Previous Session Recap

The Benchmark KSE100 Index opened with a positive gap of 200 points at 49564.35, posted day low of 49547.48 and day high of 49937.25 during last trading session. The session suspended at 49876.18 with net change of 511.35 points and net trading volume of 349.13 million shares. Daily trading volume of KSE100 listed companies increased by 167.89 million shares or 92.63% on DOD bases.

Foreign Investors remained in net selling position of 99.7 million shares and net value of Foreign Inflow dropped by 11.07 million US Dollars. Categorically Foreign Individuals, Corporate and Overseas Pakistani Investors remained in net selling position of 1.56, 93.13 and 5.02 million shares respectively. While on the other side, Local Individuals, Companies, Banks, Mutual Funds and Brokers remained in net buying position of 20.68, 32.69, 17.46, 25.08 and 6.4 million shares respectively but Local NBFCs remained in net selling position of 4.04 million shares during last trading session.

Analytical Review

The dollar was under pressure in Asia on Tuesday as U.S. President Donald Trump focuses on trade protectionism fueled suspicions his administration might seek a competitive advantage through a weaker currency. The talk of trade wars favored safe-haven Treasuries and the Japanese yen while leaving equities mixed. MSCI broadest index of Asia-Pacific shares outside Japan edged up 0.1 percent but Japanese Nikkei slipped 0.3 percent. Sentiment took a fresh knock when U.S. Treasury Secretary nominee Steven Mnuchin told senators that he would work to combat currency manipulation but would not give a clear answer on whether he views China as manipulating its yuan. In written answers to a Senate Finance Committee, Mnuchin also reportedly said an excessively strong dollar could be negative in the short term.

National Refinery Limited has announced that the tie-in connection activity of the new plants and revamping of the existing unit under the NRL up-gradation project is planned during the period from March 10, 2017 to March 24, 2017. Consequently, fuel refinery will be shut down which will affect refinery production during the above referred period, material information sent to Pakistan Stock Exchange said. The Ministry of Petroleum and Natural Resources has granted its formal approval for the above planned shut down and has asked the OCAC to direct the OMCs to mark alternate arrangements to meet the products shortfall.

Governor Khyber Pakhtunkhwa Engineer Iqbal Zafar Jhagra has said that to ensure un-interrupted electricity supply in the province and Fata, not only new grid stations are installed but the transmission lines are also being upgraded. He was addressing the launching ceremony of 132KV double circuit power transmission line at Hayatabad in Peshawar on Monday.

Pakistan Railways (PR) will start a train service to transport coal from Port Qasim Karachi to Sahiwal coal fired power plant by the last week of January. This was informed by Chief Executive Officer (CEO) Pakistan Railways Javed Anwar Bubak here on Monday. Talking to press after the arrival of 7 out of 55 freight-specific locomotives at Karachi Port from US, CEO Pakistan Railways said the General Electric manufactured 4000 hp locomotives would be operated for coal and freight transportation in the country. Initially, we are running a single train for Sahiwal. The GE locomotives will be used to exclusively haul freight, primarily coal, from Karachi to Sahiwal. Together, the 7 locomotives will help railways to generate revenue of about Rs 13 billion annually, Javed said. Each locomotive will be used to haul up to 3400 tons of freight.

The government on Monday allowed the long-awaited export of 300,000 tonnes urea fertiliser without the Rs200 per bag subsidy being extended for sales to local farmers. The decision was taken at a meeting of the Cabinet Economic Coordination Committee (ECC) presided over by Finance Minister Ishaq Dar. The move aims to partially offload substantial surplus stocks built through domestic production with subsidised gas and public sector imports. The ECC also formally endorsed the Jan 13 decision of Prime Minister Nawaz Sharif to continue sale of fertilisers to farmers at subsidised rates.

APL, MTL, HUBC and Overall Fertilizer Sector (specifically FATIMA, EFERT) can lead market in positive direction.

Technical Analysis

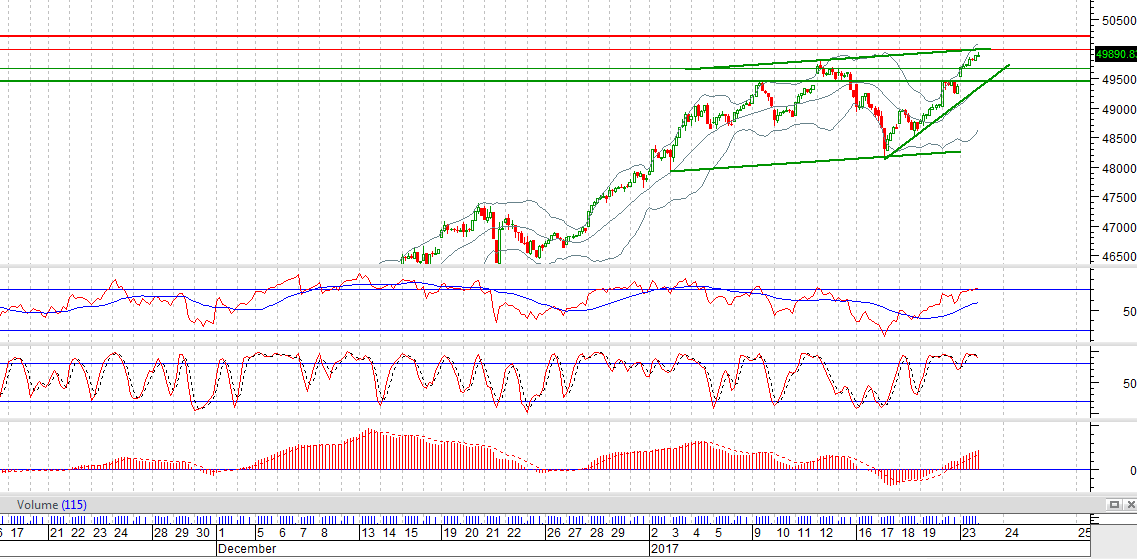

The Benchmark KSE100 Index has given a clear break out of its previous History by closing 359 points above that region during last trading session, but right now it may face resistances from its expansion levels around 49995 and 50203. Its short term bullish trend channel is going to complete at 49995 from where it can start an intraday correction as hourly stochastic is ready for an intraday pull back. It is being supported by a rising trend line inside that channel which will provide a supportive breath around 49517 but before that a horizontal supportive region will try to push index back in positive zone around 49660. Trading with strict stop loss is recommended for current trading session.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.