Previous Session Recap

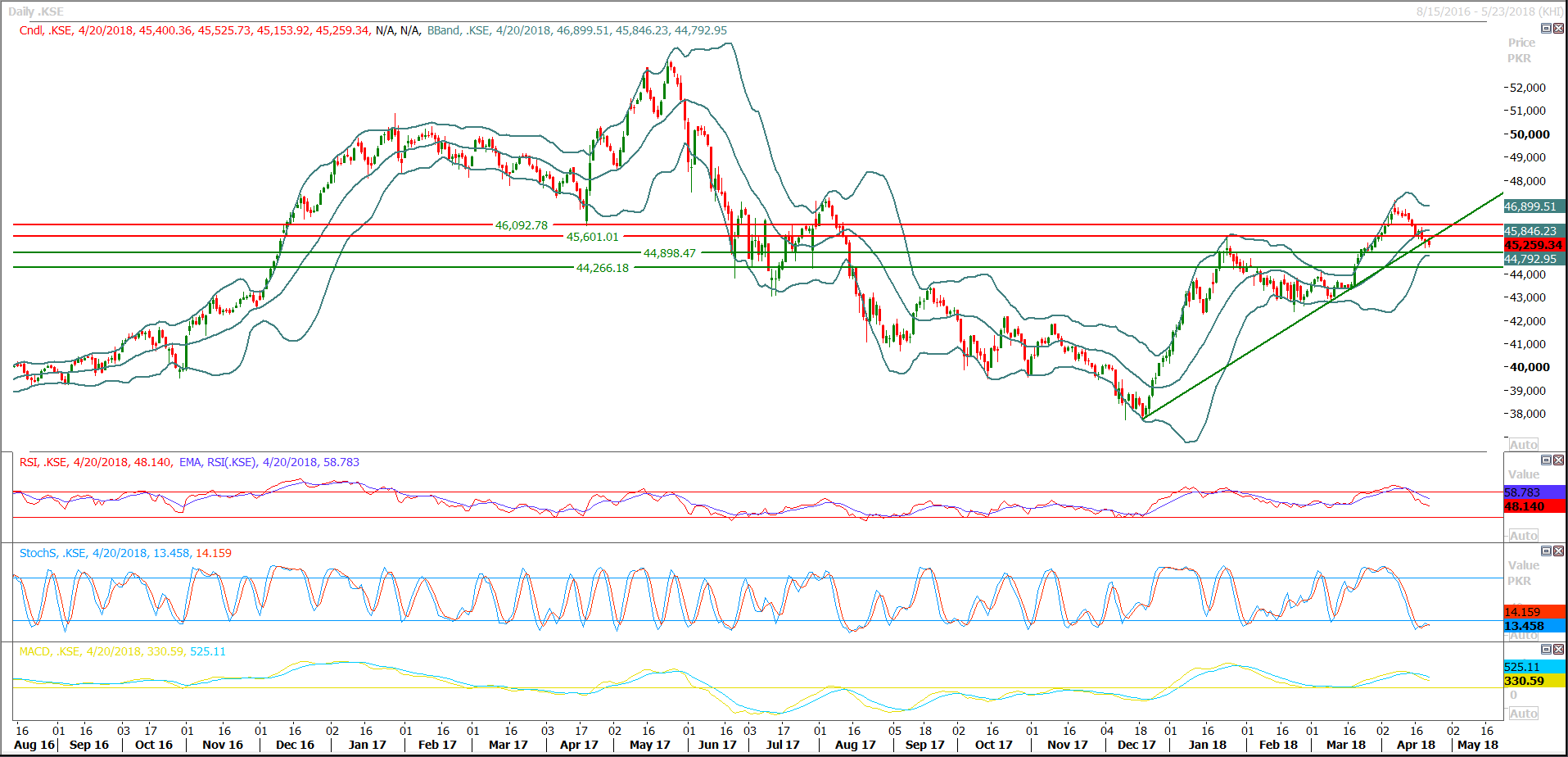

Trading volume at PSX floor dropped by 39.35 million shares or 21.46% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 45,400.36, posted a day high of 45,525.73 and a day low of 45,153.92 during last trading session. The session suspended at 45,259.34 with net change of -128.43 and net trading volume of 57.83 million shares. Daily trading volume of KSE100 listed companies increased by 53.34 million shares or 47.98% on DoD basis.

Foreign Investors remained in net buying position of 0.6 million shares but net value of Foreign Inflow dropped by 3.15 million US Dollars. Categorically, Foreign Individuals and Overseas Pakistanis remained in net buying position of 0.09 and 1.16 million shares but Foreign Corporate Investors remained in net selling position of 0.64 million shares. While on the other side Banks, Mutual Funds and Insurance Companies remained in net buying positions of 1.77, 3.98 and 0.7 million shares but Local Individuals, Local Companies, NBFCs and Brokers remained in net selling positions of 8.12, 0.41,0.06 and 1.40 million shares respectively.

Analytical Review

Asia stocks struggle with rising yields; oil stays high

Asian stocks dipped on Monday as investors braced for a bevy of earnings from the world’s largest corporations, while keeping a wary eye on U.S. bond yields as they approach peaks that have triggered market spasms in the past.Traders were also anxiously awaiting surveys on global manufacturing for April to see if economic softness in the first quarter was just a passing phase linked to poor weather and the Lunar New Year holidays. The first reading from Japan was tentatively upbeat with its PMI firming to 53.3 in April as output and domestic demand picked up. On the geopolitical front, U.S. President Donald Trump said on Sunday the North Korean nuclear crisis was a long way from being resolved, striking a cautious note a day after the North pledged to end its nuclear tests.

FPCCI for slashing sales tax rate to 13pc

Stressing upon the need for broadening tax base through reforms, the Federation of Pakistan Chambers of Commerce and Industry (FPCCI) in its budgetary proposals urged the government to slash standard sales tax rate from 17 per cent to 13pc. The FPCCI’s advisory council on budget has compiled some lengthy proposals for the upcoming budget, covering major revenue heads including sales tax, income tax, customs duty, export related issue as well as important sectors and institutions. The apex body of trade and industry suggested that standard sales tax rate should be reduced to 13pc in Value Added Tax (VAT) mode at first stage to align it with Sindh Sales Tax on service and thereafter reduce it gradually by 1pc annually.

ICCI for resolving issues of pharma industry to up exports

Islamabad Chamber of Commerce and Industry president Sheikh Amir Waheed has said that pharmaceutical industry has the potential to earn foreign exchange worth billions of dollars for the country and the government should focus on resolving its key issues that would help in improving country’s exports. He said despite decline in Pakistan’s exports during the last few years, exports of pharma industry have witnessed 26 percent growth during the last five years. It showed that if government pays more attention to this industry, it could fetch billions of dollars through exports for the national exchequer.In a press statement, Sheikh Amir Waheed said India’s pharmaceutical industry was earning over $16 billion annual exports, but Pakistan’s pharma industry’s exports could not touch $1 billion mark as yet despite the fact that this industry has huge scope to grow and improve country’s exports. He said that the pharma industry was importing 95 percent of raw material which was main hurdle in its way of better growth.

Bank Alfalah’s profit up by 18pc

The board of directors of Bank Alfalah, in its meeting held the other day, approved the bank’s un-audited financial statements for the quarter ended March 31, 2018. The bank’s profit before taxation for the quarter ended March 31, 2018 was recorded at Rs. 5.075 billion, as against Rs4.290 billion, for the corresponding period last year, improving by 18 percent. Profit after taxation improved by 17 percent to end at Rs3.264 billion for the quarter, as against Rs 2.788 billion for the corresponding period last year. This translates into earnings per share of Rs 2.02 versus Rs 1.74 per share for the corresponding period last year. The bank’s revenue for the quarter was reported at Rs10.419 billion, improving by 5 percent from the corresponding period last year. This is arising from both components of net interest income and non interest income which have improved by 2 percent and 16 percent respectively as against the corresponding period last year.

Trade deficit likely to widen to record $35b

Pakistan’s trade deficit is likely to swell to record $36 billion during current fiscal year (FY2018) due to massive increase in imports as compared to the exports. Country’s imports are expected to reach $60 billion as against exports of $24 billion during ongoing financial year. Trade deficit of $36 billion would be highest ever trade deficit of the country, breaking previous year’s record of $32.6 billion. Trade deficit is increasing due to the massive growth in imports. The trade deficit would be much higher than the government’s estimates. The Annual Planning Coordination Committee (APCC) early this week had estimated trade deficit at $28.6 billion. The government expects exports to go up to $24.5 billion while imports are targeted at $53.1 billion this fiscal year. However, the imports could increase sharply keeping in viewing the current trend.

Asian stocks dipped on Monday as investors braced for a bevy of earnings from the world’s largest corporations, while keeping a wary eye on U.S. bond yields as they approach peaks that have triggered market spasms in the past.Traders were also anxiously awaiting surveys on global manufacturing for April to see if economic softness in the first quarter was just a passing phase linked to poor weather and the Lunar New Year holidays. The first reading from Japan was tentatively upbeat with its PMI firming to 53.3 in April as output and domestic demand picked up. On the geopolitical front, U.S. President Donald Trump said on Sunday the North Korean nuclear crisis was a long way from being resolved, striking a cautious note a day after the North pledged to end its nuclear tests.

Stressing upon the need for broadening tax base through reforms, the Federation of Pakistan Chambers of Commerce and Industry (FPCCI) in its budgetary proposals urged the government to slash standard sales tax rate from 17 per cent to 13pc. The FPCCI’s advisory council on budget has compiled some lengthy proposals for the upcoming budget, covering major revenue heads including sales tax, income tax, customs duty, export related issue as well as important sectors and institutions. The apex body of trade and industry suggested that standard sales tax rate should be reduced to 13pc in Value Added Tax (VAT) mode at first stage to align it with Sindh Sales Tax on service and thereafter reduce it gradually by 1pc annually.

Islamabad Chamber of Commerce and Industry president Sheikh Amir Waheed has said that pharmaceutical industry has the potential to earn foreign exchange worth billions of dollars for the country and the government should focus on resolving its key issues that would help in improving country’s exports. He said despite decline in Pakistan’s exports during the last few years, exports of pharma industry have witnessed 26 percent growth during the last five years. It showed that if government pays more attention to this industry, it could fetch billions of dollars through exports for the national exchequer.In a press statement, Sheikh Amir Waheed said India’s pharmaceutical industry was earning over $16 billion annual exports, but Pakistan’s pharma industry’s exports could not touch $1 billion mark as yet despite the fact that this industry has huge scope to grow and improve country’s exports. He said that the pharma industry was importing 95 percent of raw material which was main hurdle in its way of better growth.

The board of directors of Bank Alfalah, in its meeting held the other day, approved the bank’s un-audited financial statements for the quarter ended March 31, 2018. The bank’s profit before taxation for the quarter ended March 31, 2018 was recorded at Rs. 5.075 billion, as against Rs4.290 billion, for the corresponding period last year, improving by 18 percent. Profit after taxation improved by 17 percent to end at Rs3.264 billion for the quarter, as against Rs 2.788 billion for the corresponding period last year. This translates into earnings per share of Rs 2.02 versus Rs 1.74 per share for the corresponding period last year. The bank’s revenue for the quarter was reported at Rs10.419 billion, improving by 5 percent from the corresponding period last year. This is arising from both components of net interest income and non interest income which have improved by 2 percent and 16 percent respectively as against the corresponding period last year.

Pakistan’s trade deficit is likely to swell to record $36 billion during current fiscal year (FY2018) due to massive increase in imports as compared to the exports. Country’s imports are expected to reach $60 billion as against exports of $24 billion during ongoing financial year. Trade deficit of $36 billion would be highest ever trade deficit of the country, breaking previous year’s record of $32.6 billion. Trade deficit is increasing due to the massive growth in imports. The trade deficit would be much higher than the government’s estimates. The Annual Planning Coordination Committee (APCC) early this week had estimated trade deficit at $28.6 billion. The government expects exports to go up to $24.5 billion while imports are targeted at $53.1 billion this fiscal year. However, the imports could increase sharply keeping in viewing the current trend.

Market is expected to remain volatile therefore it'ss recommended to stay cautious while trading today.

Technical Analysis

The Benchmark KSE100 Index slipped below its major supportive trend line during last trading session but still there is a possibility of double bottom on daily chart which would be confirmed today. Intra-day momentum is in bearish mode along with weekly trend, while daily momentum have tried to recover from bearish mode but could not succeeded and slipped in negative zone. Index has supportive regions around 45,066 and 44,860 points for current trading session. While resistant regions are standing at 45,600 and 45,860 points and it’s recommended to sell on strength with strict stop losses of 45,860 and 46,360 points on intraday and short term basis.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.