Previous Session Recap

Trading volume at PSX floor dropped by 9.51 million shares or 6.75% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 42,794.31, posted a day high of 43,060.68 and a day low of 42,677.78 during last trading session. The session suspended at 42,772.25 with net change of 27.43 and net trading volume of 76.69 million shares. Daily trading volume of KSE100 listed companies dropped by 15.58 million shares or 16.88% on DoD basis.

Foreign Investors remained in net selling position of 6.42 million shares and net value of foreign Inflow dropped by 0.73 million US Dollars. Categorically, Foreign Individuals remained in net buying positions of 0.11 million shares but Foreign Corporate and Overseas Pakistanis Investors remained in net selling positions of 6.16 and 0.37 million shares. While on the other side Local Individuals, Banks, NBFCs and Mutual Fund remained in net selling positions of 15.57, 0.59, 0.15 and 2.42 million shares but, Local Companies, Brokers and Insurance Companies remained in net buying positions of 3.84, 1.15 and 15.58 million shares respectively.

Analytical Review

Asia markets lower on renewed U.S.-China trade concerns

Asian shares moved lower on Thursday as investors fretted about new setbacks in U.S.-China trade talks, but negative sentiment was tempered by U.S. Federal Reserve meeting minutes suggesting it would not raise the tempo at which it increases interest rates. MSCI’s broadest index of Asia-Pacific shares outside Japan was flat, while Japan’s Nikkei stock index was 0.6 percent lower. A day after U.S. President Donald Trump said he was not pleased with trade talks between the United States and China, he called for “a different structure” in any trade deal. The move added to uncertainty over the negotiations and prompted a fall in stock markets. However, the release of minutes from the Federal Reserve’s May 1-2 meeting eased market concerns that it would raise interest rates more quickly than expected. The minutes, which were seen as dovish, helped to push U.S. stocks into positive territory on Wednesday.

LPG mafia mints extra bucks in absence of strict regime

In the absence of a strict regulatory regime, the LPG mafia has increased the distribution prices of domestic cylinder from Rs 920 per cylinder to Rs 1200 per cylinder during first seven days of the holy month of Ramazan. The increase has been recorded by 30 percent of the price prior to the start of the holy month, sources told The Nation. The LPG companies have increased the prices of domestic cylinder from Rs 920 to Rs 1200 during the first five days of Ramazan. "I can sell the cylinder in Rs 1300 provided that I get it at Rs 1000 or 1050, if the distribution company charges me Rs 1200 how can I sell it on the Oil and Gas Regulatory Authority's determined prices," said a LPG retailer in Islamabad.

Govt turns to China to avoid foreign currency crisis

Pakistan has again turned to China for help in avoiding a foreign currency crisis, deepening the two countries’ economic ties by borrowing $1 billion from Chinese banks in April, State Bank of Pakistan governor has revealed. In an interview with the Financial Times, Tariq Bajwa confirmed the loans were made by Beijing-backed banks, at what he said were “good, competitive rates”. The money strengthens the ties between the two countries. With Pakistan’s foreign exchange reserves dwindling due to falling exports and rising imports, officials in Islamabad hope the cash will help Pakistan avoid having to go to the International Monetary Fund for another bailout, having done so 12 times previously since 1988. Pakistan had $10.8 billion in foreign currency on May 11 — the most recent figures available — down from $18.1b as of April 2016.

PRA serves notices to recover millions of rupees tax

The Punjab Revenue Authority has served notices to recover sales tax of millions of rupees on different companies and clubs for not paying sales tax timely. The PRA issued notices to Gymkhana Club for not paying sales tax of Rs4.5 million for the month of April. The authority has also asked another Sukh Chen Club to present sales tax record which has not been paying for the long time. The sources said that Sukh Chen Club might be sealed for non-payment of its sales tax for the period of more than seven months. The club has to pay more than Rs10 million of sales tax to the authority. Sources said that The Turkish company Alburrak, which has the contract of cleaning the city, has also been served notices for non-payment of sales tax for the last over one year. The foreign company is defaulter of over Rs30.50 million of the PRA.

Punjab okays two uplift schemes

Punjab Provincial Development Working Party has approved two development schemes of urban development sector with an estimated cost of Rs 4612.36 million. These schemes were approved in the 67th meeting of PDWP of current fiscal year 2017-18. The approved schemes are: Replacement of outlived sewer in Multan, Phase-II at the cost of Rs 2168.000 million and elimination/shifting Disposal Station Chungi#9 to Northern Bypass Multan at the cost of Rs 2444.36 million.–INP

Asian shares moved lower on Thursday as investors fretted about new setbacks in U.S.-China trade talks, but negative sentiment was tempered by U.S. Federal Reserve meeting minutes suggesting it would not raise the tempo at which it increases interest rates. MSCI’s broadest index of Asia-Pacific shares outside Japan was flat, while Japan’s Nikkei stock index was 0.6 percent lower. A day after U.S. President Donald Trump said he was not pleased with trade talks between the United States and China, he called for “a different structure” in any trade deal. The move added to uncertainty over the negotiations and prompted a fall in stock markets. However, the release of minutes from the Federal Reserve’s May 1-2 meeting eased market concerns that it would raise interest rates more quickly than expected. The minutes, which were seen as dovish, helped to push U.S. stocks into positive territory on Wednesday.

In the absence of a strict regulatory regime, the LPG mafia has increased the distribution prices of domestic cylinder from Rs 920 per cylinder to Rs 1200 per cylinder during first seven days of the holy month of Ramazan. The increase has been recorded by 30 percent of the price prior to the start of the holy month, sources told The Nation. The LPG companies have increased the prices of domestic cylinder from Rs 920 to Rs 1200 during the first five days of Ramazan. "I can sell the cylinder in Rs 1300 provided that I get it at Rs 1000 or 1050, if the distribution company charges me Rs 1200 how can I sell it on the Oil and Gas Regulatory Authority's determined prices," said a LPG retailer in Islamabad.

Pakistan has again turned to China for help in avoiding a foreign currency crisis, deepening the two countries’ economic ties by borrowing $1 billion from Chinese banks in April, State Bank of Pakistan governor has revealed. In an interview with the Financial Times, Tariq Bajwa confirmed the loans were made by Beijing-backed banks, at what he said were “good, competitive rates”. The money strengthens the ties between the two countries. With Pakistan’s foreign exchange reserves dwindling due to falling exports and rising imports, officials in Islamabad hope the cash will help Pakistan avoid having to go to the International Monetary Fund for another bailout, having done so 12 times previously since 1988. Pakistan had $10.8 billion in foreign currency on May 11 — the most recent figures available — down from $18.1b as of April 2016.

The Punjab Revenue Authority has served notices to recover sales tax of millions of rupees on different companies and clubs for not paying sales tax timely. The PRA issued notices to Gymkhana Club for not paying sales tax of Rs4.5 million for the month of April. The authority has also asked another Sukh Chen Club to present sales tax record which has not been paying for the long time. The sources said that Sukh Chen Club might be sealed for non-payment of its sales tax for the period of more than seven months. The club has to pay more than Rs10 million of sales tax to the authority. Sources said that The Turkish company Alburrak, which has the contract of cleaning the city, has also been served notices for non-payment of sales tax for the last over one year. The foreign company is defaulter of over Rs30.50 million of the PRA.

Punjab Provincial Development Working Party has approved two development schemes of urban development sector with an estimated cost of Rs 4612.36 million. These schemes were approved in the 67th meeting of PDWP of current fiscal year 2017-18. The approved schemes are: Replacement of outlived sewer in Multan, Phase-II at the cost of Rs 2168.000 million and elimination/shifting Disposal Station Chungi#9 to Northern Bypass Multan at the cost of Rs 2444.36 million.–INP

Market is expected to remain volatile therefore it'ss recommended to stay cautious while trading today.

Technical Analysis

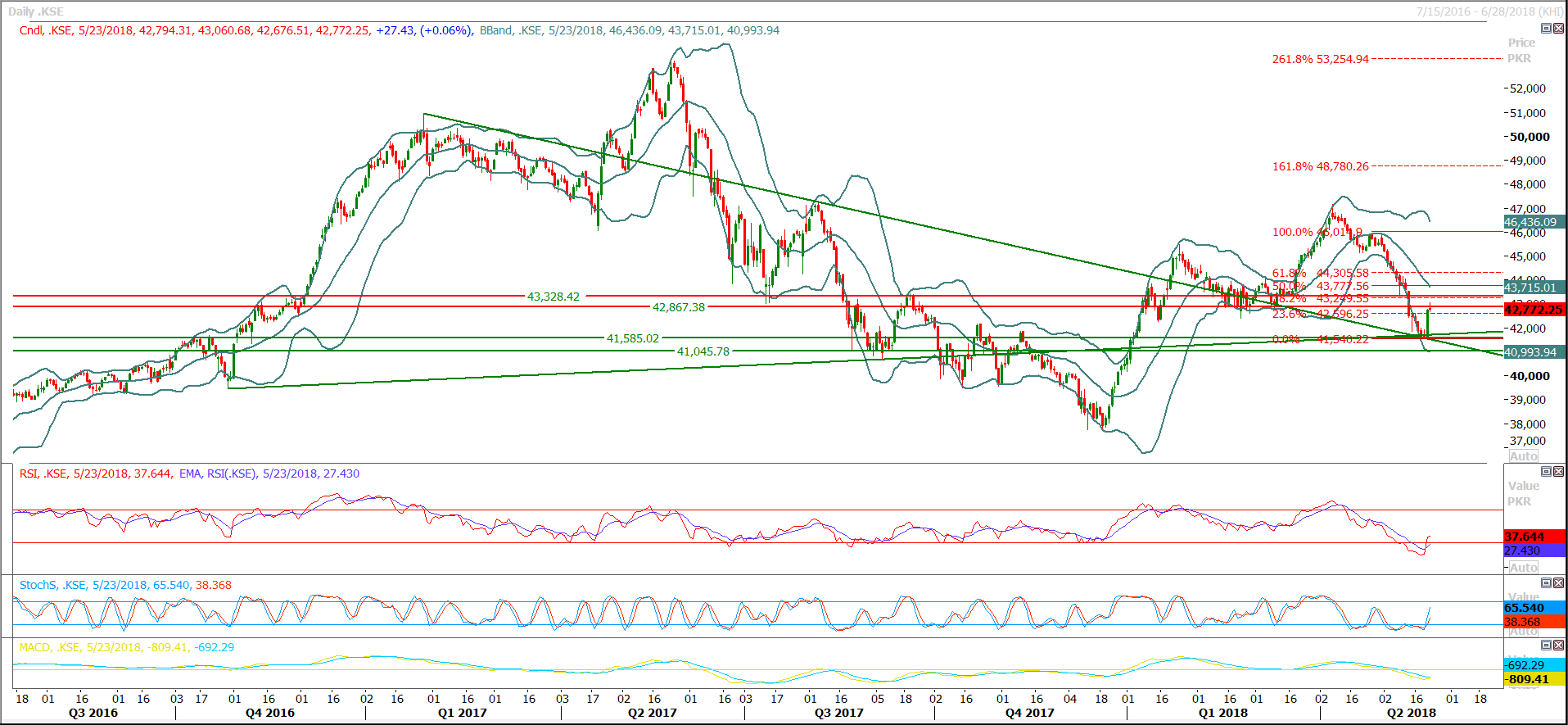

The Benchmark KSE100 Index have entertained its supportive regions very well during second last trading session and it have bounced back after getting support from a horizontal supportive region along with two supportive trend lines. But it was expected on technical grounds that index would have to bounce back either on intraday basis or daily chart because a correction was due since last 4000 points. For current trading session it’s expected that index would try to remain under pressure below 42930 and if succeeded to penetrate then next targets would be 43,045 and 43,330 where index would face strong resistances. If current bullish pull back would continue above 43,330 then this momentum would be expired by 50% or 61.8% correction levels at 43,777 and 44,305 in coming trading session. But its recommended to avoid any over optimistic buying sentiment and wait for a confirmation of reversal on daily and weekly chart because if index would start falling after completing its correction this time then a new low of this calendar year could be witnessed. Daily and Weekly Stochastic have generated bullish crossovers but still awaiting confirmation on today’s closing but hourly momentum indicators are indicating a dip.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.