Previous Session Recap

Trading volume at PSX floor dropped by 26.49 million shares or 23.63% on DoD basis, whereas the benchmark KSE100 index opened at 40,414.49, posted a day high of 40,462.40 and a day low of 40,171.10 points during last trading session while session suspended at 40,249.22 points with net change of -232.43 points and net trading volume of 58.48 million shares. Daily trading volume of KSE100 listed companies also dropped by 25.07 million shares or 30.01% on DoD basis.

Foreign Investors remained in net selling positions of 3.40 million shares and value of Foreign Inflow dropped by 1.57 million US Dollars. Categorically, Foreign Individuals, Corporate and Overseas Pakistani remained in net selling positions of 0.03, 1.25 and 2.12 million shares respectively. While on the other side Local Companies, Brokers and Insurance Companies remained in net long positions of 2.970.32 and 3.997 million shares but Local Individuals, Banks, NBFCs and Mutual Fund remained in net selling positions of 2.60, 0.05, 0.005 and 1.54 million shares respectively.

Analytical Review

Shares drop, gold surges as investors scurry for safety

Global shares and oil slid on Monday while safe-haven gold surged as the spread of the coronavirus outside China darkened the outlook for world growth with infections and deaths rising in South Korea, Italy and the Middle East. South Korea put the country on high alert while the number of infections jumped to over 700 and deaths rose to seven. In Italy, officials said a third person infected with the flu-like virus had died, while the number of cases jumped to above 150 from just three before Friday. Iran, which announced its first infections last week, said it had confirmed 43 cases and eight deaths, with most of the infections in the Shi’ite Muslim holy city of Qom. Saudi Arabia, Kuwait, Iraq, Turkey and Afghanistan imposed travel and immigration restrictions on the Islamic Republic.

Time to rev up exports

Sadly, it was only recently that the country’s policymakers realised the importance of exports for the country to break out of periodic boom-and-bust cycles responsible for leading us to the International Monetary Fund (IMF) for the fourth bailout in less than two decades. The consumption-driven growth strategy pursued by successive military and civilian governments in the recent and distant past has always brought short-term relief, caused deindustrialisation, eroded export competitiveness, built up debt and led the country back into balance-of-payments crises. Pakistan’s exports decreased from around 17 per cent of its GDP in 2003 to slightly above 9pc 2015 onwards, with its share in the world market declining from 0.16pc to 0.13pc. On the other hand, Vietnam has enhanced its market share eight times to 1.35pc from 0.17pc. The market share of Bangladesh went up by 1.4pc to 0.24pc from 0.10pc over the same period.

Govt to help KE raise generation capacity by 1,600MW

Amid delays in K-Electric takeover by the Shanghai Electric Limited (SEL) of China, the government has decided in principle to facilitate the Karachi-based power utility to increase its own generation capacity by 1,600MW and enhance supply from the national grid to 1,400MW on an urgent basis. For this to deliver, the government would immediately allow the KE to start construction of a 700MW coal-based project, provide about 150 million cubic feet of imported liquefied natural gas (LNG) for another 900MW project and enhance power off-take from the national grid to 1,400MW through diversion of upcoming nuclear power projects in Karachi.

The banality of Punjab’s business plan

Last week, Lums hosted Dr Salman Shah, adviser to the Punjab chief minister on economic affairs, for a presentation of the freshly minted “Business Plan of Punjab”. Though Dr Shah delivered the message with candour and conviction, the plan came across as nothing but a skilful patchwork of past consultancy reports devoid of a pragmatic road map for policy reforms. To be fair, words like “great plan” and “impressive plan” rang out a few times from among the audience. However, the presentation simply boiled down to a laundry list of (textbook) economic problems and failed to recognise the entrenched political economy barriers that inhibit economic growth and development.

CRRI grown cotton tops in Punjab, KPK, stands first in Pakistan

A variety of cotton produced by Central Cotton Research Institute (CCRI) tops in Punjab and KPK whereas clinched second position across the country, results declared by Pakistan Central Cotton Committee research showed. A spokesperson of CRRI Sajid Mahmood told APP that National Coordinated Trail (NCVT) research results showed that BTCIM 775 stood first in Punjab and Khyber Pakhtunkhwa (KPK) and second in Pakistan in 2019. He informed that breeder of this type of cotton is Head of Plant Breeding & Genetics deptt, Dr Idrees Khan adding that the cotton has been cultivated by crossing of ICARDA project material. Director CCRI, Dr Zahid Mahmood felicitated agri scientists specially Dr Idress Khan and his team on this success, saying that it was an honour for the institute that its grown cotton had won the position in NVCT trials placed at 22 places in the country, the spokesperson informed.

Global shares and oil slid on Monday while safe-haven gold surged as the spread of the coronavirus outside China darkened the outlook for world growth with infections and deaths rising in South Korea, Italy and the Middle East. South Korea put the country on high alert while the number of infections jumped to over 700 and deaths rose to seven. In Italy, officials said a third person infected with the flu-like virus had died, while the number of cases jumped to above 150 from just three before Friday. Iran, which announced its first infections last week, said it had confirmed 43 cases and eight deaths, with most of the infections in the Shi’ite Muslim holy city of Qom. Saudi Arabia, Kuwait, Iraq, Turkey and Afghanistan imposed travel and immigration restrictions on the Islamic Republic.

Sadly, it was only recently that the country’s policymakers realised the importance of exports for the country to break out of periodic boom-and-bust cycles responsible for leading us to the International Monetary Fund (IMF) for the fourth bailout in less than two decades. The consumption-driven growth strategy pursued by successive military and civilian governments in the recent and distant past has always brought short-term relief, caused deindustrialisation, eroded export competitiveness, built up debt and led the country back into balance-of-payments crises. Pakistan’s exports decreased from around 17 per cent of its GDP in 2003 to slightly above 9pc 2015 onwards, with its share in the world market declining from 0.16pc to 0.13pc. On the other hand, Vietnam has enhanced its market share eight times to 1.35pc from 0.17pc. The market share of Bangladesh went up by 1.4pc to 0.24pc from 0.10pc over the same period.

Amid delays in K-Electric takeover by the Shanghai Electric Limited (SEL) of China, the government has decided in principle to facilitate the Karachi-based power utility to increase its own generation capacity by 1,600MW and enhance supply from the national grid to 1,400MW on an urgent basis. For this to deliver, the government would immediately allow the KE to start construction of a 700MW coal-based project, provide about 150 million cubic feet of imported liquefied natural gas (LNG) for another 900MW project and enhance power off-take from the national grid to 1,400MW through diversion of upcoming nuclear power projects in Karachi.

Last week, Lums hosted Dr Salman Shah, adviser to the Punjab chief minister on economic affairs, for a presentation of the freshly minted “Business Plan of Punjab”. Though Dr Shah delivered the message with candour and conviction, the plan came across as nothing but a skilful patchwork of past consultancy reports devoid of a pragmatic road map for policy reforms. To be fair, words like “great plan” and “impressive plan” rang out a few times from among the audience. However, the presentation simply boiled down to a laundry list of (textbook) economic problems and failed to recognise the entrenched political economy barriers that inhibit economic growth and development.

A variety of cotton produced by Central Cotton Research Institute (CCRI) tops in Punjab and KPK whereas clinched second position across the country, results declared by Pakistan Central Cotton Committee research showed. A spokesperson of CRRI Sajid Mahmood told APP that National Coordinated Trail (NCVT) research results showed that BTCIM 775 stood first in Punjab and Khyber Pakhtunkhwa (KPK) and second in Pakistan in 2019. He informed that breeder of this type of cotton is Head of Plant Breeding & Genetics deptt, Dr Idrees Khan adding that the cotton has been cultivated by crossing of ICARDA project material. Director CCRI, Dr Zahid Mahmood felicitated agri scientists specially Dr Idress Khan and his team on this success, saying that it was an honour for the institute that its grown cotton had won the position in NVCT trials placed at 22 places in the country, the spokesperson informed.

Market is expected to remain volatile during current trading session.

Technical Analysis

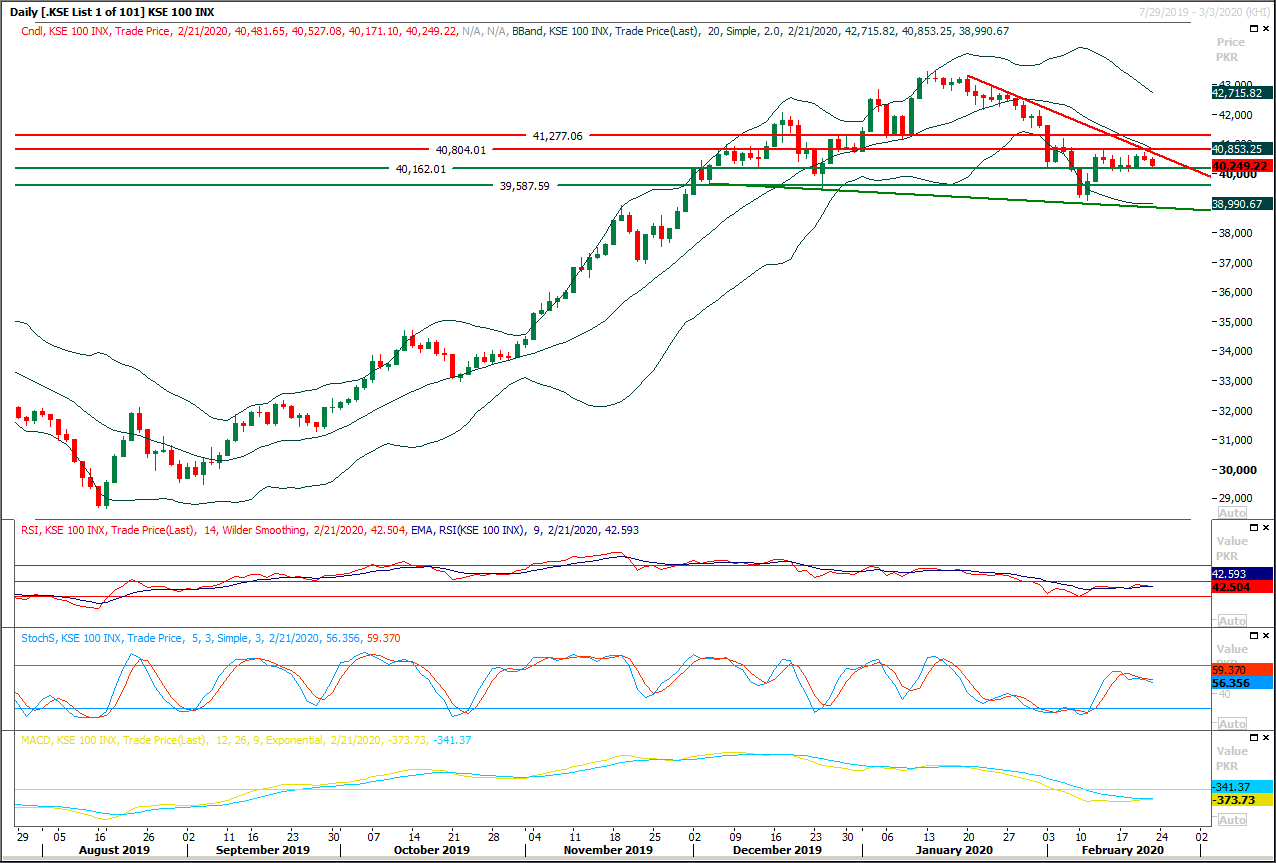

The Benchmark KSE100 index is being caged in a descending wedge on daily chart and right now it's moving beside its resistant trend line and if it would not succeed in giving a breakout above this line or 40,800 points then some serious pressure would be witnessed which may push index towards 40,000pts initially and breakout below that region would call for 39,500 points and then 38,800 points. It's recommended to trade with strict stop loss because if index would succeed in closing above 40,800 points a pull back towards 41,000 points and 41,200 points could be witnessed where once again index would face strong resistances.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.