Previous Session Recap

Trading volume at PSX floor dropped by 50.24 million shares or 23.15%, DoD basis, whereas, the benchmark KSE100 Index opened at 42000.35, posted a day high of 42949.90 and a day low of 41927.22 during the last trading session. The session suspended at 42910.79 with a net change of 927.63 points and a net trading volume of 82.01 million shares. Daily trading volume of KSE100 listed companies dropped by 30.23 million shares or 26.93%, DoD basis.

Foreign Investors remained in a net selling position of 2.57 million shares and the net value of Foreign Inflow dropped by 2.86 million US Dollars. Categorically, Foreign Corporate and Overseas Pakistani investors remained in net selling positions of 0.97 and 1.55 million shares, respectively. While on the other side, Local Individuals, Companies, Banks and Mutual Funds remained in net buying positions of 4.63, 0.61, 0.59 and 3.03 million shares, respectively. Brokers remained in a net selling position of 8.01 million shares.

Analytical Review

Asian stocks edged up on Thursday, shaking off the risk aversion that gripped financial markets overnight after U.S. President Donald Trumps threat to shut down the government, though the dollar remained sluggish. MSCI's broadest index of Asia-Pacific share's outside Japan .MIAPJ0000PUS rose 0.15 percent in early trade. Japans Nikkei .N225 pulled back 0.25 percent on a stronger yen. Overnight, U.S. stock indexes closed between 0.3 percent .IXIC .SPX and 0.4 percent .DJI lower. Trump said at a Tuesday night rally in Arizona that he would be willing to risk a government shutdown to secure funding for a wall along the U.S.-Mexico border. Those comments came ahead of a late-September deadline to raise the U.S. debt ceiling or risk defaulting on debt payments.

The National Electric Power Regulatory Authority (Nepra) has approved Rs1.7 per unit reduction in power tariff for the Ex-Wapda Distribution Companies for July under monthly fuel adjustment formula. In a public hearing, on a petition filed by Central Power Purchasing Agency (CPPA), the Nepra concluded that a relief of Rs1.7 per unit be passed on to the consumers for the month of July. The hearing was presided over by Nepra Punjab member Saifullah Chatta. The Nepra approved the power cut for July in a public hearing held here on the petition filed by Central Power Purchasing Agency Guarantee Limited (CPPA-G). The CPPA has also requested the decrease of Rs1.709 per unit reduction. The consumers will get benefit of around Rs20 billion and the relief will be given in next month bills.

The Senate Standing Committee on Finance has directed Securities Exchange Commission of Pakistan (SECP) to thoroughly examine the alleged manipulation of share price of Bank of Punjab (BOP) by underwriting of shares along with details of shares purchased and sold by the management and directors of BOP from January 2015 to March 2017. The meeting was held under the chairmanship of Senator Saleem Mandviwala at the Parliament House on Wednesday. The committee listened to the grievances of shareholders as well as the senior management of the bank. During the meeting, it was decided that the committee shall wait for SECP to compile a report after deeply looking into the matter and finding out if there have been any irregularities or illegalities in the whole process. The committee, being an oversight body, will then look into the matter.

Eying on the target of the production of 2 million barrel oil per day, by 2025, the Khyber Pakhtunkhwa Oil and Gas Company Limited (KPOGCL) on Wednesday signed a Memorandum of Understanding (MoU) with the American Halliburton company. Under the MoU, American Halliburton company would train the KPOGCL workforce and provide it with latest technology software and introduce technology in exploration and production of oil and gas in the province, KPOGCL CEO Raziuddin told media persons here after signing the MoU with Ahmed Kenawi, the senior vice president of Middle East and North America of the Halliburton company.

The auditor general of Pakistan (AGP) is reported to have found more than Rs1.32 trillion worth of embezzlement, irregularities, recoveries and overpayments by companies and organisations under the Water and Power Ministry during 2016-17. Submitted to the president and laid before parliament, the AGP report put on record that findings were based on the scrutiny of public funds not below the amount of Rs1 million spent or received by these companies and entities on a “test-check basis” and were in no way a complete audit. The audit covered only 191 of 263 formations of the Water and Power Development Authority (Wapda) and power-sector companies.

Today ATRL, DSL, GATM and ISL may lead the market in positive direction.

Technical Analysis

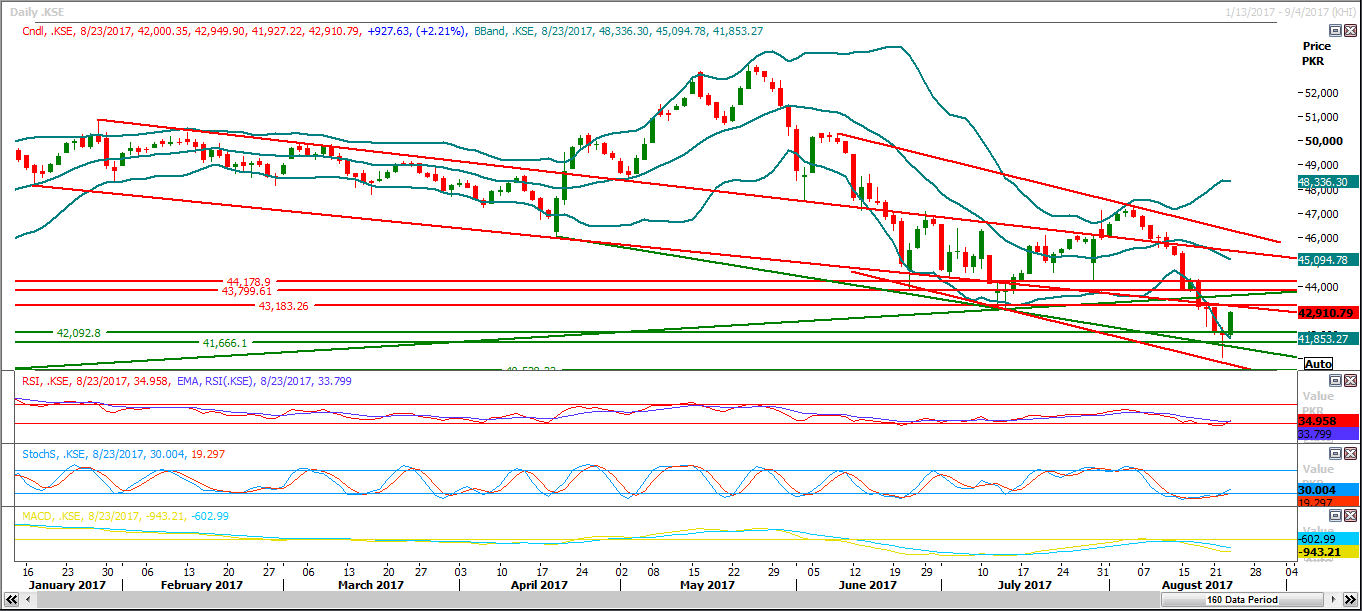

The Benchmark KSE100 Index formed a morning star on daily chart during the last trading session, which is a reliable sign for a bullish reversal. However, its capped by a resistant trend line along with a horizontal resistant region at 43180-43200 region which may cap the current bullish rally. On its way forward, the index may find resistance ahead at 43620, 43800 and 44200 in coming days as weekly chart is not supporting bullish sentiment until it closes above 44200. Therefore, trading with a trailing stop loss is recommended during current and coming sessions. A positive gap opening above 43200 would be healthy for the current bullish sentiment as index would get a further space of 400-500 points in bullish direction but if it fails to close above 43200, then a serious drop down would be witnessed in coming days. All major index movers from Oil and Gas sector are trading between correction levels and they are waiting for a major shift after completing both bearish and bullish corrections. This is an indication that breakout of either side would be leaded by Oil and Gas sector, but major index movers from Banking sector are still in bearish mode and have not indicated any reversal sign, therefore a cautious approach is recommended.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.