Previous Session Recap

Trading volume at PSX floor dropped by 31.66 million shares or 22.41% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 42,445.43, posted a day high of 42,618.16 and a day low of 42,280.54 during last trading session. The session suspended at 42,588.29 with net change of 163.19 points and net trading volume of 49.17 million shares. Daily trading volume of KSE100 listed companies dropped by 22.09 million shares or 31.00% on DoD basis.

Foreign Investors remained in net selling position of 6.03 million shares and net value of Foreign Inflow dropped by 2.01 million US Dollars. Categorically, Foreign Individuals and Foreign Corporate remained in net selling positions of 0.02 and 7.95 million shares but Overseas Pakistanis investors remained in net buying positions of 1.94 million shares. While on the other side Local Individuals, NBFCs, Mutual Fund and Insurance Companies remained in net buying positions of 12.03, 0.1, 1.76 and 1.12 million shares but Local Companies, Banks and Brokers remained in net selling positions of 5.53, 1.21 and 3.10 million shares respectively.

Analytical Review

Asia stocks track Wall St. lower, dollar buoyant; Powell in focus

Asian stocks tracked Wall Street losses and edged down in early trade on Friday, but the dollar was buoyant after ending a long losing run ahead of a speech by Federal Reserve Chairman Jerome Powell. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS shed 0.18 percent. Australian stocks rose 0.16 percent, South Korea's KOSPI .KS11 fell 0.35 percent and Japan's Nikkei .N225 climbed 0.35 percent. The S&P 500 .SPX shed 0.17 percent overnight to pull back slightly from a record high scaled midweek, with industrial shares sagging after the United States and China imposed a fresh round of trade tariffs on each other. Shares of industrial giants Caterpillar Inc (CAT.N) and Boeing Co (BA.N), which have been bellwethers of trade sentiment, were among the biggest drags on the Dow .DJI, which lost about 0.3 percent. Caterpillar shares fell 2.0 percent, and Boeing shares fell 0.7 percent.

EU agrees 18 million euro development aid for Iran

The European Union agreed 18 million euros ($20.6 mln) in aid for Iran on Thursday, including for the private sector, to help offset the impact of US sanctions and salvage a 2015 deal that saw Tehran limit its nuclear ambitions. The announcement is part of the bloc’s high-profile efforts to support the nuclear accord that President Donald Trump abandoned in May. It is part of a wider package of 50 million euros earmarked for Iran in the EU budget. The EU is working to maintain trade with Iran, which has threatened to stop complying with the nuclear agreement if it fails to see the economic benefits of relief from sanctions. The bloc’s foreign policy chief Federica Mogherini said in a statement the bloc was committed to cooperation with Iran. “This new package will widen economic and sectoral relations in areas that are of direct benefit to our citizens,”

Businessmen demand monitoring of FBR, setting export targets

The Federation of Pakistan Chambers of Commerce and Industry (FPCCI) on Tuesday said Prime Minister Imran Khan's first address to the nation after being elected the country's new premier has won hearts and minds of the nation. The speech has energised and motivated the entire business community of the country which will trigger economic activities and investment, it said. In a joint statement issued here, President FPCCI Ghazanfar Bilour, VP FPCCI Karim Aziz Malik, Chairman Coordination Malik Sohail, Atif Ikram Sheikh and Jaweed Iqbal said that the new premier promised wide-ranging reforms, safeguard Pakistan's resources and redistribute them from the rich to the disadvantaged which is laudable.

Govt releases Rs30.3b under PSDP

The government has released over Rs 30.3 billion under its Public Sector Development Programme (PSDP) 2018-19 for various ongoing and new schemes against the total allocations of Rs 1,030 billion. The released funds include Rs 18.76 billion for federal ministries and Rs 11.8 billion for special areas besides other projects, according to the data released by the Ministry of Planning, Development and Reforms. Out of these allocations, the government has released Rs 4.67 billion for Pakistan Atomic Energy Commission for which Rs 30.4 billion have been allocated for the year 2018-19, whereas for Maritime Affairs Division, an amount of Rs 334 million has been released out of total allocation of Rs 10.1 billion. Similarly, Rs 200 million have been released for Cabinet Division for which the government has earmarked Rs 1.1 billion, whereas for Aviation division, an amount of Rs 210 million was released under PSDP 2018-19.

China’s hybrid wheat successfully grown on large scale in Pakistan

China’s hybrid wheat, using the two-line hybrid technique, has been successfully harvested on a large scale in Pakistan, according to a senior official of a Chinese company which has conducted field trials of hybrid wheat varieties and realized on average 24.4 percent increase in crop yields. “Our company has sent many experts to Pakistan to teach local farmers how to plant the wheat. Around 150 experts have been sent to Pakistan, where they visited over 20 cities,” Song Weibo, Vice President of Sinochem Group Agriculture Division, China’s biggest agricultural inputs company and integrated modern agricultural services operator told the Chinese media. The two-line hybrid technique is often used in hybrid rice and wheat. It can increase wheat production by 20 percent. The hybrid wheat has been proven to outperform standard wheat in terms of yield, water usage and resistance to disease.

Asian stocks tracked Wall Street losses and edged down in early trade on Friday, but the dollar was buoyant after ending a long losing run ahead of a speech by Federal Reserve Chairman Jerome Powell. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS shed 0.18 percent. Australian stocks rose 0.16 percent, South Korea's KOSPI .KS11 fell 0.35 percent and Japan's Nikkei .N225 climbed 0.35 percent. The S&P 500 .SPX shed 0.17 percent overnight to pull back slightly from a record high scaled midweek, with industrial shares sagging after the United States and China imposed a fresh round of trade tariffs on each other. Shares of industrial giants Caterpillar Inc (CAT.N) and Boeing Co (BA.N), which have been bellwethers of trade sentiment, were among the biggest drags on the Dow .DJI, which lost about 0.3 percent. Caterpillar shares fell 2.0 percent, and Boeing shares fell 0.7 percent.

The European Union agreed 18 million euros ($20.6 mln) in aid for Iran on Thursday, including for the private sector, to help offset the impact of US sanctions and salvage a 2015 deal that saw Tehran limit its nuclear ambitions. The announcement is part of the bloc’s high-profile efforts to support the nuclear accord that President Donald Trump abandoned in May. It is part of a wider package of 50 million euros earmarked for Iran in the EU budget. The EU is working to maintain trade with Iran, which has threatened to stop complying with the nuclear agreement if it fails to see the economic benefits of relief from sanctions. The bloc’s foreign policy chief Federica Mogherini said in a statement the bloc was committed to cooperation with Iran. “This new package will widen economic and sectoral relations in areas that are of direct benefit to our citizens,”

The Federation of Pakistan Chambers of Commerce and Industry (FPCCI) on Tuesday said Prime Minister Imran Khan's first address to the nation after being elected the country's new premier has won hearts and minds of the nation. The speech has energised and motivated the entire business community of the country which will trigger economic activities and investment, it said. In a joint statement issued here, President FPCCI Ghazanfar Bilour, VP FPCCI Karim Aziz Malik, Chairman Coordination Malik Sohail, Atif Ikram Sheikh and Jaweed Iqbal said that the new premier promised wide-ranging reforms, safeguard Pakistan's resources and redistribute them from the rich to the disadvantaged which is laudable.

The government has released over Rs 30.3 billion under its Public Sector Development Programme (PSDP) 2018-19 for various ongoing and new schemes against the total allocations of Rs 1,030 billion. The released funds include Rs 18.76 billion for federal ministries and Rs 11.8 billion for special areas besides other projects, according to the data released by the Ministry of Planning, Development and Reforms. Out of these allocations, the government has released Rs 4.67 billion for Pakistan Atomic Energy Commission for which Rs 30.4 billion have been allocated for the year 2018-19, whereas for Maritime Affairs Division, an amount of Rs 334 million has been released out of total allocation of Rs 10.1 billion. Similarly, Rs 200 million have been released for Cabinet Division for which the government has earmarked Rs 1.1 billion, whereas for Aviation division, an amount of Rs 210 million was released under PSDP 2018-19.

China’s hybrid wheat, using the two-line hybrid technique, has been successfully harvested on a large scale in Pakistan, according to a senior official of a Chinese company which has conducted field trials of hybrid wheat varieties and realized on average 24.4 percent increase in crop yields. “Our company has sent many experts to Pakistan to teach local farmers how to plant the wheat. Around 150 experts have been sent to Pakistan, where they visited over 20 cities,” Song Weibo, Vice President of Sinochem Group Agriculture Division, China’s biggest agricultural inputs company and integrated modern agricultural services operator told the Chinese media. The two-line hybrid technique is often used in hybrid rice and wheat. It can increase wheat production by 20 percent. The hybrid wheat has been proven to outperform standard wheat in terms of yield, water usage and resistance to disease.

Market is expected to remain volatile therefore its recommended to stay cautious while trading during current trading session.

Technical Analysis

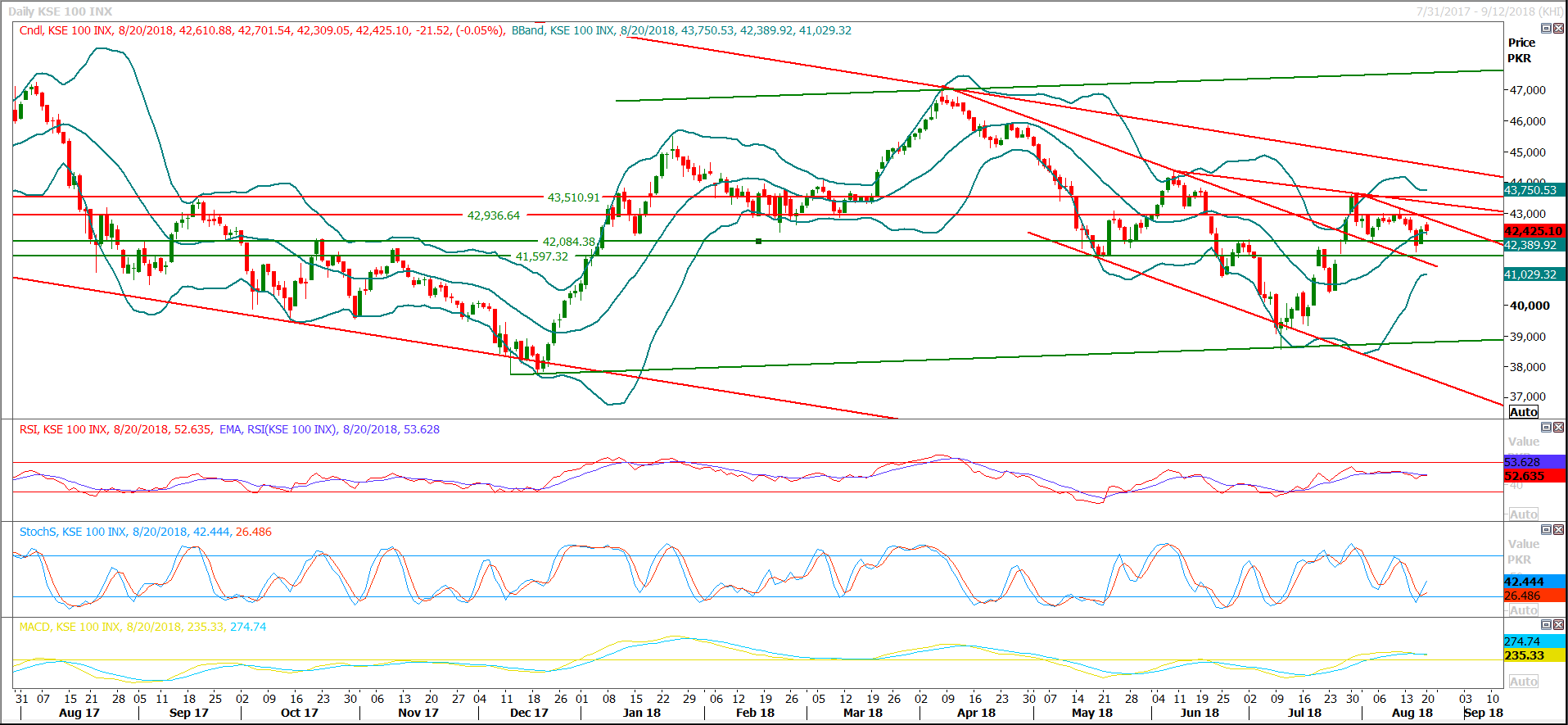

The Benchmark KSE100 Index is being capped by a descending trend line on daily chart at 42,800 along with a horizontal resistance at 42,940 points while supportive regions are standing at 42,089 and 41,800 points. It’s expected that index would try to take an intraday spike towards 42,550 points initially and if it would not succeed in closing above that region on hourly basis then some pressure would be witnessed during current trading session, therefore its recommended to trade very cautiously and profit taking is recommended before said level if penetration of that level could not happen because in that case index would try to take a dip towards its supportive regions.

In case of failure of penetration of 42,550 or 42,800 points index would witnessed pressure from DGKC, MLCF, ISL, SNGP and ENGRO as these script would witness resistances at 122, 61, 113, 103 and 348 Rs respectively and in case of any pressure on index these scripts would try to lead bearish momentum after retesting their respective resistant regions. It’s recommended to trade in chunks with strict stop loss and swing trading could be beneficial between 41,500 to 43,000 points.

In case of failure of penetration of 42,550 or 42,800 points index would witnessed pressure from DGKC, MLCF, ISL, SNGP and ENGRO as these script would witness resistances at 122, 61, 113, 103 and 348 Rs respectively and in case of any pressure on index these scripts would try to lead bearish momentum after retesting their respective resistant regions. It’s recommended to trade in chunks with strict stop loss and swing trading could be beneficial between 41,500 to 43,000 points.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.