Previous Session Recap

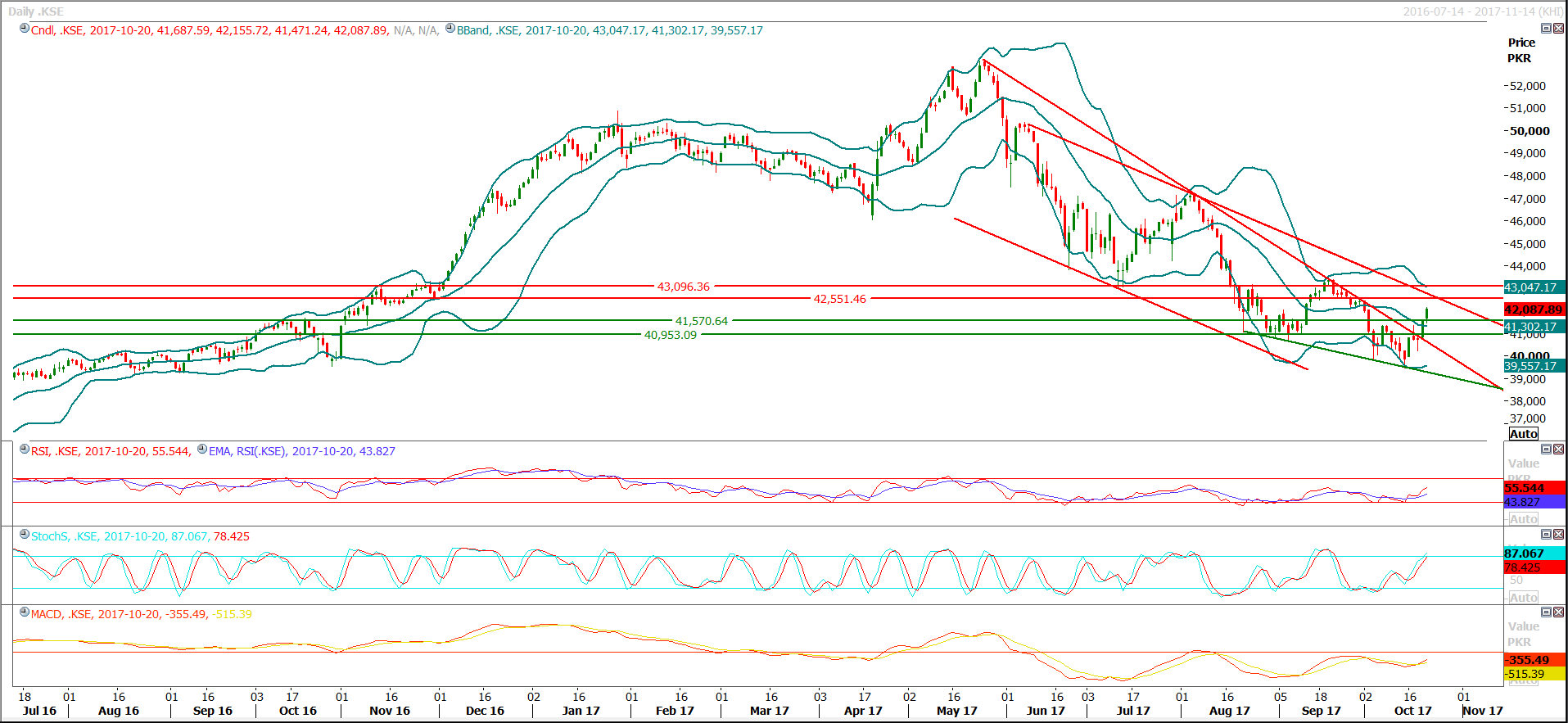

Trading volume at PSX floor increased by 29.06 million shares or 12.52%,DoD basis, whereas, the benchmark KSE100 Index opened at 41687.59, posted a day high of 42155.72 and a day low of 41471.24 during the last trading session. The session suspended at 42087.89 with a net change of 529.82 and net trading volume of 111.82 million shares. Daily trading volume of KSE100 listed companies dropped by 2.12 million shares or 1.86%,DoD basis.

Foreign Investors remained in net buying position of 3.91 million shares and net value of Foreign Inflow dropped by 5.3 million US Dollars. Categorically, Foreign Individual and Coporate Investors remained in net selling position of 0.22 and 6.69 million shares but Overeas Pakistanis remained in net buying position of 10.82 million shares.On the other side Local Individuals and Mutual Funds remained in a net selling position of 18.27 and 2.3 million shares but Local Companies, Banks, Brokers and Insurance Companies remained net buying position of 1.18, 4.56, 10.41 and 3.06 million shares respectively.

Analytical Review

Japanese shares jumped on a weaker yen on Monday as an election win for Shinzo Abe’s ruling bloc gave a green light for more super-easy policy stimulus, while the euro eased as Spain’s constitutional crisis aggravated concerns about political unity in the region. The U.S. dollar was the major beneficiary as President Donald Trump and Republicans took a small step toward tax cuts, boosting Wall Street stocks and lifting bond yields. Japan's Nikkei .N225 raced up 1 percent to its highest since 1996 after Prime Minister Abe looked to have easily won in national elections over the weekend.

According to the weekly statement of position of all scheduled banks for the week ended October 06, deposits and other accounts of all scheduled banks stood at Rs11,739.872bn after a 2pc decrease over the preceding week’s figure of Rs11,979.886bn. Compared with last year’s corresponding figure of Rs10,288.442bn, the current week’s figure was higher by 14.10pc. Deposits and other accounts of all commercial banks stood at Rs11,661.03bn against preceding week’s deposits of Rs11,902.000bn, showing a fall of 2.02pc. Deposits and other accounts of specialised banks stood at Rs78.842bn, higher by 1.23pc against previous week’s figure of Rs77.887bn.

Over the past few years, Pakistan’s construction industry has seen significant growth on the back of rapid urbanisation, population growth, improved middle-class household income, spike in public development spending, increase in payments from Pakistanis working abroad and so on. The industry’s growth has, in fact, become more pronounced in the last couple of years with this sector rising by a handsome nine per cent in 2016/2017 and 14pc in 2015/2016. The construction ‘boom’ in the country has triggered massive growth in allied industries like cement, glass, steel, construction chemicals, etc.

In the domestic currency market, no major development was witnessed last week week macro-economic indicators. However, some improvement was seen in the country’s forex reserves after the government reportedly borrowed $450 million on a short-term facility from a Credit Suisse led consortium of commercial banks. But widening trade deficit and rising debt servicing is weighing on the country’s forex reserves and exerting pressure on the rupee. On the interbank market, trading both ways in narrow ranges, the rupee/dollar parity fluctuated between Rs105.40/42 and Rs105.41/44.

The Pakistan Steel Mills (PSM) has sought urgent help of the federal government to recover more than 1,800 acres of land from the Sindh government and private parties amid the Centre’s efforts to dole out pricy land near Karachi’s Bin Qasim Port for ‘selective’ settlement of liabilities on the balance sheet of the sick unit.

Today ATRL, PPL, STPL and TRG may lead the market in the positive direction.

Technical Analysis

The Benchmark KSE100 Index has fulfilled its 61.8% correction at last bearish rally at 42042 and right now it has a strong resistance ahead at 42551 from its 74.6% correction along with a horizontal resistance and a trend line. On the weekly chart Index has generated a bullish engulfing which is the indication of the start of a bullish trend on the shorter term but index might not be considered bullish until it closes above 42555 and 43096. If Index closes above 430400 then short term trend would be completely changed, as long as current trading session is concerned it is recommended to book profits on strength.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.