Previous Session Recap

Trading volume at PSX floor dropped by 11.42 million shares or 4.85% on DoD basis, whereas the Benchmark KSE100 index opened at 38,363.70 posted a day high of 38,365.32 and day low of 37,582.69 points while the session suspended at 37,714.90 with net change of -630.52 points and net trading volume of 117.84 million shares. Daily trading volume of KSE100 listed companies dropped by 21.00 million shares or 15.13% on DoD basis.

Foreign Investors remained in net selling position of 2.04 million shares and net value of Foreign Inflow dropped by 1.20 million US Dollars. Categorically, Foreign Corporate remained in net selling positions of 3.37 million shares but Foreign Individuals and Overseas Pakistanis investors remained in net buying positions of 0.01 and 1.32 million shares. While on the other side Local Companies, Banks, Mutual Fund and Insurance Companies remained in net buying positions of 3.74, 1.90, 2.91 and 3.99 million shares but Local Individuals, NBFCs and Brokers remained in net selling positions of 4.85, 0.69 and 4.37 million shares respectively.

Analytical Review

Asia stocks struggle as global woes persist, oil near two-month lows

Asian stocks edged lower on Wednesday as concerns, ranging from worries about U.S. corporate earnings to Middle East tensions, weighed on sentiment while crude oil approached two-month lows after Saudi Arabia flagged possible supply increases. MSCI’s broadest index of Asia-Pacific shares outside Japan was down 0.2 percent, extending the decline of more than 2 percent in the previous session. Global stocks have suffered this week on worries about U.S. earnings, Italian government finances, U.S. trade tensions and mounting pressure on Saudi Arabia over the death of dissident journalist Jamal Khashoggi.

Saudi Arabia pledges $6bn package to Pakistan

After weeks of speculation, Saudi Arabia on Tuesday stepped forward with a $6 billion bailout package for Pakistan’s ailing economy. The package includes $3bn balance of payments support and another $3bn in deferred payments on oil imports.

LCCI for promotion of cottage industry in rural areas

Acting president of the Lahore Chamber of Commerce & Industry Khawaja Shahzad Nasir has called for friendly measures to give a desired strength to the cottage industry. He was addressing an over 100-member delegation of All Pakistan Cottage Industry, led by Ghulam Sarwar Malik, at the Lahore Chamber of Commerce & Industry. LCCI Vice President Fahim-ur-Rehman Sehgal also spoke on the occasion.

National Bank announces profit of Rs3.5b Share:

National Bank of Pakistan (NBP) has announced PAT of Rs3.5 billion, (EPS Rs1.6, down 44 percent YoY), lower than expectations. On a quarterly basis, net interest income (NII) fell by 16 percent QoQ and non-interest income declined by 23 percent QoQ, contrary to expectations. Non-interest income of the bank was down 3 percent YoY to Rs7.5b as a result of 9 percent decline in fee income and 66 percent decline in capital gain on securities. However, 8x increase in income from dealing in FX supported non-interest income. In 9M2018, earnings of the bank clocked in at Rs7.6/share, up 10 percent YoY due to 13 percent higher NII.

Pak Suzuki reports profit of Rs95m

Pak Suzuki (PSMC) reported its 3Q2018 earnings wherein the company posted PAT of Rs95m (EPS Rs1.2, down 91 percent YoY). Earnings are below expectations as margin compression as well as taxation were higher than anticipated. Effective tax rate clocked in at 79 percent due to applicability of turnover tax as opposed to tax on profits. Despite 10 percent YoY decline in volumes during the quarter, net sales of the company rose by 3 percent YoY due to four price hikes in 2018.

Asian stocks edged lower on Wednesday as concerns, ranging from worries about U.S. corporate earnings to Middle East tensions, weighed on sentiment while crude oil approached two-month lows after Saudi Arabia flagged possible supply increases. MSCI’s broadest index of Asia-Pacific shares outside Japan was down 0.2 percent, extending the decline of more than 2 percent in the previous session. Global stocks have suffered this week on worries about U.S. earnings, Italian government finances, U.S. trade tensions and mounting pressure on Saudi Arabia over the death of dissident journalist Jamal Khashoggi.

After weeks of speculation, Saudi Arabia on Tuesday stepped forward with a $6 billion bailout package for Pakistan’s ailing economy. The package includes $3bn balance of payments support and another $3bn in deferred payments on oil imports.

Acting president of the Lahore Chamber of Commerce & Industry Khawaja Shahzad Nasir has called for friendly measures to give a desired strength to the cottage industry. He was addressing an over 100-member delegation of All Pakistan Cottage Industry, led by Ghulam Sarwar Malik, at the Lahore Chamber of Commerce & Industry. LCCI Vice President Fahim-ur-Rehman Sehgal also spoke on the occasion.

National Bank of Pakistan (NBP) has announced PAT of Rs3.5 billion, (EPS Rs1.6, down 44 percent YoY), lower than expectations. On a quarterly basis, net interest income (NII) fell by 16 percent QoQ and non-interest income declined by 23 percent QoQ, contrary to expectations. Non-interest income of the bank was down 3 percent YoY to Rs7.5b as a result of 9 percent decline in fee income and 66 percent decline in capital gain on securities. However, 8x increase in income from dealing in FX supported non-interest income. In 9M2018, earnings of the bank clocked in at Rs7.6/share, up 10 percent YoY due to 13 percent higher NII.

Pak Suzuki (PSMC) reported its 3Q2018 earnings wherein the company posted PAT of Rs95m (EPS Rs1.2, down 91 percent YoY). Earnings are below expectations as margin compression as well as taxation were higher than anticipated. Effective tax rate clocked in at 79 percent due to applicability of turnover tax as opposed to tax on profits. Despite 10 percent YoY decline in volumes during the quarter, net sales of the company rose by 3 percent YoY due to four price hikes in 2018.

Market is expected to remain volatile therefore its recommended to stay cautious while trading during current trading session.

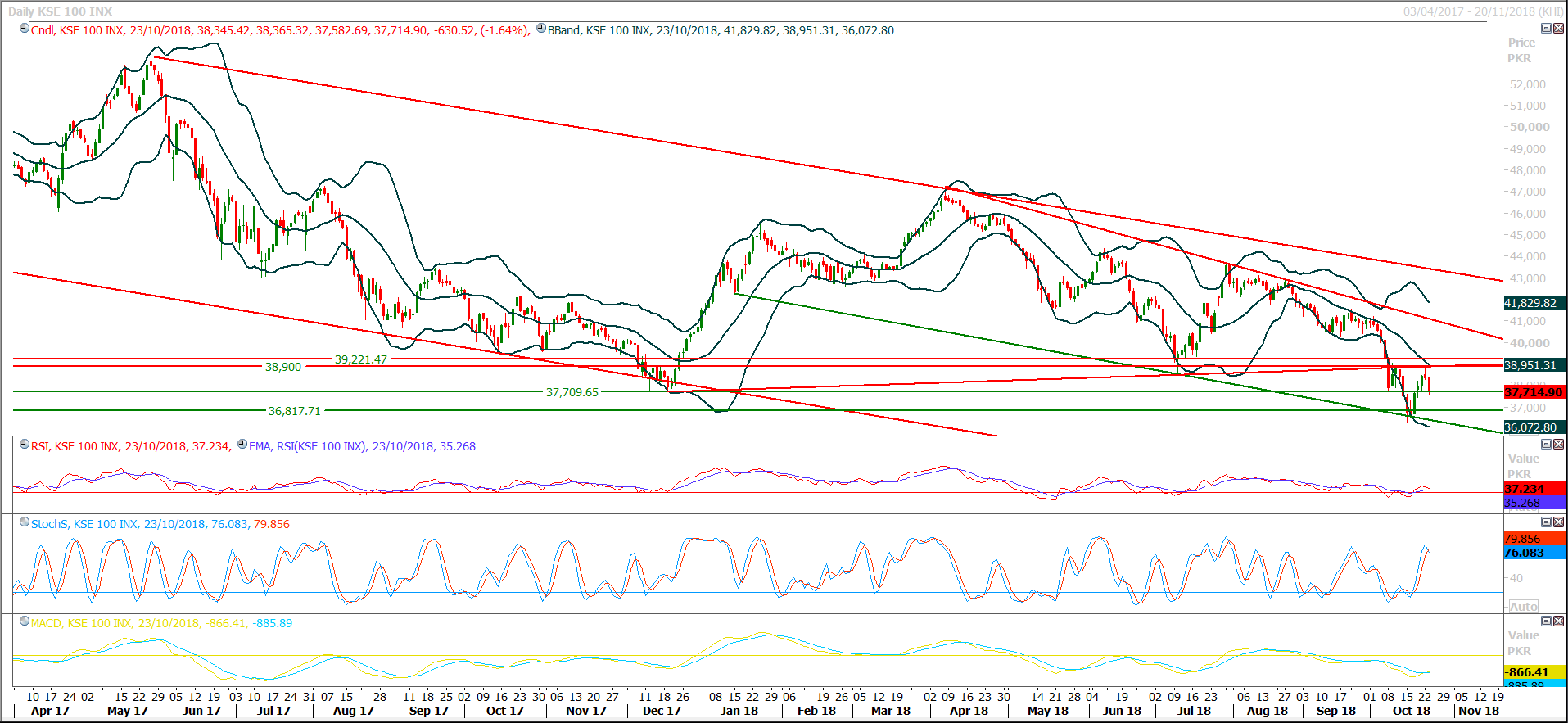

Technical Analysis

The Benchmark KSE100 Index have created an evening star formation on daily chart after getting resistance from crossover of a horizontal resistant region and a rising trend line and right now it’s getting support from a horizontal support which would try to push index in upward direction because evening star is a strong bearish formation but this kind of evident formations at such crucial levels where 50% correction is already completed don’t fulfill and usually support a cheat pattern for continuation of previous trend. Hourly and weekly stochastic and MAORSI are supporting bullish momentum but daily indicators are trying to generate bearish crossovers and these crossovers still have not happened therefore today’s closing matters a lot for index. As of now supportive regions are standing at 37,400 and 37,200 points while 38,900 and 39,300 would try to react against any kind of bullish pull back during current trading session. It’s recommended to initiate buying with strict stop loss during current trading session for intraday trading and book profits at spikes.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.