood Raja, said Tuesday. "During the year 2017 Pakistan's total exports to the United Kingdom reached over £1.24 billion which also showed an impressive growth of 8 percent as compared to previous year," Sajid Mehmood Raja said. "Our trade surplus with the UK has increased by 5 percent," he added. He said the export of textile sector products showed strong growth, mainly in the knitted garments, followed by non-knitted garments and home textile products.

Asian shares edged up on Wednesday but investors were cautious after U.S. President Donald Trump tempered optimism over progress made so far in trade talks between the world’s two largest economies. MSCI’s broadest index of Asia-Pacific shares outside Japan was up 0.15 percent while Japan’s Nikkei lost 0.2 percent. On Wall Street, the S&P 500 shed 0.31 percent overnight, losing steam after hitting a two-month high. Trump said on Tuesday he was not pleased with recent trade talks between the United States and China, souring the improved market sentiment following weekend comments from U.S. Treasury Secretary Steven Mnuchin that trade war is “on hold”. His remarks followed Beijing’s announcement that it would cut import tariffs for automobiles and car parts.

The Executive Committee of the National Economic Council (ECNEC) on Tuesday has approved updated cost of Rs506.81 billion for the Neelum Jhelum Hydroelectric Project (NJHP). The Ecnec, chaired by Prime Minister Shahid Khaqan Abbasi, has approved projects costing Rs775 billion. The meeting has approved 4th Revised PC-1 of Neelum Jhelum Hydroelectric Project at an updated cost of Rs506.808 billion. The ECNEC in 2002 approved the project at the cost of Rs84.502 billion. The cost of the project scaled up to Rs277.502 billion which the Ecnec approved in 2012. And then the cost of project was revised upward by 86 percent to Rs404 billion mainly because of the inclusion of duties, taxes which further increased up to Rs500.343 billion because of the inclusion of IDC (interests during cost) till completion of the project and the cost of the consultant. The Central Development Working Party (CDWP) has recently approved consultants for third-party validation of the Neelum-Jhelum Hydropower Project at a cost of Rs100 million.

The Ministry of Energy has Tuesday acknowledged that outdated transmission and grid system is a major cause for power breakdowns which is beyond their control as the up-gradation of the system required $ 40 to 50 billion. The Senate Standing Committee on Power which met here with Senator Fida Muhammad in the chair showed serious concern regarding the power crisis that has engulfed the urban and rural areas of Pakistan during Ramazan. The meeting was attended by Senator Ahmed Khan, Senator Muhammad Akram, Senator Moula Bux Chandio, Senator Sirajul Haq and senior officers of the Ministry of Power Division. "There is surplus electricity in the system but due to outdated transmission, the electricity cannot be supplied to the consumers fearing that the load may melt the transmission lines," said Musadiq A Khan, Joint Secretary Power Division, who is MD Pepco, while briefing the committee.

Overseas Investors Chamber of Commerce and Industry (OICCI) shared the results of its Business Confidence Index (BCI) Survey - Wave 16, which shows that the overall Business Confidence in Pakistan stands at 14 percent positive, a significant decline from the 21 percent positive recorded in the Wave 15 results announced in November, 2017. The survey results were largely influenced by the pessimism in the retail and wholesale trade sector which recorded a sharp decline in Business Confidence to positive 6 percent compared to positive 40 percent in the Wave 15. The confidence of the manufacturing sector was stable at 15 percent positive, while the services sector was bullish at 23 percent positive vs 15 percent in the previous Wave 15 survey.

The merchandise trade volume between Pakistan and the United Kingdom during the calendar year 2017 has increased to over £ 1.93 billion showing an increase of 8 percent when compared to 2016, Commercial Counsellor Pakistan High Commission London, Sajid Mehmood Raja, said Tuesday. "During the year 2017 Pakistan's total exports to the United Kingdom reached over £1.24 billion which also showed an impressive growth of 8 percent as compared to previous year," Sajid Mehmood Raja said. "Our trade surplus with the UK has increased by 5 percent," he added. He said the export of textile sector products showed strong growth, mainly in the knitted garments, followed by non-knitted garments and home textile products.

Market is expected to remain volatile therefore it'ss recommended to stay cautious while trading today.

Technical Analysis

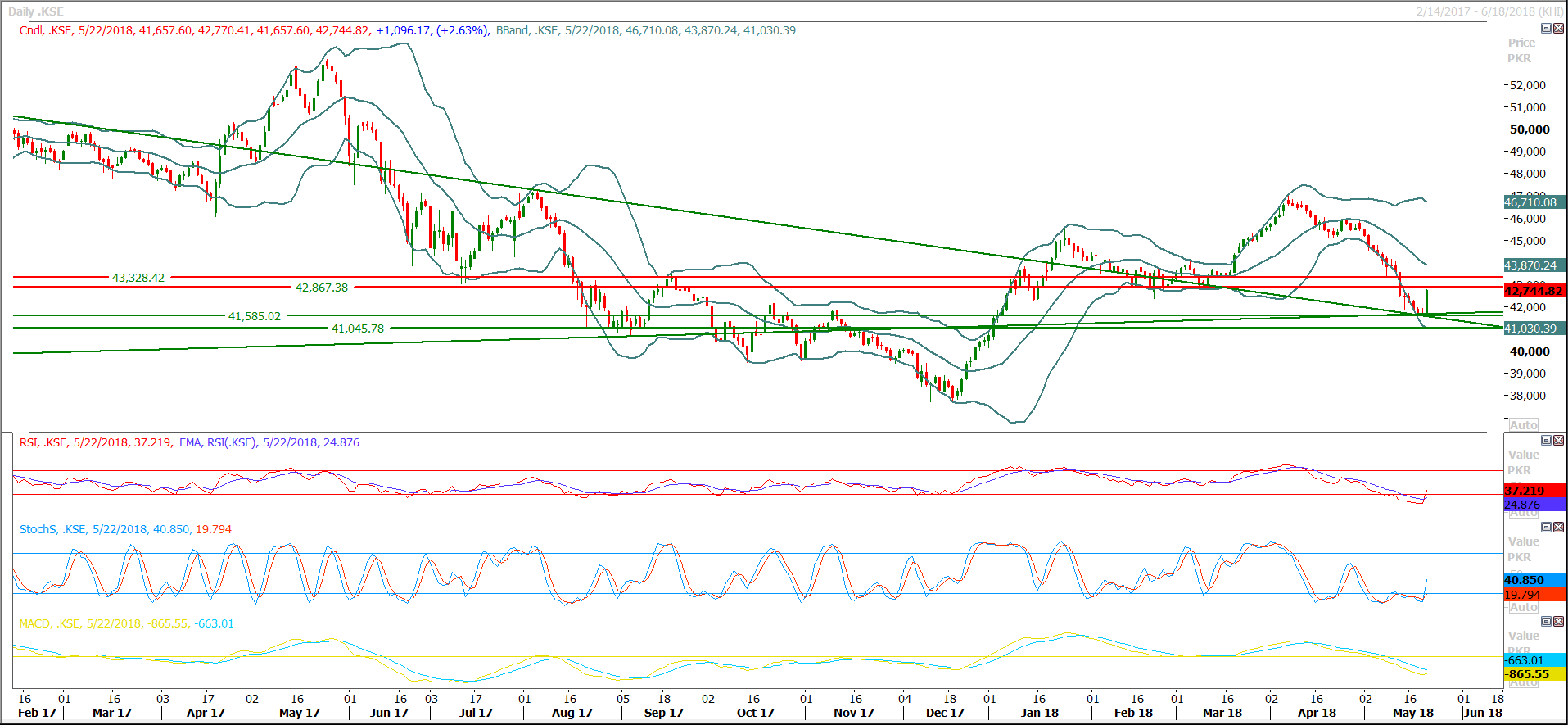

The Benchmark KSE100 Index have entertained its supportive regions very well during last trading session and it have bounced back after getting support from a horizontal supportive region along with two supportive trend lines. It was an upset for sentimental traders as this pull back consist of 2.63% or 1096.17 points and this pull back have happened when index was moving downward since one month and sentiment was completely bearish but it was expected on technical grounds that index would have to bounce back either on intraday basis or daily chart because a correction was due since last 4000 points. For current trading session it’s expected that index would try to open with a positive gap above 42,860 and if succeeded then next targets would be 43,045 and 43,330 where index would face strong resistances. If current bullish pull back would continue above 43,330 then this momentum would be expired by 50% or 61.8% correction levels at 43,777 and 44,305 in coming trading session. But its recommended to avoid any over optimistic buying sentiment and wait for a confirmation of reversal on daily and weekly chart because if index would start falling after completing its correction this time then a new low of this calendar year could be witnessed. Daily and Weekly Stochastic have generated bullish crossovers but still awaiting confirmation on today’s closing but hourly momentum indicators are indicating a dip coming before day end after a gap opening.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.