Previous Session Recap

Trading volume at PSX floor dropped by 7.13 million shares or 4.26% on DoD basis, whereas the Benchmark KSE100 index opened at 41,367.89, posted a day high of 41,367.89 and day low of 40,795.96 points during last trading session while session suspended at 40,874.03 with net change of 545.21 points and net trading volume of 88.92 million shares. Daily trading volume of KSE100 listed companies increased by 9.28 million shares or 11.66% on DoD basis.

Foreign Investors remained in net buying position of 0.54 million shares but net value of Foreign Inflow dropped by 2.08 million US Dollars. Categorically, Foreign Corporate remained in net selling positions of 0.55 million shares but Overseas Pakistani investors remained in net buying positions of 1.09 million shares respectively. While on the other side Local Companies, Banks, Mutual Fund and Insurance Companies remained in net buying positions of 0.31, 0.68, 3.80 and 1.85 million shares respectively but Local Individuals, NBFCs and Brokers remained in net selling positions of 0.97, 0.90 and 5.96 million shares respectively.

Analytical Review

Asian shares edge up, but growth woes offset Brexit progress

Asian shares barely budged in early Friday trade as investors were reluctant to make any big bets in the face of trade tensions, signs of slowing earnings and Brexit negotiations. A draft deal between Britain and the European Union on future relations offered some hope for battered markets, though more evidence of pressure on corporate earnings in Europe kept equity investors sidelined.

Punjab, Sindh urged to depute representatives in DGPC

The Federal government has asked the provinces to depute their representatives in the re-organized Directorate General of Petroleum Concessions (DGPC) so as to give them more active role in decision making in the matter related to the issuance of petroleum license/lease. The provinces of Khyber Pakhtunkha and Balochistan have already deputed their provincial Directors in the DGPC while the nomination from Punjab is still awaited, said a letter sent by Secretary Petroleum Mian Asad Hayaud Din to the chief secretaries of Punjab and Sindh.

Experts stress early solution to capital’s issues

The PRIME Institute, an economic think tank, in collaboration with Islamabad Chamber of Commerce and Industry (ICCI), organised a multi-stakeholder consultative session at ICCI for preparing a draft Economic Vision Statement of Islamabad. The participants were of the view that Islamabad was experiencing rapid and unplanned growth while water shortage, dilapidated water and sewerage infrastructure, lack of parking facility in markets, lack of good transport system, reducing green belts were emerging its major problems and stressed that the government should take urgent measures to address these issues.

CAA body to prepare report on various issues

The Civil Aviation Authority (CAA) has constituted a committee to prepare a report on aircraft manufacturing industry and taxation regimes etc in two weeks. A meeting was held at Aviation Division on Thursday to discuss the National Aviation Policy and propose recommendations for revision of the policy. It was held under the chairmanship of Honorable Secretary Aviation with participation of industrial stakeholders.

LCCI body nominates convener

Muhammad Ejaz has been nominated as the Convener on the LCCI Standing Committee on FMCG Sector so as to highlight the issues and challenges faced by the sector and their possible remedies. The LCCI President Almas Hyder through a notification issued recently has expressed the hope that Muhammad Ejaz of Fair Marketing Pakistan will utilise all his best abilities to contribute to the wellbeing of the business fraternity along with a 10 members committee.

Asian shares barely budged in early Friday trade as investors were reluctant to make any big bets in the face of trade tensions, signs of slowing earnings and Brexit negotiations. A draft deal between Britain and the European Union on future relations offered some hope for battered markets, though more evidence of pressure on corporate earnings in Europe kept equity investors sidelined.

The Federal government has asked the provinces to depute their representatives in the re-organized Directorate General of Petroleum Concessions (DGPC) so as to give them more active role in decision making in the matter related to the issuance of petroleum license/lease. The provinces of Khyber Pakhtunkha and Balochistan have already deputed their provincial Directors in the DGPC while the nomination from Punjab is still awaited, said a letter sent by Secretary Petroleum Mian Asad Hayaud Din to the chief secretaries of Punjab and Sindh.

The PRIME Institute, an economic think tank, in collaboration with Islamabad Chamber of Commerce and Industry (ICCI), organised a multi-stakeholder consultative session at ICCI for preparing a draft Economic Vision Statement of Islamabad. The participants were of the view that Islamabad was experiencing rapid and unplanned growth while water shortage, dilapidated water and sewerage infrastructure, lack of parking facility in markets, lack of good transport system, reducing green belts were emerging its major problems and stressed that the government should take urgent measures to address these issues.

The Civil Aviation Authority (CAA) has constituted a committee to prepare a report on aircraft manufacturing industry and taxation regimes etc in two weeks. A meeting was held at Aviation Division on Thursday to discuss the National Aviation Policy and propose recommendations for revision of the policy. It was held under the chairmanship of Honorable Secretary Aviation with participation of industrial stakeholders.

Muhammad Ejaz has been nominated as the Convener on the LCCI Standing Committee on FMCG Sector so as to highlight the issues and challenges faced by the sector and their possible remedies. The LCCI President Almas Hyder through a notification issued recently has expressed the hope that Muhammad Ejaz of Fair Marketing Pakistan will utilise all his best abilities to contribute to the wellbeing of the business fraternity along with a 10 members committee.

Market is expected to remain volatile therefore its recommended to stay cautious while trading during current trading session.

Technical Analysis

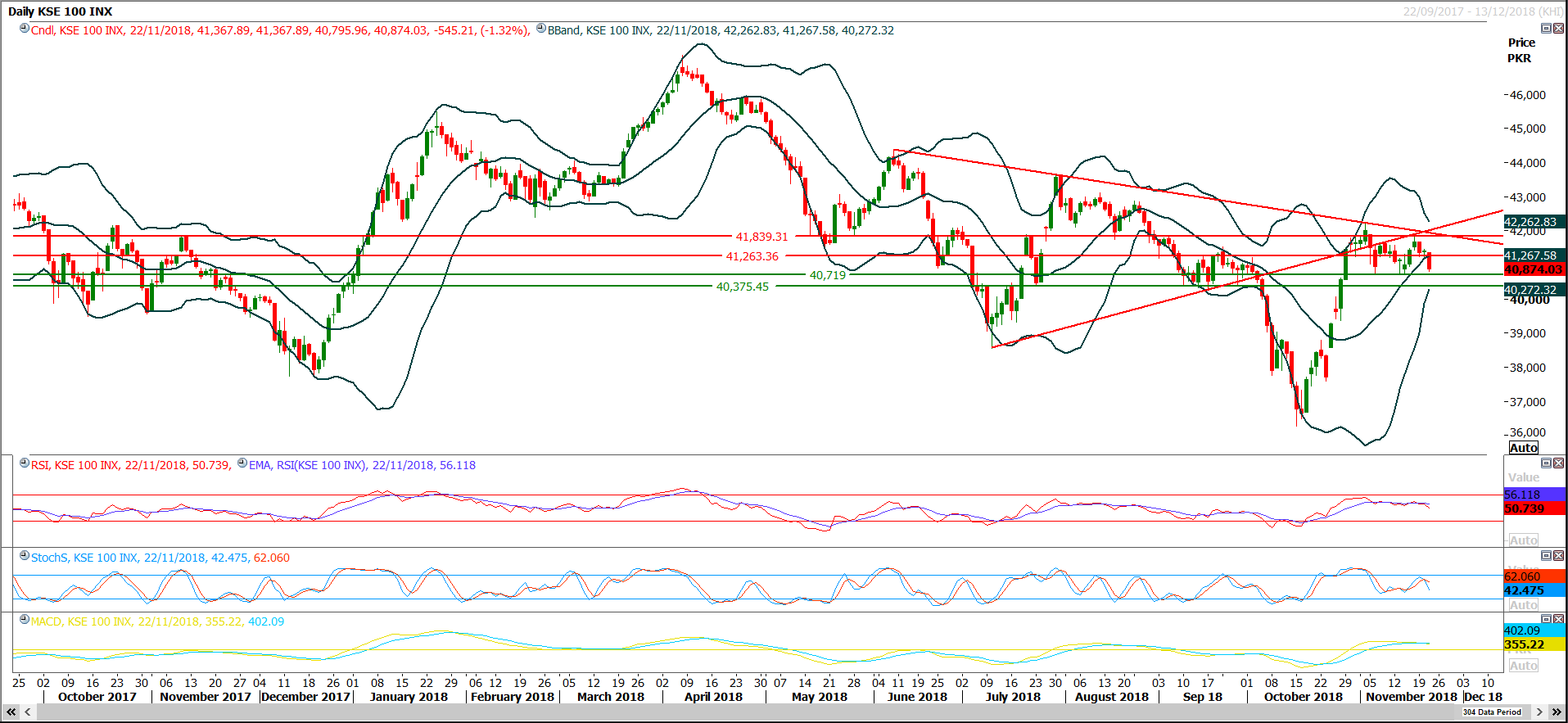

The Benchmark KSE100 index have closed on a very crucial level during last trading session because daily momentum indicators have turned to bearish direction but index still closed above its daily triple bottom of 40,760 points and to continue its downward rally index need to open below 40,760 points with a negative gap otherwise hourly confirmation would be needed for bears to ride the market again with comfort. Index have resistant regions at 41,263 and 41,500 points during current trading session while index have immediate supportive region standing at 40,760 points and breakout of that region would call for 40,375 points on intraday basis. It’s recommended to initiate short selling on strength if index succeed in sliding below 40,760 on hourly closing basis.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.