Previous Session Recap

Trading volume at PSX floor increased by 52.42 million shares or 117.26% on DoD basis, whereas the benchmark KSE100 index opened at 32,602.00, posted a day high of 32,758.44 and a day low of 32,455.10 points during last trading session while session suspended at 32,715.88 points with net change of 131.33 points and net trading volume of 79.62 million shares. Daily trading volume of KSE100 listed companies increased by 41.43 million shares or 108.47% on DoD basis.

Foreign Investors remained in net selling positions of 0.91 million shares but net value of Foreign inflow increased by 1.37 million US Dollars. Categorically, Foreign Corporate remained in net selling positions of 2.94 million shares but and Overseas Pakistani Investors remained in net buying positions of 2.03 million shares. While on the other side Local Individuals, Banks, NBFCs, Brokers and Insurance Companies remained in net buying positions of 7.11, 1.04, 0.04, 0.04 and 0.72 million shares respectively but Local Companies and Mutual Funds remained in net selling positions of 0.10 and 5.13 million shares respectively.

Analytical Review

Asia stocks welcome trade talks, euro on defensive

Asian shares on Wednesday gave a guarded welcome to hints of progress in the Sino-U.S. trade saga, while the dollar hit two-month highs on the euro as investors wagered on a dovish outcome from the European Central Bank’s coming policy meeting. Sentiment had been helped by a Bloomberg report that U.S. Trade Representative Robert Lighthizer would travel to Shanghai next week for meetings with Chinese officials. White House economic adviser Larry Kudlow on Tuesday called it a good sign and said he expected Beijing to start buying U.S. agriculture products soon. Japan’s Nikkei added 0.5%, while Australian stocks rose 0.8% to all-time highs. MSCI’s broadest index of Asia-Pacific shares outside Japan gained 0.4% and Chinese blue chips climbed 1.2%.

ADB approves $50m additional contribution for CGIF

The Asian Development Bank (ADB) has approved a US $ 50 million additional capital contribution to support the guarantee operations of the Credit Guarantee Investment Facility (CGIF), a trust fund of ADB created to promote the development of deep and liquid local currency and regional bond markets in the ASEAN+3 region. According to ADB statement received, the CGIF was established in April 2010 with an initial capital of $700 million, including a $130 million capital contribution from ADB. The ADB’s additional capital contribution will support regional cooperation within ASEAN+3 and promote financial resilience by allowing corporations and infrastructure projects to gain access to local currency and regional bond markets, the statement added.

LCCI for clubbing of taxes to facilitate business community

our Taxes in Punjab to facilitate the business community. While talking to a delegation of businessmen, LCCI President Almas Hyder said that number of taxes pertaining to industries and businesses in Punjab could be reduced considerably by clubbing Employees Old Age Benefit Institution (EOBI), Punjab Employees Social Security Institution (PESSI), Workers’ Profit Participation Fund (WPPF) and Workers’ Welfare Fund (WWF). The LCCI President also suggested that the responsibility for collection of these taxes should be given to Punjab Revenue Authority (PRA). He said that the initiative would help to separate tax collection from service provision so that the department like PESSI, EOBI stop sending inspectors for tax collection and focus only on service delivery.

IMF lowers global growth forecasts amid trade, Brexit uncertainties

The International Monetary Fund on Tuesday lowered its forecast for global growth this year and next, warning that further US-China tariffs or a disorderly exit for Britain from the European Union could further slow growth, weaken investment and disrupt supply chains. The IMF said downside risks had intensified and it now expected global economic growth of 3.2 per cent in 2019 and 3.5pc in 2020, a drop of 0.1 percentage point for both years from its April forecast, and its fourth downgrade since October. Economic data so far this year and softening inflation pointed to weaker-than-expected activity, the global lender said, with trade and technology tensions and mounting disinflationary pressures posing future risks.

‘Rise in Indian govt borrowing can squeeze corporate sector’

An increase in government borrowing runs the risk of flooding the debt market, and puts upward pressure on interest rates, making it more expensive for companies to borrow, said outgoing Reserve Bank of India Deputy Governor Viral Acharya. In a lecture published on the Federal Bank website late on Monday, Acharya said India’s borrowing relative to its output has ranged from 67 per cent to 85pc since 2000 and has outpaced many emerging markets including China. “As more government debt floods markets, the relative safety and liquidity premium attached by investors to high-rated corporate bonds diminishes, raising the cost of borrowing especially for AAA-rated borrowers and making it relatively less sensitive to policy rate cuts,” Acharya said.

Asian shares on Wednesday gave a guarded welcome to hints of progress in the Sino-U.S. trade saga, while the dollar hit two-month highs on the euro as investors wagered on a dovish outcome from the European Central Bank’s coming policy meeting. Sentiment had been helped by a Bloomberg report that U.S. Trade Representative Robert Lighthizer would travel to Shanghai next week for meetings with Chinese officials. White House economic adviser Larry Kudlow on Tuesday called it a good sign and said he expected Beijing to start buying U.S. agriculture products soon. Japan’s Nikkei added 0.5%, while Australian stocks rose 0.8% to all-time highs. MSCI’s broadest index of Asia-Pacific shares outside Japan gained 0.4% and Chinese blue chips climbed 1.2%.

The Asian Development Bank (ADB) has approved a US $ 50 million additional capital contribution to support the guarantee operations of the Credit Guarantee Investment Facility (CGIF), a trust fund of ADB created to promote the development of deep and liquid local currency and regional bond markets in the ASEAN+3 region. According to ADB statement received, the CGIF was established in April 2010 with an initial capital of $700 million, including a $130 million capital contribution from ADB. The ADB’s additional capital contribution will support regional cooperation within ASEAN+3 and promote financial resilience by allowing corporations and infrastructure projects to gain access to local currency and regional bond markets, the statement added.

our Taxes in Punjab to facilitate the business community. While talking to a delegation of businessmen, LCCI President Almas Hyder said that number of taxes pertaining to industries and businesses in Punjab could be reduced considerably by clubbing Employees Old Age Benefit Institution (EOBI), Punjab Employees Social Security Institution (PESSI), Workers’ Profit Participation Fund (WPPF) and Workers’ Welfare Fund (WWF). The LCCI President also suggested that the responsibility for collection of these taxes should be given to Punjab Revenue Authority (PRA). He said that the initiative would help to separate tax collection from service provision so that the department like PESSI, EOBI stop sending inspectors for tax collection and focus only on service delivery.

The International Monetary Fund on Tuesday lowered its forecast for global growth this year and next, warning that further US-China tariffs or a disorderly exit for Britain from the European Union could further slow growth, weaken investment and disrupt supply chains. The IMF said downside risks had intensified and it now expected global economic growth of 3.2 per cent in 2019 and 3.5pc in 2020, a drop of 0.1 percentage point for both years from its April forecast, and its fourth downgrade since October. Economic data so far this year and softening inflation pointed to weaker-than-expected activity, the global lender said, with trade and technology tensions and mounting disinflationary pressures posing future risks.

An increase in government borrowing runs the risk of flooding the debt market, and puts upward pressure on interest rates, making it more expensive for companies to borrow, said outgoing Reserve Bank of India Deputy Governor Viral Acharya. In a lecture published on the Federal Bank website late on Monday, Acharya said India’s borrowing relative to its output has ranged from 67 per cent to 85pc since 2000 and has outpaced many emerging markets including China. “As more government debt floods markets, the relative safety and liquidity premium attached by investors to high-rated corporate bonds diminishes, raising the cost of borrowing especially for AAA-rated borrowers and making it relatively less sensitive to policy rate cuts,” Acharya said.

Market is expected to remain volatile during current trading session.

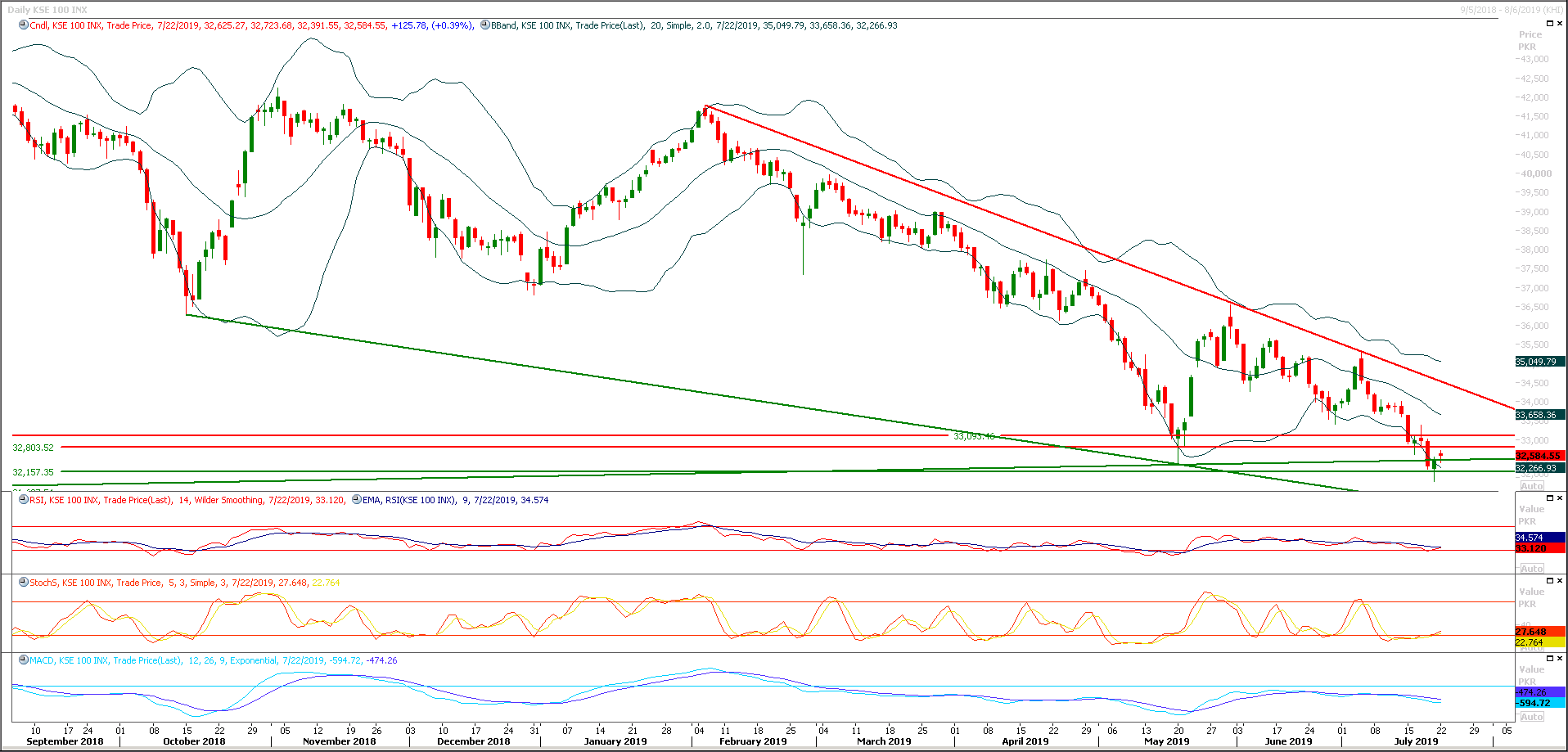

Technical Analysis

The Benchmark KSE100 index is trying to maintain its upward direction since two trading sessions but have faced a strong resistance on its way towards 34,000 points. As of now it's expected that index would face strong resistances at 32,800 and 33,063 points during current trading session, it's also expected that index would start losing momentum if it would not succeed in penetration above 32,800 points till day end today. On flipside index would try to find support at 32,300 and 32,150 points before falling towards 31,700 points in case of any bearish pressure. It's recommended to start buying on dip as daily and hourly momentum indicators are still in bullish mode and these would try to push index towards 32,800 initially and then onward.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.