Previous Session Recap

Trading volume at PSX floor dropped by 25.68 million shares or 17.33%, DoD basis. Whereas, the Benchmark KSE100 Index opened at 44975.20, posted a day high of 45382.22 and a day low of 44548.36 during the last trading session while the session suspended at 45294.39 with a net change of 234.46 and net trading volume of 56.61 million shares. Daily trading volume of KSE100 listed companies dropped by 10.52 million shares or 15.68%, DoD basis.

Foreign Investors remained in a net selling position of 1.86 million shares and the net value of Foreign inflow dropped by 0.14 million US Dollars. Categorically, Foreign Corporate and Overseas Pakistani investors remained in net selling positions of 1.36 and 0.53 million shares but Foreign Individuals remained in a net buying position of 35500 shares. While on the other side, Local Individuals and Brokers remained in net selling positions of 4.74 and 3.61 million shares, but Local Companies, Banks, NBFCs and Mutual Funds remained in net selling positions of 3.0, 0.20, 0.19 and 3.59 million shares, respectively.

Analytical Review

Asian stocks slipped on Monday as demand for riskier assets ebbed after recent strong gains, while the euro near-two-year high on the European Central Bank seeming lack of concern about its strength left the dollar languishing near a 13-month low. MSCI broadest index of Asia-Pacific shares outside Japan was down 0.1 percent early on Monday. Japanese Nikkei dropped 0.8 percent on a stronger yen. Australian shares retreated 0.2 percent and South Korean KOSPI was flat. On Friday, global stocks snapped a 10-day winning streak, taking a breather from a rally that had propelled them to a record high.

The uneasy calm that prevailed in Pakistan’s forex market prior to the July 5 massive decline in the rupee value is still not over and a debate is raging about whether the local currency will fall again. This debate became more intense as recently released data showed that the current account (C/A) deficit swelled to around $12.1 billion in FY17 from $4.867bn in FY16. Most bank treasurers are almost sure the State Bank of Pakistan would not hesitate in letting the rupee fall again. For them, it is not a question of ‘why’ but just a question of when.

The gross public debt of the country has reached Rs20.9 trillion, with an addition of Rs1.2 trillion in third quarter (July-March) of FY17. More than 90 percent of the rise in public debt came from domestic borrowing, while increase in external debt remained moderate on account of revaluation gains and marginally higher debt repayments during the period. This was stated in third quarterly report of ‘State of Pakistan Economy’ released by the central bank.

All Pakistan Oil Tankers Owner Association has announced a strike from Monday (today) according to which no tanker owner will participate in oil distribution throughout the country. All Pakistan Oil Tankers Owner Association Chairman Shams Shahwani claimed that motorway police and traffic police officials have caused hurdles in their distribution process by implementing the Oil and Gas Regulatory Authority (OGRA) safety regulations. He told that oil was distributed through the same tankers in several parts of the country, but the owners are now being forced to spend Rs 10 lac on every tanker in the light of the new OGRA safety regulations. The oil transporters have planned a strike for indefinite period following the strict policies of government, Shahwani stated. He said, “85,000 tankers are used to supply oil throughout the country.”

Sindh government is spending over fourteen billion rupees to uplift agriculture sector in the province. Radio Pakistan quoting official sources said that a number of schemes are being initiated to facilitate the farmers. These include provision of assistance to farmers for purchase of wheel type tractors, harvestors and solar pumps to increase the agriculture production in the province.

The Market is expected to remain volatile today. We advise Traders to exercise caution. Buying on dips and booking gains on strength is recommended.

Technical Analysis

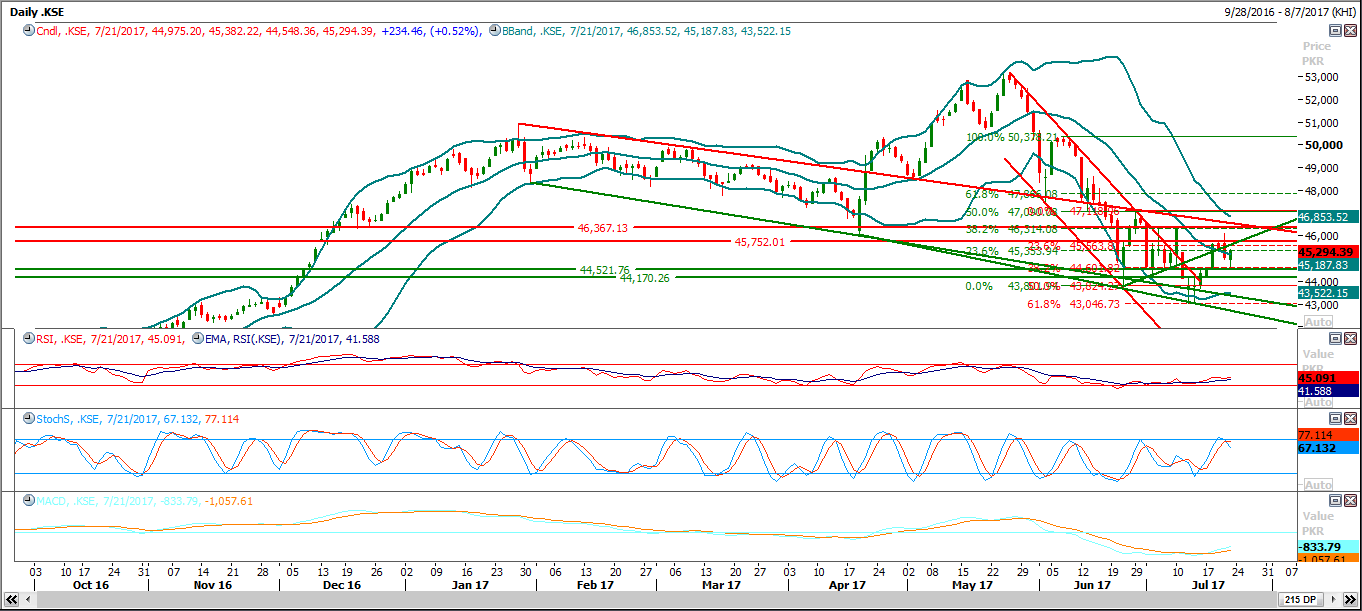

The Benchmark KSE100 Index formed a bullish engulfing pattern on weekly chart which indicates a beginning of a bullish trend on short term basis. However, daily stochastic generated a bearish crossover. As of now, the index has resistant regions ahead at 45760 and 46360, which could attempt to push the index in bearish direction. On the flip side, the supportive regions stand at 44530 and 44100. For the current trading session, buying on dip is recommended with a strict stop loss, as the index may take a spike towards 45760 if it manages to open with a positive gap.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.