Previous Session Recap

Trading volume at PSX floor increased by 52.84 million shares or 29.69% on DoD basis, whereas the benchmark KSE100 index opened at 42,646.20, posted a day high of 42,906.14 and a day low of 42,439.68 points during last trading session while session suspended at 42,506.95 points with net change of -54.32 points and net trading volume of 160.43 million shares. Daily trading volume of KSE100 listed companies also increased by 42.11 million shares or 35.59% on DoD basis.

Foreign Investors remained in net selling positions of 2.44 million shares but net value of Foreign Inflow increased by 0.19 million US Dollars. Categorically, Foreign Individuals, Corporate and Overseas Pakistani investors remained in net selling positions of 0.0065, 0.27 and 2.17 million shares. While on the other side Local Individuals, Brokers and Insurance Companies remained in net selling positions of 10.52, 2.48 and 3.23 million shares but Local Companies, Banks, NBFCs and Mutual Fund remained in net buying positions of 6.69, 0.98, 0.11 and 9.48 million shares respectively.

Analytical Review

Global stocks steady as caution on China virus continues; euro hits seven-week low after ECB

Stocks made a barely positive start in early Asian trade on Friday after the world’s health body called it a little too early to declare a coronavirus outbreak a global emergency. But worries over rapid spread of the deadly virus kept investors on guard as millions of Chinese travel during the Lunar New Year holiday period. MSCI’s broadest index of Asia-Pacific shares outside Japan rose a marginal 0.1%, while Japan’s Nikkei stood flat and Australian stocks added 0.4%. Trade in Asia is already slowing down for the Lunar New Year holiday, with financial markets in China, Taiwan and South Korea closed on Friday. Key indices on Wall Street bounced from lows after the World Health Organisation (WHO) said the latest coronavirus did not yet constitute a global public health emergency.

International restrictions blamed for lower oil production

Confirming economic slowdown due to stabilisation programme, the government on Thursday said the operations of local refineries had slowed down because of high production of residual fuel oil (RFO) and the international ban on its use for bunkering with effect from Dec 31, 2019. In a statement, the petroleum division said that because of new regulations issued by the International Maritime Organisation (IMO), crude oil import had reduced during the first six months of the current fiscal year. Under these regulations, RFO containing more than 0.5 per cent of sulphur content is disallowed for use in ships and its violation carries heavy fines.

Industry deplores ‘knee-jerk U-turns’ in economic policy

The government and the country’s big businesses entered into a serious tug of war over electricity tariff that has increased by almost 35 per cent on average over the past 18 months. Pakistan Business Council — an alliance of about 82 of the largest Pakistani business houses claiming about 18 per cent share in the country’s revenue and GDP — accused the government of "knee-jerk U-turns" in policy matters, negatively affecting the country’s competitiveness and investor confidence. All Pakistan Textile Mills Association (Aptma) — an association of about 400 textile units — earlier criticised the government for backtracking from its commitment to provide electricity to export industry at a fixed rate of 7.5 cents per unit to compete in the global market with India, Bangladesh and others.

Uncertainty hits Datsun car project

The future of Datsun car project hangs in the balance as Ghandhara Nissan Ltd (GNL) has not received any road map from Nissan Motor Company Ltd (NMCL) regarding localisation of parts. In the project progress report filed to the Pakistan Stock Exchange (PSX) on Thursday, GNL said the company together with NMCL has invested a lot of time and resources to ensure optimum level of localisation in an efficient and effective manner. However, as part of NMCL’s recent business strategy and particularly the management policy changed with respect to Datsun segment. It is critical to note that Indonesia, which is the mother plant for Datsun completely knocked down (CKD) kits, may not be a sustainable source, the company said.

Incentives in the works to diversify exports

The Imran Khan government plans to introduce significant time-bound, structured fiscal incentives and protection for 20 industries other than the five zero-rated sectors besides ensuring their easier access to cheap short- and long-term finance for diversifying and boosting the country’s stagnating exports. The incentives will be part of the new Strategic Trade Policy Framework (STPF) expected to be finalised in the next couple of months, Commerce Secretary Ahmed Nawaz Sukhera told Dawn on Thursday. "The government is looking beyond the five zero-rated export sectors including the textile. It is time we also focused and facilitated industries like light engineering, chemicals, IT, etc with substantial potential to diversify and increase our exports," he said.

Stocks made a barely positive start in early Asian trade on Friday after the world’s health body called it a little too early to declare a coronavirus outbreak a global emergency. But worries over rapid spread of the deadly virus kept investors on guard as millions of Chinese travel during the Lunar New Year holiday period. MSCI’s broadest index of Asia-Pacific shares outside Japan rose a marginal 0.1%, while Japan’s Nikkei stood flat and Australian stocks added 0.4%. Trade in Asia is already slowing down for the Lunar New Year holiday, with financial markets in China, Taiwan and South Korea closed on Friday. Key indices on Wall Street bounced from lows after the World Health Organisation (WHO) said the latest coronavirus did not yet constitute a global public health emergency.

Confirming economic slowdown due to stabilisation programme, the government on Thursday said the operations of local refineries had slowed down because of high production of residual fuel oil (RFO) and the international ban on its use for bunkering with effect from Dec 31, 2019. In a statement, the petroleum division said that because of new regulations issued by the International Maritime Organisation (IMO), crude oil import had reduced during the first six months of the current fiscal year. Under these regulations, RFO containing more than 0.5 per cent of sulphur content is disallowed for use in ships and its violation carries heavy fines.

The government and the country’s big businesses entered into a serious tug of war over electricity tariff that has increased by almost 35 per cent on average over the past 18 months. Pakistan Business Council — an alliance of about 82 of the largest Pakistani business houses claiming about 18 per cent share in the country’s revenue and GDP — accused the government of "knee-jerk U-turns" in policy matters, negatively affecting the country’s competitiveness and investor confidence. All Pakistan Textile Mills Association (Aptma) — an association of about 400 textile units — earlier criticised the government for backtracking from its commitment to provide electricity to export industry at a fixed rate of 7.5 cents per unit to compete in the global market with India, Bangladesh and others.

The future of Datsun car project hangs in the balance as Ghandhara Nissan Ltd (GNL) has not received any road map from Nissan Motor Company Ltd (NMCL) regarding localisation of parts. In the project progress report filed to the Pakistan Stock Exchange (PSX) on Thursday, GNL said the company together with NMCL has invested a lot of time and resources to ensure optimum level of localisation in an efficient and effective manner. However, as part of NMCL’s recent business strategy and particularly the management policy changed with respect to Datsun segment. It is critical to note that Indonesia, which is the mother plant for Datsun completely knocked down (CKD) kits, may not be a sustainable source, the company said.

The Imran Khan government plans to introduce significant time-bound, structured fiscal incentives and protection for 20 industries other than the five zero-rated sectors besides ensuring their easier access to cheap short- and long-term finance for diversifying and boosting the country’s stagnating exports. The incentives will be part of the new Strategic Trade Policy Framework (STPF) expected to be finalised in the next couple of months, Commerce Secretary Ahmed Nawaz Sukhera told Dawn on Thursday. "The government is looking beyond the five zero-rated export sectors including the textile. It is time we also focused and facilitated industries like light engineering, chemicals, IT, etc with substantial potential to diversify and increase our exports," he said.

Market is expected to remain volatile during current trading session.

Technical Analysis

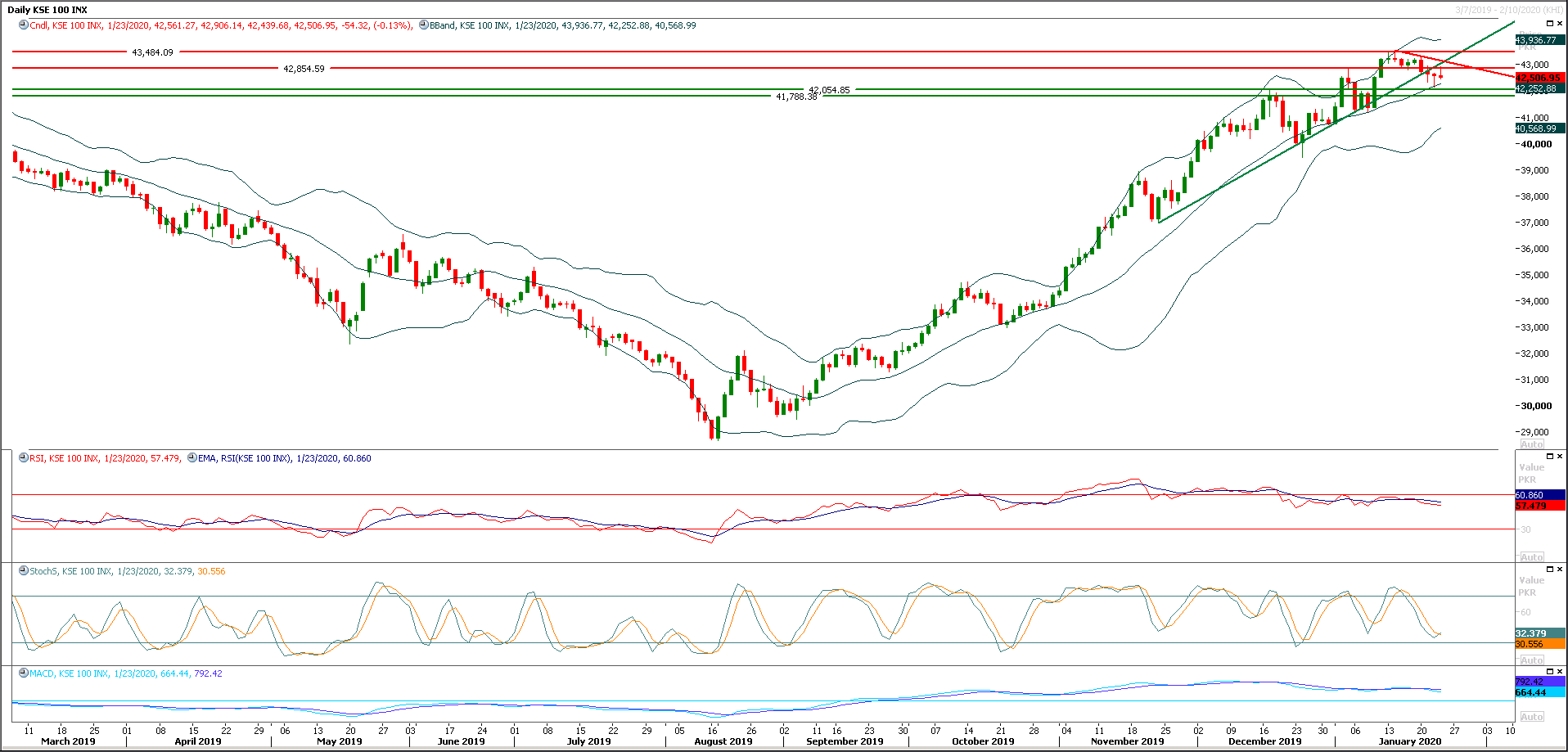

The Benchmark KSE100 index could not succeed in penetration above a resistant trend line which was previously acting as a strong support and slide downward after retesting the said trend line and completing correction of its last bearish move. Mean while index have generated a hammer in response of its previous umbrella formation. As of now it's expected that bears would dominate during current trading session and index can take a serious dip on intraday basis which may prolong till 42,050 points. On short term basis index have entered into bearish zone and this trend would be confirmed if index would slide below 42,400 points at day end today. Mean while any bullish spike would face strong resistances at42,860 points and 43,500 points in coming days. It's recommended to start adding short positions on breakout below 42,400 points.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.