Previous Session Recap

Trading volume at PSX floor dropped by 67.91 million shares or 23.07% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 44897.69, posted a day high of 44970.78 and a day low of 43465.31 during last trading session. The session suspended at 44907.20 with net change of 9.51 and net trading volume of 113.42 million shares. Daily trading volume of KSE100 listed companies dropped by 22.38 million shares or 16.48% on DoD basis.

Foreign Investors remained in net buying of 5.37 million shares and net value of Foreign Inflow increased by 11.5 million US Dollars. Categorically, Foreign Individual, Corporate and Overseas Pakistanis remained in net buying of 0.04, 4.85 and 0.48 million shares respectively. While on the other side Local Individuals, NBFCs and Brokers remained in net buying of 6.25, 0.77 and 3.8 million shares but Local Companies, Banks, Mutual Funds and Insurance Companies remained in net selling of 4.16, 3.73, 3.28 and 1.52 million shares respectively.

Analytical Review

Asian shares scaled record peaks on Wednesday as strong corporate earnings and optimism on global growth outweighed concerns over trade tensions, while a fresh burst of speculative selling took the U.S. dollar to three-year lows. A 10 percent surge in Netflix (NFLX.O) led gains across the tech sector as it became just the latest to top forecasts. So far, 82 percent of reporting companies having beaten estimates. Most Asian stock indices are up anywhere from 5 to 10 percent since the start of the year with many at all-time highs. “These markets are absolutely flying and have had seemingly one-way moves since late December,” noted Chris Weston, chief market strategist at broker IG. “There has clearly been a wall of capital hitting these markets, as is the case with many Asian currencies,” he added. “One simply can’t rule further upside here, even if there is growing risks of buyers fatigue kicking in.”

Pakistan will demand unilateral concessions on approximately 70 products mostly of export interest to China as part of the second phase of the Free Trade Agreement (FTA). This demand came from top government officials when the Chinese ambassador to Pakistan, Yao Jing, visited the commerce ministry to invite Commerce and Textile Minister Pervez Malik to a six-day international import-expo exhibition in Shanghai. The exhibition is scheduled for Nov 5-10. A source privy to the meeting told Dawn that the duty reduction on these products will be discussed in the eighth round of negotiations scheduled for Feb 7. Commerce Secretary Younus Dagha will lead Pakistan’s delegation to the meeting.

Business to consumer E-Commerce (e-B2C) is on the rise in Pakistan as 571 local e-commerce merchants were already accepting payments through banking channels as of end-June 2017, with cumulative annual domestic sales worth Rs 9.8 billion. In addition to that, transactions worth Rs 20.7 billion were carried out by consumers on international e-commerce websites, stated State Bank of Pakistan in its quarterly report quoting latest e-commerce data. According to the report, growing incomes, coupled with advancement in communication technology and expansion of internet access and branchless banking, have been propelling the sector forward.

The Grants Review and Distribution Committee (GRDC) of the Economic Revitalization of Khyber Pakhtunkhwa and FATA (ERKF) Project has approved Rs100 million grants for rehabilitation and up-gradation of crisis-hit Small and Medium Enterprises (SMEs) in 23 districts of the province. ERKF Project funded by Multi Donor Trust Fund (MDTF) for the rehabilitation and up-gradation of SMEs of Khyber Pakhtunkhwa and FATA had received nearly 4000 applications for grants under the project during the period from July to till first week of October 2017. The approved amount will be distributed amongst 100 applicants.

The Punjab Business Symposium has stressed the need for withdrawing discretionary powers given to FBR officials, as they use these powers for harassing business community. They said that one window facilitation cell should be established for industrialization, dealing with increasing trade deficit and improving ease of doing business ranking. Double taxation and withholding tax on banking transaction are the practices which promote undocumented economy. Tax amnesty scheme should also be announced for the economic growth. Tax refunds should be made as soon as possible to improve our exports. Tax return system should be simplified. Help desk of Punjab Revenue Authority should be established at each chamber of district. Business representative should be included as Board of Directors of all government institutions, PBIT, TDAP, FBR and NTC.

Its recommended to practice caution as market is expected to remain volatile.

Technical Analysis

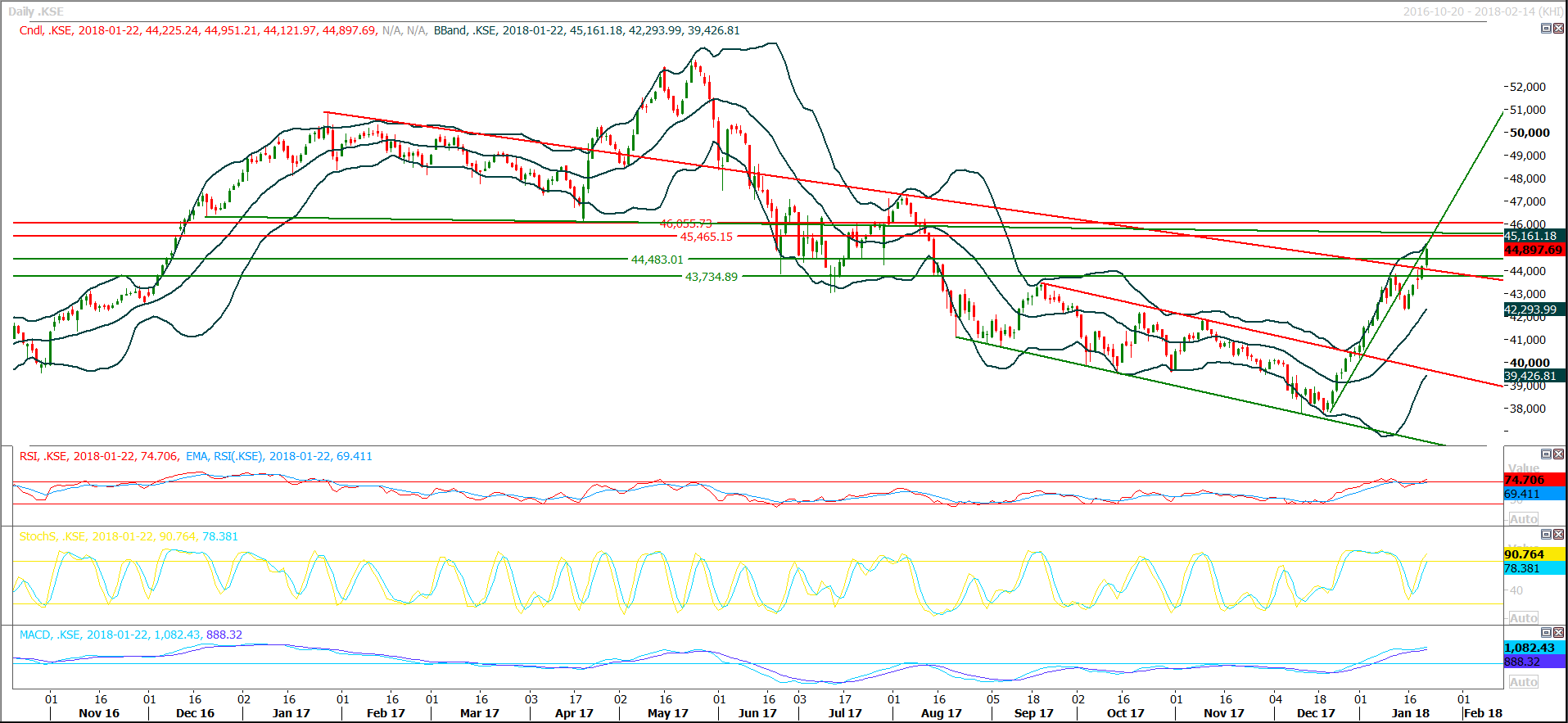

The Benchmark KSE100 Index have generated a hammeer on daily chart during last trading session and as of right now its capped by a resistant trend line along with a horizontal resistant region at 4533 and 45465 and these both levels would try to react as strong resistnaces. Daily and weekly stochastic are ready for a bearish crossover and if index would become able to slip below 44483 during current trading session then an evening star would be created which would push index in negative zone in coming days. Its recommended to stay sideline until index gives a clear breakout of either 45465 or 44483 as breakout in either direction would add 1000-1500 in index.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.