Previous Session Recap

Trading volume at PSX floor dropped by 6.29 million shares or 4.60% on DOD basis whereas the Benchmark KSE100 index opened at 38,244.90, posted a day high of 38,487.37 and day low of 37.845.42 during last trading session while session suspended at 38,251.04 points with net change of 14.52 points and net trading volume of 98.56 million shares. Daily trading volume of KSE100 listed companies increased by 16.68 million shares or 20.37% on DOD basis.

Foreign Investors remained in net selling positions of 15.52 million shares and net value of Foreign Inflow Increased by 1.81 million US Dollars. Categorically, Foreign Individuals, Corporate and Overseas Pakistanis investors remained in net buying positions of 0.17, 14.43 and 0.92 million shares. While on the other side Local Individuals, Local Companies, NBFCs and Insurance Companies remained in net selling positions of 0.54, 11.82, 0.02 and 10.93 million shares respectively but Banks, Mutual Fund and Brokers remained in net buying positions of 0.38, 10.92 and 2.28 million shares.

Analytical Review

Asian markets a reluctant spectator to U.S. political theater

Asian stocks were subdued on Monday as investors fretted that political instability in the United States was leaving the country rudderless at a time when the global economy was showing signs of faltering. Moves were limited by a holiday in Japan while many bourses are set to close early for Christmas. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS lost 0.5 percent to its lowest in seven weeks.

Currency business falls by 70pc in two months

Business volume in the currency market has fallen by 70 per cent in the last couple of months but the grey market has expanded its operation to large scale, said currency dealers. The dealers said that laws after laws by the State Bank of Pakistan (SBP) and Security Exchange Commission of Pakistan (SECP) are making the currency business increasingly cumbersome.

Italy’s 2019 budget wins Senate approval

The Italian government won a grueling vote of confidence on its 2019 budget in the upper house in the early hours of Sunday, as it races to get the package approved before a year-end deadline. The budget now has to be approved by the lower house of parliament by Dec 31 so it can take effect from the start of the new year.

CPEC body approves $1bn social uplift package

Balochistan Information Minister Mir Zahoor Ahmed Buledi has said that $1 billion has been approved for a social development package in the eighth meeting of the Joint Coordination Committee (JCC) of the China-Pakistan Economic Corridor (CPEC). Mr Buledi represented Balochistan with a strong delegation in the JCC meeting held in Beijing on Dec 20. Balochistan Chief Minister Jam Kamal Khan Alyani did not attend the meeting as he had reservations over not including development projects of the province in the CPEC.

OPEC, allies to hold extra meeting if output cuts 'not enough': UAE

If an agreed cut in oil output by 1.2 million barrels per day is not enough to balance the market, OPEC and allied producers will hold an extraordinary meeting and do what is necessary, the United Arab Emirates energy minister said on Sunday. Extending the output agreement signed in early December will not be a problem and producers will do as the market demands, Suhail al-Mazrouei told a news conference at a gathering of the Organization of Arab Petroleum Exporting Countries in Kuwait.

Asian stocks were subdued on Monday as investors fretted that political instability in the United States was leaving the country rudderless at a time when the global economy was showing signs of faltering. Moves were limited by a holiday in Japan while many bourses are set to close early for Christmas. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS lost 0.5 percent to its lowest in seven weeks.

Business volume in the currency market has fallen by 70 per cent in the last couple of months but the grey market has expanded its operation to large scale, said currency dealers. The dealers said that laws after laws by the State Bank of Pakistan (SBP) and Security Exchange Commission of Pakistan (SECP) are making the currency business increasingly cumbersome.

The Italian government won a grueling vote of confidence on its 2019 budget in the upper house in the early hours of Sunday, as it races to get the package approved before a year-end deadline. The budget now has to be approved by the lower house of parliament by Dec 31 so it can take effect from the start of the new year.

Balochistan Information Minister Mir Zahoor Ahmed Buledi has said that $1 billion has been approved for a social development package in the eighth meeting of the Joint Coordination Committee (JCC) of the China-Pakistan Economic Corridor (CPEC). Mr Buledi represented Balochistan with a strong delegation in the JCC meeting held in Beijing on Dec 20. Balochistan Chief Minister Jam Kamal Khan Alyani did not attend the meeting as he had reservations over not including development projects of the province in the CPEC.

If an agreed cut in oil output by 1.2 million barrels per day is not enough to balance the market, OPEC and allied producers will hold an extraordinary meeting and do what is necessary, the United Arab Emirates energy minister said on Sunday. Extending the output agreement signed in early December will not be a problem and producers will do as the market demands, Suhail al-Mazrouei told a news conference at a gathering of the Organization of Arab Petroleum Exporting Countries in Kuwait.

Market is expected to remain volatile during current trading session therefore it's recommended to stay cautious while trading

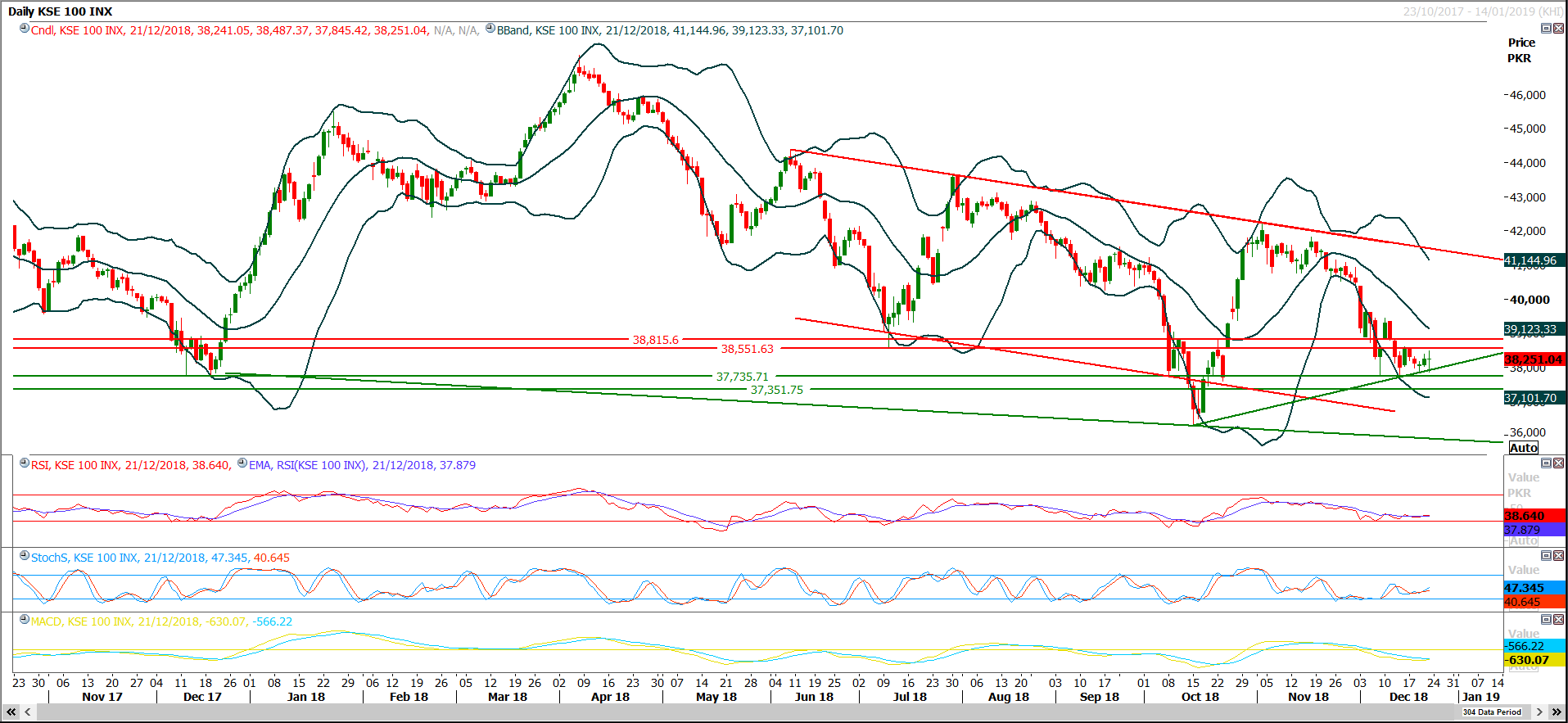

Technical Analysis

The Benchmark KSE100 index have tried to bounce back after getting support from a rising trend line on daily chart during last trading session and could not succeed in penetration of 37,700 on weekly basis in downward direction. With last trading session’s closing above 38,800 index have formatted a weekly triple bottom above 37,760 points which is indicating that index would try to take a spike during this week which may lead index towards 38,830 and 39,200 points initially, but index would not considered bullish until it close above 39,500 points on weekly basis therefore its recommended to start profit taking in chunks from buying on dips while selling on strength.

PSO have resistant region ahead at 245 till 248 therefore it’s recommended to stay cautious with buying positions while reaching these prices levels. TRG have started its pull back after getting support from a descending trend line and have succeed in closing above 25.60 during last trading session now it would try to target 27.30 in coming days. DGKC have supportive region ahead at 85 Rs and it can be bought between 87-86 with strict stop loss of 85 and target at 89 and 91.60.

PSO have resistant region ahead at 245 till 248 therefore it’s recommended to stay cautious with buying positions while reaching these prices levels. TRG have started its pull back after getting support from a descending trend line and have succeed in closing above 25.60 during last trading session now it would try to target 27.30 in coming days. DGKC have supportive region ahead at 85 Rs and it can be bought between 87-86 with strict stop loss of 85 and target at 89 and 91.60.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.