Previous Session Recap

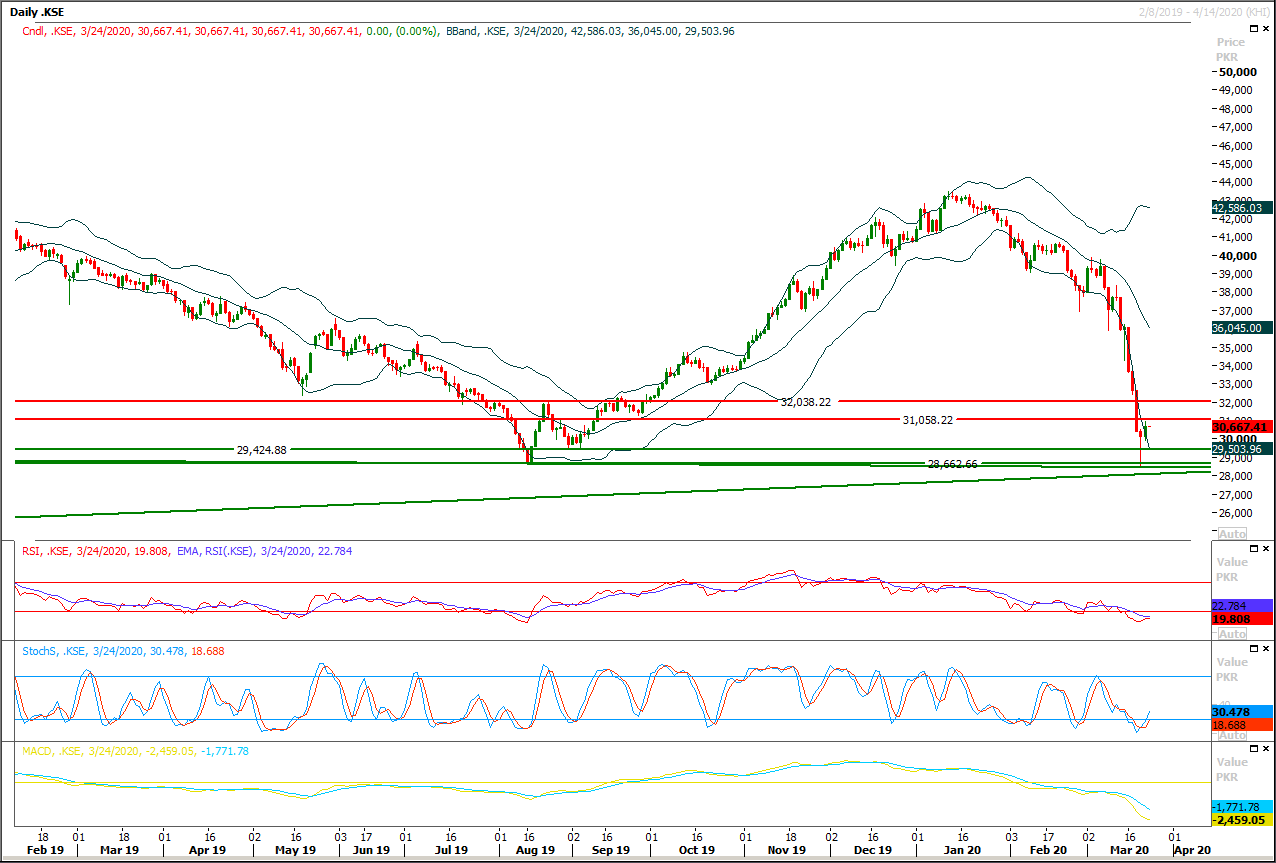

Trading volume at PSX floor dropped by 63.35 million shares or 20.54% on DoD basis, whereas the benchmark KSE100 index opened at 30,733.35, posted a day high of 30,928.05 and a day low of 29,903.81 points during last trading session while session suspended at 30,667.41points with net change of 537.58 points and net trading volume of 245.00 million shares. Daily trading volume of KSE100 listed companies also increased by 6.73 million shares or 2.82% on DoD basis.

Foreign Investors remained in net selling positions of 254.56 million shares and value of Foreign Inflow dropped by 6.67 million US Dollars. Categorically, Foreign Individuals, Corporate and Overseas Pakistani remained in net selling positions of 0.04, 16.14 and 8.37 million shares respectively. While on the other side Local Individuals Companies, Brokers and Insurance Companies remained in net long positions of 20.53, 8.38, 0.22 and 4.88 million shares but Banks, NBFCs and Mutual Fund remained in net selling positions of 2.08, 0.37 and 8.37 million shares respectively.

Analytical Review

Asia stocks rebound, Fed pits endless QE against economic reality

Asian stocks rebounded sharply on Tuesday as the U.S. Federal Reserve’s promise of bottomless dollar funding eased painful strains in financial markets, even if it could not soften the immediate economic hit of the coronavirus. While Wall Street seemed unimpressed, investors in Asia were encouraged enough to lift E-Mini futures for the S&P 500 by 3% and Japan’s Nikkei 6.2%. If sustained it would be the biggest daily rise for the Nikkei since late 2016. MSCI’s broadest index of Asia-Pacific shares outside Japan jumped 4.2%, to more than halve Monday’s drop. Shanghai blue chips gained 2.7%. Europe also looked a shade brighter as EUROSTOXXX 50 futures climbed 3.3% and FTSE futures 3.1%.

Chaos sweeps business as lockdowns begin

Goods piled up at the port and the roads fell silent as the first day of the lockdown across Sindh province brought most movement to a halt on Monday. The port has been included in the list of essential services by the provincial government to keep it operational so shipping activity was described as “normal” by the port authorities, but cargo volumes are already down by anywhere from one third to a half because of shrinking imports from China, according to Muhammad Rajpar, former chairman of Pakistan Ship’s Agents Association.

Banks to provide disinfected, quarantined cash

The State Bank of Pakistan (SBP) has directed the banks to clean, disinfect, seal and quarantine all currency being collected from hospitals and clinics, blocking it from circulation. The SBP held a meeting, chaired by governor Reza Baqir, with banks on Monday through video link to assess their readiness to ensure uninterrupted supply of services to clients in the wake of lockdowns due to the Covid-19 pandemic. Recognising the need for issuance of fit, authenticated and disinfected cash by the banks, detailed instructions have been provided by the SBP to the latter, said a press release.

SECP relaxes regulatory deadlines under Companies Act

To facilitate companies and businesses in dealing with current crises due to COVID-9 pandemic, the Securities and Exchange Commission of Pakistan (SECP) has relaxed the regulatory deadlines under Companies Act. The Commission using its powers conferred under section 510 of the Companies Act, 2017 approved following relaxations in relation to compliance with requirements of the Act. All companies which are facing difficulties in timely holding the annual general meeting (AGM) for the year ended on December 31, 2019, are allowed a general extension for a period of 30 days as provided in section 132 of the Act for holding their AGMs. The companies can now hold their AGM for the year ended on December 31, 2019 on or before May 29, 2020.

Oil falls for fourth week; US crude posts steepest weekly loss since 1991

U.S. crude tumbled 10.7% on Friday and posted its biggest weekly decline since the 1991 Gulf War as the coronavirus epidemic dried up global demand and as officials in Washington said an envoy would head to Saudi Arabia to deal with fallout of a Saudi-Russia oil price war. The week featured four days of massive selling as the growing pandemic kept people from driving and booking flights. Major forecasters like trading giant Vitol and energy researcher IHS Markit said oil demand could drop by as much as 10%. Oil prices rose sharply on Thursday after days of selling, but the rally did not last. U.S. crude prices notched a weekly loss of 29%, the steepest since the outset of the U.S./Iraq Gulf War in 1991. Brent crude dropped by 20%. Both benchmarks have dropped for four straight weeks.

Asian stocks rebounded sharply on Tuesday as the U.S. Federal Reserve’s promise of bottomless dollar funding eased painful strains in financial markets, even if it could not soften the immediate economic hit of the coronavirus. While Wall Street seemed unimpressed, investors in Asia were encouraged enough to lift E-Mini futures for the S&P 500 by 3% and Japan’s Nikkei 6.2%. If sustained it would be the biggest daily rise for the Nikkei since late 2016. MSCI’s broadest index of Asia-Pacific shares outside Japan jumped 4.2%, to more than halve Monday’s drop. Shanghai blue chips gained 2.7%. Europe also looked a shade brighter as EUROSTOXXX 50 futures climbed 3.3% and FTSE futures 3.1%.

Goods piled up at the port and the roads fell silent as the first day of the lockdown across Sindh province brought most movement to a halt on Monday. The port has been included in the list of essential services by the provincial government to keep it operational so shipping activity was described as “normal” by the port authorities, but cargo volumes are already down by anywhere from one third to a half because of shrinking imports from China, according to Muhammad Rajpar, former chairman of Pakistan Ship’s Agents Association.

The State Bank of Pakistan (SBP) has directed the banks to clean, disinfect, seal and quarantine all currency being collected from hospitals and clinics, blocking it from circulation. The SBP held a meeting, chaired by governor Reza Baqir, with banks on Monday through video link to assess their readiness to ensure uninterrupted supply of services to clients in the wake of lockdowns due to the Covid-19 pandemic. Recognising the need for issuance of fit, authenticated and disinfected cash by the banks, detailed instructions have been provided by the SBP to the latter, said a press release.

To facilitate companies and businesses in dealing with current crises due to COVID-9 pandemic, the Securities and Exchange Commission of Pakistan (SECP) has relaxed the regulatory deadlines under Companies Act. The Commission using its powers conferred under section 510 of the Companies Act, 2017 approved following relaxations in relation to compliance with requirements of the Act. All companies which are facing difficulties in timely holding the annual general meeting (AGM) for the year ended on December 31, 2019, are allowed a general extension for a period of 30 days as provided in section 132 of the Act for holding their AGMs. The companies can now hold their AGM for the year ended on December 31, 2019 on or before May 29, 2020.

U.S. crude tumbled 10.7% on Friday and posted its biggest weekly decline since the 1991 Gulf War as the coronavirus epidemic dried up global demand and as officials in Washington said an envoy would head to Saudi Arabia to deal with fallout of a Saudi-Russia oil price war. The week featured four days of massive selling as the growing pandemic kept people from driving and booking flights. Major forecasters like trading giant Vitol and energy researcher IHS Markit said oil demand could drop by as much as 10%. Oil prices rose sharply on Thursday after days of selling, but the rally did not last. U.S. crude prices notched a weekly loss of 29%, the steepest since the outset of the U.S./Iraq Gulf War in 1991. Brent crude dropped by 20%. Both benchmarks have dropped for four straight weeks.

Market is expected to remain volatile during current trading session.

Technical Analysis

The Benchmark KSE100 index is still in bearish mode and it's expected that it would continue its bearish journey after facing rejection from 31,200 or 32,000 points in case of any bullish spike in coming days. It's recommended to avoid initiating new long positions until index gave a clear reversal sign. It's expected that index would expand its previous low below 28,000 points if it would succeed in closing below 28,460 points. While on flip index would face strong resistances at 31,000 and 31,500 points in case of bullish reversal.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.